Summary: AI outsourcing offers speed and skill but is sharp; real wins follow honest discussion, flexible support, and industry know-how. In this blog, we will mainly discuss the factors for finding partners who don’t just automate but genuinely care about clients and staff as much as results.

Imagine running an insurance company where claims pile up and clients demand quick, clear answers. Modern markets are fast, unpredictable, and less forgiving of delays. With so much at stake, smart leaders are always looking for ways to reshape insurance and business operations for the better. These days, AI outsourcing stands out as an option—but is it really the silver bullet everyone thinks it is?

The hype around AI technology is real, but any CIO or operations head will admit: it’s easy to get lost in technical lingo, shiny features, and big promises. The real challenge? Making artificial intelligence services boost customer experience and efficiency, without creating more headaches or losing that all-important human touch. Outsourcing, if done right, fills gaps with specialized support, advanced AI frameworks, and often a fresh perspective. If done poorly, it brings more confusion and risk.

This blog unpacks what truly matters when exploring AI outsourcing, with a special focus on the insurance industry, AI consulting, digital transformation hurdles, compliance, and the value of the right outsourcing partners.

Roadblocks on the AI journey: Challenges nobody warns you about

Here’s what they don’t say in vendor brochures: transformation rarely goes as planned. For insurance operations, things get messy. Data is scattered, legacy systems resist change, and compliance expectations can flip overnight. AI-powered solution plans start with enthusiasm but face heavy winds, privacy headaches, staff skepticism, moving targets for cybersecurity, and sometimes confusion over what “done right” even looks like.

A major global insurer in 2024 kicked off digital transformation, investing in AI-powered insurance services to reduce claims cycle time. But too many changes hit at once, staff struggled with new interfaces, data wasn’t standardized, and clients felt lost talking with automated bots. Trust took a dip. In another case, a smaller provider leaned on an untested ai outsourcing partner, only to run into compliance gaps and costly errors in underwriting automation. The fix? Months of retraining, system rollbacks, and cautious, gradual re-adoption. Lessons learned: real-world digital transformation needs patience, practical tests, and human backup at every step.

Ten factors every decision-maker should weigh in AI outsourcing

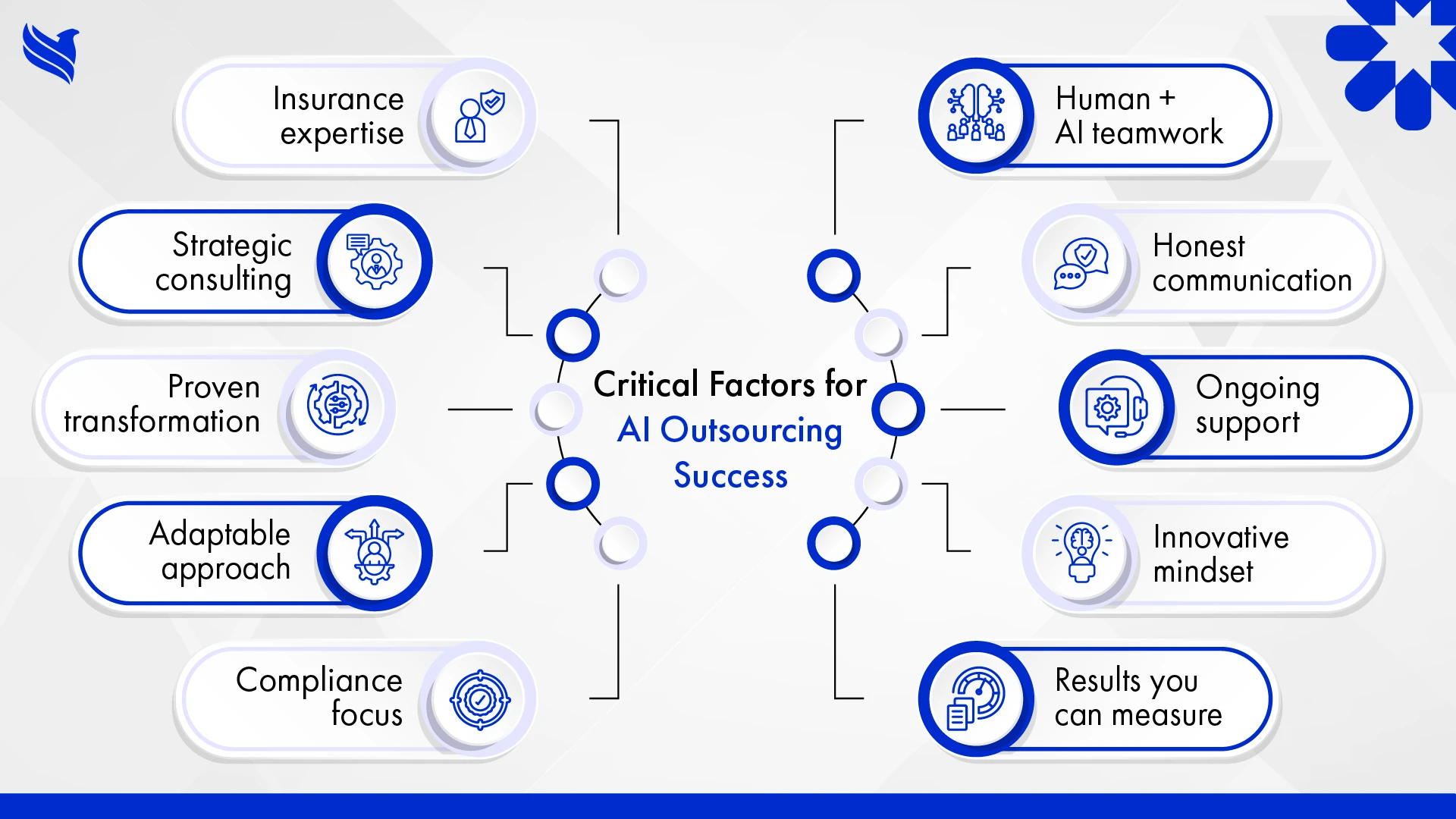

Not all AI consulting firms or BPOs offer the same value. Leaders need a keen checklist, not just buzzwords. Here are ten factors that often separate success from struggle, whether you’re deep in the insurance industry or managing general ai outsourcing:

1. Experience that’s relevant

AI solutions for insurance or financial services aren’t like retail or manufacturing. Choose partners who get your unique workflows, compliance standards, and who actually have insurance operations efficiency stories to share.

2. Real AI strategy consulting, not just tech support

A good ai outsourcing strategy comes from advisors who rethink your business model and customer lifecycle. They map out near-term wins and long-term improvements, not just plug in software and leave.

3. Hands-on digital transformation know-how

Ask for proof of successful digital transformation. Has the partner moved insurance teams from old, paper-heavy processes to transparent AI-powered solution models? Have they managed hybrid rollouts (tech and people, together) in high-stakes sectors?

4. Flexibility: plans that change when you do

Sometimes, leaders realize only months into a project that their process needs a twist. Top outsourcing partners adapt, tweak the solution, and adjust contracts so your business goals come first.

5. Rock-solid compliance and security

Regulations shift quickly, especially in insurance and finance. Pick partners with proven audits, transparency, and a focus on compliance and security in AI outsourcing (think SOC 2, GDPR, data privacy by design, regular training).

6. Automation that includes human judgment

The best AI frameworks support staff, rather than replace them. Look for Outsourcing partners who build workflows with clear escalation points; AI handles routine; people take over when nuance matters.

7. Communication: always open and honest

Updates should be regular, honest, and never sugar-coated. Humanized AI consulting means the freedom to say when something’s wrong, make new requests midstream, or admit pivots are needed.

8. Post-launch support you can rely on

Too many projects succeed in beta and fail six months later. The right AI partner offers regular health checks, retraining, and tweaking, never a hit-and-run approach.

9. Continuous innovation, not just installs

Insurance moves fast. The top AI-powered insurance services partner won’t just automate claims; they’ll pitch fresh ideas for risk detection, workflow tweaks, or even new revenue streams using ai in insurance.

10. Transparent value and accountability

You should expect (and demand) before-and-after numbers. Does this AI outsourcing strategy actually mean lower costs, fewer claims delays, fewer compliance violations, or better customer reviews? Insist on measuring what matters from day one.

The bright side: Real-world benefits of AI outsourcing

Once a business finds the right AI and BPO partner, big changes follow, usually faster and cheaper than internal projects alone.

- Sharper accuracy: AI frameworks cut manual errors, especially in claims and underwriting. This can mean 60%+ boosts in operational efficiency and 99% accuracy rates in claims.

- Faster cycles: Claims and customer service bottlenecks fade, as standard requests are automated, and staff spend more time on tricky cases. Firms have reported cutting cycle times from weeks to days.

- Happier clients: AI-powered solution chatbots handle simple requests 24/7. But for tough calls, a payout dispute, a fraud scare; you still get the human touch.

- Lower risk: Fraud detection algorithms spot red flags early, stopping millions in potential losses. Compliance flags catch mistakes before regulators do.

- Better use of people: Administrative headaches drop; staff focus shifts to advice, crisis handling, or nurturing loyalty.

These aren’t just pie-in-the-sky benefits, they’re showing up today for insurers who commit to blended, measured AI outsourcing.

Why smart outsourcing moves the needle

So, what is it about outsourcing that changes the game? It’s not a surrender. The real edge comes from quick access to deep expertise. Instead of spending years building in-house AI strategy consulting, companies bring in Outsourcing partners who already know the regulatory maze, local markets, and tough reality of insurance operations efficiency.

An AI partner brings in a global perspective too, working with clients across countries, learning what works in different markets. They offer out-of-the-box best practices for underwriting, claims, compliance, and customer engagement. Plus, a smart outsourcing partner blends tools and people: AI frameworks catch routine claims or fraud risks, while trained agents explain tough decisions or guide clients through unique policy needs.

There’s a financial edge to this model: businesses avoid giant spends on recruitment, hardware, or endless software updates. Instead, outsourcing partners scale their involvement up or down as needed.

Many successful insurance leaders now admit, their secret? Outsourcing provided just the right balance between AI speed and human touch.

Strategic wrap-up: What leaders should prioritize next

The insurance world, and many other service sectors, are at a crossroad. Everyone wants increased efficiency, faster claims, and better compliance, but few want to lose the trust only people can build. The AI secret isn’t AI itself, it’s the decision to get help from the right outsourcing partners, who blend technology strength, human insight, and an unbreakable focus on compliance and security in AI outsourcing.

In summary: Consider ten core factors, industry experience, strategy, real digital transformation, flexibility, compliance, human-led automation, open communication, ongoing support, innovation, and transparent value. The payoff can be huge: faster settlement, fewer mistakes, bigger savings, and happier clients.

Those ready to embrace true digital transformation, with an emphasis on the human touch, will find FBSPL is the partner ready to guide you. Don’t settle for one-size-fits-all solutions. See how the careful guidance of an expert partner can bring your vision to life today.

Looking for an AI and BPO partner who speaks your language, gets the industry, and cares about your long-term results? FBSPL is just a message away. Contact FBSPL and build a resilient future with AI-powered insurance services.