This guide explores how FBSPL’s AI-powered insurance toolkit is transforming insurance workflows, boosting efficiency, and strengthening client relationships.

- When insurance processes work against you

- What turnaround time really represents

- The hidden cost of delays in insurance agencies

- Why traditional methods fall short

- How AI is transforming the insurance industry

- Inside FBSPL’s AI-powered toolkit for insurance agencies

- Why these tools matter together

- Leveraging AI for competitive advantage

- The future of AI in insurance

- Strategic benefits of outsourcing

- Building the future of insurance, Together

The insurance industry has always been about trust. Clients hand over their worries, and agencies promise speed, accuracy, and protection. But anyone who has worked inside an agency knows the story is not always that smooth. Renewal piles build up, claims stall, and outdated systems keep teams buried in tasks that should have been automated years ago. Deadlines slip, and with them, client confidence.

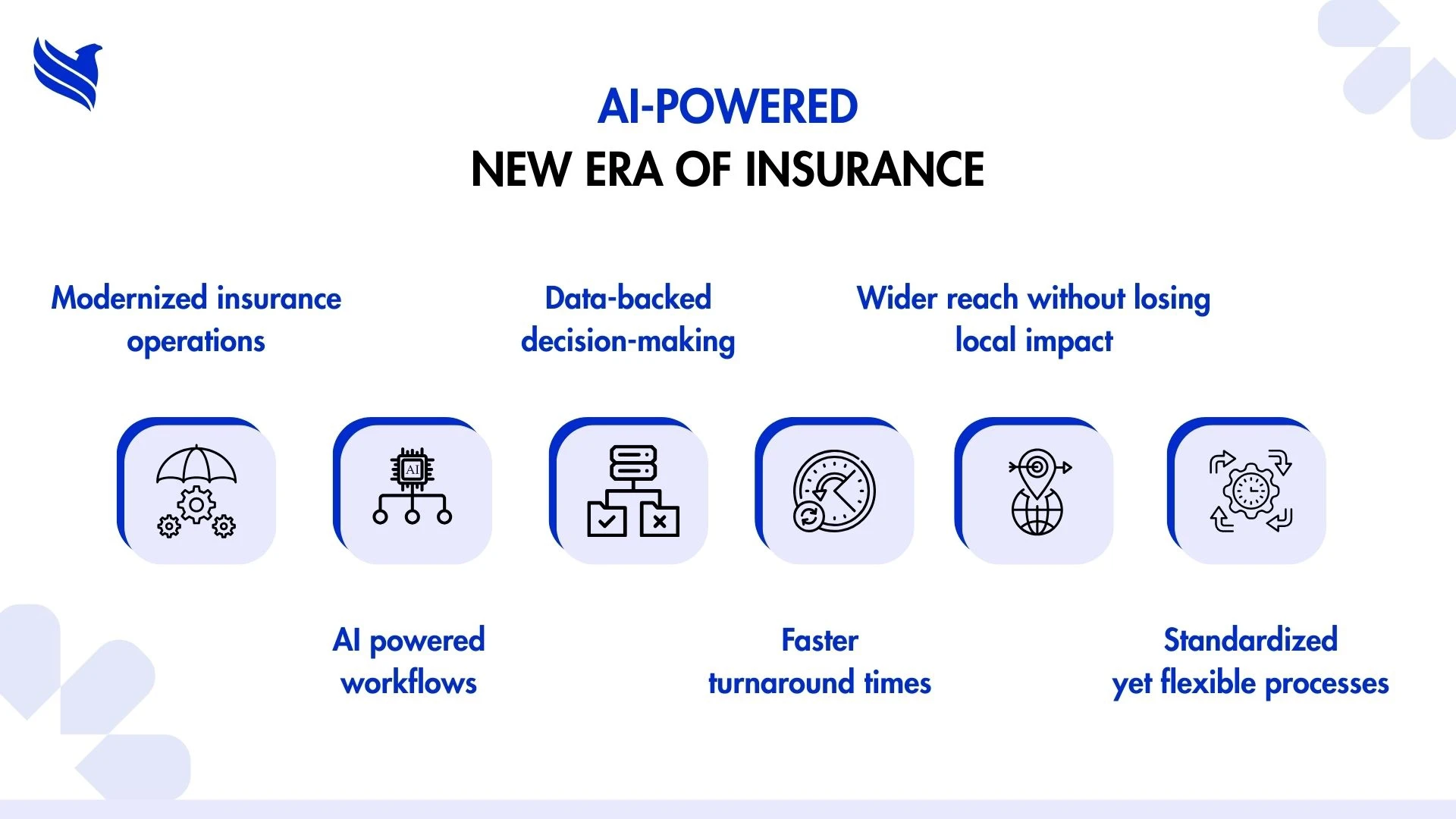

That pressure is exactly why AI in insurance is becoming less of an experiment and more of a lifeline. Instead of a single product, think of it as a complete insurance toolkit, a set of smart AI insurance tools designed to shrink delays, reduce errors, and let professionals focus on decisions rather than data entry. Imagine shaving down response times not by minutes but by entire days. Agencies that once waited on manual processes are now cutting turnaround time (TAT) by as much as 90%.

And it’s not just about speed. When competition is fierce and regulations tighten every quarter, accuracy is everything. That’s why many agencies are blending insurance outsourcing with automation. Outsourcing provides scale, AI provides intelligence, and together they create something agencies couldn’t achieve with traditional methods alone.

In this guide, we’ll look at how FBSPL’s AI-powered insurance toolkit is reshaping everyday operations, why these changes matter for growth, and how they tie into the larger conversation about the future of AI in insurance.

When insurance processes work against you

If you talk to anyone who has worked inside an insurance agency long enough, you’ll hear the same story: the bottlenecks aren’t caused by people being lazy, they’re caused by systems that were never built for the pace we live in now. A renewal might sit untouched because data has to be retyped across three different platforms. A claim could take weeks, not because the facts are in question, but because paperwork gets stuck in endless loops. By the time something moves forward, the client has already lost patience.

What’s worse is that every piece of the puzzle depends on something else. One person’s delay slows the entire chain, and soon what should have taken a few hours drags into days. This is the reality of insurance process management when it leans too heavily on outdated methods. It’s no wonder agencies feel buried even when their teams are working overtime.

The fix isn’t as simple as adding more staff. Throwing people at the problem only stretches budgets and makes errors more likely. The smarter approach is rethinking how processes are designed. That’s where business process management for insurance has begun shifting. Agencies are experimenting with AI applications in insurance, tools that scan documents automatically, flag inconsistencies instantly, and handle repetitive tasks in the background.

Outsourcing adds another layer of relief. Offshore partners are no longer just about cost savings; they’re blending automation into their delivery. In fact, automation is now reshaping the insurance BPO workflow altogether, cutting out steps that once consumed hours.

The challenges haven’t disappeared, but with AI and outsourcing working together, agencies finally have a way to stop fighting their own processes.

What turnaround time really represents

Ask any insurance professional what clients value most, and “speed” always makes the list. But turnaround time is more than just speed, it’s a signal. It tells clients whether their agency is attentive, organized, and dependable. When a claim takes too long or a renewal sits waiting in someone’s inbox, clients don’t see the backlog behind the scenes; they only see a broken promise.

Think of a prospect waiting on a proposal. They’re probably talking to two or three agencies at the same time. Whoever gets their offer across the table first has an advantage before price or coverage even enters the conversation. That’s why tools like AI proposal generators are reshaping how agencies work, delivering polished proposals in hours rather than days.

The same logic applies to claims, endorsements, or even simple queries. A quick turnaround reassures clients they made the right choice. A slow one plants doubt. And that’s where AI in insurance starts to play a bigger role, not as some abstract technology, but as a practical way to shrink waiting time and keep relationships intact.

The hidden cost of delays in insurance agencies

Delays in insurance don’t always look dramatic at first. A claim takes a few extra days, a renewal slips past its deadline, or a proposal sits in draft a little too long. But these small hold-ups often snowball into bigger problems that drain both time and trust.

From the agency’s perspective, delays create multiple pain points:

- More back-and-forth with clients – When customers don’t hear updates, they call or email more often. Instead of moving work forward, teams spend hours answering the same questions.

- Slower revenue cycles – Every day lost in processing means slower billing, delayed collections, and tighter cash flow.

- Strained employees – Staff burn hours on manual checks, rework, and chasing paperwork, which kills productivity and morale.

Clients feel the pinch too. Most don’t see the internal struggles, what they see is silence. And silence during stressful times, like a car accident or urgent renewal, feels like abandonment. In an era where switching providers is as easy as clicking a button, these gaps in service can cost agencies loyal customers.

The good news? Many of these delays aren’t permanent features of insurance, they’re the result of outdated workflows. By 2027, several insurance processes will be fully automated (here’s a look at what’s coming). Agencies that embrace this shift now can protect revenue, improve client experience, and give their teams breathing room to focus on high-value work instead of repetitive tasks.

Why traditional methods fall short

Ask someone who has been in insurance for 20 years, and they’ll probably tell you the same thing: “We’ve always done it this way.” That line worked fine in an era when paperwork moved at the speed of fax machines and customers had fewer choices. Today, it’s a different story. Traditional workflows, the ones built on paper-heavy processes and endless Excel sheets, are now the biggest reason agencies can’t keep up.

The cracks usually show in everyday tasks:

- Data being typed three or four times into different systems, increasing the chance of error each time.

- Teams working in silos, claims in one system, accounting in another, policy servicing in a third, with no easy way to stitch the picture together.

- Leaders reacting to problems only after clients complain, rather than spotting risks before they explode.

That’s the reality of old-school insurance process management. It’s not that people aren’t skilled, it’s that the tools were never designed for the volume and complexity agencies face now.

The fix isn’t hiring more staff or asking people to “work harder.” Agencies need AI insurance tools that can shoulder the repetitive load: scanning documents instantly, flagging missing fields, even predicting renewal trends. Pair this with insurance outsourcing, and you get a model where human expertise meets automation. That combination is what modern business process management for insurance really looks like.

This is why so much attention is now on how AI is transforming the insurance industry. Agencies that cling to tradition risk being left behind, while those embracing smarter workflows are cutting costs, improving accuracy, and slashing TAT in ways spreadsheets never could.

How AI is transforming the insurance industry

It’s strange to think that only a few years back, automation in insurance meant little more than digitizing paper files. Fast forward to now, and entire workflows are being reshaped by AI solutions for insurance business. What once felt like a buzzword is quietly becoming the engine that keeps agencies running on time.

You see the difference most clearly in claims. Anyone who has handled claims manually remembers the endless checks, policy verification, document comparisons, phone calls to confirm details. It could stretch into weeks. With AI applications in insurance, much of that grunt work is gone. Systems read forms, cross-check data, and highlight what looks off before a person even touches the file. A job that ate up days suddenly lands on your desk already 80% done.

Renewals tell a similar story. In the old model, agencies waited for clients to call. Now, predictive tools scan histories and behaviors, pointing out who’s likely to churn. That gives agents the chance to act early, often saving business that might otherwise slip away.

Fraud detection is another game changer. Traditional sampling was like fishing with a net full of holes. You caught some, but most slipped by. AI spots patterns across thousands of records at once, behavior that no human eye could track in time.

And then there’s customer interaction. Clients no longer wait for office hours to ask a simple question. Chatbots and self-service portals, powered by machine learning, keep the conversation alive round-the-clock. It’s not perfect, sometimes they stumble, but for routine queries, it keeps clients engaged without piling on staff workloads.

What excites me most isn’t each piece on its own, but the way they start connecting. Picture insurance outsourcing teams that already handle scale, now powered by automation in the background. Humans oversee, machines accelerate. The balance works.

All of this points to something bigger: AI in insurance isn’t just a technical upgrade, it’s a shift in how trust is built. A client who gets their claim resolved in days remembers the speed more than the paperwork. That memory is loyalty. And loyalty is the one thing every agency fights to keep.

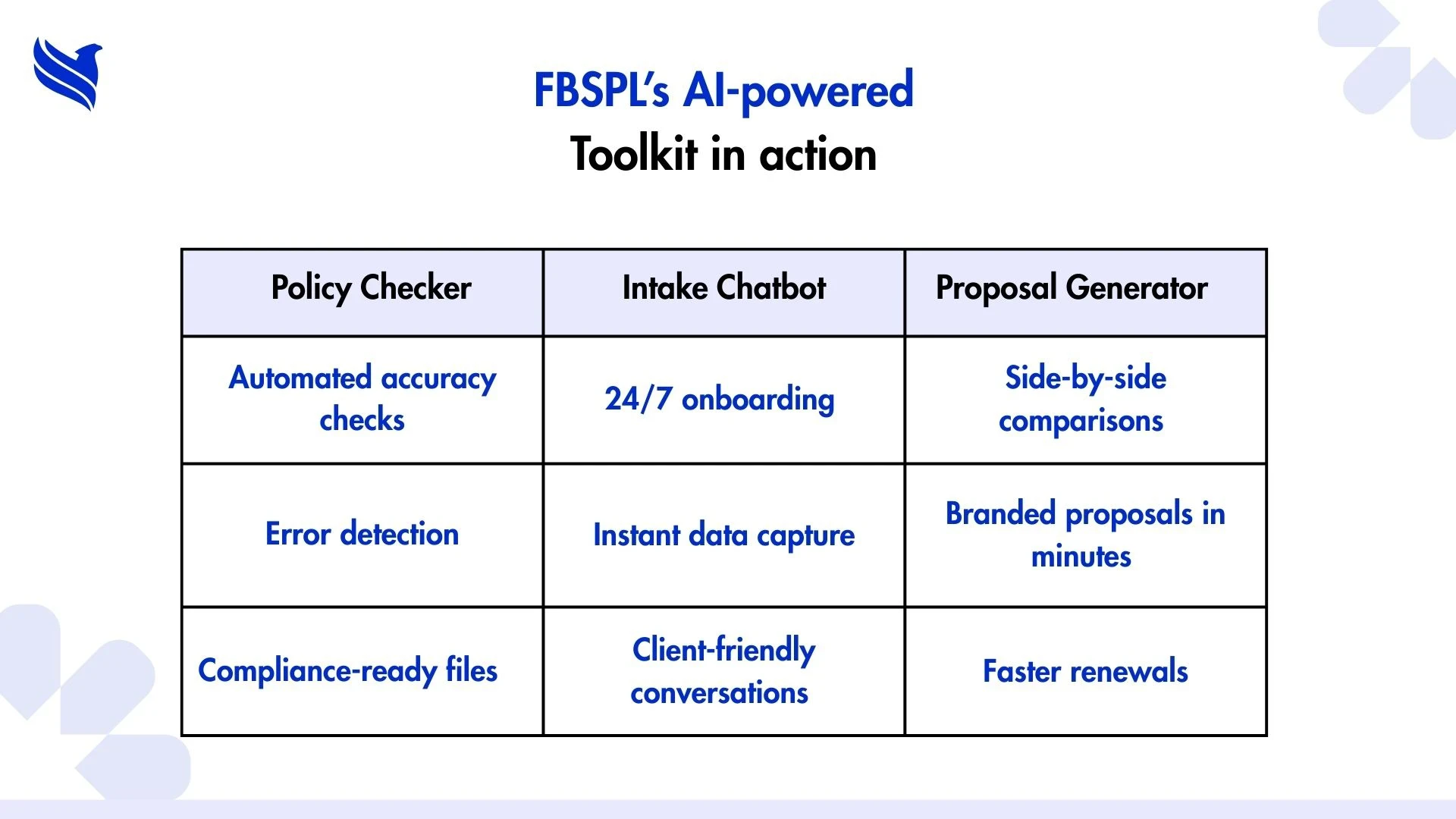

Inside FBSPL’s AI-powered toolkit for insurance agencies

Insurance has always been a paper-heavy industry. Anyone who’s worked in it knows the drill, policies piled on desks, quotes saved in ten different folders, and renewal comparisons that steal away half a day. The work gets done, of course, but often at the cost of late nights and a few sighs along the way. That’s why when new tools started showing up, they weren’t just “nice extras.” They felt like lifelines.

These aren’t robots replacing people. They’re more like smart helpers, tidying up the mess, pointing out what humans might overlook, and cutting hours of manual effort. Three tools, in particular, are quietly reshaping how agencies move:

- A Policy Checking & Comparison Tool for personal lines

- The Smart Intake Chatbot

- A Proposal Generation & Comparison Tool

1. Policy checking & comparison tool – Personal lines

Let’s be honest, going line by line through a 40-page home or auto policy isn’t anyone’s favorite task. Yet agents can’t skip it because one overlooked deductible change could mean a client blaming them later.

This tool does the unglamorous but vital job of pulling policies apart and putting them back together in a way that makes sense. Upload the document, and instead of staring at endless clauses, you get a snapshot of what’s actually different.

What makes it useful:

- Quick reviews → The tool cuts hours of manual checking into minutes.

- Spotting quiet changes → A bumped deductible, a missing endorsement, stuff that gets buried in the fine print now stands out.

- Side-by-side clarity → Renewal, existing, and competitor quotes can be stacked together, so explanations to clients are simpler.

- Covers different personal lines → Auto, home, renters, and more, it doesn’t lock itself to one product.

- Professional summaries → Instead of messy notes, agents can show clients clean, digestible reports.

The real win? Agents feel less like tired auditors and more like trusted advisors.

2. Smart intake chatbot – Modernizing onboarding

If you’ve ever chased clients for missing information, you know the frustration. Traditional forms get left half-filled, or worse, clients send back screenshots with incomplete details.

The chatbot changes that. It doesn’t look like a form at all. It feels more like a guided conversation: “Hi, let’s get started with your home insurance. Do you own or rent?” → Client picks → Next question.

It’s not perfect, but it’s far friendlier than a PDF attachment in an email.

Why agencies find it handy:

- Better first impressions → Instead of overwhelming paperwork, clients ease into the process.

- Guided questions → Reduces blanks and mistakes because the bot asks step by step.

- No tech headache → Agencies don’t need coders to set it up; it’s pretty much plug-and-play.

- Cleaner data → Inputs get validated on the spot, so wrong formats or missing info aren’t an issue.

- Saves staff time → Less chasing and double-checking, more moving the process forward.

Clients notice the difference too. It feels modern, like the agency cares about making things easier, not harder.

3. Proposal generation & comparison tool

This one might be my favorite because it solves a pain most agents never admit out loud: proposal formatting. Traditionally, you’d juggle Word and Excel, copy-paste data from three quotes, and pray you didn’t miss a number. A single polished proposal could take half an hour. Multiply that by ten, and you’ve lost a workday.

Now? Drop in the quotes, and the tool spits out a clean, editable proposal. No awkward formatting. No manual retyping. And yes, it creates a ready-to-send PDF with just a click.

Where it makes life easier:

- Drafts done instantly → What took 20–30 minutes now takes under a minute.

- Comparisons built-in → Original quotes can be matched up side by side.

- Editable before finalizing → Agents can still tweak and personalize.

- Consistency → Every proposal looks professional, not thrown together.

- Clients understand faster → Cleaner layout means decisions come quicker.

It’s not just time saved, it’s also about perception. Clients feel like they’re dealing with an agency that has its act together.

Why these tools matter together

On their own, each solves a nagging problem. But when you connect them, the whole client journey smooths out.

- Intake chatbot → collects accurate info without the headache.

- Policy checking tool → compares policies in minutes, so agents catch gaps and explain clearly.

- Proposal generator → turns that into a polished, client-ready document without eating half a day.

It’s like a relay race where the baton never gets dropped. By the end, clients walk away feeling cared for, and agents finish the day with energy left instead of being drained by paperwork.

That’s the quiet revolution happening, less about flashy AI promises and more about everyday tools that actually make insurance work human again.

Leveraging AI for competitive advantage

In insurance, the playing field doesn’t stay level for long. Some agencies still rely on legacy processes, manual comparisons, Excel sheets running on shaky formulas, while others have already folded AI in insurance operations into their daily rhythm. It’s not always flashy. Most clients won’t even realize their broker is leaning on algorithms. What they’ll notice, though, is speed, fewer mistakes, and answers that feel on point.

I remember hearing about a mid-sized agency that handled renewals with a mix of late nights and extra temps every December. Once they put in an AI-powered renewal management tool, the staff no longer scrambled. Instead of chasing data mismatches, they had time to call clients directly. Clients, in turn, felt more cared for. That’s the kind of edge AI creates, it doesn’t look like magic, but it changes the energy of a team.

Some edges worth noting:

- Time reclaimed – hours once wasted on reconciliation suddenly free up for higher-value work.

- Consistency at scale – humans get tired; systems don’t. Service levels stay even.

- Sharper advice – with quick insights, conversations move beyond paperwork into real problem-solving.

- Morale lift – teams feel less like machines, which ironically makes them more human in service.

Competition today isn’t about who works hardest, it’s about who works smarter. The ones who adopt AI quietly build reputations for accuracy and responsiveness. Those who don’t? They’ll find themselves explaining delays while others are already moving forward.

The future of AI in insurance

It’s tempting to think AI is a temporary wave, but truthfully, it feels more like a new baseline. Just as no one questions online banking anymore, the future of AI in insurance looks like something we’ll all take for granted. The question isn’t if it becomes standard, but how far it goes.

Looking ahead, a few directions stand out:

- Hyper-personalized coverage – Imagine car insurance priced not broadly by age or ZIP code, but by actual driving behavior from telematics.

- Instant underwriting – no waiting days; risks assessed in real time.

- Fraud detection that sees patterns early – saving millions before the claim even processes.

- Proactive engagement – systems predicting when a client might be ready for a policy upgrade or likely to churn.

There’s also the side we don’t talk about as much: the friction. Questions around data privacy. Regulators asking how much automation is “too much.” Agents wondering if technology is edging out their role. The reality is, it won’t. Clients still lean on relationships, judgment, and reassurance. What AI does is strip out the repetitive grind, leaving more room for the human part of this business.

In that sense, the future isn’t machines replacing people. It’s machines carrying the weight so people can show up better. Insurance at its heart has always been about trust. AI just gives professionals the breathing room to deliver it without being buried in spreadsheets.

Strategic benefits of outsourcing

There’s a limit to how much one team can stretch. Even with the best tools in place, insurance operations have peaks, renewal seasons, compliance crunches, sudden claims surges, that push teams beyond comfort. That’s where outsourcing insurance processes comes in, not as a band-aid, but as a structural advantage.

A small agency once told me they used to bring in interns during renewal season just to “keep the lights on.” The interns, of course, made mistakes; the permanent staff spent evenings correcting them. When they shifted part of that load to an outsourcing partner, the difference was night and day. Staff could focus on client calls and cross-selling, while routine tasks, policy checks, data updates, claims follow-ups, kept moving quietly in the background.

Here’s why outsourcing pairs so well with AI adoption:

- Scalability on demand – need 10 extra people this month, 2 the next? External teams flex where in-house staff can’t.

- Round-the-clock operations – global teams often run 24/7, so turnaround shrinks without burning out your own people.

- Specialization without hiring – claims management, compliance, finance tasks, outsourcing firms often come pre-trained in these.

- Cost stability – instead of unpredictable overtime bills, you get a predictable service fee.

Combined with AI-powered insurance solutions, outsourcing makes operations less about firefighting and more about strategy. Instead of pulling all-nighters to fix reporting errors, leaders can finally look at growth opportunities.

Building the future of insurance, Together

Insurance has always been about trust, policies, numbers, paperwork, yes, but at its core, it’s about people relying on you in critical moments. The challenge today is that the old ways of running an agency don’t always match the speed or clarity that clients expect. Technology is filling that gap, but it doesn’t replace the human side; it strengthens it.

This is exactly where FBSPL fits in. Think of them less as an outsourcing provider and more as a behind-the-scenes partner, helping agencies trim the noise, compliance checks, policy reviews, renewals, so that advisors can spend their energy where it matters: with clients.

The future of insurance isn’t a distant idea. It’s already unfolding. And those who adapt early will lead.

So, if you’re looking for a partner who can help you move faster, smarter, and with confidence, reach out to FBSPL today.