Summary: This guide breaks down insurance process automation, showing agencies how to streamline workflows, reduce errors, and boost compliance. From claims to renewals, discover what to automate first and why outsourcing brings fast gains. Practical use cases, clear benefits, and proven best practices equip agencies for digital transformation and competitive success.

- Common barriers in today’s insurance operations

- Essential workflows to automate for maximum impact

- Benefits of automating insurance agency tasks

- Best practices for successful insurance automation

- Real-world use cases of automated insurance workflows

- Deciding which processes to automate first

- How outsourcing enhances agency automation

- Ready for change? Time to make insurance automation work

Learn how insurance agencies automate core processes, overcome common obstacles, strengthen compliance, and achieve measurable growth faster.

Picture the average insurance agency. The phones ring, emails stack up, folders crowd the desk. Every week, the same questions and tasks repeat. Staff chase a missing document, try to remember an old password, and squint at a spreadsheet. Nothing ever feels truly finished. Why does it feel like insurance workflow processes are always behind, even when everyone tries hard to keep up?

The truth is that things pile up quickly. Policies get approved; claims get filed, but it all seems to move slower than clients want. Rules change, deadlines pop up, and the smallest errors become costly. Insurance process automation isn’t just a buzzword; it’s a method that cuts through all of this. Agencies using workflow automation find less clutter and more control.

Some agencies hesitate. They’re unsure if insurance agency automation will actually fit their business. It’s not just about software or fancy tools. Many turn to insurance consulting agencies or outsourcing partners who understand these details, how compliance workflow automation works, or how to merge old systems with new ones. It helps to get outside help if your team’s stressed or stretched thin.

In this guide, you’ll see how insurance process automation changes daily work for agencies, what insurance workflow automation actually improves first, and why outsourcing and digital partnerships might make sense. If you’ve ever thought insurance agency optimization was out of reach, these examples and tips might change your mind.

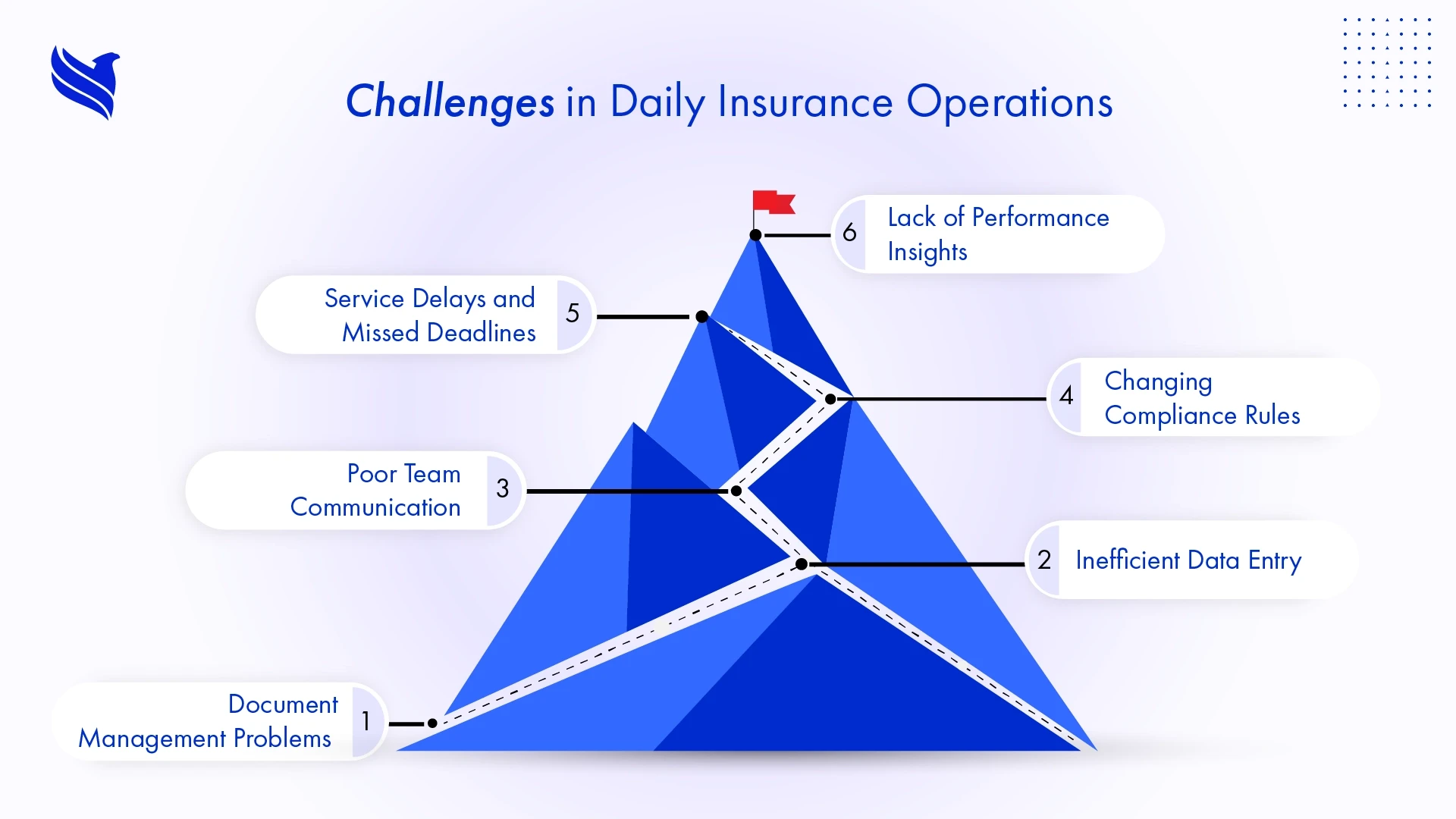

Common barriers in today’s insurance operations

Insurance agencies tend to run into the same problems again and again. Not because people aren’t working hard, but because old systems can’t keep up. Below: the biggest pains, and how automation helps.

- Documents, always on the move

Documents get lost. Hard drives crash, folders go missing, emails vanish. Someone spends an hour looking for a claim file that’s buried under ten other attachments. Insurance workflow automation removes paper trails. Files are saved, tagged, and easy to find. Compliance workflow automation keeps track of edits, so audits don’t turn complex. - Too much typing

A name gets typed in one form, then it’s typed again for billing. Then again for quoting. One slip, and details are wrong everywhere. Data entries are boring and error-prone. Automation picks up these jobs, moving info from digital forms into every system that needs it. Clients get accurate quotes and bills, and staff do less repeat work. - Teams don’t talk

The person in sales knows half the story. Claims knows another part. Customers call for an update but get passed around. Automation tools, like insurance process automation platforms, connect departments. Alerts go out automatically. Everyone’s on the same page. The rush to find someone who knows the answer? Gone. - Rules keep changing

Regulations grow. Security gets stricter. Someone forgets to file a report and gets fined. Compliance workflow automation runs checks, sends reminders, flags missing steps. Mistakes drop. Agencies waste less time on paperwork and worry less about penalties. - Service are not fast enough

Clients don’t want to wait for answers. People forget to send renewal reminders or claim status emails. Insurance agency automation schedules these automatically. Deadlines get met, updates go out, and the pace feels better. - Too many numbers, not enough answers

Managers want to improve, but numbers are scattered everywhere. Who knows which team did well last quarter? Automation pulls reports, highlights problems, and shows what needs fixing. That’s agency optimization in action.

These problems aren’t special, they’re common. Insurance digital transformation starts with admitting things aren’t perfect, and insurance process automation is how agencies pull themselves out of those daily traps. Next, you’ll learn which workflow processes make the biggest impact when automated, and why starting with a few small changes can push an agency forward.

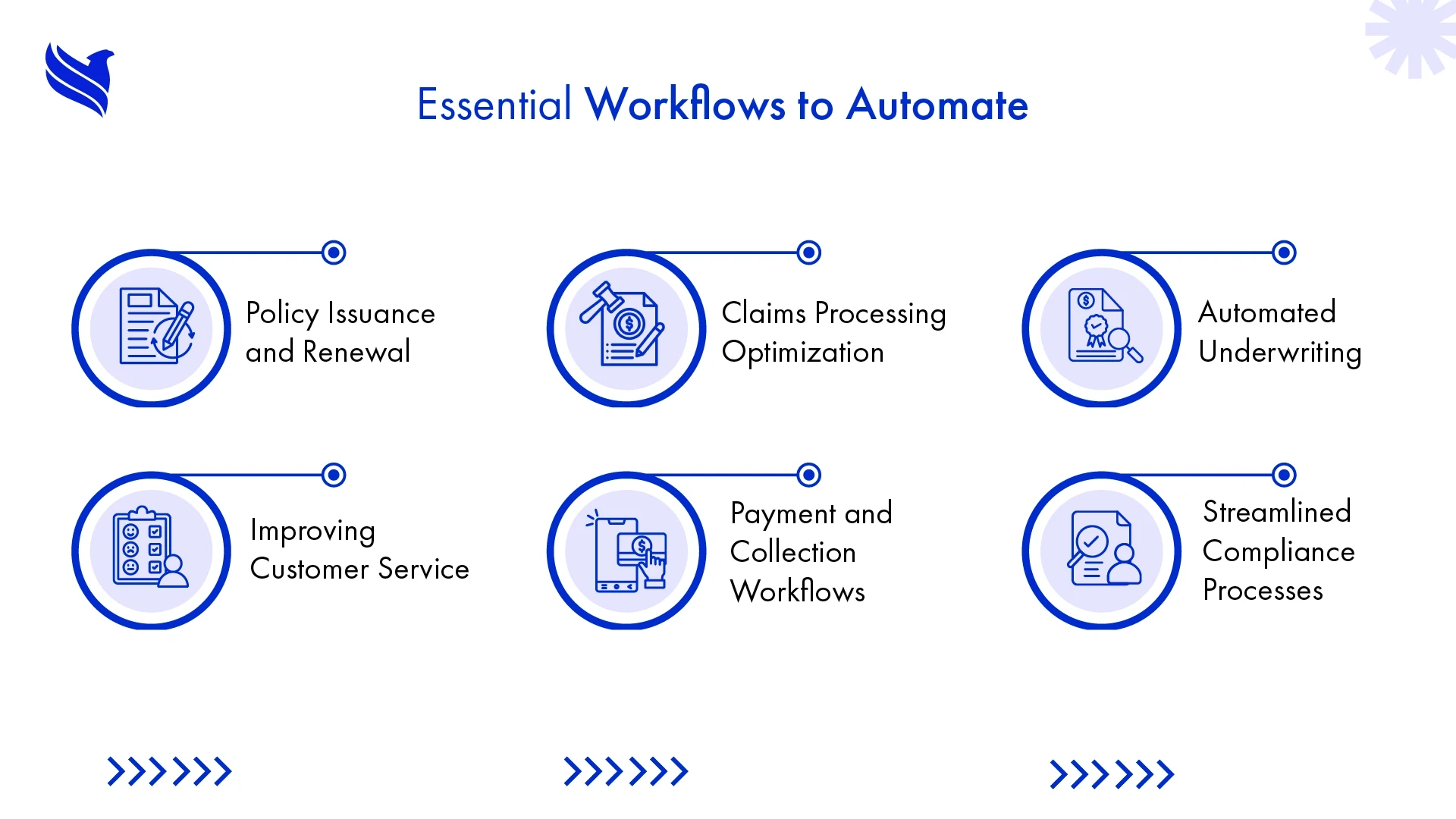

Essential workflows to automate for maximum impact

Insurance agencies handle a dizzying amount of paperwork every single day. Ask any agency manager about daily irritations, and one answer pops up often: “Why do we handle the same task five different times?” This is where insurance workflow automation tips the scales. Not every process needs the same level of automation right away, but some are obvious choices. They keep coming up in agency consulting, digital transformation plans, and even small-shop conversations about optimization.

Let’s walk through those, one by one.

1. Policy issuance and renewal: The lifeblood tasks

Most agencies wouldn’t last long without getting policies out the door, fast and error-free. The old routine? Collect all the details, chase down missing fields, manually generate papers, and then follow up with big piles of emails and calls. It’s slow, frustrating, and invites mistakes, especially when renewal time rolls around, and the same panic appears every year. Insurance process automation here means all details get funneled into a system, documents generate on their own, and reminders go to clients automatically. Policies are sent, calculations stay correct, and records sync across systems without a staff marathon at quarter-end.

2. Claims processing: Where messes become expensive

If policy work drives the business, claim processing keeps clients coming back or leaving for good. Manually reviewing claims (documents, photos, payments, voice memos) can stretch for weeks. The process gets especially painful when files go missing or approvals hang on somebody being out of the office. Automation captures claims, checks completeness, and pushes them through the steps, assigning adjusters, retrieving supporting data, and even alerting for possible fraud. Faster claims, fewer complaints, and fewer “where’s my money?” calls. This is exactly the sort of workflow insurance agency consulting services now push as table stakes for competitive agencies.

3. Underwriting: Risk, but not guesswork

Every agency, big or small, needs to assess risk to stay afloat. Underwriting needs to pull data from credit bureaus, customer applications, and sometimes third-party APIs. When these info streams don’t talk to each other, people end up retyping (and rechecking) the same fields over and over. With insurance workflow automation, data comes together, assessments are quicker, client histories are compared in real time, and compliance checks are built in. The process doesn’t depend on who’s at their desk that day, it happens whenever the data’s ready.

4. Customer service and communication

Clients expect fast answers, even after hours. Hundreds of little requests, update an address, change a beneficiary, document a phone call, bubble up every week. Replying to each one by hand gets old. Automated workflows, paired with secure portals or even AI-powered chat, handle the routine stuff. Forms for COI (certificate of insurance) requests, simple endorsements, or real-time status updates keep service steady and clients happier.

5. Payments, collections, and reminders

Chasing missed payments or sending reminders for renewals easily eats up hours, even for experienced front office teams. Instead, insurance process automation pulls in billing schedules, flags accounts, and nudges clients at the right moment. Integration with payment systems (or just recurring reminders) makes sure bills don’t slip through the cracks.

6. Regulatory and compliance work

Insurance isn’t just about helping people; it’s about following very strict rules. Compliance workflow automation checks that required documents are in place, flags missing information, and tracks changes for easy audits. This is high-stakes work, slip-ups can lead to fines or worse. With automation, agencies can show exactly what happened and when, any time the regulators come knocking.

Benefits of automating insurance agency tasks

Some agencies ask, “Is it really worth switching things up?” The answer shows up almost everywhere insurance agency automation is used. The benefits go way beyond “saving time”, they change the nature of work inside the agency and how outsiders see it.

1. Lower costs, more focused teams

It’s no secret that manual work is expensive. Every double-check, every email sent, every week spent reconciling data, that’s money lost. Automated workflows handle high-volume, repetitive stuff quietly in the background. Staff can now spend time solving real problems, talking to customers, or actually closing new business instead of re-entering numbers. Agencies using these tools report spending less on overtime, hiring fewer temporary staff during renewal crunches, and getting more from each team member.

2. Faster service

Speed matters. A client who files a claim wants an answer now, not next week. Agencies that automate claims, payments, and renewals see their response times drop. Customers receive emails, texts, or updates without manual follow-up. Quicker quotes, faster claims, same-day changes, these things win clients and keep them loyal. Happy clients lead to more referrals. It’s a simple cycle, but impossible without workflow automation.

3. Fewer mistakes

Nobody likes dealing with errors in client names, addresses, or policy numbers. Manual processing is a minefield for typos, missed steps, and unstapled forms. Insurance process automation cuts these out at the source. Data entered once moves everywhere it needs to go, in the right format, checked for errors each step along the way. Mistake rates plummet, and so does the time spent fixing them.

4. Audit-ready without the panic

When audit time hits, the scramble starts. Who handled this file? Is the change log complete? Did every required step happen? Compliance workflow automation makes this simple: full logs, automatic document histories, and a simple export for reviewers or regulators. Agencies no longer dread compliance seasons, they welcome them, knowing proof is a click away.

5. Real data for better decisions

What’s working? Where does work get stuck? Which department is running hot, and which one is falling behind? Insurance digital transformation means having dashboards available at any time. Decisions aren’t just gut feel, they’re backed by numbers. Leaders adjust, invest, or shift resources where they’re truly needed, not where they hope things will improve.

6. A security boost agencies can’t ignore

Insurance data is private, and breaches are costly. Security in insurance and compliance standards is greater than ever. Automated processes limit data access, keep logs, encrypt details, and flag suspicious activities. Insurance consulting agencies stress that controlled automation is easier to secure than random, disconnected email threads or USB drives floating around the office.

Insurance agency optimization isn’t just about doing the work right, it’s about making space to do more business with less stress. Automation scales easily. See a surge in policyholders? The software adjusts. Winning a new partnership? Set up a repeatable workflow in days, not months. The path to the future of insurance agencies isn’t rocket science, just a willingness to automate where it matters most.

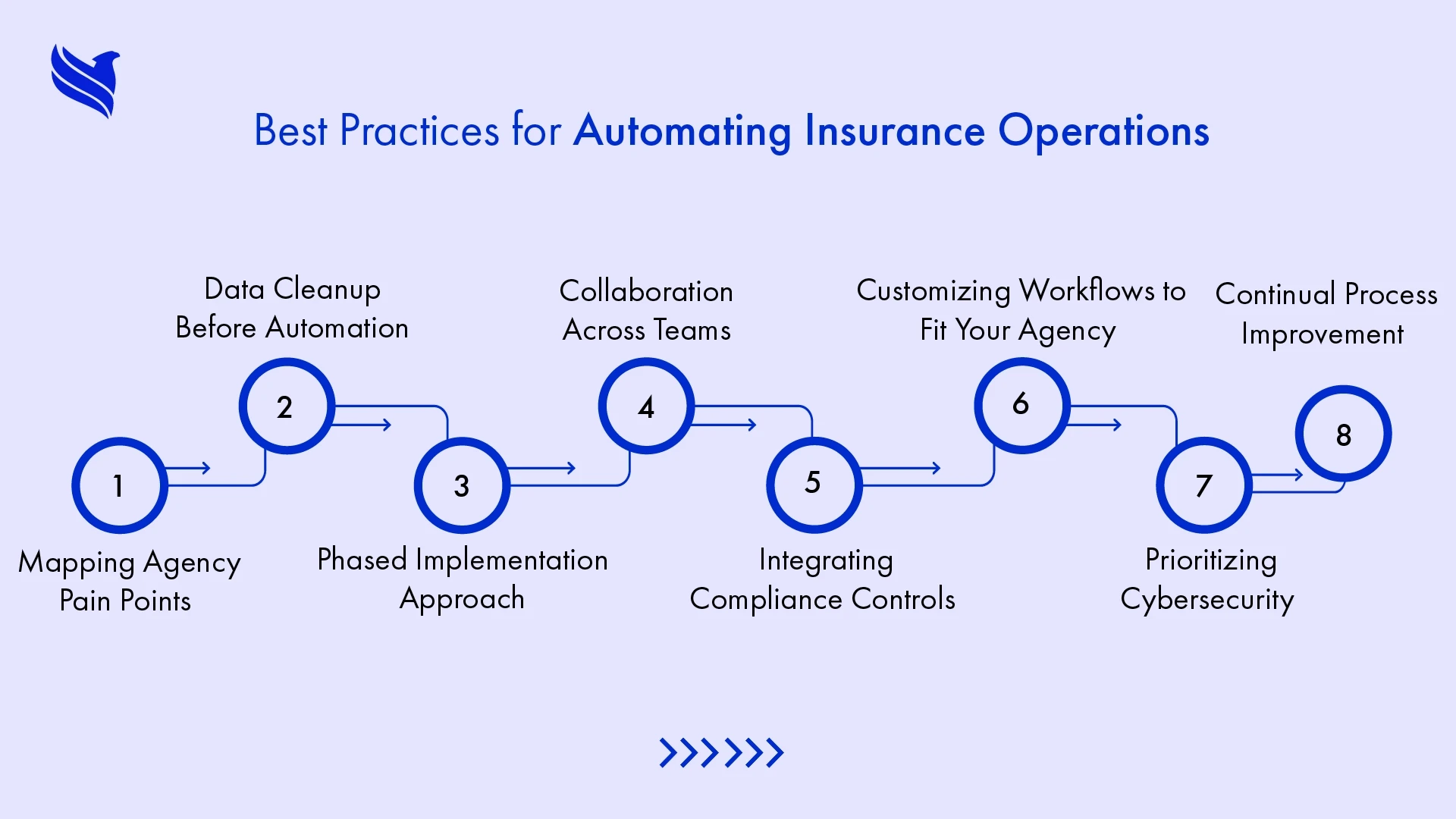

Best practices for successful insurance automation

From the outside, automation looks simple. Inside most agencies, it’s a series of small choices and mindset tweaks that separate success from confusion. Here’s how the best insurance consulting agencies and digital leaders genuinely get it right:

Start with clarity, not just excitement

Automation can tempt agencies to overhaul everything overnight. But successful teams pause. They map their most painful insurance workflow processes, not the ones everyone else automates, but the real sources of delay and frustration in their own shop. Maybe renewal reminders get missed, maybe claim paperwork stacks up. The point is honesty. Authentic insurance agency optimization starts with clarity.Fix data issues early

Automation won’t fix messy data. Before rolling out new workflows, agencies clean up client details, resolve duplication, and make sure information is accessible to every team. It’s not glamorous, but solid data underpins every insurance process automation initiative.Step small, scale smart

The best success stories always begin with a pilot. One specific workflow, like claim intake, customer onboarding, or policy changes, gets automated first. Teams watch, adjust, and only then repeat the approach elsewhere. It keeps failures contained and wins visible, which builds staff trust and momentum.Collaboration, not command

Change works best when it’s two-way. IT, business, and compliance teams all need a say while mapping workflows. Insurance consulting agencies that get invited in early usually spot compliance workflow automation opportunities that busy staff might miss. Staff engagement also helps the new process "stick" because the workflow actually fits real-life routines.Compliance isn’t afterthought

Insurance digital transformation means more rules, not less. Successful agencies automate documentation, approval trails, and audit logs as part of the insurance workflow automation. Automated checks mean fewer surprises during audits, and a much easier time answering regulators' questions.Customization always beats cookie-cutter

Every agency has its quirks. Best-in-class automation platforms allow tweaks, custom steps, and human-reviews for complex cases. Think: a claims workflow that automates all standard steps, but pauses for a manager's input on high-value payouts or complicated claims. It’s not just about speed, but getting better outcomes from blended tech and human decision-making.Security: silent, but essential

Security in insurance and compliance is non-negotiable. Modern tools encrypt data, lock down access, and keep audit logs. Agencies should check for regular updates, user-level permissions, and clear tracking of who did what, when, even if clients never see the back end.Ongoing review

Automated workflows must keep pace with changing markets, compliance rules, and evolving customer needs. That means a quarterly review, quick tweaks, and honest feedback loops. Insurance agency automation is most valuable when it evolves, so reviews aren’t just best practice, they’re survival.

Real-world use cases of automated insurance workflows

Theory sounds good, but results matter most. Here’s how insurance process automation is actually reshaping agency life:

- Claim processing: From drag to done

Manual claims used to slow everything down. Now, agencies use automation to pull forms, verify policy details, and check documentation right at intake. Bots chase missing items, and employees review only the tough stuff. One insurer cut claim cycles from weeks down to a few days, freeing adjusters to focus on customer care instead of paperwork. - Streamlining policy renewals and issuance

Forget stacks of reminders and hand-filled forms. Automated systems map policy dates, send reminders, generate renewal documents, and even take electronic signatures automatically. No more missed deadlines or irate clients. The peace of mind helps retain business and boosts satisfaction, clients notice steady, smooth service. - Upgrading customer service

Clients don’t always want to wait. Chatbots and self-serve portals powered by automation answer simple questions, handle policy changes, and even assist with payments. Real people step in for edge cases, but most inquiries get solved right away. Agencies adopting these tools free up staff, who can now tackle complex needs instead of answering “what’s my deductible?” all day. - Onboarding new clients with less hassle

A new client means documents, compliance checks, KYC, often delays. Automation gathers info, checks IDs, verifies compliance, and routes applications to the right staff if issues crop up. Agencies have seen onboarding times drop from days to hours, and the client feels the improvement immediately. - Proactive compliance with fewer surprises

Compliance workflow automation doesn’t just keep agencies safe, it creates audit trails as work happens. These logs, paired with automated alerts and approval templates, help agencies sail through audits and prove every step was followed. - Detecting fraud before It hurts

With AI and automation, claims data can be checked for patterns, flagging fraud attempts or inconsistencies before losses happen. This protects the agency’s bottom line and, ultimately, honest clients as well. - Collection and billing made smooth

Late payment calls aren’t anyone’s favorite. Automation tracks who owes what and sends reminders as needed, matching payments to policies and alerting staff if problems appear.

Every case above shows this: insurance process automation is much more than tech hype. It turns real daily struggles into strong points, delivering speed, accuracy, and happier clients across the board.

Deciding which processes to automate first

In every agency, some processes scream for improvement. Where to begin? It’s rarely the shiniest task, it’s where the headaches live. Think of insurance process automation like a “pressure release valve” for jobs that tie up staff or trigger the most client complaints.

Policy renewals and claims processing are the obvious picks for most. No agency enjoys renewal season meltdowns, when emails pile up and deadlines get missed. Automating renewal reminders, document creation, and payment tracking frees staff and keeps clients happy. Claims are even more telling. Paperwork moves from desk to desk, cases wait on missing info, and staff burn out fast. Automated claims systems capture reports, verify coverage, send checks for straight claims, and flag odd cases for review.

But don’t ignore smaller workflows. Endorsements, certificates of insurance, underwriting updates, all take time if left manual. Even basic client communication, like welcome messages or status follow-ups, eats away at a team’s focus. Insurance agency optimization comes from fixing what slows you down the most, not chasing some “industry standard” list.

The best agencies review performance data, audit workflows, and listen to staff. Which task has the most mistakes, the longest delays, or the highest error rate? That’s where automation starts. The goal isn’t doing everything at once, but making a real dent where it hurts.

And always remember: each agency is different. What’s crucial for one might not matter elsewhere. The only wrong move? Not making one at all. The future of insurance agencies will always reward the teams brave enough to simplify what needs it most.

How outsourcing enhances agency automation

Insurance agencies today can’t always build or run automation projects alone. That’s where partnering with experienced outsourcing teams gives a serious edge.

Outsourcing can sweep away repetitive processes, claims intake, policy checking, endorsements, certificates, that normally choke in-house staff. External experts manage daily workflows using the latest tools, freeing the internal team to focus on advising clients or bringing in new business. You get efficiency gains of 30–50%, often with shorter turnaround times and stronger accuracy.

Good outsourcing companies come with their own technology, compliance know-how, and battle-tested workflows. They blend automation with human review and help agencies scale up or down easily based on demand, so spikes in claims after a storm or rapid growth never risk quality or timelines. Agencies avoid big up-front costs for tech or hiring, pay only for what they use, and can test improvements quickly.

One hidden benefit? Outsourcing providers often bring advanced automation you couldn’t justify building alone: AI-powered fraud detection, automated compliance flagging, real-time performance dashboards. These tools sharpen decisions, help avoid regulatory headaches, and let you stay current without draining cash on upgrades.

Of course, strong oversight matters. Agencies must pick partners with a track record for data security and insurance digital transformation, and should check on reporting, access, and escalation protocols before signing on.

Outsourcing isn’t about giving up control. It’s about bolstering your team so that every process, automated or not, runs smoother, faster, and more secure. With the right support, insurance workflow automation is no longer a future dream,it’s table stakes for agencies determined to compete and grow.

Ready for change? Time to make insurance automation work

Insurance process automation isn’t some distant trend, it’s how forward-thinking agencies survive and grow in today’s market. From claims to renewals, onboarding to compliance, every repeated task is a chance to improve speed, cut mistakes, and make real room for personal service. The right workflows and technology bring security, happier clients, fewer headaches, and data-driven results that keep an agency competitive. Outsourcing and smart consulting fill the resource gaps, bringing transformation within reach for all sizes of agencies, not just the biggest players.

Still wondering where to begin, or how to get your automation project right the first time? FBSPL specializes in guiding insurance agencies through digital progress, with proven solutions, consulting, and full-scale support that gets results.

Ready to automate? Contact FBSPL to start your insurance process transformation today.

Written by

Bhavishya Bharadwaj

Bhavishya Bharadwaj is the Digital Marketing Manager at FBSPL, bringing over a decade of experience across insurance, outsourcing, accounting, and digital transformation.Frequently Asked Questions

Insurance process automation uses digital tools to perform repetitive tasks, speeding up operations, improving accuracy, and ensuring compliance for agencies.

Start with high-volume tasks: claims processing, policy renewals, onboarding, customer service queries, and compliance checks, all benefit the agency most when automated.

Automation tracks actions, maintains audit logs, enforces access controls, and sends alerts, making compliance reporting simple and boosting data protection.

Agencies see lower costs, faster service, fewer mistakes, smoother audits, better data for decisions, and easier scaling during growth or busy seasons.

Outsourcing brings technology, expertise, and flexible support, letting agencies automate quickly, handle demand spikes, and cut costs, while focusing in-house teams on growth and client service.