There’s a hidden cost that most insurance companies ignore until it slaps them hard; the cost of broken routines. You don’t always see it on paper, but it’s there. It shows up as the delay in getting back to a client. It shows up when a simple claim takes three different people and five emails to sort out. And it shows up in reviews that start with: “I wish I could give zero stars.”

But can you fix this? Start by getting serious about your standard operating procedures (SOPs). They’re not just documents collecting dust. In the real world, SOPs for insurance companies are the difference between inefficiency and control, between a client who churns and a client who refers.

And if you’re short on time, staff, or systems? That’s where outsourcing steps in to offload grunt work and keep your operations sharp.

In this blog, we’ll walk through the pain points, the real benefits, and how to actually optimize your SOPs to move faster and serve better.

When good teams break under bad systems

“When you're running in circles…”

Meet Sarah, a new hire at an insurance agency. On day two, a client calls for a policy change. Sarah fumbles through a half-written checklist on the whiteboard, scribbles an email to three different departments, and tags along for approvals. Two days later, the client calls again. Sarah digs through her own sent folder to discover she used the wrong form. The request gets delayed, the client becomes frustrated.

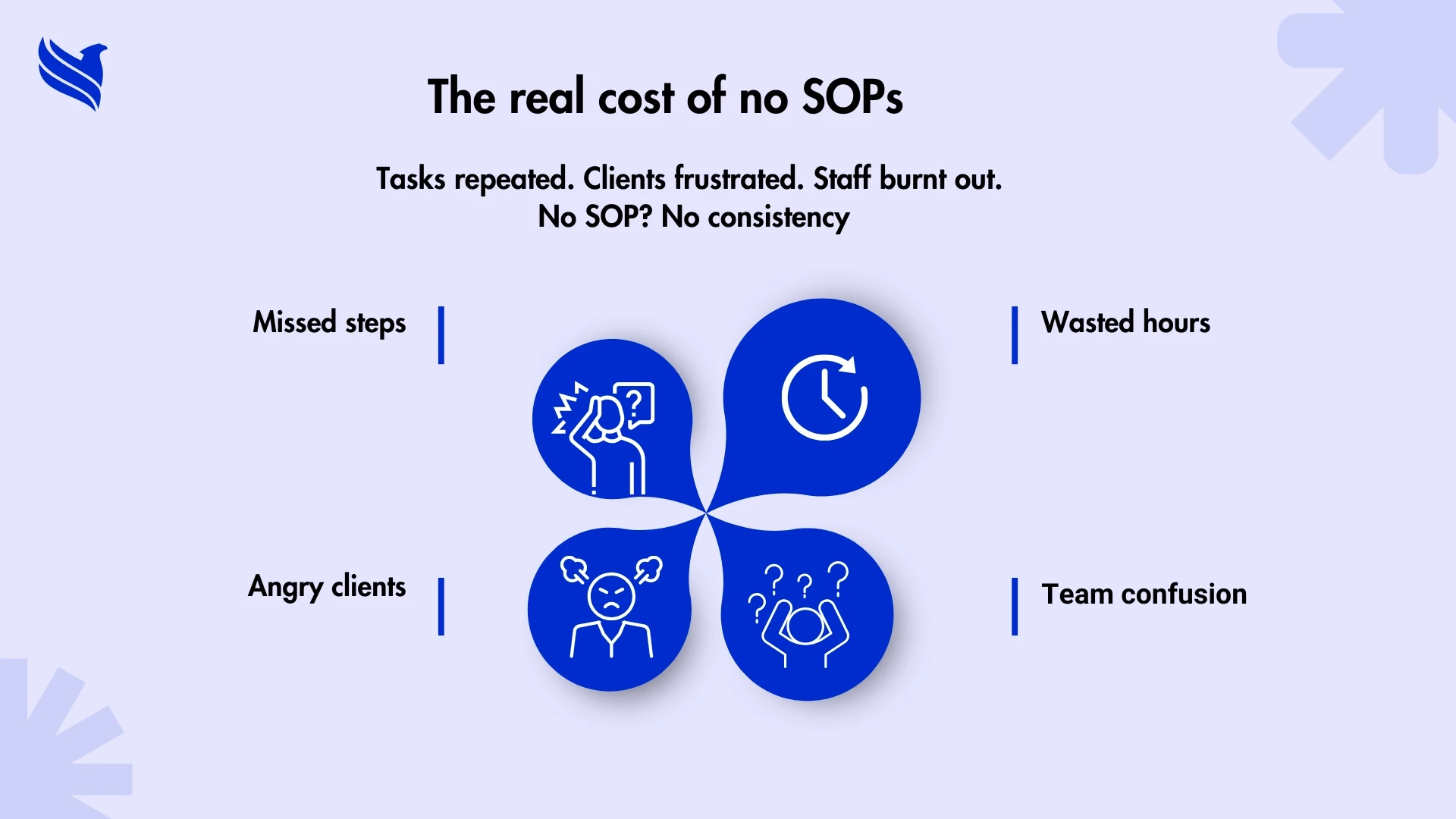

These moments aren't just one-offs; they’re patterns that drain morale, inflate costs, and degrade trust. Without clear, enforced SOPs for insurance companies & agencies, your team constantly re-discovers what “normal” should look like. That leads to:

- Days lost on redundant tasks.

- Quality dropping when instructions diverge.

- A bossy email culture where ‘cc-ing everyone’ substitutes for clarity.

That whiteboard checklist might seem harmless, but it reveals deeper disorder: missing steps, unchecked assumptions, and invisible bottlenecks. And at the end of the day, the client pays the price (though the bill might be internal).

Why a good SOP matters more than you think

When SOPs are well-written and followed, they stop being rulebooks, and start being tools:

- Speed with consistency: Teams move faster when they know exactly what comes next. That eliminates the “where do I go now?” pauses.

- Resilience to turnover: When an employee leaves, their work habits shouldn’t vanish. Solid SOPs preserve institutional know-how.

- Quality protection: You keep mistakes from creeping in. Misfiled forms? Forgotten steps? All prevented with good SOPs.

- Training efficiency: New hires can get onboard quickly when they have a clear playbook instead of vague oral instructions.

- Measuring what matters: With repeatable processes, you can benchmark, reduce time spent on renewals, increase policy issuance volume, and drop error rates.

That’s the importance of SOP; it’s not just compliance or professionalism. It’s about creating business velocity and client satisfaction. (Plus, when your auditors come calling after a compliance review, you’ll smile.)

How can SOPs impact client’s experience?

Have you ever felt that knot in your stomach when a company tells you, “Yes… we’ll get back to you”? Now imagine an insurance agency that replies, “We just need your updated driver’s license, once we have it, your coverage will be active today.” Picture a smooth process with no guesswork. That’s not imagination; it’s the magic of well-optimized insurance operations.

Consider three ways clients actually feel the difference:

- Trust: When clients see forward motion, notifications sent, milestones hit, they relax. They know progress is real.

- Clarity: SOPs equip your team with clear scripts and forms. Clients get answers; they’re not left guessing.

- Control: When a client’s request goes from pending to on hold to completed, they feel that the agency is hands-on. That’s empowerment.

Story time: At FBSPL, one midsize agency sets a goal to cut claim-response time by 50%. After mapping each step (intake, vetting forms, internal approvals, external vendors), they rewrote their SOP in Insurance framework. Within 8 weeks, the average client wait went from six days to three. Satisfied clients started calling to say, “I’ve never heard from an agent that quickly.”

That momentum remains consistent throughout: teammates feel accomplished; clients share referrals; your agency’s reputation improves.

How consistent processes win client trust

Let’s breakdown the ripple effect of polished Standard Operating Procedures:

| SOP focus area | What it fixes | How clients feel |

| Incoming Lead Handling | Contacts slip through the cracks | “They reached out before I followed up!” |

| Policy Setup | Missing forms, typos, multiple revisions | “I got my documents clean and correct.” |

| Renewal Notifications | Six-month lapses and missed reminders | “They reminded me, early!” |

| Claim Filing | Forms lost, emails bouncing around | “I could file quickly, even on my phone.” |

| Feedback & Follow-up | No “how’d we do?” post-service | “They actually cared about my experience.” |

Those feelings aren’t accidental. They’re built into the design of the SOPs themselves. Insurance agencies that prioritize client-facing steps in their documentation create real, measurable experiences.

Real-world strategies to fix messy SOPs

You’ve got an SOP draft gathering dust in a binder, now what? Here are actionable steps you can take right now:

- Map the flow: Pick a task (like “new policy setup”). Ask: who touches it, what forms are used, where decisions happen. Draw it out, whiteboard or sticky notes, whatever works.

- Stand in their shoes: Act like a client. Does the experience feel disjointed? Can they sign documents online? Does your office ask for info they already provided?

- Cut the fat: Challenge each step: is it legally required? Is it redundant? Merge stages, drop needless approvals. You’ll free up hours per week.

- Standardize documents & scripts: Pick a consistent format for emails, phone greetings, intake forms, label them clearly (e.g. “POLICY_CHANGE_REQUEST_FORM”). Say goodbye to word-of-mouth variations.

- Technology that supports, not distracts: Use your agency management system (AMS) to automate reminders. But don’t automate form-filling entirely; some steps still need human judgment.

- Pilot and iterate: Roll out small. Maybe assign one claims person or one branch. Track outcome: time saved, errors dropped, client feedback. Adjust.

- Enforce, then scale: Make SOP access easy. Store documents centrally. Train staff. Tie completion metrics to performance reviews or team goals.

- Outsource where it makes sense: Certain tasks, like document digitization, CRM follow-up, or notifications, can be offloaded professionally. Outsourcing can help refine your SOPs because third‑party experts bring external lean methods and lighten your in‑house load.

- Anchor the culture: Create a ritual: “10‑minute SOP refresh” every week. Ask, “What’s slowing us down?” Keep updating the documents, not just the lore.

- Connect to the bigger picture: If you’ve ever thought “Having broken workflows? Learn how SOPs can save time, reduce errors, & scale operations,” check out our other piece on workflow recovery and rewire that link here, so you can build both speed and scale smartly.

By cycling through these steps, you build a system that simultaneously sharpens internal coordination and external client delight.

Bonus tip: Fixing broken workflows? Start here

If you’re already dealing with clogged systems and constant errors, you don’t need a fresh process; you need a rescue. Read a guide on how SOPs can save time, reduce errors, and scale operations. It dives deep into getting out of the daily slog and building workflows that actually move.

Better SOPs. Better ops. Better business.

“Your SOPs should be the lever, not the anchor”

When SOPs are well-built and actively maintained, they stop being static forms people ignore; they become living engines that drive repeatable quality, speed, and trust. Start with one area: maybe claims, maybe renewals. Bring together voices, front-line staff and leadership, and treat each SOP like code: build, test, deploy, and monitor. Tie results to client sentiment and internal pride.

At FBSPL, we believe that every agency can turn SOPs into engines of growth. Like millions who love smoother processes, you’ll see how sharpened SOPs lead to fewer errors, faster delivery, and cheers from clients. If you’re ready to empower your team and delight your policyholders, start here, with one clear step at a time.

Get in touch with FBSPL today, and let’s build SOPs that work for you, your team, and your clients.