When was the last time you made a big financial decision without second-guessing whether you had all the right numbers in front of you? For most CFOs, that’s a rare luxury.

In today’s insurance landscape, leadership roles wear many hats, strategy setter, risk evaluator, growth planner, all rolled into one. But here’s the catch: a surprising number is still stuck with month-old reports, sluggish reconciliations, and systems that don’t talk to each other. The result? Decisions made with more gut feel than hard facts.

That’s why AI for CFOs isn’t just another tech fad, it’s becoming a necessity. With AI in finance and accounting, you’re no longer waiting days (or weeks) for critical figures. You’re looking at live numbers, spotting patterns as they form, and running “what-if” scenarios before committing to big moves.

And here’s the thing, building this capability in-house takes time and money. For a lot of companies, it’s quicker to lean on outsourcing accounting & bookkeeping to partners who’ve already invested in the right AI systems. They bring the tech, the expertise, and the speed, without the learning curve.

In this blog, we’ll unpack the pain points CFOs face without AI, the importance of AI in financial operations, how to integrate it into your playbook, where the field is headed, and why outsourcing might be the quickest way to level up.

When the numbers hold you back

Any CFO can tell you that bad data, or slow data, kills momentum. Without AI, it’s easy to fall into patterns that limit agility:

- Lagging Insights – By the time monthly reports are ready, the market may have shifted under your feet.

- Human Error – Even strong teams slip up when manually reconciling accounts or crunching complex spreadsheets.

- System Silos – Finance, sales, operations; each has its own database, and stitching them together is a job in itself.

- Forecasting Blind Spots – Projections based on historical trends alone miss live market signals and unexpected disruptions.

- Compliance Gaps – Regulations change, and manual tracking can leave you scrambling to catch up.

It’s not that CFOs don’t know what they’re doing, it’s that they’re operating without a clear, continuous feed of reliable intelligence. That’s like trying to steer a ship while the compass updates once a week.

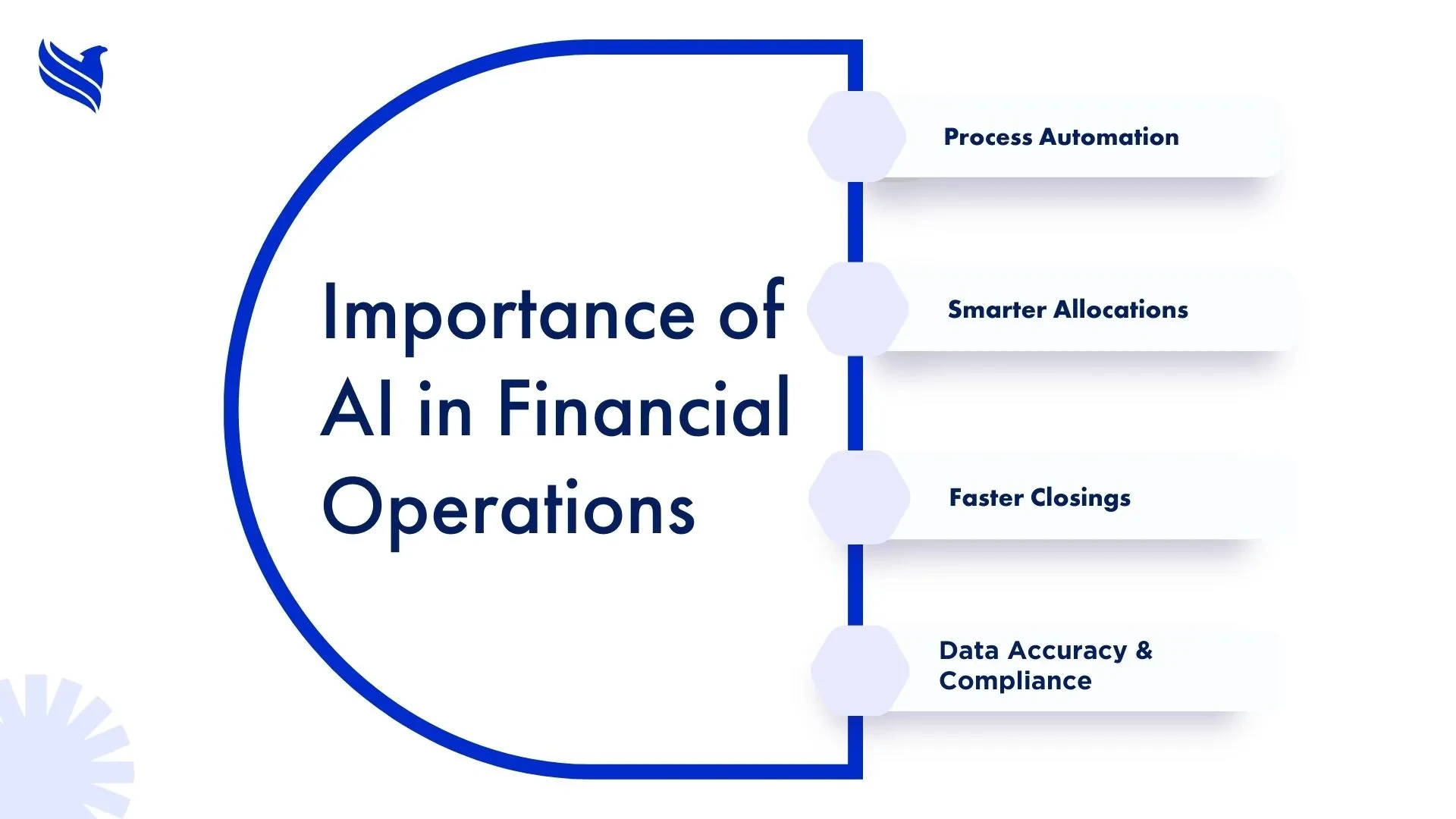

Importance of AI in financial operations

The importance of AI in financial operations lies in one thing: turning raw data into something you can actually use, quickly and with confidence.

- Live, All-in-One Views – Pulling data from across the business into one dashboard means no more chasing separate reports.

- Adaptive Forecasting – Machine learning models factor in live variables like currency swings or sudden supply shortages.

- Compliance Without Panic – Automated checks flag anomalies long before auditors do.

- Uncovering Inefficiencies – AI spots the small leaks, like underused assets or overpriced vendors, that quietly drain profits.

- Sharper Decisions – Whether you’re rebalancing budgets or greenlighting an expansion, AI ensures the numbers behind your choice are current and reliable.

In our use of AI in financial reporting for businesses in the US blog, we’ve shown how real-time AI reporting not only speeds up decision-making but also builds investor trust, something no CFO can overlook.

Bringing AI into the finance suite: practical steps

Adopting AI isn’t about installing one app and calling it done. It’s about aligning the technology with your workflows and priorities.

- Pinpoint the Real Problem – Don’t just “get AI.” Decide if your priority is faster close cycles, better forecasts, fraud detection, or something else entirely.

- Clean Up the Data First – AI is only as good as the information you feed it. Standardize formats, remove duplicates, and make sure every system talks to the others.

- Select Purpose-Built Tools – There’s a big difference between generic software and solutions made for AI in accounting or artificial intelligence in accounting. Finance-specific tools understand the rules of the game.

- Integrate Seamlessly – Make sure new tools plug into ERP, CRM, payroll, wherever the data lives, so you’re not creating a new silo.

- Train the Humans – Your finance team needs to read, question, and refine AI outputs, not just accept them at face value.

- Blend Internal Control With External Support – Use in-house oversight for strategy but outsource operational execution to AI-enabled providers offering accounting & bookkeeping services.

We’ve explored in how automation & AI are transforming modern accounting that hybrid models, where internal teams set direction and outsourced AI-driven teams execute, can give you the best of both worlds: control and efficiency.

What’s next: The future of AI in accounting

If you think AI’s current role is impressive, you’ll want to see what’s coming. Here’s what the next few years may bring in AI in accounting:

- Custom-Built CFO Dashboards – Forget cookie-cutter templates. These dashboards shape themselves around your industry’s realities, the risks you face, and the growth milestones you’re chasing.

- Self-Updating Compliance Rules – When regulations shift, sometimes overnight, the system adjusts its own protocols so you stay in the clear without scrambling.

- Instant “What-If” Scenarios – Wondering how a 10% premium cut or expansion into a new market might hit your bottom line? The numbers are ready before you’ve even finished asking the question.

- Voice-Activated Queries – Ask for “last quarter’s cash position by region” and get the answer without touching a keyboard.

- AI Meets Blockchain – Expect transaction records that are both secure and instantly verifiable, combining two powerful tech forces.

This isn’t about replacing finance teams, it’s about letting them focus on strategy instead of manual processes.

Outsourcing: The shortcut to AI gains

Here’s the truth: building an AI-ready finance operation yourself takes time, money, and a lot of testing. Outsourcing accounting & bookkeeping to an AI-capable partner can cut that timeline dramatically.

- Immediate Access to Tools – Providers already have tested AI platforms in place.

- Minimal Startup Costs – No need to pour money into servers, software, or a permanent tech department. You start lean and keep it that way.

- Support That Grows With You – As your book of business expands, your outsourcing partner can ramp up without derailing the way your teams already work.

- Compliance Handled by Pros – You’re tapping into people who track every regulation change for a living and adjust operations before it ever becomes a problem for you.

For CFOs, it’s less about handing over control and more about getting to value faster, with fewer distractions from the bigger strategic picture.

Moving from reactive to predictive finance leadership

At the end of the day, numbers don’t create strategy, insights do. And in a fast-moving economy, insights have an expiry date. AI in finance and accounting give CFOs the tools to see further, react faster, and lead with more confidence.

If you’re ready to shift from data overload to clear, actionable strategy, partner with FBSPL. Our AI-enabled accounting & bookkeeping services are built to help finance leaders make faster, smarter, and more strategic decisions, no matter the market conditions.

Transform Your Finance Operations with FBSPL