Every agency dreams of growth, yet many find themselves buried under mounting tasks, inconsistent service, and workflows that simply don’t hold up under pressure. The bigger the client list, the more obvious the cracks become. Manual steps get missed, team stress rises, and quality slips. There’s a better way to run the show.

Scaling isn’t about cramming more into the same broken system; it’s about building one that works at any size. This is where clear Standard Operation Procedures (SOPs) and automation change the game. For insurance agencies, tapping into outsourcing partners to handle heavy lifts adds even more power to this transformation.

In this guide, we’ll break down how to craft a workflow playbook that evolves with you, instead of holding you back.

Insurance SOPs: The quiet engine powering agencies

Growth doesn’t come from running harder on the same broken track. It comes from fixing the track itself. That’s what SOPs do. Think of SOPs as the instructions everyone wishes they had on a chaotic day. For insurance agencies, where mistakes can cost both clients and compliance, a solid Insurance SOP isn’t optional, it’s survival.

Picture a claims team in the middle of renewal season. Without an SOP, one person is chasing documents, another is stuck double-checking forms at midnight, and clients are calling to ask why they haven’t heard back. One missed step snowballs into three more problems. Give an SOP to the same team and it will increase their productivity and accuracy.

But here’s the catch—writing an SOP once and filing it away doesn’t cut it. Agencies that win treat SOPs as living documents. They ask the team what’s working, tweak the steps, and adjust when the industry shifts. It’s those tiny, ongoing corrections that save hours and keep clients happy. If you’ve ever wondered how much difference those tweaks make, this guide on optimizing SOPs for faster workflows and better client experience shows why the small stuff matters more than you think.

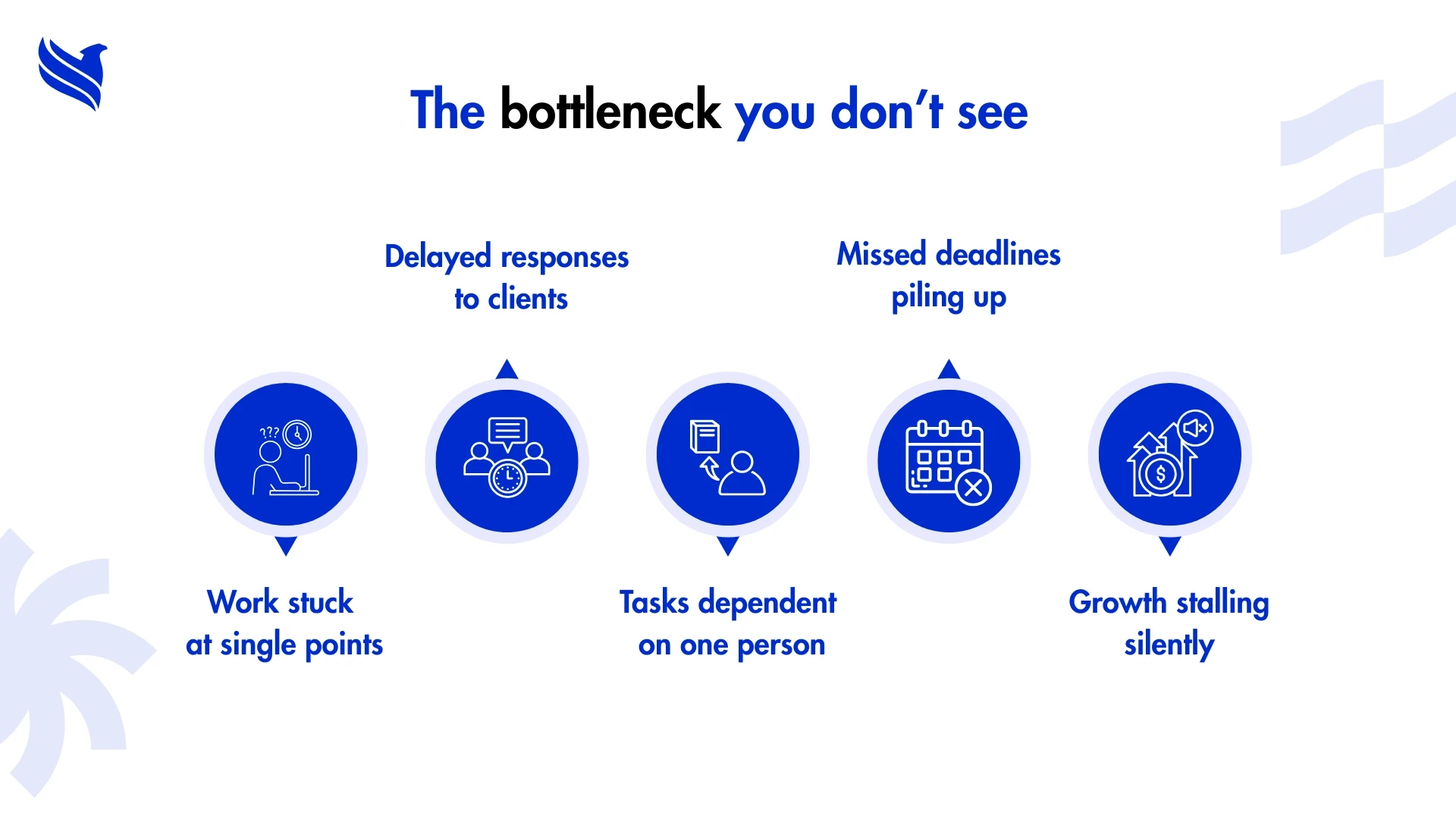

The hidden workflow bottlenecks that chokes agency growth

Every agency has that moment. The phones keep ringing, leads keep coming in, but progress slows to a crawl. The problem isn’t demand, it’s what’s happening inside. Bottlenecks creep in quietly. They hide in that pile of emails nobody’s gotten to, the report waiting on one signature, the “only Sarah knows how to do this” tasks. It’s not dramatic, but it’s deadly.

Imagine an insurance agency where every claim still passes through the same pair of hands because “that’s the way it’s always been.” One person checks every file, approves every step, and holds the process together. Then that person takes a sick day, and everything stops. Deadlines get pushed, clients grow frustrated, and the pile of unfinished work keeps getting taller. When fragile spots like this exist across several processes, trying to grow feels less like progress and more like dragging a heavy weight uphill.

Adding more people might look like the answer, but it rarely solves the root problem. You’re just throwing bodies at a broken system. The real work comes from pulling the process apart, looking at where it actually slows down, and rebuilding it piece by piece. Write down every step as it’s done today, trim out the ones that add no value, and pinpoint where better tools or automation can step in. Agencies that put in this effort don’t just fix one bottleneck, they keep them from creeping back. They move away from constant firefighting and start running the business on their terms.

Transforming insurance workflows growth-boosting system

There’s a difference between workflows that keep things running and workflows that actually grow the business. The first kind gets you through the day. The second kind changes where you’ll be a year from now. Strategic workflows do more than organize; they align every step with why the agency exists and what it’s trying to achieve.

Imagine an insurance playbook where renewals aren’t just processed—they’re flagged for proactive calls, risk reviews are built in, and automation takes care of reminders. Instead of just moving paperwork, the team is building relationships and spotting new opportunities. That’s the kind of workflow that feeds growth rather than just maintaining the status quo.

And here’s the thing, strategic workflows don’t sit still. They’re adjusted, tested, and improved. They shift when the market shifts. Agencies that treat their workflows as living systems, not frozen documents, end up leading the pack. They don’t wait for problems to force change; they build processes that keep them ahead. Over time, those smart adjustments turn what used to be routine into a quiet engine that drives success.

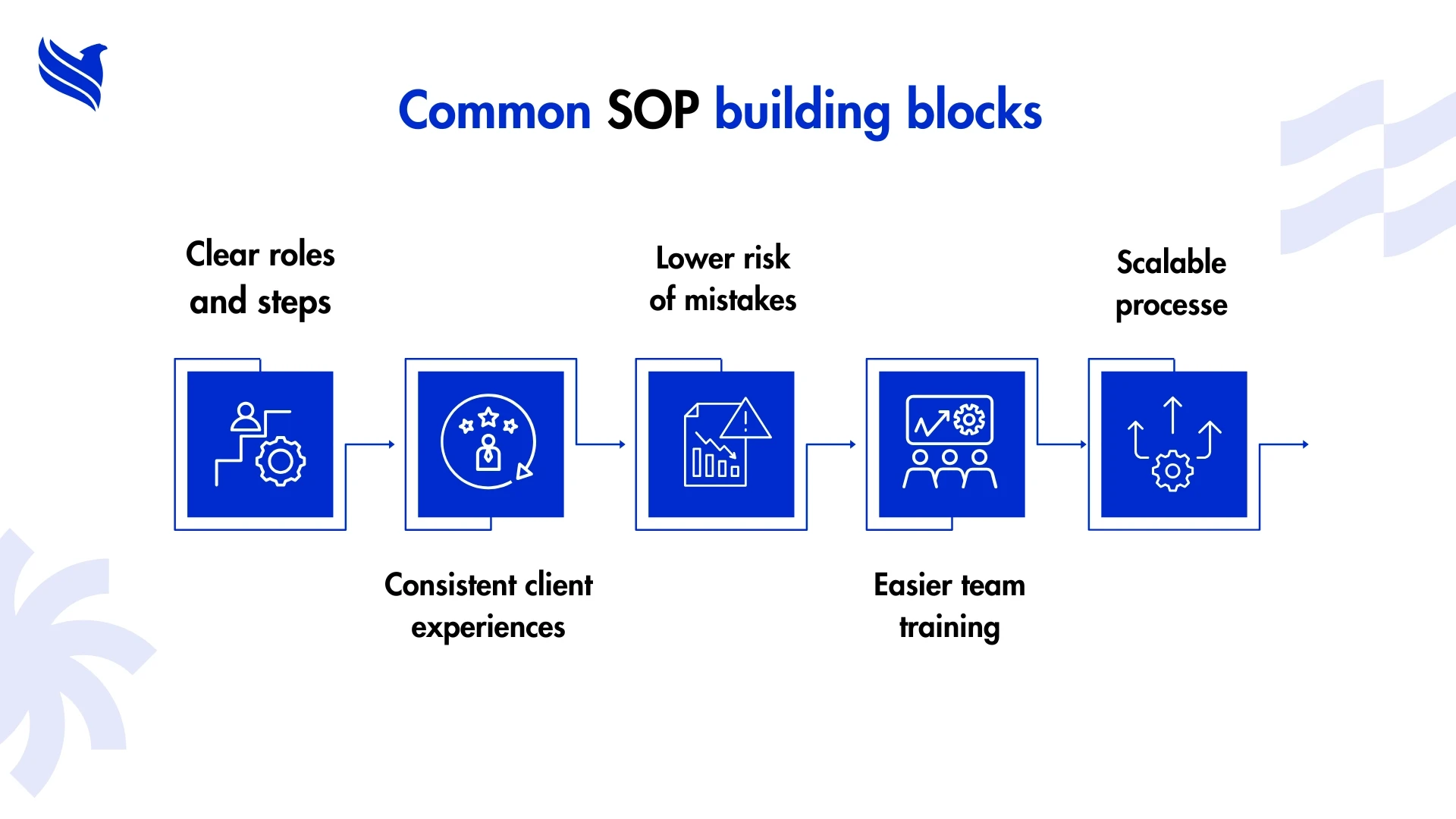

Agency SOPs: The building blocks of consistency

If workflows are the roads, SOPs are the rules of the road. They ensure everyone drives in the same lane, at the right speed, with no confusion. In industries like insurance, where errors can cost clients and your reputation, Common SOPs become non-negotiable.

Examples of SOPs include:

- New client onboarding

- Claims intake and processing

- Policy renewal reminders

- Compliance checks

These aren’t just documents. They’re training tools, risk reducers, and quality controllers all in one. Once they’re in place, you can build automation on top of them, making them even stronger.

For agencies stuck in manual chaos, automation is the natural next step. Shifting from manual to automated insurance workflows can take what you’re already doing right and make it faster, cleaner, and more scalable. Curious how? Check out this detailed take: automating insurance workflows.

The insurance automation tools that actually pull their weight

Automation gets talked up everywhere, but the agencies that truly benefit know it’s not about cutting jobs, it’s about cutting the grind. The right tools step in where humans shouldn’t have to waste their time. The repetitive stuff fades. Mistakes that used to slip through the cracks? Gone. Suddenly, the team that was drowning in admin is free to tackle the work that grows the agency instead of just keeping it afloat.

You see the difference in the small moments. In an insurance agency, policy updates don’t sit waiting for someone to key them in, they happen on their own. Follow-ups go out like clockwork, without anyone scrambling at the last minute. Client records stay current without the dreaded copy-paste marathons. These little shifts separate the agencies dragging their feet from the ones ready for what’s next.

Insurance automation isn’t just about saving time. It’s about building reliability into every client interaction. When automation takes care of the routine, every client—whether there are ten or ten thousand, gets the same level of service. Pair that consistency with clear, active SOPs, and scaling stops feeling risky. It starts feeling like control.

Real-world SOP example that actually work for agencies

Far too many agencies write their SOPs once and then shove them into a folder nobody touches again. That’s wasted effort. The goal of an Insurance SOP is to serve as a living document, one that evolves with new regulations, client needs, and internal growth. Real-world SOPs reflect how work actually gets done, not how leadership wishes it worked. They bridge the gap between intent and execution, guiding teams through each step without leaving room for misinterpretation.

Creating such SOPs means involving the people who use them daily. When teams contribute to drafting and refining these processes, adoption skyrockets. For example, in one mid-sized agency, claims handling used to take three days. After rewriting their SOP with input from front-line staff, they cut that down to under a day. These are the kind of wins that keep businesses competitive.

For agencies aiming to take their SOPs to the next level, it’s worth reading this guide on optimizing SOPs for faster workflows and better client experience. It explains how small tweaks can have an outsized impact.

Automation in insurance: The shift from grind to real growth

Automation isn’t there to replace people; it’s there to take the weight of repetitive work off their backs. In every insurance agency workflow, you’ll find tasks that loop endlessly: renewals, claims data entry, compliance checks. These jobs chew up time and patience. Automate them and the stress drops. Accuracy climbs. The team finally gets breathing room to work on what actually drives the agency forward, keeping clients close and hunting new business.

One agency in Texas learned this the hard way. Missed renewal reminders were costing them clients. They added a simple insurance automation tool to send follow-ups on schedule. Half a year later, their churn rate had fallen by a fifth. That’s what happens when the routine stops owning you and starts working for you.

If automation still feels far off, there’s a straightforward guide on moving from manual to automated insurance workflows. It shows how to start small and build trust in the process without ripping everything apart.

Tools to keep your insurance agency workflow scaling

Trying to scale on spreadsheets and scattered emails is like building on sand, it holds for a while, then collapses. Agencies often patch problems with outdated software and quick fixes, but as the work piles up, those cracks widen. That’s when you see tools not as extras, but as the backbone of growth.

The right stack isn’t about hoarding apps. It’s about choosing tools that match the way your agency actually works.

- SOP management tools such as Process Street or SweetProcess keep agency SOPs alive and easy to follow instead of buried.

- Insurance automation systems handle renewals, claims, and compliance without endless manual hours.

- Insurance-focused CRMs bring client data into one spot so no one wastes time digging through email chains.

- Project management platforms like Asana or ClickUp keep tasks clear and work moving.

Many agencies fall into the trap of piling on disconnected tools that create new chaos. The ones that win pick software that blends quietly with their setup, strengthening it without forcing a rebuild.

For anyone wondering if standardization still matters, read why workflow standardization is key for insurance businesses. Consistent processes supported by the right tech remain at the heart of insurance agency optimization, and they’re what separates agencies that keep climbing from those that stall.

When SOPs and automation work together

SOPs tell you what to do. Automation does it faster. Put the two together, and suddenly the gears start turning smoother than they ever did on their own. SOPs give structure, clear instructions, no guesswork. Automation takes the routine parts of that structure and runs with them, freeing up your people for the work that actually needs their judgment.

Think about client onboarding. One agency documented the process down to every detail, who gathers documents, who calls the client, when approvals happen. Then they automated the repetitive pieces: data collection forms, policy document generation, follow-up emails. The time to onboard a client was cut in half. Clients felt the difference. Staff felt it too, because they weren’t buried in repetitive tasks.

This is the sweet spot, documented processes supported by technology that takes care of the grind. The agencies that combine both don’t just keep up; they pull ahead. That’s what the insurance playbook for the coming years looks like: strong SOPs, smart automation, and tools that grow with you instead of against you.

Training teams to make the workflow theirs

All the tech and SOPs in the world won’t save you if the people using them don’t take ownership. The best processes only work when the team behind them believes in them. That belief comes from understanding, from practice, and from knowing why it matters. Training isn’t a one-hour presentation, it’s something you weave into the culture.

Real training means hands-on work. Scenario-based workshops where staff run through real cases. Open Q&A where they can voice concerns and learn the “why,” not just the “how.” Leadership needs to show up, not to hover, but to reinforce that these workflows matter to the agency’s future and everyone’s success.

There’s a case worth mentioning here: an agency drowning in claim errors rebuilt its training around live simulations. Agents swapped roles, shared tricks, and spotted holes nobody had noticed before. Within months, error rates dropped by half. They didn’t just learn the SOPs, they owned them. Feedback loops kept it alive, letting staff improve the process instead of blindly following it.

This is how you create a culture where workflows don’t just exist—they thrive. New hires don’t just get a manual; they get mentorship and a sense that they’re part of something built to work, not to frustrate. And when people own the process, the process works.

Common SOP & workflow mistakes agencies make (and how to avoid them)

When agencies rush to document workflows, they sometimes create SOPs that look good on paper but fail in practice. Overly complex instructions bury staff in details, causing more confusion than clarity. Others never revisit their SOPs, leaving teams following outdated steps long after rules or client needs changed. Ignoring frontline input is another critical mistake; those closest to the work often see bottlenecks first.

Automation has its traps too. Implementing software without first cleaning up broken processes magnifies inefficiencies. For instance, an agency implemented an automated follow-up system before fixing its contact database, clients received duplicate or wrong messages, damaging trust. The recovery involved pausing automation, cleaning data, and involving staff in redesigning the flow.

To avoid these setbacks, keep SOPs short and actionable, revisit them every quarter, and treat feedback as a resource, not a complaint. Pilot new tools in small teams before scaling. Celebrate small wins when a bottleneck is removed, it keeps morale high and reinforces why this effort matters.

Building your future-ready insurance agency with SOPs & automation

Future-ready agencies don’t wait for problems to force change; they build systems that anticipate them. By weaving together strong SOPs, smart automation, and a culture of team ownership, they create an operation that adapts as markets shift. Imagine an agency where onboarding a client takes hours instead of days, renewals happen with zero errors, and staff spend their time solving client problems, not chasing paperwork. That’s the payoff.

The journey isn’t a sprint. It’s a steady climb made easier with the right partners. Agencies that leverage expert outsourcing, modern tools, and continuous training find themselves ahead of competitors who cling to outdated methods. Every small step, refining an SOP, testing an automation, improving training, compounds into long-term growth.

FBSPL has helped countless agencies make this climb, replacing chaos with clarity and giving teams the room to focus on what they do best. If your agency is ready to ditch inefficiencies and embrace a smarter way to work, now is the time to move.

Contact FBSPL today and start building your agency’s future with workflows that truly scale.