Summary: This guide explains how insurance agency consulting supports insurance strategic planning, introduces practical Insurance Consulting Strategies, and improves agency optimization services. It also shows how outsourcing, clearer processes, and focused consulting services together drive business transformation, client retention, and long‑term strategic planning and growth for agencies.

Insurance agency consulting turns scattered planning into targeted growth, bringing clarity, accountability, and practical strategies for agencies wanting business transformation.

Ever notice how some insurance agencies keep growing while others work just as hard and stay stuck at the same level? Many times, the difference is not effort but planning. Agencies handle thousands of policies, constant renewals, staff issues, and carrier demands, yet very few sit down and build a clear, realistic roadmap. Strategic planning sounds good in theory, but it often loses out to day‑to‑day fires.

This is where insurance agency consulting becomes practical. Instead of relying on guesswork, an outside consulting team helps an agency understand what is working, what is wasting money, and what needs to change for real growth. They bring structure to insurance strategic planning and turn “we should grow” into a specific, step‑by‑step plan that fits the agency’s size, market, and resources.

Why external insurance consulting matters for agencies

Most agency owners know their book and their people very well. That is also the reason blind spots appear. It is hard to step back and question habits that have existed for years. Here the Importance of Insurance Consulting becomes clear: consultants look at the business without internal history or emotion.

Instead of only asking “How many new policies did we write?”, consultants go deeper: Which lines are truly profitable? Which segments create the most service load? Where does the agency lose clients and why? They connect those answers to Insurance Agency Strategic Planning so leadership can focus on the right markets and stop spreading effort too thin.

Another reason Why Insurance Consulting Matters to Businesses is the way it links people, process, and technology. Many agencies buy good tools, hire capable teams, and still feel stuck. Insurance Consultants review operations end‑to‑end, sales, service, renewals, accounting, reporting, and show how each area supports or blocks strategic planning and growth. That outside view is often what pushes an agency from “we are busy” to “we are moving in a defined direction.”

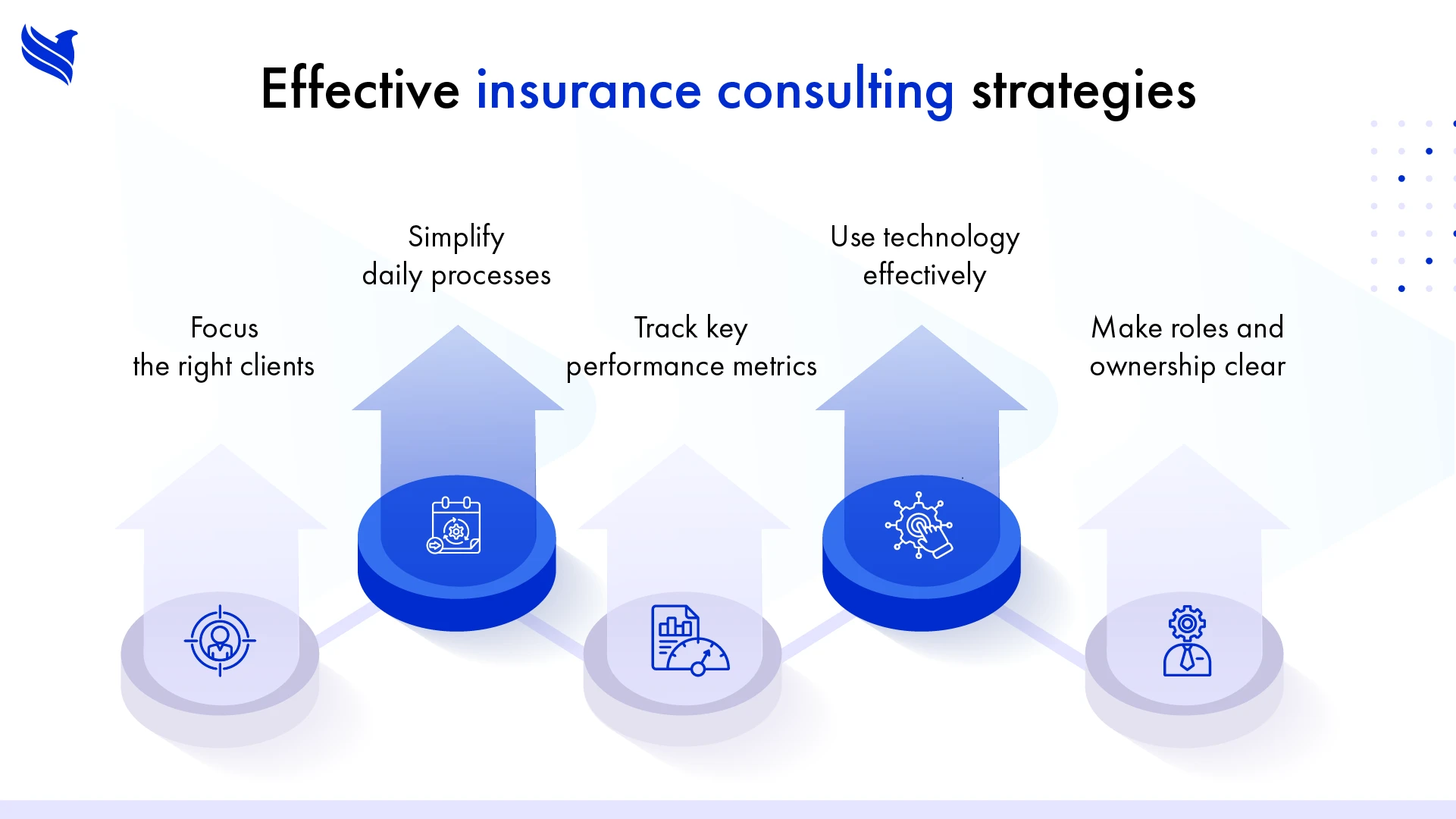

Core insurance consulting strategies that deliver results

Good consulting is not about long slide decks. It is about Insurance Consulting Strategies that show up in everyday work. A few common, practical approaches include:

- Sharpening agency focus: Instead of chasing every possible account, consultants help define a clear position: which client size, industry, and product mix make the most sense. This focus shapes the rest of the insurance strategic planning work; hiring, carrier selection, marketing, even service standards.

- Cleaning up processes: In many agencies, two account managers handle the same task in completely different ways. That creates errors, delays, and confusion. With insurance agency optimization, consultants map how work actually flows today, then design a simpler, consistent path: who does what, in what order, and with which tools. The result is less chaos and more predictable service.

- Track key performance metrics: Strategy fails when no one knows what to track. Consultants set up a small group of meaningful numbers—retention by segment, revenue per producer, response time on service requests, hit ratio on new quotes. These metrics tie directly into Insurance Agency Strategic Planning so leaders can see, in real time, whether actions are working.

- Aligning technology with real use: Many tools in an agency are under‑used. Consulting services review the AMS, CRM, email tools, and reporting systems to make sure they support the plan. If the strategy includes more cross‑selling, for example, workflows are built to remind staff when a client is eligible for additional products. Technology then supports business transformation instead of sitting idle.

- Clarifying roles and accountability: Growth often exposes fuzzy roles. Consultants help describe each role clearly; producers, service staff, managers, operations; and link responsibilities to goals. This keeps strategic planning and growth from becoming “management’s project” and turns it into shared work across the agency.

Together, these Insurance Consulting Strategies translate big ideas into daily decisions. Over time, they shift the agency from reacting to renewals and carrier changes to operating with intent.

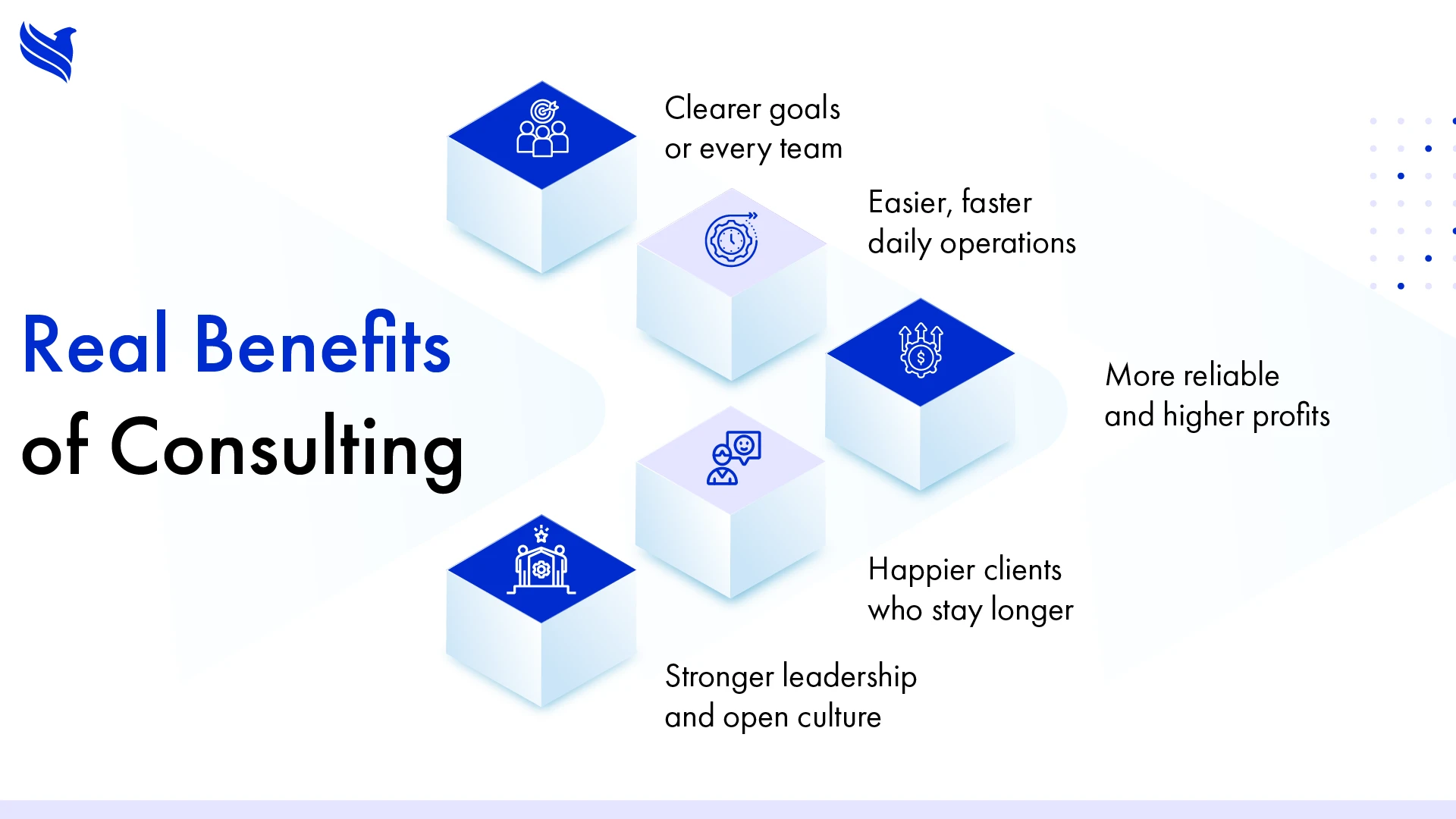

Tangible benefits for an insurance agency consultation

When strategic planning is backed by solid consulting, the benefits show up in several areas, not just in annual revenue charts.

- Clear direction for the team: Staff know the type of business the agency wants, what “good” looks like, and how success will be measured. Meetings become more focused, and decisions are easier because there is a defined strategy to refer to.

- Leaner, smoother operations: With agency consulting services in place, repeated hand‑offs and rework drop. Workloads are easier to balance, onboarding new people becomes simpler, and client issues are resolved faster.

- More stable and profitable growth: Instead of random spikes, growth becomes more predictable. Insurance consulting companies help agencies emphasize profitable segments, tighten renewal routines, and build better cross‑sell habits. That combination improves margins, not just top‑line numbers.

- Better client experience and retention: When service workflows are clear, clients receive faster responses and more proactive communication. They feel guided rather than processed. Stronger retention naturally supports long‑term strategic planning and growth.

- Stronger leadership and culture: A structured plan gives leaders a tool to manage change. It also gives employees clarity on why changes are happening. That reduces resistance and creates a culture that is more open to improvement.

These outcomes show why the Importance of Insurance Consulting extends far beyond a one‑time audit. It becomes part of how the agency manages performance year after year.

How outsourcing supports strategy and consulting

Many agencies like the idea of strategic planning but struggle with one hard truth: the team is already stretched. Here, outsourcing combines neatly with insurance agency consulting.

When routine and back‑office work is handled by an external partner, internal staff gain time to focus on higher‑value tasks. For example, outsourcing certificate processing, data entry, or policy checking frees up account managers to spend more time on renewal strategy and client relationships. This supports the consulting roadmap instead of fighting it.

Outsourcing also adds flexibility. As the agency grows, volumes change. An external team can scale up or down more easily, while the internal team stays focused on activities linked to strategic planning and growth. Consultants can then design Insurance Agency Strategic Planning that assumes a mix of in‑house and outsourced capacity, which is often more realistic than expecting internal staff to “just handle more.”

Another benefit is access to specialized skills. Some partners focus specifically on insurance agency optimization and process‑heavy work. Others bring expertise in analytics or reporting. When combined with consulting services, this blend speeds up business transformation; operations improve while the strategy is being rolled out, not years later.

Building a future‑ready agency with consulting

In the current market, growth for an insurance agency rarely happens by accident. Carriers are demanding, clients are better informed, and competition is aggressive. Agencies that continue to work only on instinct and habit will find it harder to protect margins and hold on to key accounts over time.

Insurance agency consulting gives leadership a structured way to think about the next three to five years, not just the next quarter. Through a mix of Insurance Agency Strategic Planning, agency optimization services, and clear Insurance Consulting Strategies, consulting helps turn scattered efforts into a coordinated plan. It supports smarter use of technology, better use of people, and balanced use of outsourcing where it makes sense.

For agencies that want to move from “busy” to “strategic,” partnering with experienced insurance consulting companies is often the turning point. It is a practical path to refine operations, guide business transformation, and build a clear, workable roadmap for sustainable strategic planning and growth.

If your agency is ready to take that step, FBSPL offers agency optimization services and support solutions designed specifically for insurance businesses, helping them straighten their operations, sharpen their strategy, and grow with more control and less guesswork.