Insurance has never been known for moving quickly. It’s an industry that built its reputation on caution, on slow, manual checks, on layers of approval that often stalled real progress. That’s worked for decades. But the game has changed.

Today, customer expectations don’t come from the insurance industry. They’re shaped by fast apps, one-click services, and AI-backed support that runs 24/7. The insurance sector is waking up to the fact that being slow and careful now feels more like being outdated and inefficient.

So, what’s the fix? Automate Insurance Process. Real automation. Not buzzwords.

And outsourcing is quietly becoming the fast lane. More agencies are partnering with insurance BPO firms to not only handle operations but also to inject tech that automates those same processes, often faster and cheaper than building in-house.

In this blog, we’ll unpack five insurance processes that will be fully automated by 2027. We’ll also talk about why this shift is happening, what could trip it up, and what’s next after automation becomes the baseline.

From tedious to tech-driven: How automation quietly took over

"The shift that no one saw coming"

The transformation didn’t happen with flashy tech expos or big headlines. It started quietly, with bots handling basic tasks like email sorting or form validation. Now? Entire workflows are being run by systems that don’t sleep.

Automation in insurance isn’t just about saving money. It’s about surviving in a market where manual just doesn’t cut it anymore. One missed claim detail, one late renewal notice, and a customer leaves. Automation reduces that risk.

More importantly, it’s changed how agencies work. Instead of drowning in backlogs, staff are free to handle real client problems. Instead of taking days to process, claims get handled in hours.

And for agencies wondering whether automation pays off, the proof is already out. Check out how automation helps insurance agencies optimize operations and create higher efficiency, how firms that embraced automation early saw 35–50% faster turnaround across core operations.

This isn’t a maybe. This is happening.

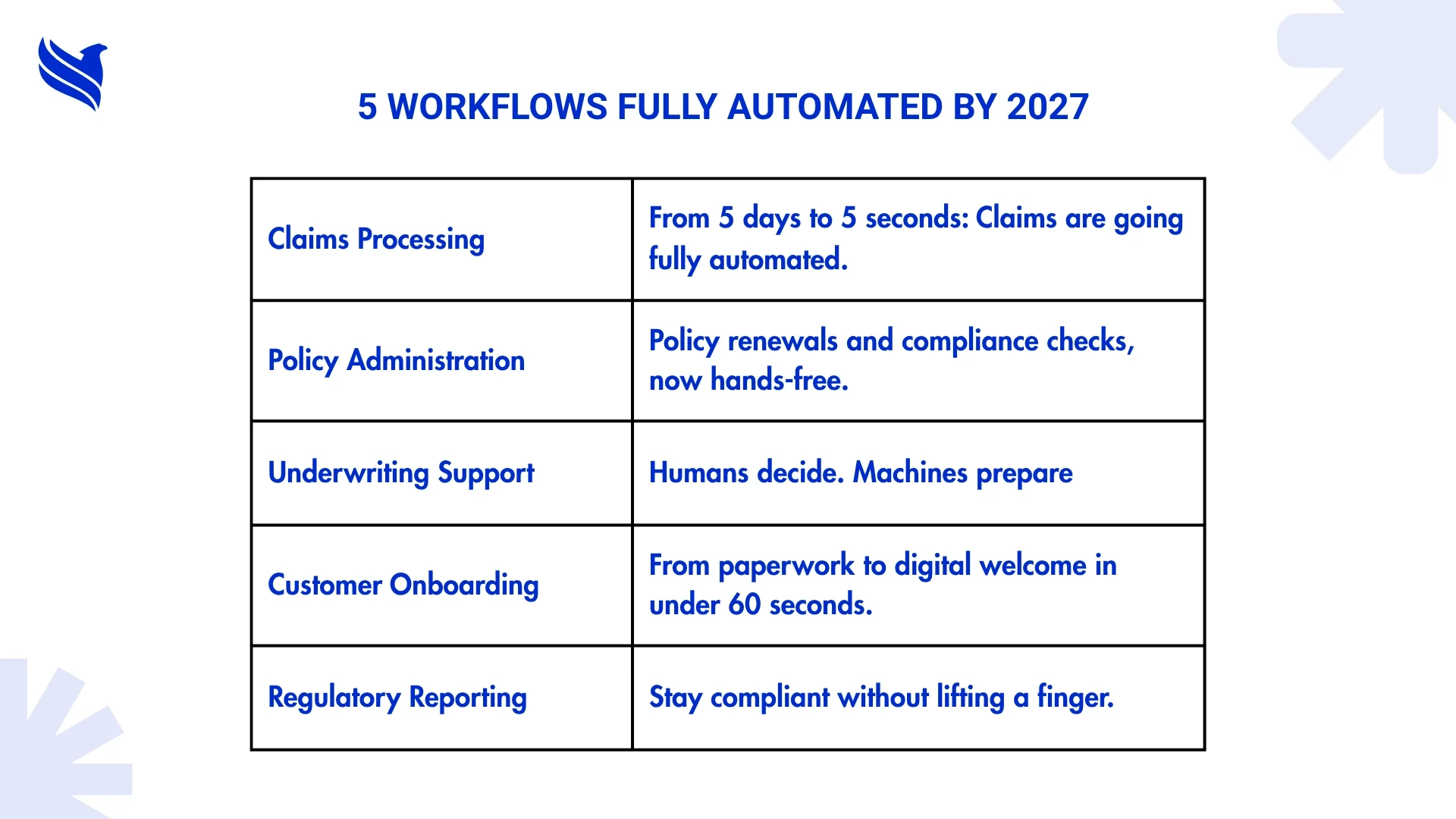

Five insurance workflows that will be full automated by 2027

Let’s skip the drama and get straight to it. These are the five processes in insurance that will be fully automated within the next two years.

1. Claims processing

This is where most of the mess lives. Manual claim checks, back-and-forth, delays, and errors. The process is bloated and brittle. But not for long.

AI-driven platforms are already scanning incoming claims, verifying documents, checking policy coverage, and approving low-risk claims in minutes.

- The old way: 5-7 business days.

- The new way: 30 minutes, max.

We’ve already seen different platforms cut claim approval to under 5 seconds. That’s not hype. That’s what happens when you let machines handle predictable tasks.

2. Policy administration

Writing, modifying, renewing, or canceling policies, this used to require full teams working across multiple systems. Now? Insurance automation handles it all.

Policy data gets pulled in automatically. Underwriting rules apply themselves. Renewals get triggered based on behavior, not reminders. Add to that automated compliance checks, and you’ve got a process that runs on its own.

You can dive deeper into this topic in our recent write-up on why automation is essential for policy management in insurance, where we explain why this shift is becoming non-negotiable.

3. Underwriting support

Underwriting is still too nuanced for complete automation (yet), but the grunt work around it? That’s almost entirely automated.

Pulling financial data, scraping risk profiles, analyzing customer history, comparing quotes; all of that is done through machine logic now.

What used to take human underwriter hours can now be prepped by a system in under ten minutes. Humans still call the shots, but they’re no longer buried under data.

4. Customer onboarding

If you’ve ever been through a manual onboarding process, you know how painful it is. Forms. Follow-ups. Uploads. Errors.

Now? Customers upload their ID. OCR tech grabs the data. API systems verify it in seconds. Contracts are generated and signed electronically.

Chatbots handle FAQs. Backend automation takes care of account creation. By 2027, onboarding will be completely hands-off, unless the customer wants human help.

5. Regulatory reporting

It’s boring, but it’s critical.

Regulatory filings are tedious, error-prone, and time-consuming. But that’s exactly what automation is built for. Systems now track activities, log audits, generate reports, and send alerts when compliance rules change.

By automating this function, insurance companies not only save time, they avoid hefty fines from compliance slip-ups.

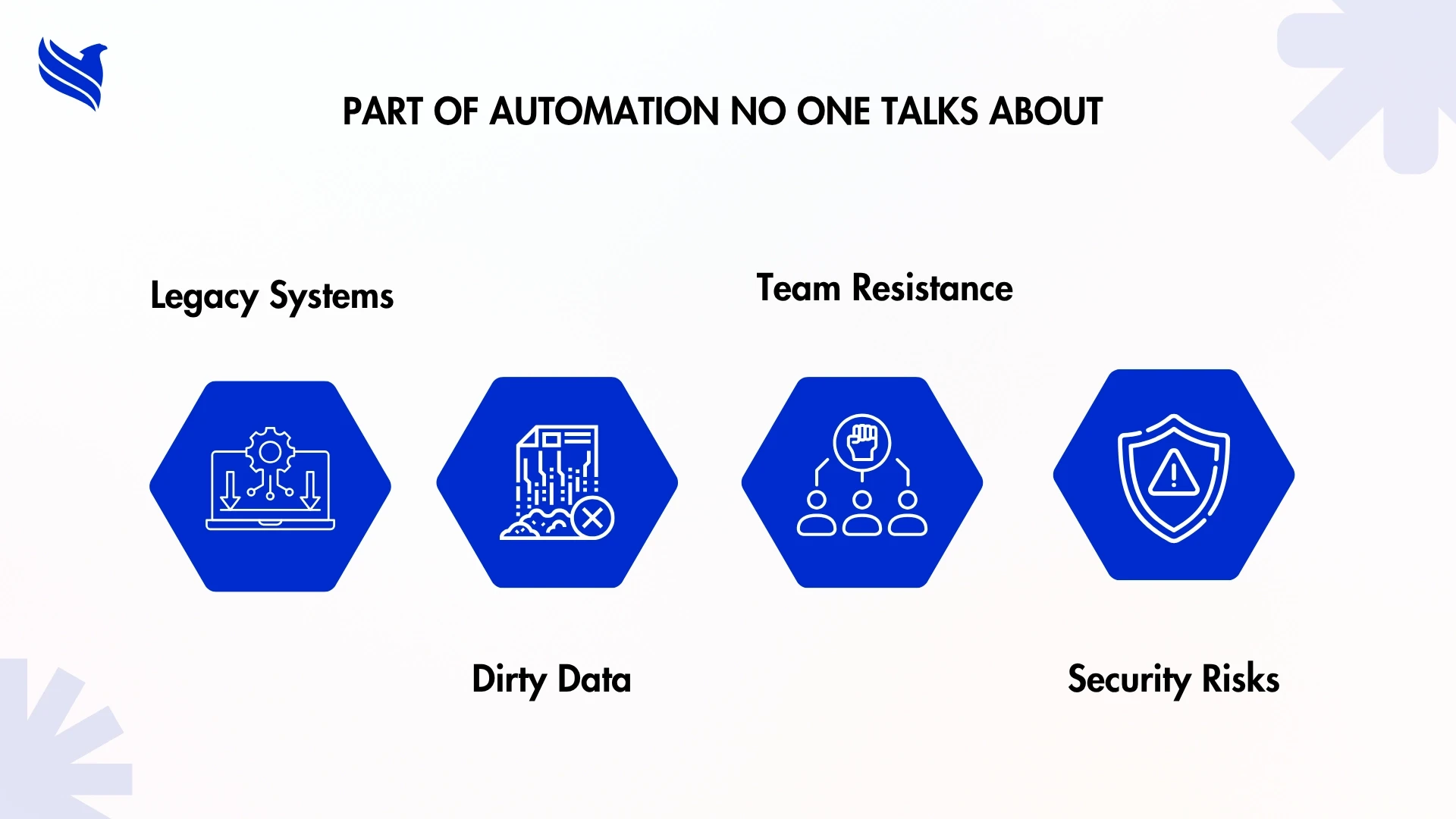

Why full automation isn’t a cakewalk

Here’s the part most guides skip over; what could actually go wrong.

Yes, automation is powerful. Yes, it’s changing the way insurance runs. But no, it doesn’t work like flipping on a light switch. Here’s where most agencies stumble:

1. Outdated core systems

A lot of insurers still rely on tech built back when floppy disks were a thing. These legacy systems don’t mesh well with today’s automation tools, and forcing them to talk to each other? It’s messy, expensive, and usually unreliable.

2. Dirty data

Automation is only as good as the data it works with. If your customer information is outdated, misfiled, or riddled with duplicates, you’ll automate a bad process faster, nothing more.

3. Internal resistance

Even the best automation plan fails if your team isn’t on board. Some fear being replaced. Others don’t trust the tools. Without clear communication and training, expect delays, errors, and frustration.

4. Security blind spots

Every time you hook up a new system or bring in a third-party tool, you're creating a doorway, sometimes without realizing it. And if your cybersecurity game isn’t strong, automation can quietly leave those doors wide open. Not intentionally, but wide open all the same.

The good news? These challenges aren’t deal-breakers. But they do need clear thinking, a flexible team, and often, someone who's been through the fire already and knows where the snags are.

After 2027: What’s the industry going to look like?

Here’s the truth: once the machines take over the grunt work, the role of insurance professionals changes.

Imagine an agency that doesn’t just respond to events; it anticipates them. Instead of reacting to a flood claim, the system alerts you the second there's a weather alert in a high-risk zone. It pulls policy data, checks coverage, and queues up proactive communication to those clients. All before the first call comes in.

This isn’t fantasy; it’s where intelligent automation becomes the future of insurance. Smarter systems, not just faster ones.

Smaller agencies won’t be left behind either. Thanks to insurance outsourcing services, you don’t need a Silicon Valley budget to get intelligent systems. You need the right partner, someone who knows the workflows, the bottlenecks, and the automation tools that make it all click.

FBSPL helps agencies build this future, not by replacing people, but by empowering them to do more with less friction.

The tools are ready. Are you?

If you’ve made it this far, you already know what’s coming. The question is: do you wait for the shift to catch up with you, or do you make the shift on your own terms?

Start by identifying the workflows draining the most time. Claims. Renewals. Data entry. They’re probably already on your mind. Then, talk to someone who’s built automation into those exact areas.

That’s where FBSPL comes in. We help insurance teams offload the heavy stuff, automate where it matters, and bring operations into the now.

Don’t wait for 2027 to decide for you. Build smarter insurance workflows with FBSPL. Call today.