Quick summary: This blog walks through how financial management and solid reporting bring clarity to accounting. It looks at where companies slip up, how AI fits in, and why outsourcing certain tasks can save time and protect accuracy. Whether it’s a startup or a mature business, the goal is the same: fewer surprises and better control over every financial move.

From messy spreadsheets to meaningful insights, discover how financial reporting and management can simplify, strengthen, and future-proof your accounting.

Can a business really grow if its own numbers don’t make sense? For many companies, the struggle isn’t about earning money, it’s about understanding where it’s coming from and where it’s going. Sometimes, the reports are late, the accounts don’t match, or too many spreadsheets tell different stories. When that happens, it’s hard to see what’s truly driving profit or loss.

That’s where financial reporting and financial management accounting step in. To understand the importance of financial reporting, one must acknowledge that it is not just about bookkeeping; it brings structure to financial chaos. When data is clean and timely, leaders can plan smarter and act faster. And with new tools like AI in financial reporting and the option to outsource accounting & bookkeeping, even smaller businesses can enjoy the clarity big enterprises have.

In this blog, let’s look at how good reporting and management practices can make accounting simpler, faster, and far more accurate.

Common financial reporting challenges

Behind every balance sheet or profit and loss statement, there’s a team trying to piece together data from emails, systems, and files. And that’s where things start to get messy.

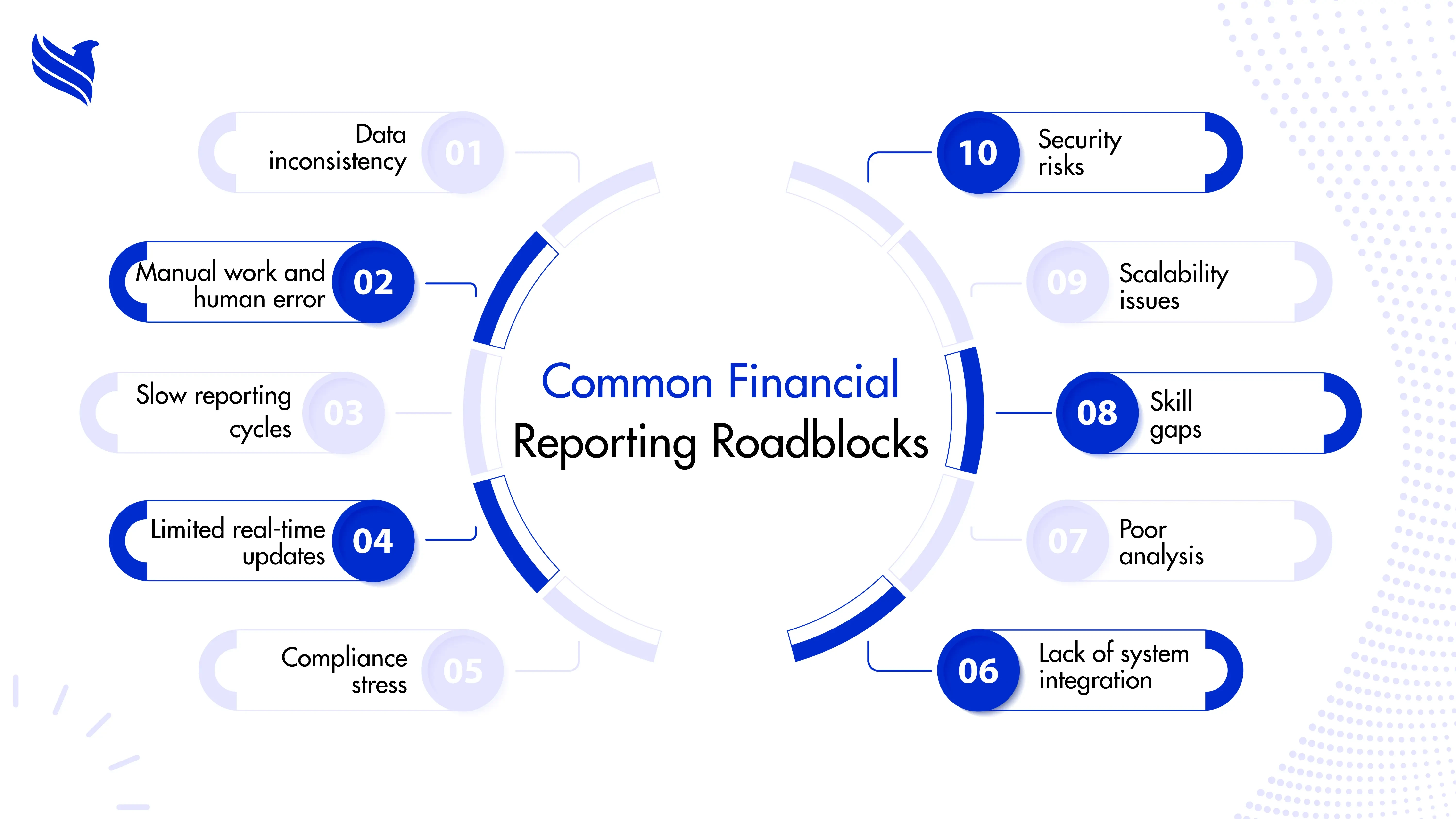

Here are some common financial reporting challenges most businesses face today:

- Data inconsistency: Different departments often use different tools. When numbers don’t align, reconciling them takes hours.

- Manual work and human error: Spreadsheets may look simple but are prone to mistakes. One wrong formula or missing entry can throw off an entire report.

- Slow reporting cycles: Compiling and checking data by hand causes delays. By the time the report is ready, decisions may already be outdated.

- Limited real-time updates: Many companies only see what happened last quarter, not what’s happening now. That delay makes quick responses nearly impossible.

- Compliance stress: Accounting standards and tax rules change constantly. Without automation or expert help, staying compliant becomes a full-time job.

- Lack of system integration: When financial data isn’t connected to sales, HR, or inventory systems, reports tell only half the story.

- Poor analysis: Some reports only show totals, not insights. Without clear financial statement analysis, leaders miss early signs of risk.

- Skill gaps: Not every business has a CFO or trained analyst to interpret numbers correctly.

- Scalability issues: As companies grow, manual processes can’t keep up. Outsourced accounting & bookkeeping helps solve this by adding flexibility.

- Security risks: Spreadsheets stored on shared drives or emailed back and forth are not always safe. Financial data deserves tighter protection.

These issues don’t just slow down the finance team; they limit how fast a business can move. Fixing them starts with better financial management reporting and a clear, connected system.

Why strong financial reporting changes everything

When reporting is done right, numbers stop being a burden and start becoming a guide. Financial management isn’t only about balancing books; it’s about understanding performance and using that knowledge to grow.

Accurate financial statement analysis helps spot which areas bring the most return and where money leaks out. You can see what’s really driving profit, or what’s quietly dragging it down.

A smart accounting and business management setup gives teams a single source of truth. Reports pull automatically from integrated systems, saving hours of manual work. The difference is huge: fewer errors, faster insights, and cleaner data.

It also creates transparency. When every department can see the same numbers, decisions happen faster. Executives don’t need to wait for end-of-month reports; they already have what they need.

Companies that outsource accounting & bookkeeping often find it even easier. Outsourcing partners maintain compliance, manage reporting, and use the latest technology so internal teams can focus on planning, not paperwork.

In short, proper financial management reporting replaces confusion with confidence.

How AI improves financial reporting

Artificial intelligence is changing how accounting teams work. With AI in financial reporting, tasks that once took hours now take minutes, and with fewer mistakes.

AI tools can scan invoices, match transactions, and generate financial statements automatically. They also learn patterns over time, meaning they get smarter with each cycle. A late payment, an unusual expense, or a sudden spike in cost; all can be flagged instantly.

Forecasting is another big plus. AI models can study historical data and predict cash flow, helping finance heads prepare before problems hit. Imagine having a system that can show you next month’s profit forecast or identify a dip before it happens; that’s what AI now enables.

For a growing business, this kind of speed and accuracy can make all the difference. Real-time balance sheets and profit and loss statements mean leaders don’t have to guess; they can see.

Still, technology works best when guided by experts. AI can crunch numbers, but human accountants give them meaning. That’s why many companies blend automation with professional support to get the best of both worlds.

Choosing the right outsourcing partner

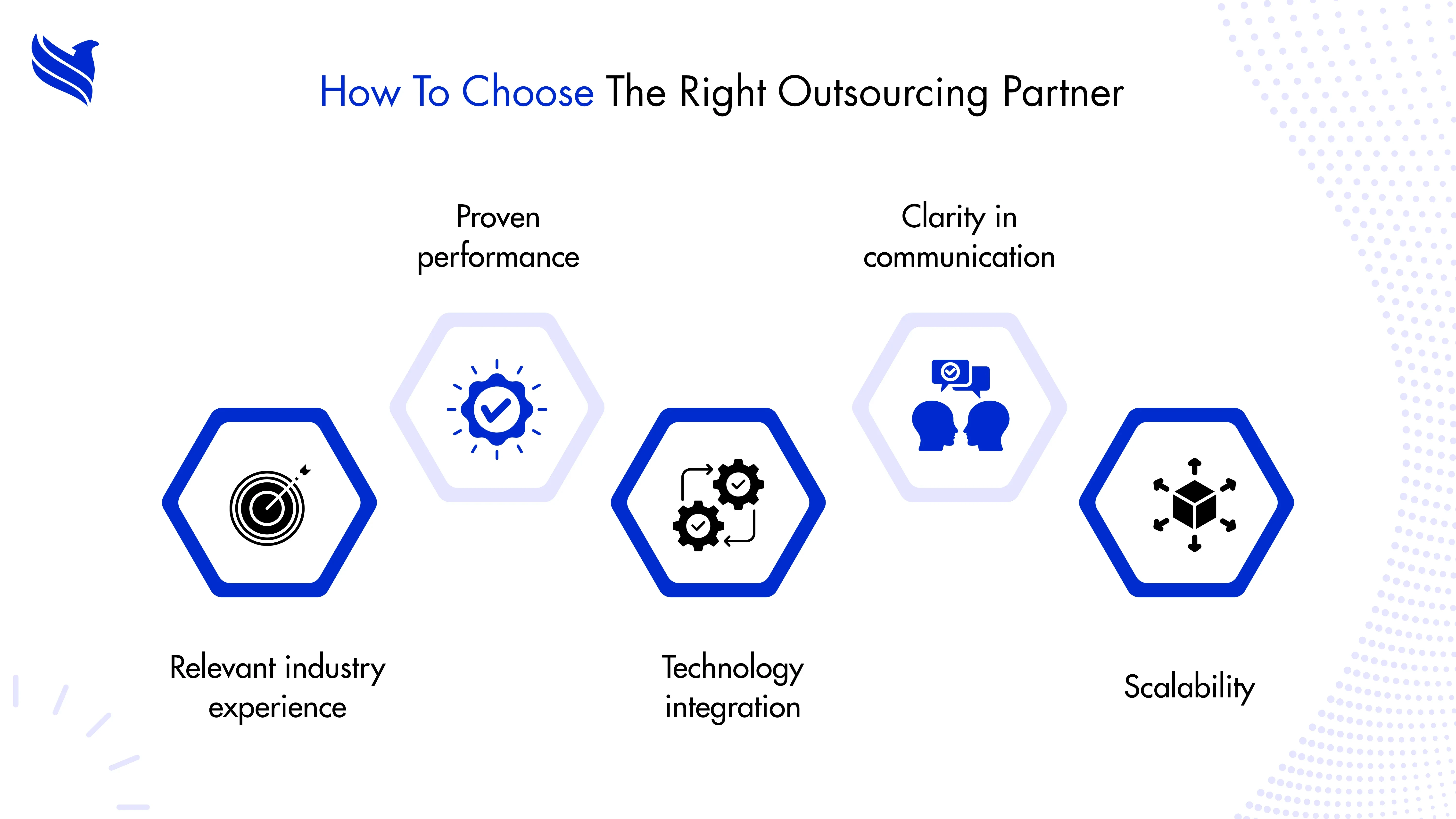

Outsourcing isn’t only about saving money, it’s about finding a partner who understands how your business runs day to day. The right fit can make reporting smoother, data cleaner, and decision-making faster. The wrong one can make things messier than before.

Here’s what to keep an eye on:

Experience that matches your world

Work with people who already know your industry. If they understand your compliance rules, reporting cycles, and the way your teams operate, the learning curve disappears fast.

Proof that they deliver

Ask for real examples, shorter closing times, fewer reporting errors, and reduced overhead. Numbers tell you if they can actually do what they promise.

Easy tech integration

Good partners don’t ask you to rebuild everything. Their systems should plug into yours smoothly, making automation an upgrade, not a headache.

Clear communication

You don’t need more jargon. The best teams explain things simply, what changed, why it matters, and what to do next.

Room to grow

As your company scales, your partner should too. Flexible support, on-demand capacity, and new tools when needed; that’s what long-term partnership looks like.

A skilled outsourcing team blends human know-how with the precision of AI-based accounting. It’s not just about technology; it’s about trust, consistency, and freeing your business from the small stuff so you can focus on the big picture.

Finding the right mix of tech and human thinking

Technology has changed how finance works, but it hasn’t replaced human sense. Automation can tidy up data, crunch numbers, and spot errors in seconds, yet it still can’t understand why something happened. That’s where people come in.

AI handles the numbers; people make sense of them. The real magic happens when both sides meet in the middle. Machines are great at speed and accuracy, but only humans can see the bigger picture, how those numbers connect to timing, goals, and the company’s direction.

When that balance clicks, finance stops feeling like maintenance work. Teams spend less time cleaning up spreadsheets and more time asking the questions that actually drive growth. Reports stop being just pages of figures and start becoming real insight.

For business owners and CFOs, this kind of clarity changes everything. Decisions like hiring, expanding, or investing don’t feel like leaps of faith anymore, they turn into confident, well-informed moves that push the business forward.

Making numbers matter: Turning reports into action

Financial reports aren’t just records; they’re maps. Every balance sheet shows where the company stands; every profit and loss statement shows how far it’s come. When managed well, they stop being files for auditors and start becoming guides for growth.

The key is to make data work for you, not the other way around. Organized reporting, a bit of automation, and sometimes an outsourced expert can change the whole picture. Instead of chasing down figures, teams begin to understand them, and act on them.

That’s the real shift: moving from “What did we do last quarter?” to “What should we do next?”

For small business owners and CFOs, this isn’t just about adopting tools. It’s about changing how decisions are made, with current data, clear insight, and the confidence to move forward faster.

Empower your accounting with FBSPL

If your company wants better control over its finances, FBSPL can help. With nearly two decades of experience in financial management, automation, and process optimization, FBSPL supports over 550 clients worldwide.

From financial management reporting and financial statement analysis to AI-powered bookkeeping and compliance support, FBSPL helps businesses make sense of their data, so leaders can focus on growth, not guesswork.

Ready to turn your financial data into your biggest advantage?

Reach out to FBSPL and start building a smarter, more efficient future for your business.