Summary: This blog explains how AI outsourcing transforms insurance operations by automating workflows, improving accuracy, reducing costs, and supporting compliance. It highlights key challenges, best-fit processes, benefits, and best practices, and shows how agencies modernize their workflows with human-supported automation.

- Why use AI workflow automation in insurance?

- Navigating integration complexities in insurance workflow automation

- Which insurance workflows fit AI automation best?

- Benefits of AI outsourcing in insurance

- Best practices for implementing AI workflow automation

- How outsourcing supports insurance workflow automation

- Stronger, faster insurance workflows with AI outsourcing

A practical guide to using AI outsourcing and workflow automation to streamline insurance operations, boost accuracy, reduce delays, and scale efficiently with expert support.

Insurance work isn’t easy. Every day brings more claims, new policy changes, and a mess of records, physical and digital. People put in extra hours just transferring numbers from one sheet to another. Some files go missing. Outdated systems don’t sync up, adding frustration to each task. Insurance agency workflow keeps dragging unless someone steps in and makes a change. Staff get tired. They deal with repeats, and mistakes slip through, especially when rules from regulators keep stacking up and slowing things down.

Switching to outsourcing in insurance is turning the tide. Agencies are letting outside experts handle tasks that suck up hours. With AI technology right at their fingertips, these partners can automate insurance workflows. It isn’t magic, real people use smart tools to sort, move, and check information faster than before. Teams finally get more time for customers.

Why use AI workflow automation in insurance?

AI in insurance has started to put stubborn problems in their place. It’s not about replacing the team. It’s about shifting the boring, repetitive stuff somewhere it won’t hurt the day-to-day work.

- Staff once spent afternoons on data entry. Now, forms and records fill out themselves behind the scenes. People focus on calls, real cases, and solving what matters most.

- Claims used to get held up by missing info, spelling errors, or duplicate paperwork. Automated checks catch these before they cause trouble, reducing disputes and do-overs.

- Customers notice the change. Requests don’t pile up. Renewals, quotes, updates, they all come faster. People trust agencies that move.

- Leaders in each department see the whole business process flow in one digital dashboard. Status updates aren’t hidden. Anyone can check where a task stands. Daily work isn’t a guessing game.

Automation shrinks problems. Suddenly, policies and claims move through the insurance agency workflow without every bump taking an hour to fix.

Navigating integration complexities in insurance workflow automation

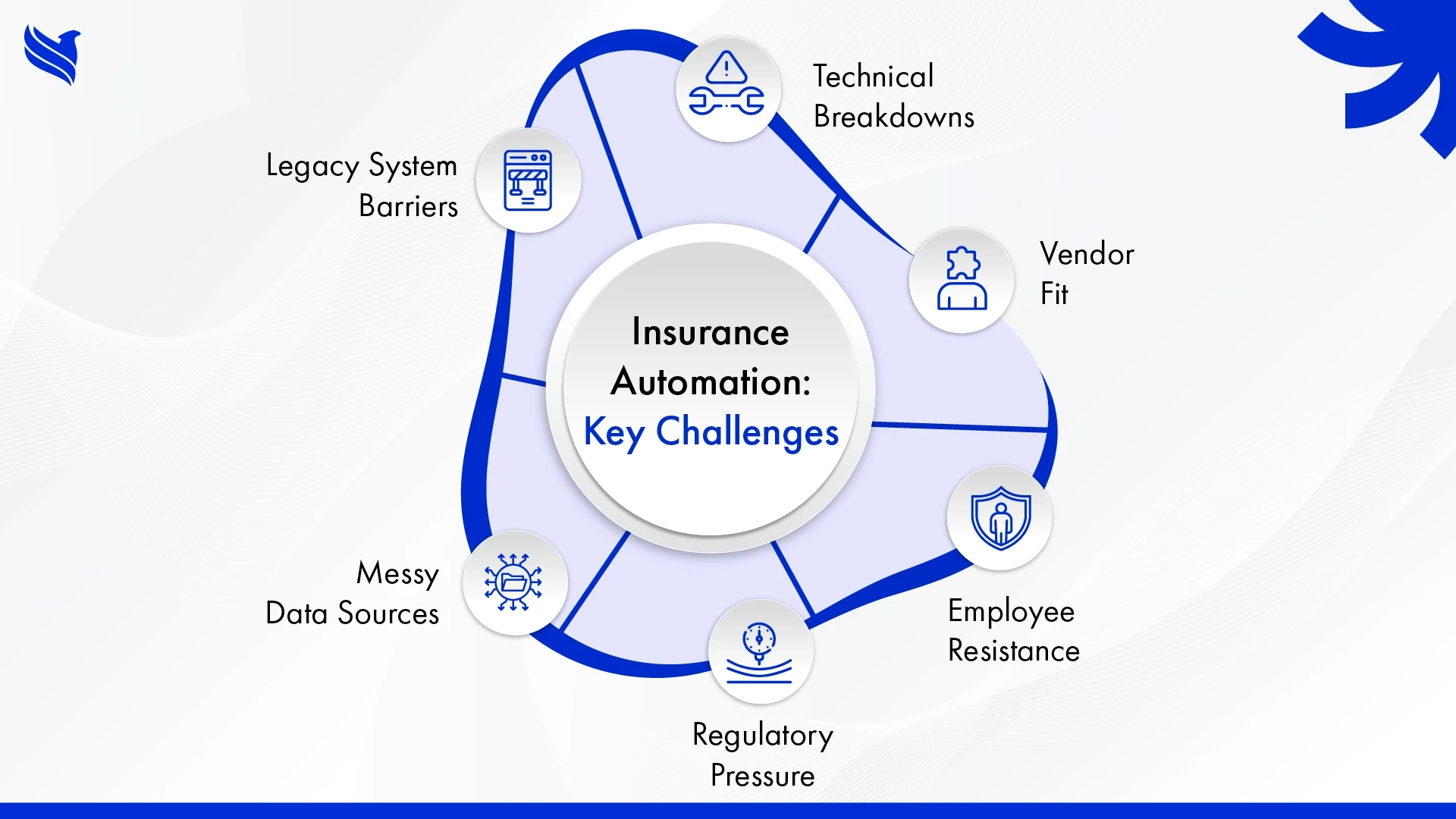

The switch to insurance workflow automation isn’t smooth for everyone. Several challenges tend to pop up, each with clear fixes once agencies spot them.

- Legacy system barriers: Old software blocks progress. Insurance businesses bought systems years ago. Now data doesn’t want to transfer cleanly. Upgrades help, but sometimes you just need to piece old and new together, one connector at a time.

- Messy data sources: Records aren’t clean. Users find duplicates, outdated policy info, or missing forms. Automated tools need organized data, so cleaning up comes first. Otherwise, processes stall or spit out errors.

- Regulatory pressure: Compliance isn’t just fine print. Auditors want to see action logs, track every change, and check privacy. Automation needs built-in tracking, retaining every move for easy review.

- Employee resistance: It isn’t easy convincing a team to trust AI or tech outsourcing in insurance. Habit kicks in. Steady training, a good support line, and real-time help smooth the way. Staff need to see benefits, not just read about them.

- Vendor fit: Tech partners might not get insurance. Agencies do better hiring people who’ve worked with claims, renewals, and audits before. Generic vendors miss industry-specific details, costing time and risking compliance.

- Technical breakdowns: APIs break, updates trigger bugs, and software glitches happen. Insurance-focused outsourcers handle problems faster. Testing makes rollout less risky.

No one solves these overnight. Agencies tidy records, run pilots, build cross-department teams, and keep checks in place to keep workflow automation on track.

Which insurance workflows fit AI automation best?

Some insurance processes just fit automation. The rest stick with people who know the business.

- Claims processing: Software reads files, checks documents, and sorts claims based on risk or fraud clues. It routes things automatically, stopping only when personal judgment is needed.

- Underwriting: Instead of sifting through stacks, AI technology reviews all relevant data, rates risks, and suggests custom policy options quickly. Nothing forgotten, nothing missed.

- Policy administration: Renewals or document updates used to be manual. AI workflow automation deals with reminders, checks compliance rules, and keeps records current, reducing mistakes.

- Customer support: Simple questions, like coverage details, policy expiration, or first claim steps, are answered by bots. Agents step in for big issues or emotional cases.

- Document and data management: Forms, PDFs, or images from emails get scanned and sorted. AI picks out numbers, names, and status, storing information so everything is ready when requested.

The rest comes down to human expertise. Disputed claims, special accounts, or unusual exceptions still land with experienced staff for final decisions.

Benefits of AI outsourcing in insurance

When outsourcing insurance is paired with workflow automation, agencies change the way operations look and feel.

- Speed: Processing times drop. Claims, renewals, and records update much faster, giving customers less to wait for and staff less backlog to clear.

- Lower payroll & cost savings: Routine jobs leave with the software. Smaller teams handle more, allowing businesses to put savings into better tech or talent.

- Accuracy: Automation catches mismatches and keeps logs up-to-date. Mistakes fall, so disputes and corrections become rare.

- Fraud protection: AI flags suspicious claims before money goes out. Claims teams focus on genuine service instead of sorting fakes.

- Scaling and growth: As volumes pick up, say, after a new marketing push, partners and automation help handle demands without hiring frantically.

- Continuous updates: Regulations and workflows evolve. Outsourcing teams manage upgrades and compliance so that the insurance business process flow doesn’t fall out of date.

- Audit simplicity: Automated trail logging means policies and claims are ready for regulatory review, without last-minute stress.

Positive outcomes show up across operations. Better client relations and fewer blunders mean insurance optimization service is finally practical.

Best practices for implementing AI workflow automation

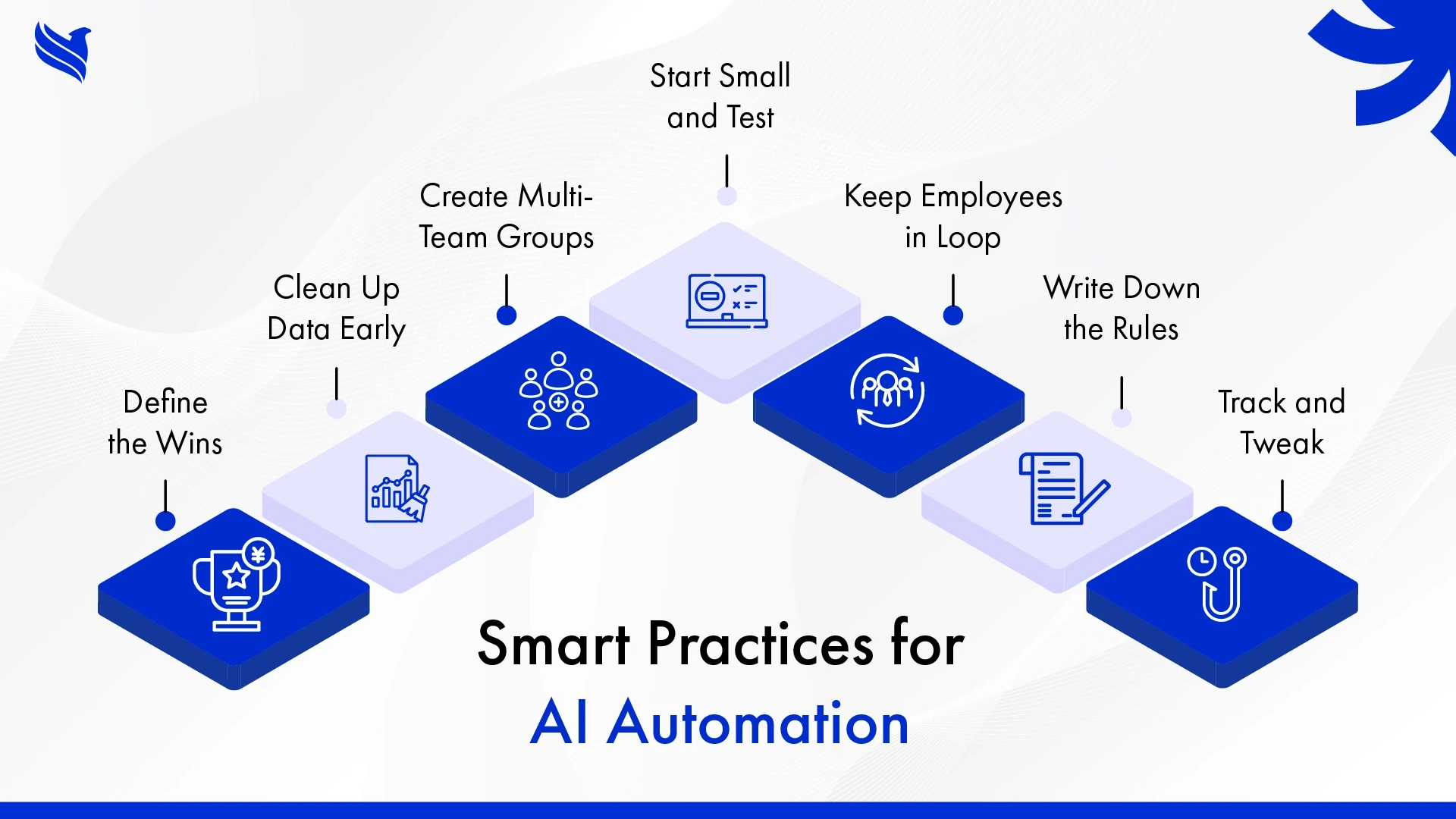

Agencies that plan well, execute well. Some practical steps that always help:

- Define the wins: What does success mean? Faster claims? Cheaper payroll? Flawless compliance? Name what matters.

- Tidy up data early: Don’t skip the record cleanup before launching. Cluttered databases choke automation and delay results.

- Build multi-team groups: IT, sales, compliance, and operations should meet often. That way, someone catches a problem before it grows.

- Start small and test: Don't shift every process overnight. Pilot automation for just one type of claim or policy update, then expand.

- Keep staff in the loop: Workshops, help desks, and honest communication reduce fear and help people feel supported.

- Write down the rules: Everyone should know how exceptions, audits, and data privacy are handled. Build a simple checklist.

- Track and tweak: Monitor performance. If a process isn’t smooth, fix it. Smart agencies adjust on the fly, not just at year-end.

How outsourcing supports insurance workflow automation

When agencies partner with outsourcing experts who understand insurance business process flow, improvement feels natural. These partners pick the right tech, create custom fit-outs, and close gaps between old systems and modern needs. Compliance becomes automatic. Whenever rules change, the team updates the system; agencies don’t stress about getting caught out by auditors. Sudden spikes in claim volume just mean scaling resources. There's no scramble to add new hires or buy updated tools in a hurry. Whenever processes get stuck, external partners have fixes ready, so work keeps moving.

For exception-heavy workflows, partner firms coordinate with in-house experts. Automation runs what it can, then hands off special cases to trained staff. It means people aren’t buried in basics but have the time and context to help clients directly. Outsourcing keeps routine business humming, supports flexible growth, and lets real insurance professionals do what only humans can.

Stronger, faster insurance workflows with AI outsourcing

Insurance work is changing faster than ever. Agencies caught up in manual work, slow claims, unhappy customers, and compliance headaches finally have options. AI outsourcing fits naturally. With smarter workflow automation, spreadsheets and missed records become history. FBSPL provides insurance optimization service designed just for agencies who want reliability, quick turnaround, and scalable support.

It’s not about letting robots run the business. Real teams work with trustworthy automation and outsourcing partners. This mix means fewer delays, fewer mistakes, and more energy for clients. FBSPL understands insurance workflows and the need for simplicity. With tailored agency optimization and seamless integration of AI in insurance, agencies move faster, stay accurate, and keep growing smarter.

For insurance businesses ready to drop manual stress and lead their field, reaching out to FBSPL is a smart next move. They make insurance workflow automation work for today’s needs.