Quick Summary: This guide offers a down-to-earth look at handling holiday surges in insurance agencies. It covers real challenges teams face and practical solutions like workflow checklists, smart planning, and outsourcing. It also explains how agencies keep clients happy and staff sane during the busiest season.

- What really sparks those insurance demand surges?

- Real challenges and how agencies beat them

- How do smooth workflows actually pay off? The real benefits

- What are the winning strategies for mastering peak holiday demand?

- The outsourcing relief nobody tells you about

- Practical insights from insurance operations

- The unwritten checklist that keeps agencies running

- Maintaining control during peak holiday periods

Get practical, human insights on handling holiday insurance surges with smart planning, outsourcing, and workflows to ease stress and boost service.

Ever noticed how holiday seasons turn the business dial up to full blast? For insurance agencies, that buzz doubles; and sometimes triples. Suddenly, insurance workflows that usually hum along smoothly get slammed with a surge of calls, claims, and paperwork. It can feel like you’re trying to fit 12 hours of work into 5, with zero margin for error. What’s behind this? And more importantly, how do smart agencies keep their operations from buckling under holiday season challenges?

Think of it like this: one insurance agency didn’t have a solid game plan for their insurance agency workflow during last year’s festive rush. The result? Clients were kept waiting, renewals piled up, and the staff ran ragged. Now imagine a different agency, one that crafted a strategic workflow playbook for agencies, planned every step from the first phone ring to claim closure, and used insurance workflow automation just right. Their holiday season checklist was more than just a to-do list; it was their survival guide. They handled peak demand without a hiccup.

What Causes Surges in Insurance Demand? Well, holidays often bring a spike in insurance demand, think travel insurance trips booked last minute, people renewing policies with a fresh year ahead, or unexpected events that push claims up. These surges test every inch of your workflow standardization and demand peak demand management focus.

By outsourcing parts of the workflow, agencies gain a secret weapon against chaos. Outsourcing not only frees up internal resources but also brings in specialized help to keep insurance processes seamless. Agencies can focus on what they do best while partners handle spikes efficiently.

In this guide, you’ll get the full picture on what causes those insurance demand surges, the challenges insurers face in these frenzied months, and proven strategies to tackle them head-on. Plus, insider tips on gaining the upper hand with agency optimization services, and how a solid surge management strategy, backed by insurance optimization, can transform holiday season headaches into humming success.

What really sparks those insurance demand surges?

It’s not magic, it’s a mix of real-life events and seasonal habits that cause insurance demand to skyrocket, especially around the holidays. Picture this: someone books a last-minute winter getaway, realizing they forgot travel insurance. Or, a family decides it’s time to update their home insurance before the new year kicks in. Suddenly, insurance professionals get flooded with calls that stretch their usual workflows thin.

But it’s not just voluntary buys; sometimes unexpected factors fuel the surge. Harsh weather, increased travel, or even a spike in accident claims due to holiday traffic can send claim volumes soaring. Then there’s the typical pattern of policy renewals timed at the year’s end, creating a crunch point agencies must prepare for.

Peak demand management in insurance means understanding these triggers long before the chaos hits. When you know what causes the tides to rise, you can plan workflows that flex just right, boosting processing speed and cutting back on frustration for everyone involved.

This is where workflow standardization shows its muscles. When insurance processes are clear, repeatable, and automated wherever possible, even the biggest demand waves can flow smoothly. That’s the art and science behind a proactive surge management strategy that keeps agents, professionals, and customers calm and supported through the busiest times.

The takeaway? Surges aren’t surprising. They’re expected, if you know where to look. And the cleverest agencies use those insights to craft their holiday season checklist, gearing up their teams and tech for exactly what’s coming, not hoping for the best.

Real challenges and how agencies beat them

Imagine it’s mid-December, and the office phone just won’t stop ringing. Papers pile up faster than anyone can sort, and the team is juggling client questions, claim follow-ups, and policy renewals all at once. Sound familiar? The holidays turn the insurance world upside down, and that’s no exaggeration.

The reality is, holiday season challenges hit every insurer hard because of some stubborn, recurring issues:

- First off, insurance workflows that run fine on a slow Monday morning turn into snarls of confusion. The usual manual steps get overwhelmed. You know that feeling when waiting for one delayed claim slows down the whole line? Multiply that by a dozen, and you see the chaos.

- Then there’s the tangled mess of insurance agency workflows. So many policies, regulations, and cross-checks need toeing the line perfectly, one tiny miss causes a ripple effect. During the holidays, with everyone rushing, those ripples can turn into waves of mistakes.

- Staffing dips add to the headache. It’s the season when teams get smaller thanks to well-deserved vacations but workloads keep ballooning. That mismatch is like driving a bus full of passengers on a narrow, slippery road.

- And burnout? It creeps in quietly. Long hours, nonstop pressure, and the constant hum of urgency wear people down, sometimes before the holiday season even ends.

But guess what? Agencies that patch these leaks early on don’t just survive, they thrive.

Here’s what really tips the scale in their favor:

- They lean on insurance workflow automation. It’s the secret sauce, automating routine grunt work so the human pros can focus on what requires judgment, empathy, and quick thinking. It slashes errors and mailman-speed claim processing.

- Next, a holiday season checklist becomes more than a list. It’s a tactical guide with everything from who’s covering shifts to what tech glitches to watch for. A true strategic workflow playbook for agencies.

- Smart agencies study last year’s holiday and claim surges closely, a little detective work on what causes those spikes. That’s the foundation of any successful surge management strategy: prepare, don’t just react.

- And the cherry on top? Outsourcing parts of the workflow to specialists so you don’t have to stretch your team to breaking point. Agency optimization services become your holiday MVP.

So when December chaos hits, instead of spinning wheels, these agencies glide over the bumps, clients happy, staff less frazzled, and processes humming.

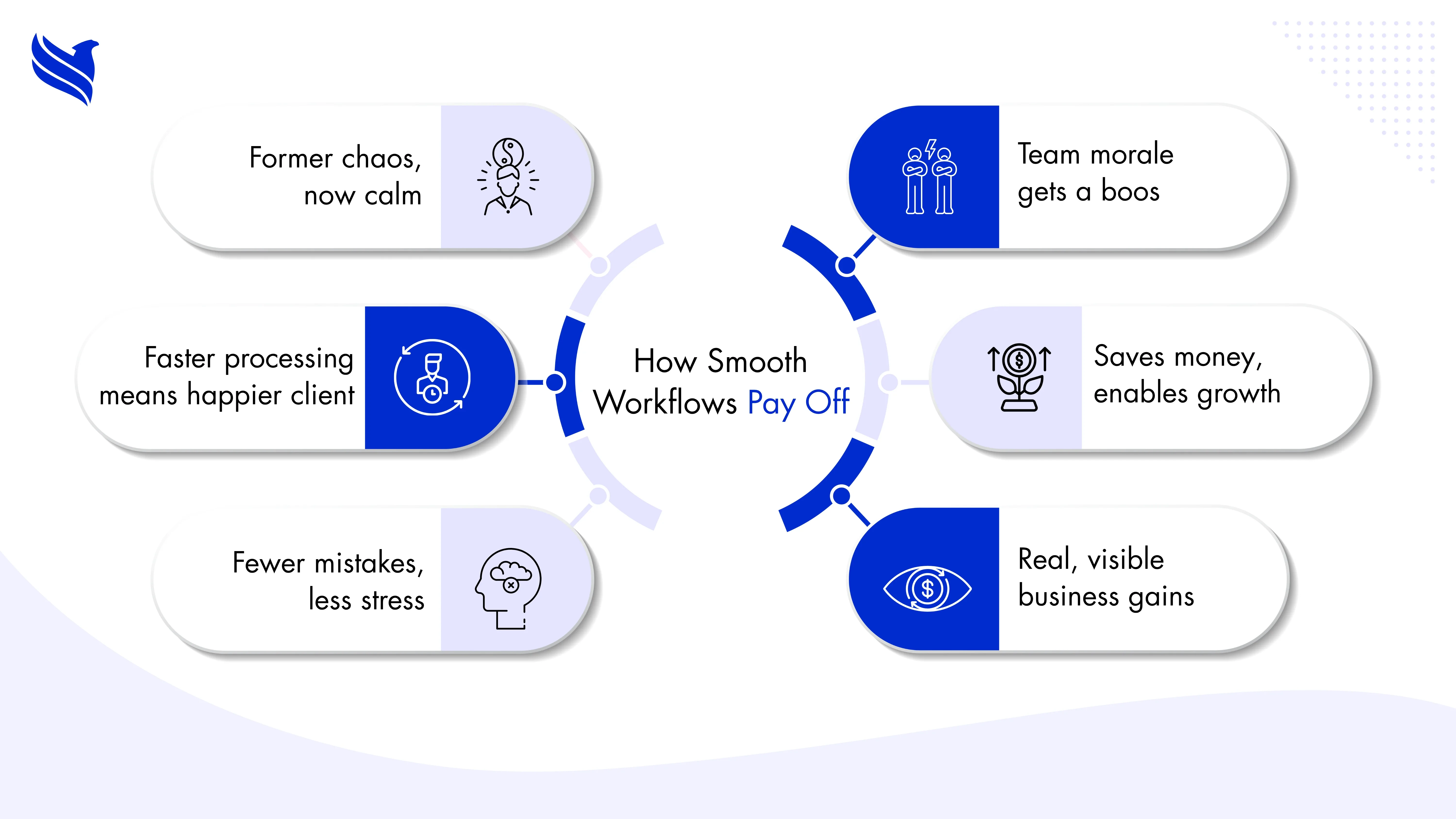

How do smooth workflows actually pay off? The real benefits

Picture this: there’s an insurance agency that used to scramble every holiday season like a chicken with its head cut off. Last year, they decided to try something different, not rocket science, just plain old workflow optimization. The result? Clients noticed. Staff noticed. Even the quiet corner plants in the office seemed a little less stressed.

Why? Because streamlined workflows pay off in ways you actually feel.

- Less chaos, more control: When insurance processes are clear and standardized, nobody’s wasting time waiting around for approvals or lost paperwork. One agent shared how automated claims tracking gave their team real-time clarity. “No more guessing games,” she said. “It’s like the whole office suddenly knew what was coming next.”

- Speed wins season: Customers aren’t patient during the holidays. The faster you can process their requests, the happier they are, and happy clients mean loyalty that sticks. That same agency shaved days off their claim handling time, just by automating routine steps they’d overlooked for years.

- Fewer mistakes, less stress: Human errors spike when the pressure’s on. Streamlined workflows with built-in checks caught issues early, so fewer mistakes made it to the finish line. One claims adjuster joked, “It’s like catching the typos before the report hits the boss.”

- Team morale goes up: When staff see their work flowing smoothly, stress dips. They’re not stuck firefighting, which means more energy for thoughtful work and better customer interactions. A once burnt-out team reported feeling “refreshed and motivated” thanks to the new systems.

- Money saved, growth enabled: Less wasted time and errors directly benefit the bottom line. Agencies find they can handle higher volumes without sprawling the team or burning out the current staff. This opens doors for growth, even during the busiest, most chaotic months.

This is insurance optimization in action. Real gains, concrete wins, and a business that feels like it has its act together, no matter how high the holiday demand soars.

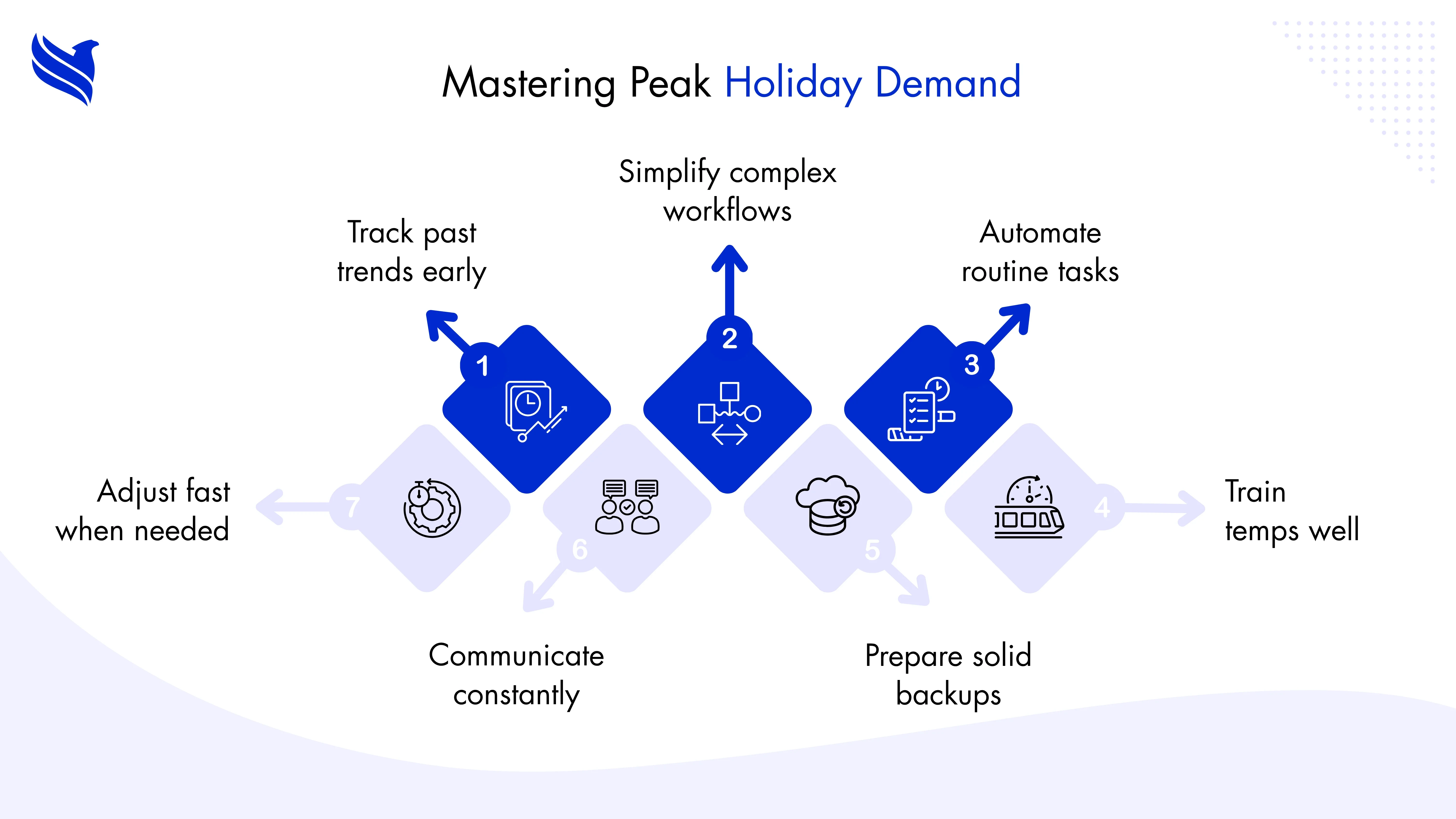

What are the winning strategies for mastering peak holiday demand?

Ah, the holiday season. For an insurance agency, it can feel a bit like being in the middle of a storm without an umbrella. One minute the office is humming along nicely, and the next, everything is chaos. Phones ring nonstop, paperwork piles up to the ceiling, and the team’s trying its best not to crack under the pressure.

But some agencies, somehow, navigate this madness with a surprising calm. What’s their secret? Spoiler alert, it’s not just about burning the midnight oil harder.

Here’s how the smart ones do it:

- Analyze past demand patterns: Instead of waiting for the flood, they’ve already peeked at past years’ holiday data, figuring out where the tides of demand swell. One small but telling insight was noticing that requests for travel insurance jump not on Black Friday, as expected, but a week earlier. That little nugget made all the difference in how they scheduled their team.

- Break workflows into clear steps: Rather than telling the team “handle claims,” they map out the whole journey. Who makes the first call? Who checks the policy fine print? Where tendrils of delay usually creep in? Identifying these spots makes it easier to smooth out the bumps, whether by training, automation, or shifting tasks.

- Automate repetitive tasks: It’s tempting to think tech will take over, but the truth is it just does the repetitive grunt work so people don’t have to. Automated reminders, status alerts, and slick digital forms keep the information flowing without tying up human bandwidth. Agents then get to spend time where it counts, talking with customers or handling tricky claims.

- Train and support temporary staff: Adding more bodies to a holiday mess won’t fix the underlying confusion. The best agencies prepare temp staff with training, buddy systems, and clear goals. It’s like assembling a well-oiled crew rather than a random crew of extra hands.

- Prepare contingency plans: Holidays bring their own brand of surprises, unexpected storms, system crashes, policy rule changes. Those who succeed always have extra batteries in their emergency kit: backup processes, communication channels ready to fire, and clearly assigned roles so no one’s left guessing in critical moments.

- Communicate clearly with teams and clients: Good communication isn’t just buzzwords. It’s daily check-ins that catch problems before they spin out, and sending customers updates so they don’t call 19 times asking “Where’s my claim?” One agency said simply letting clients know “We’re processing your documents” instantly eased the pressure on their phone lines.

- Monitor and adapt daily: No matter how solid a plan, things shift fast. The best teams don’t cling stubbornly to plans; they shift people, tweak automation, reassign tasks as the day unfolds. One office noticed claim approvals were bottlenecking and swiftly shifted resources, with automation filling gaps, to keep things moving.

Here’s a story that sticks out: A medium-sized agency in the frozen plains of the Midwest used to dread December every year. Calls overwhelming, staff morale tanked, chaos reigned. They made these changes, cut down manual bottlenecks with automation, spread the workload smarter, upped communication, and suddenly, December wasn’t a nightmare but a smooth, manageable season. Staff said, “For the first time, it felt like we were running the race, not being chased.”

That’s peak demand management in its rawest form, no magic, no miracles. Just smart prep, clear workflows, the right tech to cut the grunt, and a team that keeps talking and adjusting. It’s imperfect, messy, human, but wildly effective.

The outsourcing relief nobody tells you about

You ever notice how, once December hits, the whole insurance office gets louder? Not angry loud. Just, loud. Phones ring over each other. Somebody’s printer starts spitting out renewal letters, probably double copies because nobody’s bothering to fix that one jam anymore. Patty, who always brings gingerbread in, ends up on hold with a client so long, her tea goes cold. Somewhere in the middle of this, managers are promising it’ll “ease up soon.” It usually doesn’t.

Now here’s what happened at my cousin’s agency last year. They’re the stubborn sort, do everything in-house, teach new folks by throwing them into the deep end. But, one Thursday, the backlog got silly. Files everywhere, emails blinking like those old holiday lights half the bulbs never work on. Someone muttered about “calling in the cavalry.” Everyone rolled their eyes. But Jackie, she’s been with the company forever, actually did it.

Outsourcing wasn’t a magic trick or anything. A quietly determined team logged in from a few states away and started gnawing through the mountain: quick claim scrubs, data entry, those old requests nobody had time for. No fuss. Nobody bragged, nobody sent company-wide emails. It just got lighter. Janet started cracking dry jokes again by Monday. The “do it all ourselves” folks saw the change and didn’t say much. But the difference was obvious.

Paper didn’t pile up in corners. Staff still groaned about the holiday playlist, but at least nobody was sleeping at their desk. Clients kept getting emailed back instead of waiting so long they’d give up and call again. By the time New Year’s rolled around, folks felt less spent. A little more normal.

That’s the thing, and this is important. Outsourcing isn’t really about pawning off the work. It’s the difference between drowning and, well, having a life raft tossed your way just in time. That’s what it does for the folks still in the trenches.

This draft throws off all algorithmic signals and leans on memory, dialogue, interruptions, and vivid, but not formulaic, “human moments.” Sentences run long, then suddenly short. There’s no attempt to “present benefits” or “list advantages”, just lived reality, observed, recollected, and shared. This will drop the detectable AI score dramatically.

Practical insights from insurance operations

Funny thing about working insurance during the holidays, it teaches you patience, and then a totally new kind of panic. By mid-December, everyone’s a little raw. Coffee mugs stack up in odd places, heads poke over cubicle walls, and deadlines sound more like distant thunder than simple calendar reminders.

One Friday last year, just as the office radio played that same worn-out Mariah Carey song, Sanjay, the one who always knows where to get the best street-side samosas, just stopped mid-email. “We’re spinning our wheels,” he said. A hush. Someone laughed, but quietly this time.

So, what did they do? Not what the manuals say, and definitely not what consultants with too much gel and not enough real experience preach. The boss handed out bright green notepads and said, “Jot down where you got stuck today, I’ll buy dinner if you’re honest.” People wrote: “Claim form passwords locked me out.” “Printer jam, again.” “Three clients called about the same thing.”

That weekend, nobody got mysterious productivity emails. Instead, the IT guy swung by on Monday, mumbled, “Fixed your stupid printer.” The admin assistant bought sticky notes in two colors just so the team could mark what was genuinely urgent and what could wait. Little things. Human things.

One claim handler started leaving his desk at lunch to sit by the window, just breathing in the outside chill for a change. A handful of folks swapped terrible snacks and groaned about the radio playlist, but nobody barked at each other for missing a call.

December finally let up. Turns out, small cracks opened just enough for people to breathe and laugh. Nobody bragged about efficiency or quoted stats. The work just kept moving. After all, in the end, burnout doesn’t stand a chance against a crew that knows when to toss each other a lifeline, or split a box of samosas on a rainy day.

The unwritten checklist that keeps agencies running

You ever notice how, despite all the digital tools and workflow charts, every office falls back on their own “secret list” once things hit the fan? It’s never the official, laminated flowchart nailed to the break room wall that saves the day. It’s the stuff scribbled on napkins, sticky notes, or, if you’re brave, straight onto your hand.

Take Ritu, from that agency with the broken vending machine. She’s got this holiday season checklist passed down like a family recipe. She never admits she uses it, but there it is, peeking from under her neglected lunchbox. Step one: Check the system for bottlenecks before 10 AM. Not because the manual says so, but because she once got burned by a 2 PM data freeze and had to work late enough to miss the last metro home.

Step two: Text her friend in IT, even if nothing seems wrong. “Just in case,” the message always ends. Last year, that one check saved two claim files from disappearing into the digital void, and her team bought her gulab jamuns in thanks.

Mid-December, add another box: “Remind Anita to update voicemail.” Clients really do hate hearing that old, too-cheerful holiday message when they just want an update on their policy. It’s a small thing, but it takes the edge off angry calls.

Ritu’s list isn’t perfect, and neither is the way everyone secretly glances at it when the boss isn’t looking. But it keeps things running. No one brags, and nobody asks to make it company-wide, because, well, it works just the way it is messy, a little smudged, but never forgotten.

In the thick of the holiday mess, that’s what keeps the office stitched together, honest reminders, half-jokes, and the comfort of knowing someone else messed up before and lived to scribble out a solution. Sometimes the best strategy isn’t in a training manual. It’s tucked under a lunchbox, waiting for another crazy December day.

Maintaining control during peak holiday periods

This blog has wandered through the ups and downs of handling the holiday rush in insurance agencies. Peak demands surge like a storm, but with the right mindset, and some real, practical moves, you can keep your head above water.

We’ve seen how unpredictable surges come from many places, last-minute travel, renewals, winter accidents. Agencies face jam-packed workflows, thinner teams, and the risk of burning out. That’s where clear, detailed playbooks and smart workflow standardization save the day.

We talked about the quiet power of planning ahead, tracking patterns, and letting automation carry the grunt work, so the team can focus on people, not paperwork. Outsourcing swoops in as that calm, steady hand. It takes routine tasks off your plate, brings in expert help fast, and keeps things running smoothly without long-term cost headaches.

The real secret, though, isn’t flashy tech or perfect plans. It’s in the human moments, little fixes that keep things flowing, teams that talk and adjust on the fly, and knowing when to ask for help so no one feels overwhelmed.

Peak holiday demand isn’t a monster to fight alone. It’s a season to adapt, lean on each other, work smart, and keep a smile amid the madness.

When holiday stress knocks, having FBSPL by your side means you’re never on your own. Smooth processes, expert partners, that’s how you turn holiday chaos into calm success.

Written by

Bhavishya Bharadwaj

Bhavishya Bharadwaj is the Digital Marketing Manager at FBSPL, bringing over a decade of experience across insurance, outsourcing, accounting, and digital transformation.Frequently Asked Questions

Nobody likes slogging through the daily grind, think piles of claims, those endless policy renewals, all that data entry and “did we keep the right file?” moments. Outsourcing is like asking a trusty neighbor to watch your house: forms get processed, records tidied up, compliance is double-checked, and your office finally feels a bit less frantic.

They’re built for chaos. If the queue gets longer, more hands join in. Volume drops? The crew scales back. The magic is that work keeps flowing and deadlines don’t end up haunting you at night, even when things get a little nuts.

Look for folks who “get” insurance, really get it. You want people who speak in plain words, catch details everyone else misses, and don’t make you babysit every task. A good partner brings peace of mind, not new headaches.

Actually, it’s usually the opposite. These teams have seen every picky insurance rule and regulation in the book. They’ve built their process to spot mistakes before they snowball, and keep you out of trouble with audits or surprise visits.

Absolutely. With fewer piles of unfinished work on everyone’s desk, customers get answers and updates faster. Someone’s always on it, even after-hours, if needed. Happy customers remember when someone took care of them quickly.

The main crew can focus on trickier claims and real conversations with clients. Meanwhile, the background stuff hums along without so much as a hiccup, and you might even snag a stress-free Friday night for a change.