Quick summary - This comprehensive guide explains how security and compliance shape modern insurance. It covers regulatory challenges, AI-driven solutions, best practices, and the strategic role of outsourcing in improving accuracy, performance, and resilience, empowering insurers to stay compliant and competitive in a fast-evolving landscape.

- Why security & compliance define modern insurance

- Evolving landscape of security and compliance in insurance

- Challenges and strategic solutions that might help

- Best practices for strengthening security and compliance in insurance

- The transformative role of AI and automation in insurance

- Building a security-first culture in insurance

- The future of security and compliance in insurance

- How outsourcing strengthens security and compliance

- Conclusion: A smarter path to compliance and confidence

Explore how insurers can strengthen data protection, meet global compliance standards, leverage AI, and use outsourcing to build secure, future-ready operations.

How well is your insurance business prepared to protect sensitive client data and stay compliant with ever-evolving regulations? The insurance industry, built on trust, is now navigating an era where digital innovation and data dependency bring as many risks as rewards. From complex regulatory frameworks to increasing cyber threats, insurers face mounting pressure to safeguard information while maintaining operational efficiency.

The challenge lies not just in meeting compliance requirements but in doing so consistently and accurately across systems, teams, and geographies. Security in insurance isn’t only about defending against cyberattacks; it’s about ensuring data integrity, preventing breaches, and maintaining transparent operations that regulators and clients can rely on.

Many forward-thinking insurers are turning to insurance outsourcing and BPO partners who specialize in compliance monitoring, cybersecurity protocols, and automation-driven accuracy. Outsourcing provides the agility and expertise needed to keep pace with global standards and emerging risks.

In this guide, we’ll explore how security and compliance shape the insurance industry today, the challenges insurers face, the role of AI and automation, and how outsourcing can help improve performance and compliance accuracy, building a stronger, safer, and more resilient insurance ecosystem.

Why security & compliance define modern insurance

In today’s data-driven insurance ecosystem, security and compliance are no longer back-office functions; they are the backbone of trust, credibility, and growth. Every policy written, claim processed, or customer interaction depends on how secure data is handled, and how well an organization aligns with ever-tightening regulatory standards. The modern insurer’s reputation rests on two questions: Can clients trust us with their data? and Can regulators trust our systems?

The reason is clear, insurance companies manage some of the most sensitive personal, financial, and medical information in the world. Any lapse in data security compliance can lead to financial losses, legal penalties, and irreversible reputational damage. Similarly, failure in regulatory compliance, from privacy laws like GDPR to region-specific solvency and reporting norms, can disrupt entire operations.

As technology advances, insurers are adopting AI-driven platforms, cloud-based systems, and digital distribution channels to improve speed and service. However, each innovation introduces new compliance challenges and security vulnerabilities. That’s why leading organizations are embedding security in every process and making compliance an ongoing discipline rather than a checklist item.

In essence, security in insurance is not just a defense mechanism; it’s a business enabler. Insurers who build compliance-first frameworks gain a competitive edge, delivering seamless experiences, avoiding disruptions, and earning long-term customer loyalty. This shift from reactive protection to proactive governance defines the future of modern insurance.

Evolving landscape of security and compliance in insurance

The insurance industry is undergoing a rapid digital transformation, reshaping how organizations manage data, assess risk, and ensure compliance. Yet, this progress comes with a new wave of complexity. The rise of hybrid work models, cloud migration, and interconnected platforms has expanded the threat surface, exposing insurers to higher risks of data breaches, identity theft, and cyber fraud. As a result, cyber security insurance itself has emerged as both a product necessity and a business safeguard.

Regulatory bodies across the globe are tightening oversight to protect consumer data and promote transparency. From the NAIC’s cybersecurity model law in North America to the EU’s GDPR and India’s DPDP Act, regulatory compliance expectations now demand not just adherence but demonstrable proof of continuous monitoring and control. This shift has made compliance in insurance a living process; which is dynamic, adaptive, and heavily data dependent.

Internally, insurers are grappling with legacy systems and siloed operations that hinder visibility and make challenges in managing compliance even greater. Manual reporting, inconsistent data formats, and fragmented processes can lead to errors, missed deadlines, and costly penalties.

To navigate this changing landscape, forward-looking organizations are investing in automation, centralized compliance dashboards, and strategic partnerships with insurance BPO providers who bring specialized knowledge and scalable frameworks. This convergence of technology and expertise enables insurers to modernize operations without compromising control.

In today’s insurance ecosystem, the ability to maintain data security compliance while innovating at speed has become a defining differentiator. Those who succeed are not just meeting regulatory demands; they are setting new benchmarks for trust, resilience, and long-term value creation.

Challenges and strategic solutions that might help

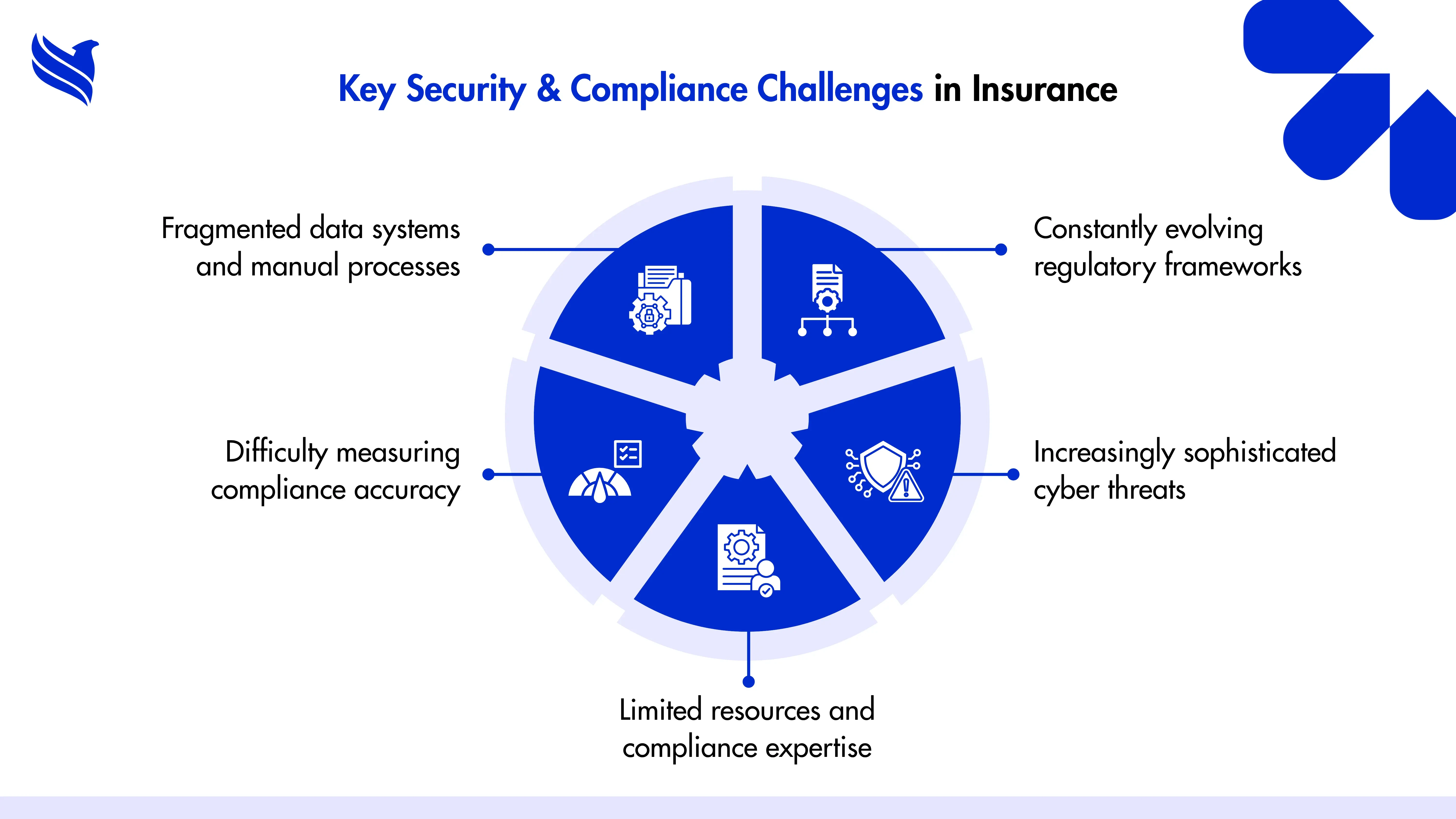

While technology has opened new opportunities for insurers, it has also introduced an intricate maze of compliance obligations and security threats. Today’s insurers must juggle customer expectations, data protection laws, and operational efficiency, all while keeping pace with evolving digital ecosystems. The result? A complex set of compliance challenges that require structured, technology-driven solutions.

1. Fragmented data systems and manual processes: Many insurance companies still operate with legacy systems and isolated data silos. This fragmentation leads to inconsistent reporting, duplicated effort, and increased risk of non-compliance. The solution lies in data integration and automation. centralizing policy, claims, and client information on secure digital platforms. Automation tools ensure data security compliance by validating information in real time and minimizing human error.

2. Evolving regulatory frameworks: Laws governing security in insurance differ across jurisdictions and are constantly changing. Keeping up with new mandates, from AML and KYC rules to data privacy acts, can overwhelm compliance teams. Implementing RegTech (Regulatory Technology) solutions that help organizations track, interpret, and apply these updates efficiently, reducing delays and improving accuracy.

3. Rising cyber threats: Cyberattacks are not hypothetical; they’re inevitable. From ransomware to phishing, insurers face continuous attempts to exploit sensitive client data. Establishing multi-layered cybersecurity insurance strategies that combine encryption, network monitoring, and AI-driven anomaly detection can drastically mitigate risk. Regular employee training is equally vital to strengthen internal defense.

4. Resource and expertise constraints: Maintaining a full-scale compliance team is costly and difficult, especially for mid-sized insurers. That’s why many turn to insurance outsourcing and insurance BPO partners. These partners bring domain expertise, 24/7 monitoring capabilities, and access to global compliance specialists, ensuring seamless adherence without overstretching internal resources.

5. Measuring and improving compliance accuracy: Compliance isn’t static. To continually improve, insurers must audit processes, benchmark performance, and deploy analytics for predictive insights. Leveraging AI-driven dashboards helps improve performance and compliance by identifying gaps before they become risks and enhancing decision-making speed.

Ultimately, overcoming these challenges requires a mindset shift, from reactive compliance management to proactive governance. Insurers that combine advanced technology, skilled outsourcing support, and a culture of accountability are best positioned to protect data, satisfy regulators, and maintain the trust their clients expect.

Best practices for strengthening security and compliance in insurance

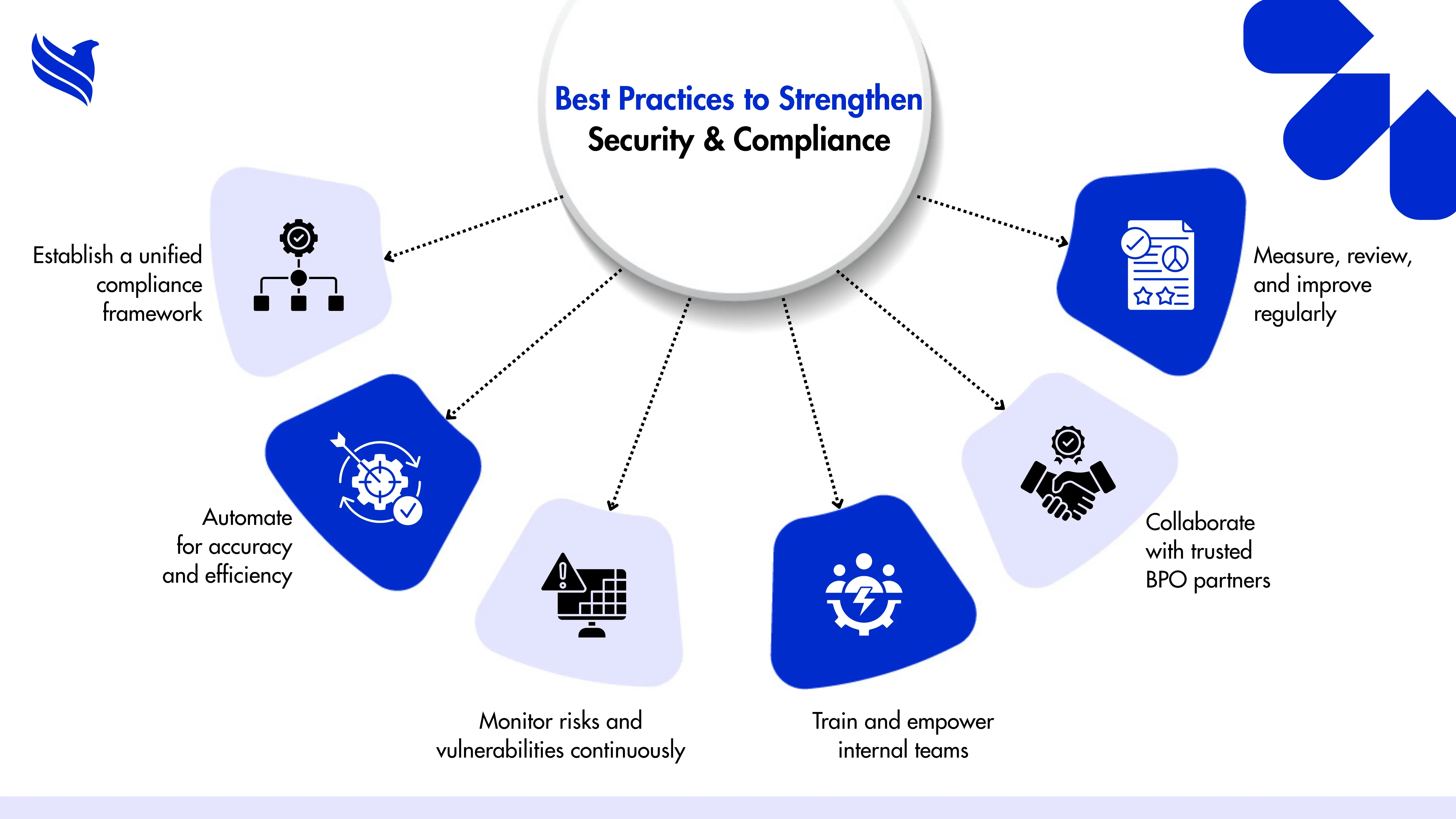

Building a resilient insurance organization today demands more than meeting minimum compliance requirements; it requires embedding security and compliance into every operational layer. To protect customer data, maintain trust, and stay ahead of regulatory expectations, insurers must adopt a proactive, technology-driven, and culture-oriented approach. Here are key best practices leading firms are following:

1. Establish a unified compliance framework: A well-defined governance framework is the foundation of compliance in insurance. It aligns all departments, claims, underwriting, finance, and IT, under consistent data-handling and reporting standards. This prevents duplication, streamlines documentation, and ensures compliance accuracy across every process.

2. Automate for accuracy and efficiency: Automation reduces manual intervention, which is often the root cause of reporting errors and delayed audits. Insurers can leverage intelligent bots to validate transactions, generate compliance reports, and flag discrepancies. This directly supports how to improve compliance accuracy while freeing teams to focus on strategic decision-making.

3. Prioritize continuous monitoring and risk assessment: Compliance isn’t a one-time task; it’s a living process. Regular risk assessments, vulnerability testing, and policy audits help identify blind spots early. Using AI and predictive analytics, insurers can monitor unusual patterns, ensuring data security compliance and early detection of potential threats.

4. Train and empower teams: Human error remains one of the biggest vulnerabilities in any organization. Investing in ongoing employee training builds awareness about cybersecurity insurance, privacy policies, and incident reporting procedures. When compliance becomes everyone’s responsibility, performance naturally improves.

5. Collaborate with trusted partners: Outsourcing compliance monitoring, data management, and regulatory reporting to experienced insurance BPO partners brings in specialized expertise and scalability. These partners can implement standardized procedures and 24/7 monitoring, crucial for insurers expanding into multiple markets.

6. Measure, review, and improve: To truly improve performance and compliance, organizations must track metrics such as audit accuracy, incident resolution time, and regulatory adherence rates. Periodic reviews ensure ongoing improvement and adaptability to changing laws.

Ultimately, best-in-class insurers don’t treat compliance as a burden; they treat it as a business advantage. By combining automation, continuous oversight, and collaborative governance, they build trust that endures, and performance that scales safely into the future.

The transformative role of AI and automation in insurance

Artificial Intelligence (AI) and automation are redefining how insurers approach security and compliance. Once considered secondary to operations, compliance is now becoming a competitive differentiator, driven by the speed, precision, and predictive power of digital technologies. As insurance companies manage increasingly complex regulations and massive data volumes, manual monitoring is no longer sustainable. This is where AI and automation bridge the gap between efficiency, accuracy, and proactive governance.

1. Automating data security compliance: AI-driven systems can analyze vast datasets, detect anomalies, and identify non-compliant actions faster than any manual audit could. From policy documentation to claims processing, intelligent tools automatically validate data fields, ensuring every transaction adheres to data security compliance standards. They also enable real-time alerts when suspicious patterns emerge, reducing breach response times from hours to seconds. This not only strengthens security in insurance but also helps insurers avoid penalties linked to delayed detection.

2. Enhancing regulatory compliance through predictive analytics: Regulations evolve continuously, and keeping pace can overwhelm even experienced compliance teams. AI can track, interpret, and apply changes in regulatory compliance across jurisdictions automatically. Machine learning algorithms scan government portals, industry bulletins, and regulatory updates to flag potential implications before new laws take effect. This predictive approach transforms compliance from a reactive activity into a proactive, future-ready function.

3. Streamlining audits and Reporting: Automation tools drastically simplify internal and external audits. They consolidate data from multiple systems into unified dashboards, eliminating inconsistencies and reducing manual data reconciliation. Automated workflows generate audit trails, version histories, and performance summaries, supporting transparency and reliability. This level of audit readiness also demonstrates a strong commitment to compliance in insurance when facing regulatory reviews.

4. Improving accuracy and performance at scale: AI enhances not only compliance accuracy but also operational performance. Intelligent bots can process thousands of records simultaneously with 99.9% precision, minimizing human error and bias. This directly supports the goal of improving compliance accuracy and how to improve performance and compliance together. The result is faster turnaround times, lower costs, and greater customer satisfaction.

5. Strengthening cybersecurity insurance defense: AI plays a vital role in cybersecurity insurance, where early detection and predictive prevention are key. Advanced algorithms monitor network activity, detect intrusions, and assess risk exposure in real time. By simulating attack patterns and predicting vulnerabilities, AI enables insurers to prepare rather than react, transforming cybersecurity from damage control to defense by design.

6. Supporting outsourced compliance models: When integrated into insurance outsourcing or insurance BPO frameworks, AI enables seamless coordination between in-house teams and external compliance specialists. Automated workflows, secure data sharing, and real-time dashboards ensure consistency, transparency, and accountability across geographies.

In essence, AI and automation are not replacing human oversight, they’re enhancing it. They provide the precision, scalability, and foresight insurers need to navigate today’s regulatory complexity while maintaining the human judgment that builds trust. The insurers that embrace intelligent automation now will define the next era of secure, compliant, and customer-centric insurance operations.

Building a security-first culture in insurance

Technology can protect systems, but only culture can protect organizations. In the insurance industry, where every employee handles sensitive customer and financial data, a security-first culture is as critical as any software or regulation. It’s the human firewall that ensures compliance in insurance isn’t just a checklist; it’s a shared mindset.

Building this culture begins with leadership. Executives must set the tone by prioritizing data security compliance in decision-making, budgeting, and daily operations. Regular communication about risks, best practices, and success stories keeps awareness alive and turns compliance from a mandate into a mission.

Empowering teams through ongoing training, transparent reporting structures, and recognition programs helps reduce human error, the most common source of data breaches. When employees understand the “why” behind each security measure, accountability becomes natural.

Partnering with specialized insurance outsourcing or BPO providers also reinforces this culture, ensuring consistent adherence to global compliance standards across every function and location.

Ultimately, a security-first culture transforms compliance from a burden into a behavior. It builds an organization where vigilance, responsibility, and integrity come naturally strengthening trust with clients, regulators, and the market at large.

The future of security and compliance in insurance

The future of security and compliance in the insurance industry will be defined by intelligence, integration, and adaptability. As digital transformation accelerates, insurers will need to navigate a landscape where technology, regulation, and customer expectations evolve simultaneously, and often unpredictably.

We’re entering an era where security in insurance will become fully embedded into every transaction and customer interaction. Advanced encryption, zero-trust frameworks, and AI-driven monitoring will make real-time compliance validation of the norm. Rather than conducting audits quarterly or annually, insurers will operate with continuous compliance, detecting and resolving deviations as they occur.

Regulatory bodies, too, are evolving. Expect tighter regulatory compliance frameworks that demand greater transparency, data ethics, and sustainability alignment. Cybersecurity insurance will grow from a niche offering into a core necessity as organizations seek protection not just from attacks, but from reputational and regulatory fallout.

Collaboration will also redefine the future. Insurers, reinsurers, and technology partners will form digital ecosystems that share insights on threats and compliance best practices. Insurance outsourcing and BPO partnerships will play a crucial role here, bringing scalable talent, automation expertise, and advanced compliance infrastructure to meet global standards.

Ultimately, the next decade will favor insurers who see compliance not as a constraint, but as a catalyst for innovation. By combining human judgment, machine intelligence, and ethical governance, the insurance industry can transform compliance from a regulatory demand into a business advantage, building resilience, trust, and sustained growth in a hyper-connected world.

How outsourcing strengthens security and compliance

In an industry where compliance accuracy and data security define success, outsourcing has emerged as a powerful enabler. Partnering with specialized insurance BPO providers allows insurers to streamline operations, access domain expertise, and maintain continuous oversight, without overburdening internal teams.

Outsourcing partners bring structured frameworks, advanced automation, and round-the-clock monitoring to help insurers meet data security compliance and regulatory compliance mandates efficiently. They specialize in handling large-scale policy, claims, and accounting data, ensuring every process adheres to the latest privacy and security standards.

By leveraging insurance outsourcing, insurers can reduce human error, accelerate reporting cycles, and achieve measurable improvements in both performance and compliance accuracy. The scalability of outsourced models also means insurers can adapt quickly to new regulations or market expansions without disrupting their core operations.

Moreover, outsourcing introduces objectivity; external experts can audit, validate, and optimize compliance processes with a fresh perspective, minimizing internal bias and operational blind spots.

In short, outsourcing is not just a cost-saving decision; it’s a compliance-strengthening strategy. It enables insurers to operate with confidence; secure, compliant, and always ready for the next wave of regulatory change.

Conclusion: A smarter path to compliance and confidence

Security and compliance are no longer background functions; they’re the driving forces shaping modern insurance. From evolving regulations and rising cyber threats to the integration of AI and automation, insurers must build systems that are as intelligent as they are secure. The key lies in creating a security-first culture, investing in continuous monitoring, and partnering strategically to ensure every process meets the highest standards of data security compliance and regulatory compliance.

As we’ve explored, outsourcing, automation, and proactive governance empower insurers to overcome complexity while improving accuracy, performance, and trust.

At Fusion Business Solutions (P) Limited (FBSPL), we help insurance organizations achieve this balance by combining technology, process excellence, and compliance expertise to build secure, future-ready operations.

Ready to strengthen your compliance foundation and accelerate growth?

Partner with FBSPL, your trusted ally in secure and compliant insurance transformation.

Written by

Bhavishya Bharadwaj

Bhavishya Bharadwaj is the Digital Marketing Manager at FBSPL, bringing over a decade of experience across insurance, outsourcing, accounting, and digital transformation.Frequently Asked Questions

Because insurers handle sensitive customer and financial data, maintaining strong data security and compliance ensures trust, prevents breaches, and avoids regulatory penalties.

Evolving global regulations, fragmented legacy systems, human error, and increasing cyber threats are key challenges affecting consistent compliance management.

AI tools automate monitoring, detect risks in real time, and streamline audits, reducing human error and ensuring continuous regulatory adherence.

Outsourcing provides expert support, automation infrastructure, and 24/7 monitoring, helping insurers strengthen compliance while improving efficiency and scalability.

By training teams, reinforcing leadership commitment, and embedding compliance into everyday workflows, ensuring security becomes part of company DNA.

The future lies in continuous compliance, AI-enabled governance, and collaborative ecosystems where technology and outsourcing partners drive proactive, real-time risk management.