Summary: This guide explains how today’s CFOs evaluate outsourcing partners, what support they expect, and which capabilities matter most in 2026. It covers operational needs, technology expectations, risks, KPIs, and the qualities that define a dependable financial outsourcing relationship.

- The benefits CFOs expect from outsourcing partners

- The challenges CFOs confront in today’s environment

- The hidden causes of AI implementation failures in insurance

- What insurance teams look for in a strong technology partner

- KPIs and success metrics CFOs value most in 2026

- Emerging risks CFOs need to watch in 2026

- Global vs. local outsourcing: What CFOs prefer in 2026

- Checklist: what CFOs should look for in an outsourcing partner in 2026

- The future of CFO–outsourcing partnerships

- Conclusion: strengthening the CFO playbook for 2026

A detailed, practical guide that explores what modern CFOs expect from outsourcing partners in 2026 and how these relationships shape financial performance.

The role of the CFO has stretched far beyond spreadsheets and monthly closings. Today’s finance leaders face pressure from every direction, rapid technology shifts, tighter budgets, and leadership teams expecting faster answers than ever. Many organizations now lean on outsourcing to steady the workload, strengthen financial operations, and build room for strategic moves that used to feel out of reach.

The challenge, however, is knowing what truly matters when choosing an outsourced CFO service or any form of outsourced accounting & bookkeeping support. Some providers promise efficiency; others emphasize automation; a few talk about transformation. Yet only a handful can deliver all three.

In this guide, the goal is simple: lay out what modern CFOs look for, what they expect, and how the right outsourcing partners can help create meaningful financial improvements, without adding complexity to an already demanding year.

The benefits CFOs expect from outsourcing partners

CFOs looking ahead to 2026 usually want more than task support. They want a partner who helps the finance function breathe a little easier. It’s not about replacing people or cutting corners. It’s about creating room for better decisions, steadier routines, and a finance team that doesn’t feel like it’s always catching up.

Many CFOs turn toward outsourced CFO services and outsourced accounting & bookkeeping because internal teams are often weighed down by work that never seems to end, reconciliations, numbers that don’t match, reports that need to be redone. The right partner steps in and absorbs the weight without creating extra noise.

The benefits most CFOs talk about tend to fall into a few practical areas:

1. Reliable month-to-month execution

Finance needs predictability. When closings follow a steady rhythm and records stay clean, the whole department feels more grounded.

2. Clearer financial insight

A competent outsourcing partner helps sort the numbers in ways that reveal patterns. Leaders notice things earlier; expenses rising in odd places, revenue dropping in one corner of the business, or a margin shift that deserves attention.

3. Better tools without carrying the upgrade burden

Finance technology changes quickly, and keeping up is expensive. Many partners already work with updated systems, giving companies the benefit without internal overhaul.

4. Room for teams to focus on more than daily noise

When repetitive tasks move outside the organization, in-house staff finally have time for planning, analysis, and conversations that shape the future.

5. Flexibility during heavy periods

Year-end, audits, expansion phases, these moments strain internal teams. Outsourcing support helps carry the extra load.

6. Lower exposure to errors and operational gaps

With consistent checks, organized processes, and documented responsibilities, companies face fewer unpleasant surprises.

None of these benefits feel flashy, but they matter. They help CFOs create the kind of financial environment where the organization can move forward without stumbling over basic operational issues. That steady foundation is what many leaders value most in 2026.

The challenges CFOs confront in today’s environment

Every CFO walking into 2026 faces a collection of pressures that didn’t exist in the same way a decade ago. Some of them are predictable, tight budgets, and shifting goals. Others show up suddenly, usually at the wrong moment. Teams feel these pressures long before they reach the boardroom.

One of the biggest hurdles is finding and keeping experienced finance talent. Skilled professionals are in short supply, and vacancies take months to fill. In the meantime, deadlines don’t wait. Tasks pile up, controls weaken, and the team stretches itself thin.

Another challenge comes from systems that don’t work together. Many finance departments deal with tools that were added one at a time over the years. Data gets stored in different places, reports require extra adjustments, and a simple update turns into a long chain of fixes. The work becomes slower and more tiring than it should be.

CFOs also face tough compliance expectations. Rules shift frequently; documentation, reporting timelines, disclosures, and accuracy standards. One missed update can cause unnecessary trouble. Keeping up becomes a job of its own.

Cost pressure is another real issue. Leaders need to maintain strong financial operations but must do it with fewer resources, not more. When visibility is unclear or reports come late, making the right spending decisions becomes even harder.

There is also the growing demand for strategic input. CFOs are expected to guide long-term planning, technology selection, data initiatives, and investment decisions, on top of everything else. When daily tasks consume most of the team's energy, these larger responsibilities fall behind.

And, of course, there are the operational bottlenecks. Month-end closings, audits, acquisitions, sudden increases in transaction volume, these pressure points can expose weaknesses quickly. Even well-run teams struggle when the workload jumps without warning.

These challenges explain why outsourcing partners have become important allies. They help absorb the load, steady the routine, and give CFOs and their teams breathing space. The problems don’t disappear, but they become manageable. And that alone makes a real difference in a demanding year.

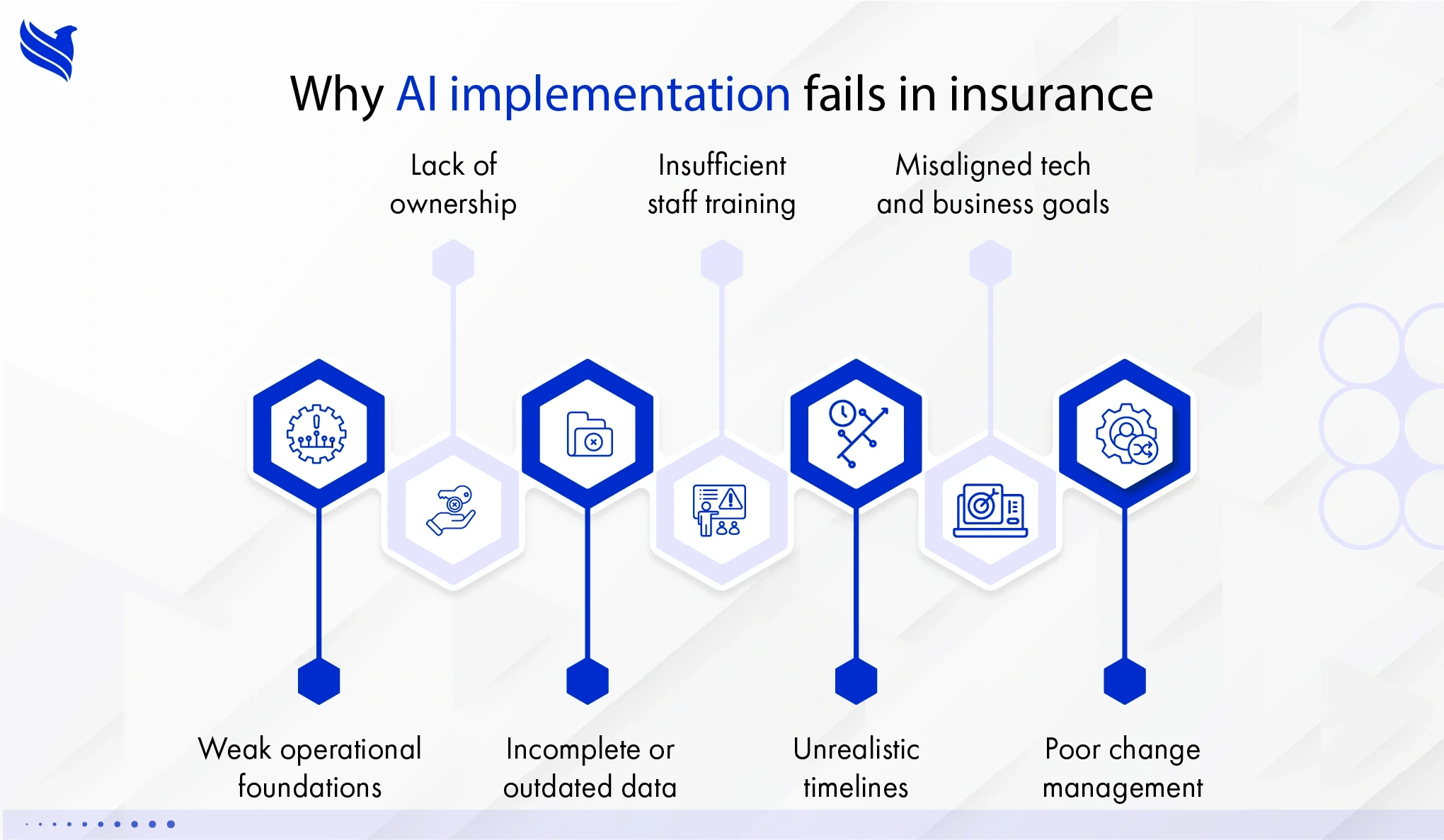

The hidden causes of AI implementation failures in insurance

Many insurance companies invest in AI with strong intentions, but the results often fall short of expectations. Most failures have little to do with the technology itself. The root problems usually lie in planning, data quality, role clarity, and the assumptions made before the project begins.

Common causes of AI failures include:

- Unclear operational foundations: When existing workflows are inconsistent or poorly documented, AI tools struggle to perform reliably. If basic steps vary from team to team, the system never receives the structure it needs to work correctly.

- No assigned ownership: AI initiatives slow down when no single team is accountable for decisions, quality checks, or adoption. Projects float between departments, and progress becomes inconsistent.

- Outdated or incomplete data: Insurance operations rely on underwriting files, policy information, endorsements, and historical claims data. When these records contain gaps or conflicting details, AI outputs become unreliable and teams lose confidence quickly.

- Limited staff training: Employees may hesitate to use tools that feel unfamiliar, especially when early interactions take more time instead of less. When training is rushed or unclear, adoption becomes difficult, no matter how advanced the technology is.

- Unrealistic timelines: AI models need time to learn, adjust, and be validated. When leaders expect immediate gains, early results feel disappointing, causing teams to label the entire project ineffective.

- Misalignment between tech goals and business needs: Some projects focus on features instead of actual process issues. Without tying AI to real underwriting, servicing, compliance, or claims challenges, the tool becomes “nice to have” instead of truly useful.

- Poor change-management planning: Teams need support during the transition period, not just documentation. A lack of discussion, demonstrations, or ongoing guidance often leads to resistance.

These issues aren’t signs that AI cannot work in insurance. They highlight the importance of clarity, structure, and realistic expectations. When foundations are strong, AI can meaningfully support underwriting teams, policy servicing units, accounting groups, and claims departments with accurate, repeatable and timely outputs.

What insurance teams look for in a strong technology partner

Insurance teams do not seek generic tech vendors. They prefer partners who understand policy cycles, compliance timelines, documentation needs, and the day-to-day work that shapes the industry. A valuable partner strengthens operations, reduces rework, and supports teams during high-pressure workloads.

Key expectations include:

- Consistent reliability

Insurance operations are deadline-driven. A dependable partner ensures that endorsements, renewals, compliance checks, and claims tasks are completed on schedule without frequent delays. - Clear communication and transparency

Leaders expect straightforward updates on timelines, deliverables, and challenges. When communication is open, teams can plan workload, manage deadlines, and avoid last-minute pressure. - Industry-specific familiarity

Partners who understand underwriting, policy servicing, accounting, and claims workflows can anticipate challenges and provide meaningful guidance. This eliminates trial-and-error and ensures faster adoption of new tools. - Flexible and scalable support

Insurance workloads fluctuate throughout the year. Partners should adjust capacity during renewal seasons, large migrations, or project expansions without compromising quality. - Practical implementation support

Training, hand-holding, and real explanations matter. Teams adopt tools faster when they receive clear walkthroughs, examples, and steady assistance instead of technical documents alone. - Long-term partnership mindset

Insurance operations evolve with regulation changes and market shifts. Leaders want partners who stay involved, recommend improvements, and help the technology grow with the business. - Ability to blend technology with human judgment

Insurance work still requires reasoning, documentation checks, and compliance thinking. Strong partners design solutions that support teams rather than overwhelm them with complexity.

These expectations reflect what insurance teams value most; reliability, clarity, domain understanding, and consistent support. When a partner aligns with these needs, technology becomes easier to adopt and far more effective in daily operations.

KPIs and success metrics CFOs value most in 2026

CFOs stepping into 2026 rely heavily on measurable outcomes when judging the value of outsourcing partners. Numbers carry weight in boardrooms, but they also help leaders understand whether a partner strengthens day-to-day financial operations or quietly creates more work behind the scenes. The metrics they focus on go far beyond simple cost savings; they reveal whether the relationship actually supports better decisions, cleaner books, and long-term stability.

Key KPIs that guide CFO evaluations include:

- Accuracy and error-reduction levels

Mistakes in reports, reconciliations, or month-end files can disrupt planning cycles. CFOs measure how consistently outsourced accounting & bookkeeping services deliver error-free work, especially during busy periods. Strong partners show patterns of improvement instead of fluctuating quality. - Turnaround times on recurring tasks

Managing financial reporting, AP processing, AR follow-ups, and reconciliations all run on tight schedules. Leaders check whether outsourcing partners meet timelines every cycle, not occasionally, not only when workloads are light. Consistency matters more than speed alone. - Clarity of financial visibility

A partner’s ability to deliver usable reporting is a major benchmark. CFOs track whether dashboards, statements, and forecasts offer straightforward clarity or require additional cleanup. Time saved on interpretation often becomes a quiet but powerful indicator of value. - Impact on cash flow health

Outsourced CFO services are assessed on how well they help maintain predictable cash flow patterns. This may include improved collections, better spend tracking, or sharper forecasting accuracy. Even small improvements show up quickly in financial reviews. - Cost efficiency without quality trade-offs

CFOs compare internal workload before and after outsourcing. If staff members no longer spend hours correcting entries or searching for missing information, it becomes a clear sign of value. They also monitor whether outsourcing financial operations reduces reliance on expensive temporary staff or rushed internal overtime. - Scalability and workload absorption

During mergers, acquisitions, system migrations, or rapid growth, external teams often face heavier volumes. Leaders track how smoothly the partner absorbs extra tasks without slipping on quality. - Adoption and ease of collaboration

If internal teams find it comfortable to work with the partner, the relationship typically performs well. CFOs watch for reduced back-and-forth, fewer clarification requests, and stable communication patterns. - Technology utilization and automation gains

Metrics linked to automation, reduced manual entries, faster data availability, fewer duplicates, help CFOs understand whether the partner can modernize processes rather than simply maintain them.

These KPIs guide how financial leaders judge outsourced CFO services and accounting & bookkeeping support. In many cases, a strong outsourcing partner becomes recognizable not by a single achievement but by steady improvements across several metrics over time. This combination of operational dependability and visible financial improvements usually defines whether a partnership feels like a true extension of the finance team or just an external vendor checking tasks off a list.

Emerging risks CFOs need to watch in 2026

The business environment in 2026 brings a mix of opportunities and pressure points. CFOs face a landscape shaped by shifting regulations, changing workforce patterns, unpredictable markets, and rapid technology adoption. Outsourcing partners play a central role in helping leaders stay grounded, but only if those partners understand the risks shaping the year ahead.

Major risks that financial leaders are preparing for include:

- Data instability and reporting discrepancies

As systems evolve and new tools integrate into older ones, the risk of inconsistent data increases. A small mismatch in one area can affect forecasting, tax planning, or compliance calculations. CFOs rely on outsourcing partners to detect irregularities early and keep reports dependable. - Rising compliance complexity

Regulations tied to privacy, financial reporting, international transactions, and industry-specific rules continue to grow. Missed updates or incomplete filings can create penalties and reputational harm. Outsourced accounting & bookkeeping teams must stay alert to industry changes and ensure documentation remains audit-ready. - Cybersecurity vulnerabilities

Financial departments handle sensitive information daily, making them common targets for breaches. Even trusted platforms can face risks if access controls are weak or monitoring is inconsistent. CFOs expect partners to follow strict security practices and respond quickly to suspicious activity. - Talent shortages and knowledge gaps

The competition for skilled finance talent remains strong. Internal teams may feel stretched during peak seasons or major transitions. Outsourcing becomes a strategic way to balance workloads, but only when partners bring steady experience and industry familiarity. Without this, bottlenecks can grow rather than shrink. - Technology overdependence

Rapid digital adoption creates excitement but also carries risks. Automation, AI systems, and analytics tools can misfire when inputs are incomplete or processes lack structure. CFOs watch closely for situations where technology becomes a burden instead of support. - Economic unpredictability

Whether due to shifting interest rates, buyer behavior, or market confidence, uncertainty affects liquidity planning. Outsourced CFO services become especially important when helping organizations adjust budgeting rhythms, refine scenarios, or assess cost-saving opportunities. - Global operational disruptions

Supply chain challenges, currency fluctuations, and geopolitical tensions all create ripple effects. Financial leaders monitor how outsourcing partners handle cross-border tasks, especially when files, approvals, or reconciliations depend on timely international coordination. - Vendor concentration risks

Depending heavily on one internal system or one external partner can become risky. CFOs assess whether outsourcing relationships include backup plans, documented workflows, and knowledge sharing that prevents dependency failures.

By understanding these emerging risks, CFOs can set stronger expectations for outsourcing partners and ensure their organizations remain resilient. The right partner helps detect issues early, strengthens reporting accuracy, and supports long-term financial stability, making risk management a shared responsibility rather than a solo concern for the finance department.

Global vs. local outsourcing: What CFOs prefer in 2026

CFOs comparing global and local outsourcing options in 2026 look beyond cost differences. Their focus often shifts to reliability, depth of expertise, and how smoothly a partner can integrate with ongoing operations. Both models offer value, but each comes with practical considerations that influence a finance leader’s final choice.

What CFOs commonly evaluate:

Global outsourcing advantages

- Wider talent availability, especially in specialized areas like financial analysis, reconciliations, and compliance support.

- The ability to cover extended hours, which shortens turnaround times during month-end or audit seasons.

- Cost flexibility that allows organizations to scale quickly without heavy overhead.

- Access to broader industry knowledge gained from supporting diverse markets.

Local outsourcing advantages

- Easier coordination for tasks requiring same-day discussion or rapid document reviews.

- Familiarity with country-specific regulations, tax changes, and reporting nuances.

- Faster alignment on cultural expectations, internal communication styles, and approval workflows.

What CFOs consider most

CFOs rarely choose one model based solely on geography. Instead, they weigh factors such as capacity, industry experience, data security, and the ability to maintain consistency during peak periods. Many finance teams now prefer a blended structure; global partners handling high-volume accounting & bookkeeping services, while local experts oversee regulatory matters that require closer involvement.

In 2026, the decision largely depends on how well a partner fits into the organization’s rhythm. The strongest outsourcing relationships, whether global or local, are the ones that offer reliable communication, predictable quality, and enough flexibility to handle growth without slowing internal teams down.

Checklist: what CFOs should look for in an outsourcing partner in 2026

CFOs selecting outsourcing partners in 2026 want clear standards that prevent costly trial-and-error. A structured checklist helps leaders compare providers and identify the ones that truly support outsourcing financial operations, outsourced CFO services, and accounting & bookkeeping tasks with consistency.

A dependable partner usually meets the following criteria:

1. Proven experience in finance operations

A strong track record in reconciliations, reporting, AP/AR cycles, month-end support, and documentation handling shows the partner can manage day-to-day work without constant supervision.

2. Familiarity with industry-specific requirements

Companies in regulated sectors, insurance, healthcare, finance, property management, and others, require partners who understand compliance demands, terminology, and audit expectations.

3. Stable communication rhythm

CFOs look for partners who provide timely updates, respond quickly to queries, and maintain clarity when volumes increase.

4. Ability to scale without compromising accuracy

The partner should absorb additional tasks during expansions, mergers, busy seasons, or system migrations while keeping accuracy levels steady.

5. Reliable workflows and documentation processes

Clear SOPs, strong handover processes, and consistent file management reduce internal confusion and keep cycles on track.

6. Technology capability and adaptability

CFOs expect partners to work comfortably with accounting software, dashboards, automation tools, and data platforms. Familiarity with modern systems ensures smoother collaboration.

7. Defined quality controls

A solid QC structure indicates the partner can identify errors early, prevent rework, and protect reporting integrity.

8. Security and confidentiality measures

With finance data becoming more sensitive each year, partners must show robust access controls, secure file handling, and documented security practices.

9. Understanding of cash flow priorities

Outsourced CFO services should help improve collections, monitor spending patterns, and support stable cash flow management, not just complete tasks.

10. Long-term partnership mindset

CFOs want teams who stay engaged, identify improvements, and align their efforts with the company’s growth path.

When outsourcing partners meet most of these criteria, finance leaders gain more than operational relief, they gain a dependable extension of their team. This checklist helps organizations select partners who strengthen financial visibility, increase accuracy, and contribute meaningfully to organizational goals.

The future of CFO–outsourcing partnerships

CFO–outsourcing relationships are changing quickly, shaped by shifting economic conditions, tighter reporting expectations, and stronger reliance on technology. In 2026 and beyond, these partnerships move away from task-based coordination and evolve into long-term operational support systems that influence how organizations plan, measure, and grow.

What’s becoming clear is that CFOs no longer view outsourcing partners as temporary capacity fillers. They expect deeper involvement across budgeting, forecasting, compliance preparation, financial improvements, and even technology recommendations. Outsourced CFO services will increasingly support scenario planning, cash flow stability, and risk assessment as leadership teams seek more dependable guidance.

Technology also plays a larger role. Automation, real-time dashboards, and smarter tools will blend into outsourced accounting & bookkeeping services, reducing manual errors and giving CFOs more visibility without additional effort. Partners that adapt quickly to new tools and help clients use them effectively will remain in demand.

Another noticeable shift involves cross-functional collaboration. CFOs want outsourcing partners who can coordinate smoothly with operations, sales, HR, and compliance teams rather than working in isolation. This interconnected approach helps resolve issues at the root instead of fixing individual transactions.

As businesses expand into new markets, the demand for scalable and globally flexible outsourcing partners will rise. Teams that handle large volumes, maintain accuracy during peak periods, and understand regional differences will stand out.

The future points toward stronger, more integrated partnerships where outsourcing becomes a strategic extension of the finance function rather than an external add-on. CFOs gain steady support, and organizations benefit from clearer reporting, better planning, and fewer operational disruptions.

Conclusion: strengthening the CFO playbook for 2026

CFOs in 2026 face rising expectations, tighter regulations, and constant pressure to improve clarity across financial operations. This guide highlights what modern leaders look for; reliable reporting, scalable support, accurate outsourced accounting & bookkeeping, effective technology use, and partners who genuinely help drive financial improvements. Outsourcing is no longer a simple cost decision; it’s a strategic move that shapes performance, risk management, and long-term stability.

The right partner offers more than task execution. They help create cleaner books, steadier cash flow, and stronger decision-making. With clear KPIs, supportive technology, and a focus on measurable value, CFOs can build relationships that strengthen the entire finance structure.

For organizations ready to elevate their financial operations with dependable expertise, FBSPL stands prepared to support that next step.

Written by

Bhavishya Bharadwaj

Bhavishya Bharadwaj is the Digital Marketing Manager at FBSPL, bringing over a decade of experience across insurance, outsourcing, accounting, and digital transformation.Frequently Asked Questions

They look for accuracy, reliability, clear communication, strong financial insight, scalable support, and partners who help improve reporting quality and long-term financial health.

Leaders rely on outsourced expertise to strengthen forecasting, stabilize cash flow, manage growth, handle compliance needs, and support strategic planning without expanding internal teams.

They evaluate consistency, turnaround time, error rates, visibility in reporting, cost efficiency, and whether the partner reduces internal workload rather than adding to it.

Both have strengths. CFOs often choose a blended model; global teams for high-volume tasks and local experts for compliance or region-specific requirements.

Domain knowledge, strong documentation habits, stable workflows, secure data practices, and the ability to support technology adoption while delivering dependable daily execution.