Discover how insurance agency consulting services can drive strategic growth, optimize operations, and enhance leadership for long-term success.

- What are insurance agency consulting services and why are they important?

- How do insurance agency strategic planning services work?

- Can consulting enhance leadership and organizational strategy?

- What is the role of independent insurance agency planning?

- How do agency consulting services support operational optimization?

- Strategic planning: A key to insurance agency growth

- What should a successful strategic plan include?

- Agency optimization services: Benefits at a glance

- Why is leadership consulting critical for insurance agencies?

- How does consulting supports risk management & compliance?

- Improving client experience through consulting

- How can agencies measure the impact of consulting services?

- Emerging trends in insurance agency consulting

- How do you select the right insurance agency consulting partner?

- Partnering for strategic success: Unlock your agency’s full potential

In today’s competitive insurance landscape, agencies face mounting pressure to deliver exceptional client service while maintaining operational efficiency and profitability. For independent and larger insurance agencies alike, navigating growth, operational challenges, and strategic decision-making requires guidance beyond traditional industry practices. This is where insurance agency consulting services come into play, offering expert insights, tools, and frameworks that help agencies thrive.

This guide explores how insurance agency consulting services can support strategic planning for insurance agencies, operational optimization, and long-term business growth, and why integrating professional consulting is vital for sustained success.

What are insurance agency consulting services and why are they important?

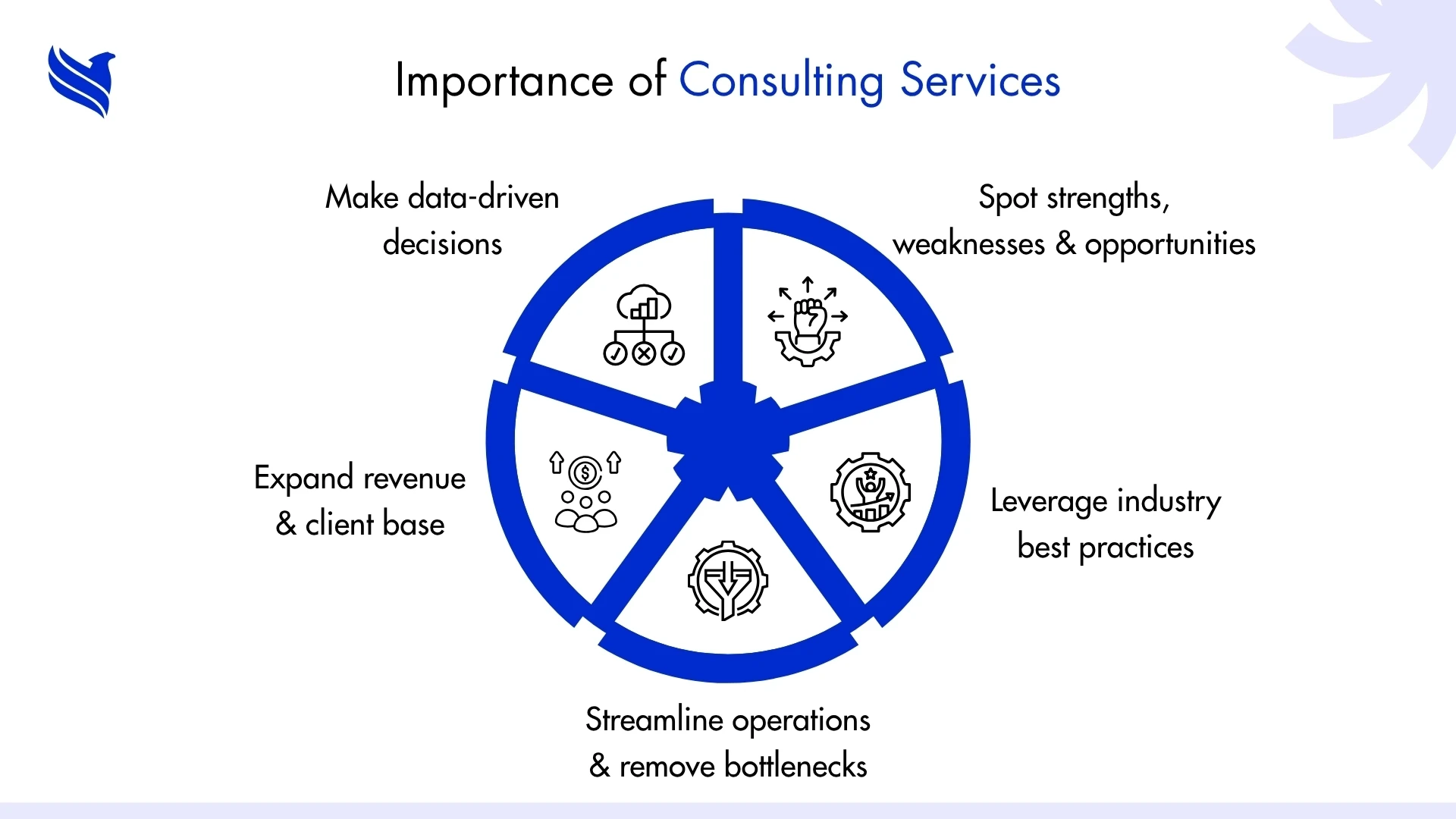

Insurance agency consulting services are specialized advisory services designed to help insurance agencies navigate the complexities of running a successful business. They go beyond simple advice, providing structured support to analyze current operations, identify gaps, and develop actionable strategies that drive both performance and growth. These services often cover areas such as comprehensive business assessments, leadership development, operational reviews, and hands-on support for insurance agency strategic planning.

Agencies turn to consulting services for several reasons. First, consultants offer an objective assessment, a perspective free from internal biases, highlighting strengths, weaknesses, opportunities, and risks that might otherwise go unnoticed. They also bring strategic expertise, leveraging industry best practices, regulatory knowledge, and benchmark data to guide informed decisions.

Operational efficiency is another critical focus. Consultants identify bottlenecks, streamline workflows, and recommend operational optimization for insurance agencies, helping reduce costs while improving productivity. Additionally, consulting supports insurance agency growth, guiding agencies on client acquisition, revenue expansion, and market diversification.

By partnering with professional insurance agency consulting services, agencies gain clarity, actionable insights, and a competitive edge. This ensures they are not only efficient in day-to-day operations but also strategically positioned for sustainable, long-term success.

How do insurance agency strategic planning services work?

Insurance agency strategic planning is more than just creating a document; it’s a disciplined process that helps agencies define their goals, initiatives, and performance metrics in a way that aligns with their long-term vision. A well-executed strategic plan acts as a roadmap, guiding every operational and business decision to ensure the agency moves in a unified, purposeful direction.

Strategic planning typically involves several key elements:

1. Vision and Mission Development

Consultants work closely with agency leadership to clarify the organization’s purpose and direction. A clear vision provides a long-term destination, while a well-crafted mission articulates the agency’s role in the market and its commitment to clients. Together, they create a foundation for every decision, from day-to-day operations to growth initiatives, ensuring that every team member understands the “why” behind the work.

2. Market and Competitive Analysis

Understanding the market is critical. Consultants conduct thorough research to assess competitive positioning, identify industry trends, and analyze client expectations. This insight allows agencies to anticipate challenges, differentiate themselves from competitors, and identify untapped opportunities that can drive revenue and growth.

3. Operational Review

Agency Optimization Services focus on examining workflows, staff performance, technology platforms, and process efficiency. By identifying bottlenecks, inefficiencies, or gaps, consultants help implement operational improvements that save time, reduce costs, and improve overall productivity.

4. Goal Setting and KPI Alignment

Consultants assist in establishing SMART goals, Specific, Measurable, Achievable, Relevant, and Time-bound, tailored to the agency’s unique needs. These goals might include increasing client retention, expanding new policy sales, or enhancing internal process efficiency. Aligning KPIs with these objectives ensures that progress is measurable and actionable.

5. Strategic Plan Implementation

A plan is only valuable if it’s executed effectively. Consultants support agencies in implementing the plan by assigning responsibilities, setting timelines, and creating accountability systems. This approach ensures that the strategic plan is more than a static document; it becomes a living framework that drives real, measurable outcomes.

When executed thoughtfully, insurance agency strategic planning services provide clarity, structure, and direction, allowing agencies to focus resources efficiently, make informed decisions, and position themselves for sustainable growth and long-term success.

Can consulting enhance leadership and organizational strategy?

Strong leadership and an effective organizational structure are essential for any insurance agency aiming for sustainable growth. Without clear direction and alignment, even capable agencies can struggle with executing strategy, responding to market changes, or retaining top talent. Insurance agency leadership consulting strengthens decision-making, fosters accountability, and aligns the organization around shared goals.

Consultants help agencies define clear roles and responsibilities, ensuring every team member understands how their work contributes to overall objectives. They also provide structured guidance for navigating change, whether adopting new technology, managing mergers, or responding to shifting market conditions, reducing disruption and maintaining continuity.

Key benefits of leadership and organizational strategy consulting include:

- Developing leadership teams to drive strategic initiatives effectively.

- Aligning roles and responsibilities with business objectives for clarity and efficiency.

- Enhancing employee engagement and retention through strong, competent leadership.

- Facilitating change management during mergers, acquisitions, or technology adoption.

- Optimizing organizational structure by refining departments, reporting lines, and management systems.

- Improving operational agility to respond quickly to challenges and opportunities.

By leveraging these consulting services, agencies create a well-aligned, high-functioning organization capable of executing strategic plans, adapting to change, and achieving sustainable insurance agency growth.

What is the role of independent insurance agency planning?

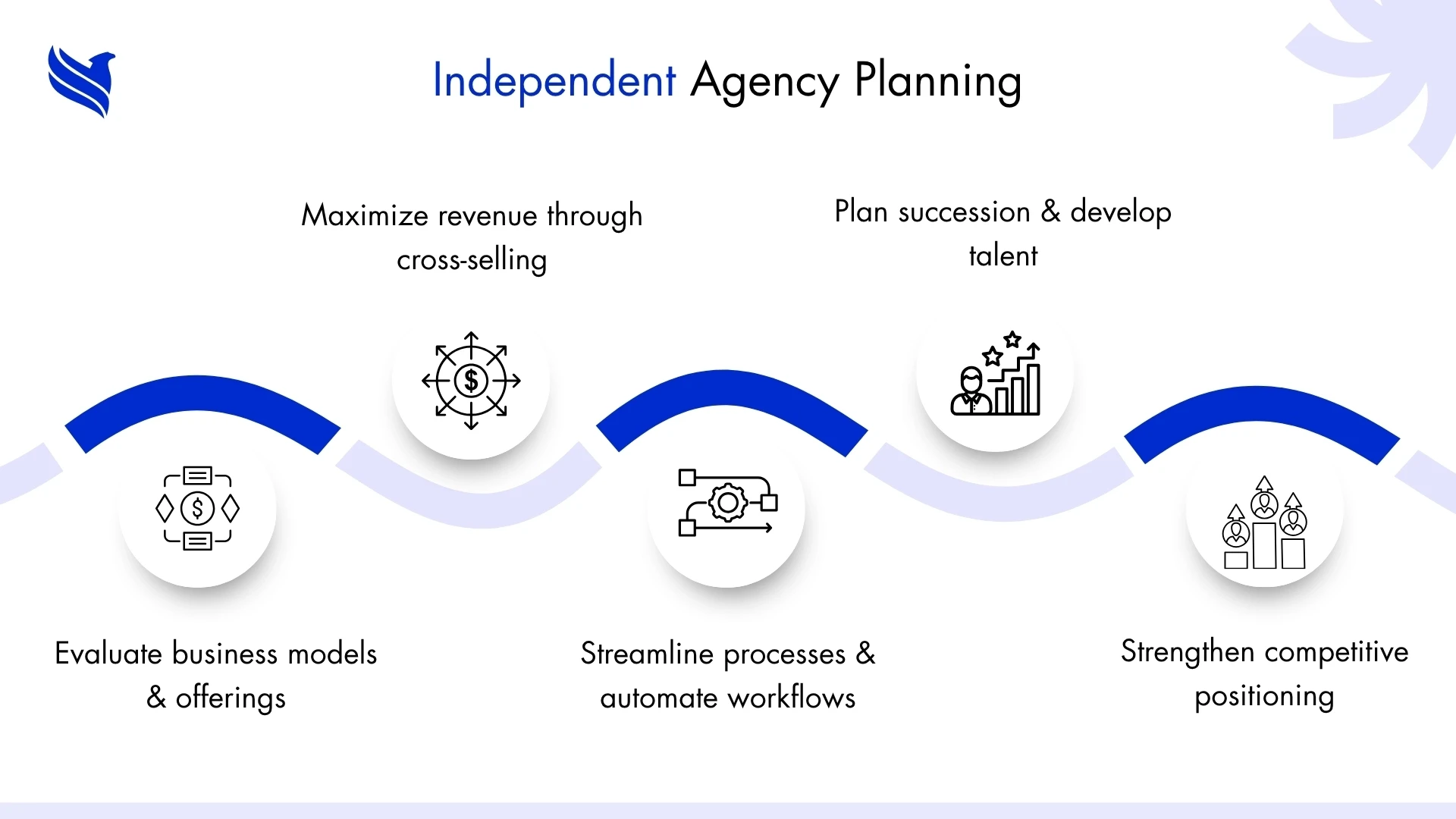

Independent insurance agencies face a unique set of challenges. Limited resources, competitive pressure, and diverse client needs make day-to-day operations demanding, and long-term growth planning even more complex. Independent insurance agency planning through consulting services provides structure, guidance, and actionable strategies to help agencies navigate these challenges effectively.

Key focus areas include:

- Business Model Assessment: Consultants evaluate an agency’s product offerings, distribution channels, and service models to ensure alignment with market demand and profitability. This process uncovers gaps, redundancies, or underutilized opportunities that can be leveraged to improve competitive positioning. Agencies gain insight into which products or services drive the most value and how to optimize delivery to clients.

- Revenue Optimization: Expanding revenue isn’t only about acquiring new clients, it’s also about maximizing value from existing relationships. Consultants identify opportunities for cross-selling, upselling, and deepening client engagement. By refining pricing strategies, portfolio management, and client communication, agencies can increase revenue while strengthening client loyalty.

- Operational Efficiency: Streamlining processes and leveraging technology are critical to reducing costs and freeing staff for higher-value work. Consultants help agencies optimize workflows, implement automation tools, and improve resource allocation. The outcome is more efficient operations, faster response times, and enhanced client satisfaction.

- Succession Planning: Leadership transitions can be disruptive, particularly in closely held or family-owned agencies. Consultants develop structured succession plans to ensure continuity, talent development, and long-term sustainability. This safeguards both client relationships and the agency’s legacy, preparing the organization for smooth transitions and ongoing growth.

By integrating consulting services, independent agencies can create a robust, actionable insurance agency strategic plan that addresses immediate operational needs while laying the foundation for future growth. These services help agencies compete more effectively, scale efficiently, and make informed decisions in a complex and evolving insurance landscape.

How do agency consulting services support operational optimization?

Operational efficiency is a cornerstone of profitable and sustainable insurance agencies. Without streamlined workflows, effective technology use, and aligned staff resources, agencies can struggle with errors, delays, and missed growth opportunities. Agency consulting services provide structured support through Agency Optimization Services, helping agencies identify gaps, improve processes, and create systems that support long-term growth.

Key operational optimization initiatives include:

- Process Mapping: Consultants document and analyze every step of an agency’s workflows, from client onboarding to policy issuance and claims management. This reveals bottlenecks, redundancies, and areas where manual effort can be reduced. By visualizing processes in detail, agencies gain clarity on what works, what doesn’t, and where improvements can be made.

- Technology Assessment: Modern agencies rely on multiple systems for policy management, claims processing, and client relationship management (CRM). Consultants evaluate technology platforms to ensure they are used efficiently, integrated where possible, and capable of supporting growth objectives. Recommendations may include automation tools, data analytics platforms, or workflow management software tailored to the agency’s needs.

- Staff Productivity Analysis: Aligning staffing resources with agency priorities ensures that team members focus on high-value activities. Consultants assess workloads, role responsibilities, and performance metrics to reduce redundancies and optimize employee output. The result is a more productive, engaged workforce capable of delivering better service without increasing headcount unnecessarily.

- Cost Management: Operational optimization isn’t just about efficiency—it’s also about managing expenses. Consultants evaluate vendor contracts, service providers, and internal processes to uncover savings opportunities without compromising service quality. This allows agencies to reinvest resources into growth initiatives, technology upgrades, or client engagement programs.

By implementing these strategies, agencies can deliver faster, more accurate service to clients, reduce errors, and create a scalable operational foundation. Well-executed Agency Optimization Services transform day-to-day operations into a streamlined, efficient system, giving leadership the confidence to pursue growth opportunities, expand market reach, and improve overall profitability. Operational optimization is no longer optional; it is essential for agencies aiming to compete effectively and achieve sustainable long-term success.

Strategic planning: A key to insurance agency growth

Strategic planning is one of the most powerful tools for driving sustainable insurance agency growth. Agencies that operate without a clear plan often react to challenges rather than anticipate them, leading to missed opportunities, inefficient operations, and inconsistent results. By integrating consulting services, agencies gain a structured approach to growth, ensuring that decisions are proactive, aligned with long-term goals, and based on actionable insights.

Key ways strategic planning drives growth include:

- Identifying Target Markets and Client Segments: Consultants help agencies evaluate their current client base and market opportunities to pinpoint segments with the highest potential for growth. This includes analyzing demographics, needs, risk profiles, and service expectations. Understanding these segments allows agencies to focus resources on the most promising opportunities rather than spreading efforts too thin.

- Developing Marketing and Sales Strategies: Strategic planning supports the creation of tailored marketing campaigns and sales initiatives. Consultants help define messaging, client acquisition tactics, and retention programs, ensuring the agency’s efforts are aligned with its growth objectives. This approach helps increase policy sales, improve cross-selling opportunities, and strengthen long-term client relationships.

- Implementing Data-Driven Decision-Making: Effective growth requires more than intuition. Consultants guide agencies in using performance metrics, dashboards, and analytics to monitor key indicators. Tracking client acquisition, retention rates, and operational efficiency allows agencies to adapt strategies quickly, optimize resource allocation, and identify trends before they become challenges.

- Evaluating Partnerships, Mergers, or Acquisitions: For agencies seeking rapid expansion, consultants provide guidance on potential partnerships or acquisitions. They assess compatibility, financial viability, and strategic fit to ensure that any growth initiative accelerates results without compromising organizational stability.

Through comprehensive insurance agency business planning, agencies can establish actionable steps that align with their vision, anticipate market trends, and remain compliant with regulatory requirements. By combining operational insight, market intelligence, and strategic foresight, agencies can make informed decisions that drive measurable growth.

Strategic planning transforms growth from a reactive, uncertain process into a deliberate, structured journey. With the guidance of experienced consultants, agencies can not only expand their client base and revenue streams but also strengthen internal operations, improve market positioning, and achieve long-term sustainability in an increasingly competitive insurance landscape.

What should a successful strategic plan include?

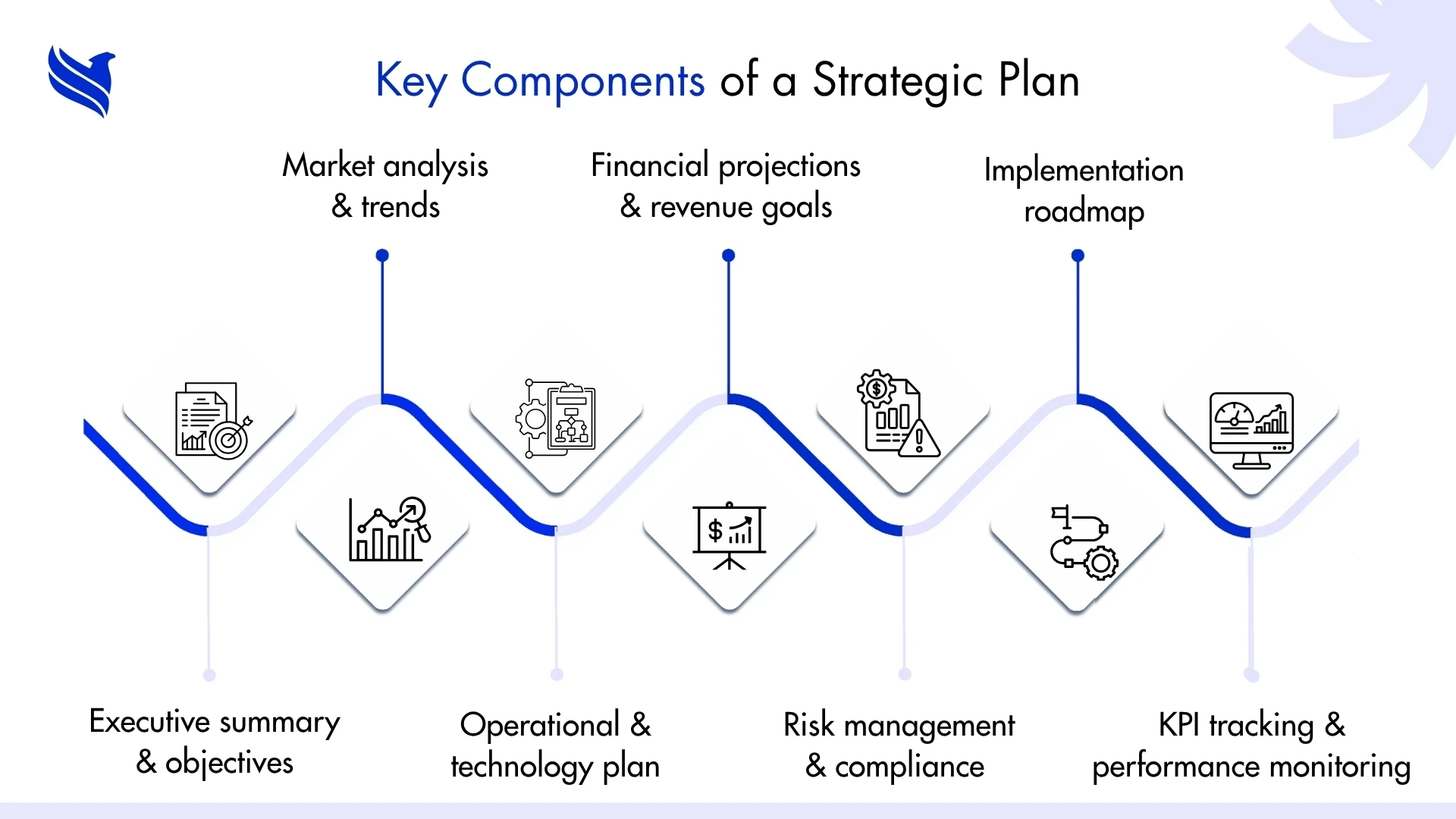

A comprehensive insurance agency strategic plan typically includes:

- Executive Summary: Overview of goals, objectives, and strategies.

- Market Analysis: Insights into competition, market trends, and client needs.

- Operational Plan: Guidelines for staffing, technology, and workflow improvements.

- Financial Plan: Revenue forecasts, cost projections, and profitability targets.

- Risk Management Plan: Identification and mitigation of operational and regulatory risks.

- Implementation Roadmap: Clear milestones, timelines, and accountability measures.

- Performance Monitoring: KPIs, dashboards, and review cycles for continuous improvement.

By partnering with insurance agency consulting services, agencies ensure that strategic plans are not only comprehensive but also actionable and measurable.

Agency optimization services: Benefits at a glance

Agency Optimization Services are designed to help insurance agencies operate at peak efficiency while maintaining high standards of service and compliance. These services provide structured, expert guidance to evaluate and refine internal processes, ensuring that operations run smoothly and resources are used effectively. Consultants tailor their solutions to the agency’s size, organizational structure, and stage of growth, delivering actionable strategies that improve both day-to-day operations and long-term performance.

Key benefits include:

- Streamlined operations and reduced administrative burden.

- Increased client satisfaction through faster response times and better service quality.

- Improved revenue generation by optimizing sales workflows.

- Reduced errors and compliance risks through standardized processes.

Agencies that adopt agency Optimization Services often see measurable improvements in performance metrics such as client retention, policy turnaround times, and staff productivity. Beyond the numbers, these services create a foundation for sustainable growth, operational clarity, and competitive advantage. By combining expert guidance with tailored solutions, agencies can transform complex, resource-intensive operations into efficient, scalable systems that support both current performance and long-term strategic goals.

Why is leadership consulting critical for insurance agencies?

Effective leadership is the driving force behind both organizational culture and the successful execution of strategic initiatives. Without strong leadership, even well-designed strategies can falter, and teams may struggle with alignment, accountability, or performance. Insurance agency leadership consulting provides guidance and support to agency owners and executives to strengthen their leadership capabilities and ensure organizational effectiveness.

Key benefits of leadership consulting include:

- Developing strong decision-making capabilities: Consultants help leaders make informed, timely decisions that align with business goals and market realities.

- Fostering a culture of accountability and performance excellence: By setting clear expectations and reinforcing accountability, agencies can build high-performing, motivated teams.

- Aligning leadership behavior with organizational goals: Leadership consulting ensures that executive actions, communication, and priorities support the agency’s mission and long-term vision.

- Preparing for succession planning and talent development: Consultants guide agencies in developing future leaders, creating continuity, and safeguarding long-term sustainability.

Leadership consulting becomes particularly critical during periods of growth, technology adoption, or industry disruption. Agencies navigating these transitions without structured guidance risk misalignment, operational inefficiencies, and lost opportunities. With professional leadership consulting, agencies gain the insight, tools, and frameworks needed to steer the organization through change successfully, maintaining both stability and momentum toward strategic objectives.

How does consulting supports risk management & compliance?

Insurance agencies operate in a heavily regulated environment. Non-compliance can lead to fines, reputational damage, and operational disruptions. Consultants help agencies with:

- Policy and procedure development aligned with regulatory requirements.

- Staff training on compliance best practices.

- Technology implementation to automate compliance tracking.

- Audit preparation and risk assessment.

This ensures that agencies maintain regulatory compliance while focusing on strategic planning for insurance agencies and growth initiatives.

Improving client experience through consulting

Client experience is a key differentiator in today’s insurance industry. Insurance agency consulting enhances customer interactions by:

- Mapping the client journey to identify pain points.

- Implementing CRM systems for personalized client communication.

- Optimizing claims processing to reduce delays and errors.

- Training staff in client service excellence and relationship management.

Satisfied clients are more likely to stay loyal, refer others, and increase revenue, contributing directly to insurance agency growth.

How can agencies measure the impact of consulting services?

Measuring the effectiveness of consulting services ensures ROI and informs future strategies. Agencies typically track:

- Revenue growth and profitability improvements.

- Client retention and satisfaction scores.

- Operational efficiency metrics (time saved, errors reduced, process completion rates).

- Staff performance and engagement levels.

- Achievement of strategic goals outlined in the insurance agency strategic plan.

These metrics provide tangible evidence of the value that insurance agency consulting services bring to both daily operations and long-term planning.

Emerging trends in insurance agency consulting

The insurance industry is evolving rapidly. Leading consulting services focus on emerging trends such as:

- Digital Transformation: Leveraging technology for policy management, claims processing, and customer engagement.

- Data-Driven Decision Making: Using analytics to inform growth, marketing, and operational decisions.

- Process Automation: Implementing workflow automation to reduce manual tasks and increase accuracy.

- Market Expansion: Identifying niche markets, partnerships, or new product opportunities.

- Leadership Development: Strengthening leadership pipelines to support growth and innovation.

Agencies that embrace these trends with the guidance of consulting services position themselves for competitive advantage and sustainable success.

How do you select the right insurance agency consulting partner?

Choosing the right partner is crucial for achieving results. Considerations include:

- Expertise and Experience: Look for consultants with a proven track record in insurance agency consulting.

- Comprehensive Services: Ensure they offer support in strategic planning, operational optimization, leadership consulting, and growth planning.

- Customization: Avoid one-size-fits-all approaches; select a partner who tailors solutions to your agency’s needs.

- Technology Integration: Ensure the consultant can recommend and implement modern tools for efficiency and analytics.

- References and Case Studies: Review prior successes and client testimonials to gauge effectiveness.

A well-chosen partner becomes a strategic ally in achieving agency objectives and long-term growth.

Partnering for strategic success: Unlock your agency’s full potential

In today’s complex and competitive insurance market, relying solely on experience or intuition is no longer enough. Insurance agency consulting services provide the expertise, tools, and frameworks necessary to:

- Execute effective insurance agency strategic planning.

- Optimize operations through Agency Optimization Services.

- Strengthen leadership and improve organizational effectiveness.

- Drive sustainable insurance agency growth and profitability.

By integrating consulting services into their strategic initiatives, agencies gain clarity, streamline operations, and position themselves to confidently navigate change while achieving long-term business objectives.

Investing in insurance agency consulting is not just a tactical choice—it is a strategic imperative for agencies that want to thrive and remain competitive in a rapidly evolving market.

Take the next step with FBSPL: Partner with our team of experts to craft a customized strategic plan, optimize your operations, and unlock measurable growth. Contact FBSPL today to discover how professional consulting services can transform your agency’s performance and future success.

Written by

Bhavishya Bharadwaj

Bhavishya Bharadwaj is the Digital Marketing Manager at FBSPL, bringing over a decade of experience across insurance, outsourcing, accounting, and digital transformation.Frequently Asked Questions

Insurance agency consulting services provide expert guidance on strategic planning, operational optimization, leadership development, and growth strategies to improve efficiency and profitability.

Strategic planning helps agencies set clear goals, align operations with long-term objectives, anticipate market trends, and make data-driven decisions for sustainable growth.

Agency Optimization Services focus on streamlining workflows, improving technology usage, enhancing staff productivity, reducing errors, and optimizing costs for better operational efficiency.

Consultants assist in developing leadership skills, defining roles, fostering accountability, managing change, and aligning the organization to execute strategic initiatives effectively.

Independent agencies face unique challenges; planning ensures efficient operations, revenue optimization, succession readiness, and competitive positioning in the market.

Yes, consultants provide policy guidance, staff training, technology solutions, and risk assessment to ensure regulatory compliance and minimize operational risks.