Insurance companies are feeling the strain. Claims flood in, paperwork piles up, and old systems drag every process down. Add to that strict regulations and customers who expect quick resolutions, and the pressure only builds. One missed claim deadline or a small error in policy handling can snowball into bigger financial and reputational damage.

- Key obstacles in automating insurance processes

- Benefits of automating insurance workflows

- Getting started with insurance workflow automation

- Putting automation to work in insurance BPO

- The role of outsourcing in successful insurance automation

- Looking ahead: Automation as a catalyst for insurance growth

- So, where does automation really belongs in insurance

The way forward isn’t about working longer hours; it’s about working differently. Automation in Insurance industry has become that game-changer, taking over repetitive tasks, cleaning up process gaps, and reducing the errors that cost time and trust. At the same time, many insurers rely on outsourcing partners to handle the heavy back-office load while embedding automation into everyday operations.

In this blog, we dig into where automation fits within insurance BPO workflows, why it matters now more than ever, and how insurers can combine automation, AI, and outsourcing to build stronger, future-ready operations.

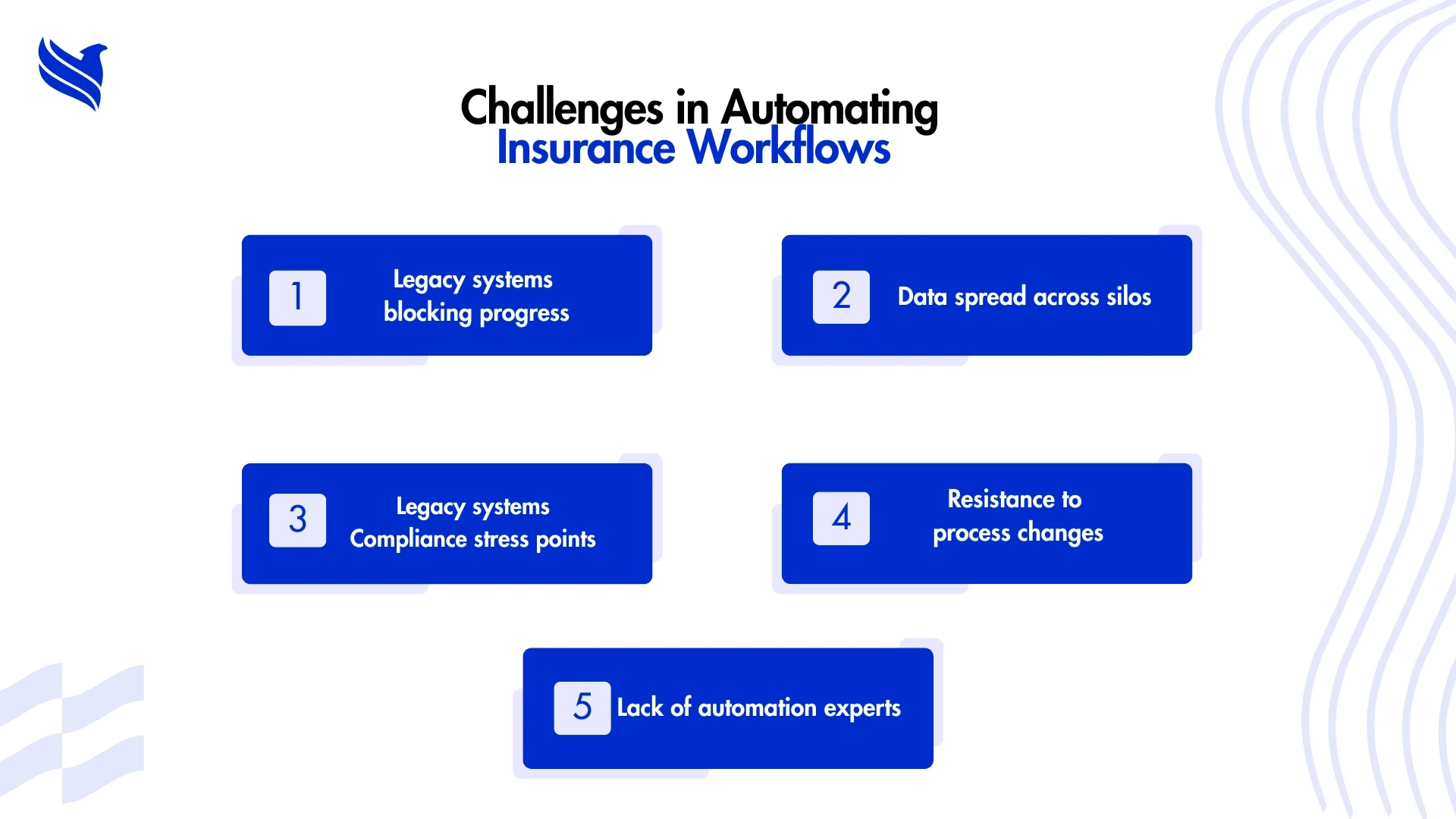

Key obstacles in automating insurance processes

Companies hit several obstacles when they start working with insurance workflow automation. Some of them are:

- Outdated systems and scattered data: Many insurers still rely on aging policy systems and countless spreadsheets. Trying to layer automation on top of this patchwork is a constant battle. Bots often fail when document formats shift or when the data they pull isn’t consistent.

- Process complexity and regulation: Insurance workflows, from underwriting to claims, are rule‑heavy and require compliance at every step. Automating without checking has led to costly mistakes. Automation in insurance business process flow needs rigorous validation.

- Change fatigue and skill gaps: People in claims or policy teams are good at flags and exceptions but pushing them toward automation sometimes meets resistance. And firms often lack in‑house automation architects or RPA developers.

- Governance and scale issues: A pilot bot on one process doesn’t guarantee success. Many projects stall because there’s no centralized governance or roadmap for scaling from one process to enterprise‑wide.

But despite those challenges, the pressure keeps building, customers expect instant quotes, agents want faster policy issuance, regulators demand traceability. That’s where automation in insurance workflows becomes not just nice, but essential.

Benefits of automating insurance workflows

Automation isn’t abstract. When done well, it transforms everyday insurance workflows.

1. Cost reductions of 30–45 %

Insurance BPOs report cutting costs by up to 30 % on claims, underwriting, renewals, onshore operations see even bigger savings, offshore around 15 %.

2. Speed increases by 40–50 %

Underwriting can be processed 40 % faster; claims and endorsements go through 50 % more quickly with AI‑powered submissions and OCR/NLP tools.

3. Fewer errors, stronger compliance

Bots work by strict rules, no fatigue, no typos. They flag incomplete data, enforce regulatory protocols, and generate audit trails reliably.

4. Better customer experience

Automated status updates, chatbots, instant renewals, all of this raises trust. Customers don’t want to wait, and BPOs that adopt insurance business process flow automation deliver more transparency and responsiveness.

5. Scalability without headcount

Peak load seasons, like renewals or disaster claims, can overwhelm teams. Automation lets you flex without hiring waves of temporary staff.

In short: when insurance agency workflow transforms through automation, savings, accuracy, and speed all align with experience improvements.

Getting started with insurance workflow automation

Here’s how leading BPOs and insurance firms figure out where insurance workflow automation fits in their operations:

- Audit existing insurance workflows: Map the insurance workflow, from customer onboarding to policy administration to claims, and identify repetitive, rule‑based, high‑volume steps that drag.

- Run pilot automation projects: Start with parts like policy renewal automation, document generation, claims triage. Let small bots run in parallel, validate outputs, and track improvements.

- Choose tech wisely: Choose tools that actually solve the problems you face. Combine RPA with document readers that can handle both structured forms and messy files, use rule engines to keep decisions uniform, and add advanced analytics only where it genuinely improves tasks, like sorting claims or supporting underwriting reviews.

- Create governance structures: Assign ownership, outline how changes will be managed, and have a plan for handling errors. Keeping control of all bots in one place makes updates and fixes far easier to manage.

- Measure continuously: Track before/after metrics, processing time, cost per file, error rate, customer satisfaction. Use metrics to justify budget for scaling automation.

This strategic process ensures automation isn’t merely a pilot, it becomes part of the evolving insurance business process flow framework.

Putting automation to work in insurance BPO

Here’s one example: an insurance BPO handling submissions, endorsements, claim intakes, policy servicing. They layer automation into:

- Data entry and form registration: RPA bots read inbound emails or scanned documents, extract data, and populate internal systems. No re‑keying.

- Policy issuance and renewals: After the data checks out, bots handle the creation of policy documents and renewal notices, sending them straight to agents or customers without delay.

- Claims triage and processing: Automation reads claim details, sorts them by type, checks policy terms, and flags anything suspicious for review. Once clear, approvals move forward faster.

- Underwriting support: Bots pull data from internal records and outside sources, fill in underwriting templates, and give underwriters everything they need to make decisions quickly.

- Accounts receivable workflows: Automation manages invoicing, premium reminders, reconciliation, improving cash flow and chasing overdue premiums 24×7.

Insurance BPOs act as both the hub and enabler for this automation. They own the environment, optimize processes, and deliver consistent throughput for dozens of insurer clients. And when done well, insurers gain flexibility without trading away quality.

The role of outsourcing in successful insurance automation

As powerful as automation is, it works best when partnered with world‑class insurance outsourcing. Here’s why:

- Domain expertise: A BPO deeply experienced in insurance workflows understands rules across underwriting, claims, compliance. They know where bots fail and where manual attention matters.

- Owned automation infrastructure: BPOs often build and maintain automation platforms. They manage bot licensing, environments, and updates, shielding insurers from technical complexity and vendor lock‑in.

- Scalable operations: A BPO can scale bot farm capacity during peak claims cycles or new product launches. An insurer doesn’t need to hire or train new staff.

- Compliance and data privacy: Especially when outsourcing involves cross-border operations, proper governance, encryption, and data localization are critical aspects handled by savvy insurance BPO firms.

- Innovation via AI: Many outsourcing partners now combine workflow automation with AI applications, claim fraud analytics, endorsement prediction, chatbot servicing.

If you’re interested in how those AI layers work, check out our blog on Top 5 AI use & applications in the insurance industry 2025. Integrating those AI tools into insurance agency workflow only multiplies productivity.

In other words: outsourcing plus automation equals more than a sum of parts. It becomes a high‑value engine.

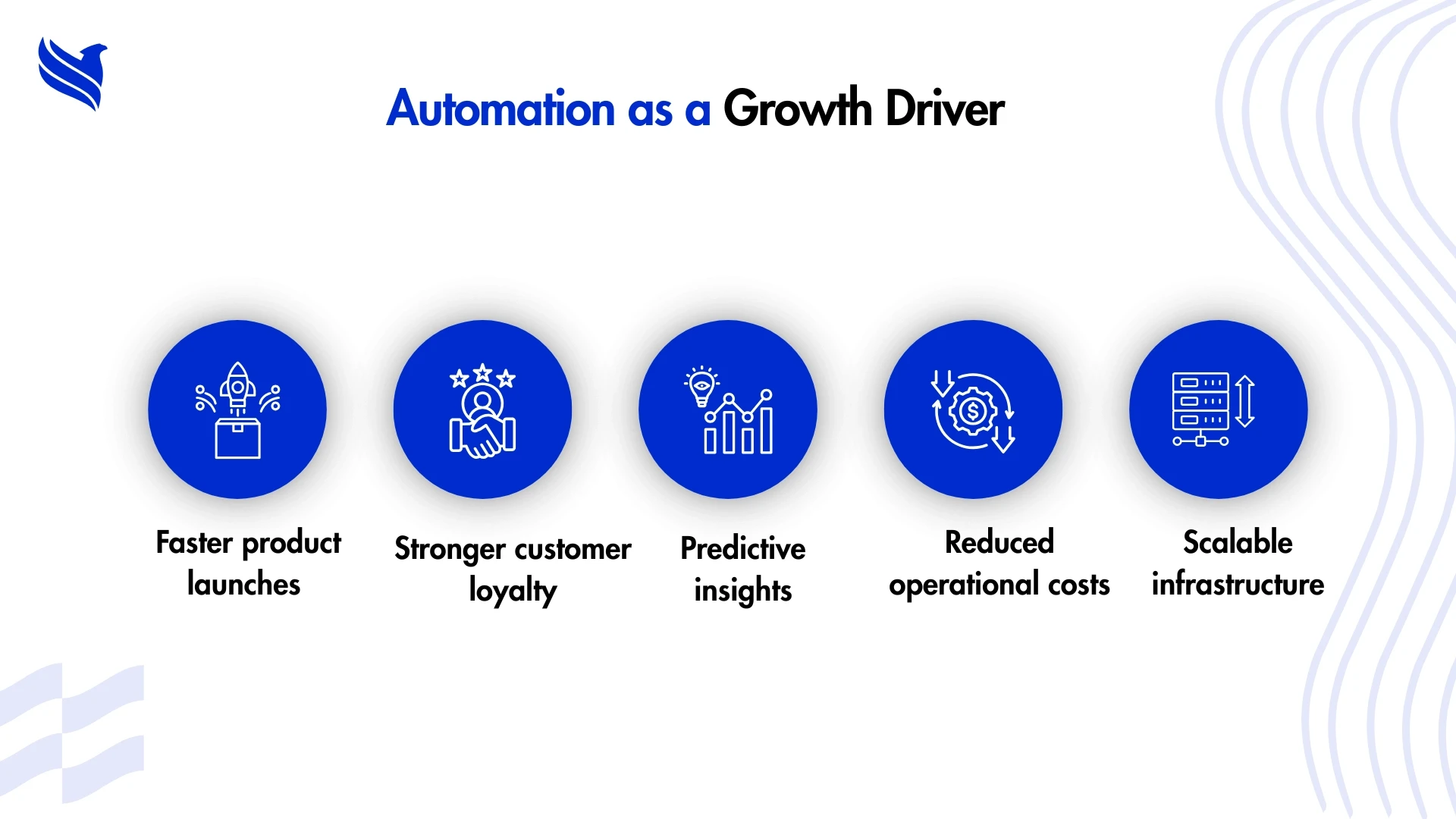

Looking ahead: Automation as a catalyst for insurance growth

More often than not, firms treat automation as back‑office cost cutting. But the real opportunity is strategic growth:

- Product innovation: With approvals and underwriting sped up, insurers can test new micro‑insurance or parametric coverage faster. Bots handling backend work free analysts to build creative products.

- Data‑driven service models: Automation platforms capture operational data: cycle times, error rates, customer interaction points. That data becomes fuel for predictive analytics and better customer journeys.

- Retention and up‑sell potential: If policy renewals and claims resolution become frictionless, customer loyalty increases. Automated triggers can suggest upsell or cross‑sell at key moments in the workflow.

- Competitive positioning: Onboarding new partners or regional insurers becomes easier when you operate with consistent workflow automation embedded in your BPO operation. Turns insurance outsourcing into a value proposition, not just cost arbitrage.

- Future‑proofing for AI and ML: Built automation footprints are the light tracks on which more advanced AI, like chatbots, loss‑run analytics, intelligent underwriting, can ride. The automation backbone prepares you for further innovation.

So, where does automation really belongs in insurance

This is the part where most blogs say “automation is unstoppable”. But real success happens when you go deeper:

Automation isn’t just an add-on in the insurance BPO workflow, it becomes part of how the entire process runs. It cuts costs, moves work faster, reduces mistakes, and gives both insurers and their BPO partners a clear view of how operations are performing.

Most importantly, done right, automation doesn’t replace humans, it powers them. Agents, underwriters and support staff are freed from mundane tasks so they can do what humans do best: judgment, empathy, customer relationships.

Looking to make automation work for your insurance workflows? Partner with FBSPL. Our expertise in insurance BPO and automation ensures your processes run faster, cleaner, and smarter, without losing the human touch that clients value most.