Summary: The blog walks through seven key technologies changing insurance work in 2026. It covers claims automation, AI in underwriting, data insight, and secure digital platforms, and shows how outsourcing partners such as FBSPL can support agencies with practical implementation and daily operations.

Here are seven practical technology developments reshaping insurance in 2026, helping agencies work smarter, cut delays, and serve policyholders with reliable digital experiences.

What happens to an insurance agency that keeps working the way it did five years ago while clients move to fully digital habits?

Most teams already feel pressure. Claims rise, new risks appear, and customers want quick online help instead of printed forms on a desk. Insurance technology and Insurtech tools are no longer side projects; they sit inside daily work, shaping how quotes, renewals, and claims are handled. AI-powered innovation, digital transformation, and other technology developments are now tied directly to growth, cost control, and even agency reputation.

At the same time, many firms still depend on manual work, spreadsheets, and older software. This makes it harder to use new insurance business solution platforms or modern Technology in Claims Processing.

In this blog, the focus stays on seven key technologies impacting insurance in 2026 and how they are redefining insurance. Outsourcing also appears as an important option, especially for agencies that want insurance digital transformation but do not want to build everything in‑house.

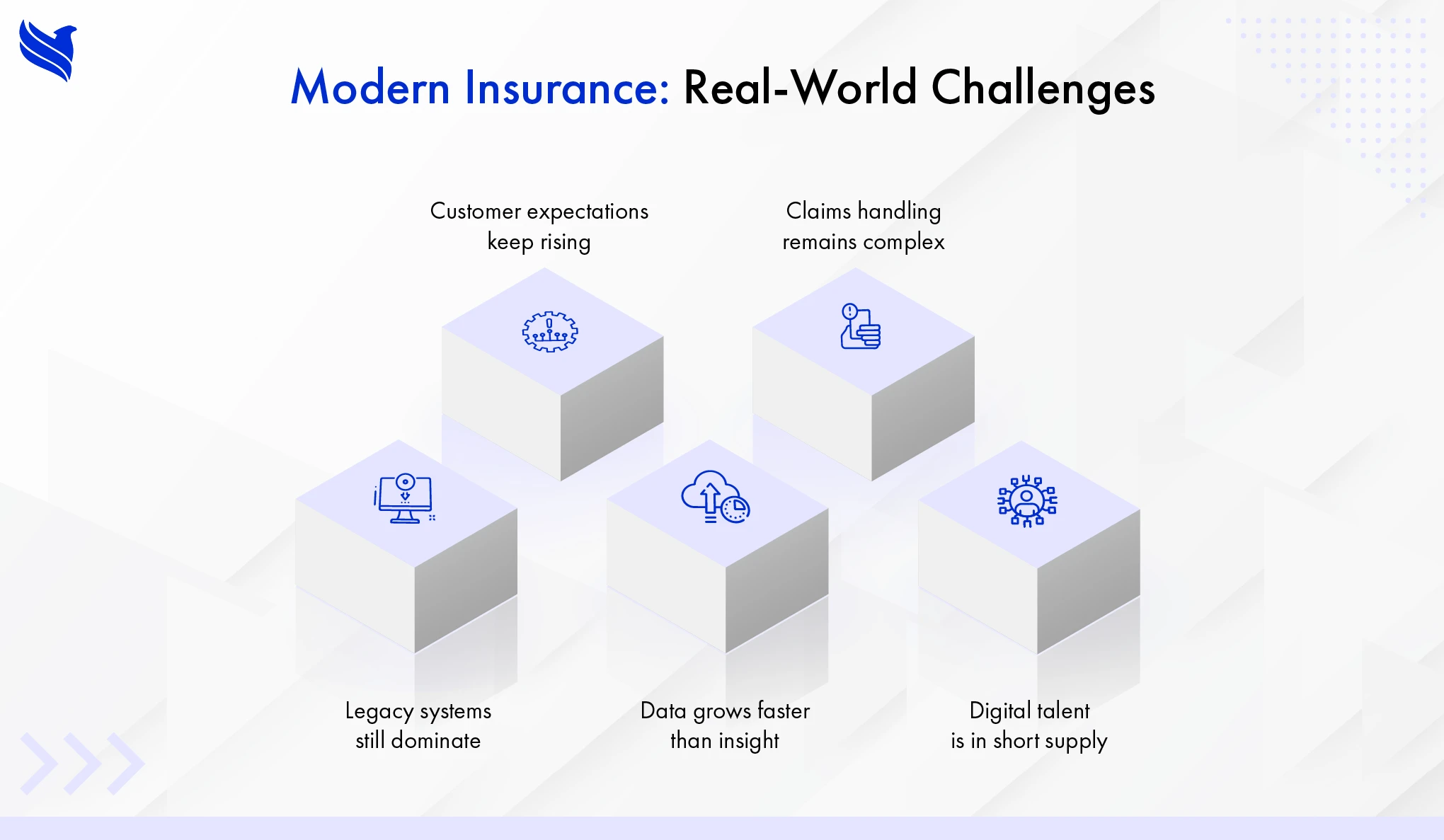

The real-world challenges in modern insurance

The idea of change sounds exciting; the reality inside an agency office often feels different. People must handle daily tasks while also learning new tools, and that mix can slow progress.

- Old policy and claims systems are still active, and connecting them with newer platforms is tricky and expensive.

- Customer journeys are broken across email, phone, and portals, so data is scattered and service feels inconsistent.

- Years of information exist, but very little is turned into clear insight for pricing or product design.

- Claims staff handle repeated checks and data entry instead of complex cases and real decision work.

- Hiring talent that understands both technology developments and insurance rules is difficult, especially for smaller agencies.

Because of this, many leaders know that technology in insurance is essential but feel unsure where to start or how fast to move.

7 technologies redefining insurance businesses in 2026

1. AI‑driven risk and underwriting

AI‑powered innovation has moved from theory to daily use in underwriting. Models read large amounts of policy, claims, and external data and produce risk scores that help underwriters make clearer calls. Pricing can be more accurate, and risk appetite can be adjusted in a more informed way.

This style of technology in insurance also helps detect unusual behavior. When claim or quote patterns do not fit the normal picture, AI tools can flag them for human review. That combination of automation and expert judgment is one of the strongest technological developments, shaping how insurers select and manage business.

2. Technology in claims processing and automation

One of the most visible changes in 2026 is Technology in Claims Processing. Digital forms, document capture, and automated rules can move a claim from “reported” to “ready for payment” with fewer touches. Simple claims can be checked against policy terms automatically and pushed forward if everything looks correct.

These technology automation solutions reduce delays and errors. Staff members can focus on complex, high‑value files and on supporting clients who are going through serious events. This shift improves both customer satisfaction and internal cost control, which is why it sits high on many technology developments lists.

3. IoT and telematics data

Connected devices now affect how risk is measured and priced. Cars with telematics, homes with sensors, and even industrial equipment with trackers all generate data that can feed into insurance business solution platforms.

This information helps insurers move toward usage‑based products and real‑time risk monitoring. Drivers with safer patterns can receive better rates, while early alerts from home or factory devices can prevent losses. It is a clear example of technologies impacting insurance in a direct, practical way.

4. Cloud‑based insurance platforms

Cloud infrastructure has become the foundation for many modern insurance systems. Instead of running everything on local servers, agencies and carriers use cloud platforms to host policy admin, billing, and claims tools.

This approach supports insurance digital transformation and insurance agency optimization & consultation efforts. New Insurtech tools can be connected through APIs, upgrades are easier, and remote teams can log in from anywhere. For leaders, this means a more flexible insurance business solution setup that can change with new products or regulations.

5. Analytics and customer insight tools

Another key trend is the wider use of analytics that go beyond finance and actuarial needs. Modern platforms bring together quote data, claim history, service interactions, and marketing responses in one place.

From there, teams can see which customer segments stay longer, which products lead to frequent claims, and where communication breaks down. Supported by AI tools, these insights can guide cross‑sell campaigns, pricing reviews, and even decisions about which lines of business to expand or exit. It is a quieter form of digital transformation, but it has a strong effect on strategy.

6. Digital self‑service and virtual assistance

Customers now expect to make changes, request documents, or check claim status without calling a desk line. That is why many insurers have added portals, mobile apps, and chat‑based virtual assistants.

These elements, when done well, make life easier for both sides. Clients handle routine tasks on their own schedule, while call centers and agency staff deal with fewer repetitive questions. This area of insurance technology also supports consistent service quality because information is drawn from the same core systems every time.

7. Security, privacy, and compliance tools

As data volumes grow, so does the need to protect them. Security tools, access controls, monitoring systems, and automated compliance checks are now part of standard insurance technology plans.

Good practice here is not just a technical matter; it also protects brand trust. Policyholders share personal and financial information, so strong protection around those records is necessary. Many modern Technology automation solutions now include built‑in logging, alerts, and reporting to help meet regulatory demands in different regions.

Benefits of these tech developments in insurance

When these technology developments are planned and used carefully, the impact shows up in both daily work and long‑term numbers. The benefits are not limited to large carriers; mid‑sized agencies also gain a lot.

- Shorter cycle times for quotes, policy changes, and claims, thanks to insurance technology and smarter workflow design.

- More consistent decision‑making in underwriting and claims when AI tools and clear rules support human review.

- Better customer experience as self‑service options, digital communication, and faster answers become standard.

- Lower operational cost per policy because Technology automation solutions take over repetitive and low‑value tasks.

- Clearer planning and forecasting using analytics tied directly to portfolio performance and customer behavior.

Over time, these gains support steady growth without adding the same level of headcount or manual workload.

How outsourcing powers insurance success

Not every agency can hire full in‑house teams for analytics, Technology in claims processing, or platform administration. This is where outsourcing aligns strongly with insurance digital transformation.

Specialized partners can manage back‑office processing, data clean‑up, document handling, and other operational tasks using modern insurance business solution platforms. They can also help set up or maintain insurance technology stacks, making sure that tools stay updated and correctly configured. For many firms, this mix of outsourcing and Insurtech reduces risk, shortens project timelines, and brings in skills that would be hard to build alone.

When outsourcing is tied to thoughtful insurance agency optimization & consultation, agencies get more than just extra hands. They receive guidance on which processes to automate first, how to use Technology automation solutions without losing control, and how to align day‑to‑day work with long‑term plans.

Conclusion: The road to reinventing insurance in 2026

The year 2026 will not be about one single breakthrough; it will be about how well insurers combine multiple technologies impacting insurance into a clear, workable model. AI-powered innovation, IoT, cloud platforms, analytics, and Technology in Claims Processing are already changing what agencies can offer and how quickly they can respond.

Agencies that choose to engage with these technology developments, and that use outsourcing partners where it makes sense, will be better placed to adapt to new risks and rising expectations. For insurance leaders looking to modernize operations and build a stronger future, FBSPL can support with focused insurance business solution services, technology in insurance expertise, and practical Technology automation solutions that match real‑world workflows.