Quick Summary: This blog explores why, in 2026, more small businesses are turning to finance and accounting outsourcing to work smarter and stay compliant. It highlights real challenges owners face, the best ways to manage them, and how the right outsourcing partner can simplify bookkeeping, reporting, and everyday financial decisions.

Discover how finance and accounting outsourcing in 2026 helps small businesses save time, cut errors, and make smarter financial decisions.

Ever wonder where all the time goes in a small business day?

You start with plans to focus on customers, growth, maybe a new idea, and then suddenly, you’re knee-deep in receipts, invoices, or that never-ending spreadsheet you promised to fix last week. It’s not that owners don’t want control; it’s just that the “numbers part” quietly eats away at hours meant for everything else.

By 2026, keeping up with financial accounting for small businesses has turned into a full-time job in itself. New tax updates drop every few months; reporting formats keep changing, and software tools multiply faster than you can learn them. What used to feel manageable now feels like a maze of tasks waiting to trip you up.

That’s where many small business owners are changing course. Instead of trying to do everything in-house, they’re choosing finance and accounting outsourcing services, letting professionals take over the heavy, repetitive work like bookkeeping, payroll, and financial reporting. The idea isn’t to give up control; it’s to finally have time to think, plan, and move forward with cleaner numbers and fewer surprises.

This blog looks at what outsourcing really means in 2026, the problems it quietly solves, and how small business owners can use it to save time, cut down mistakes, and make clearer financial decisions every day.

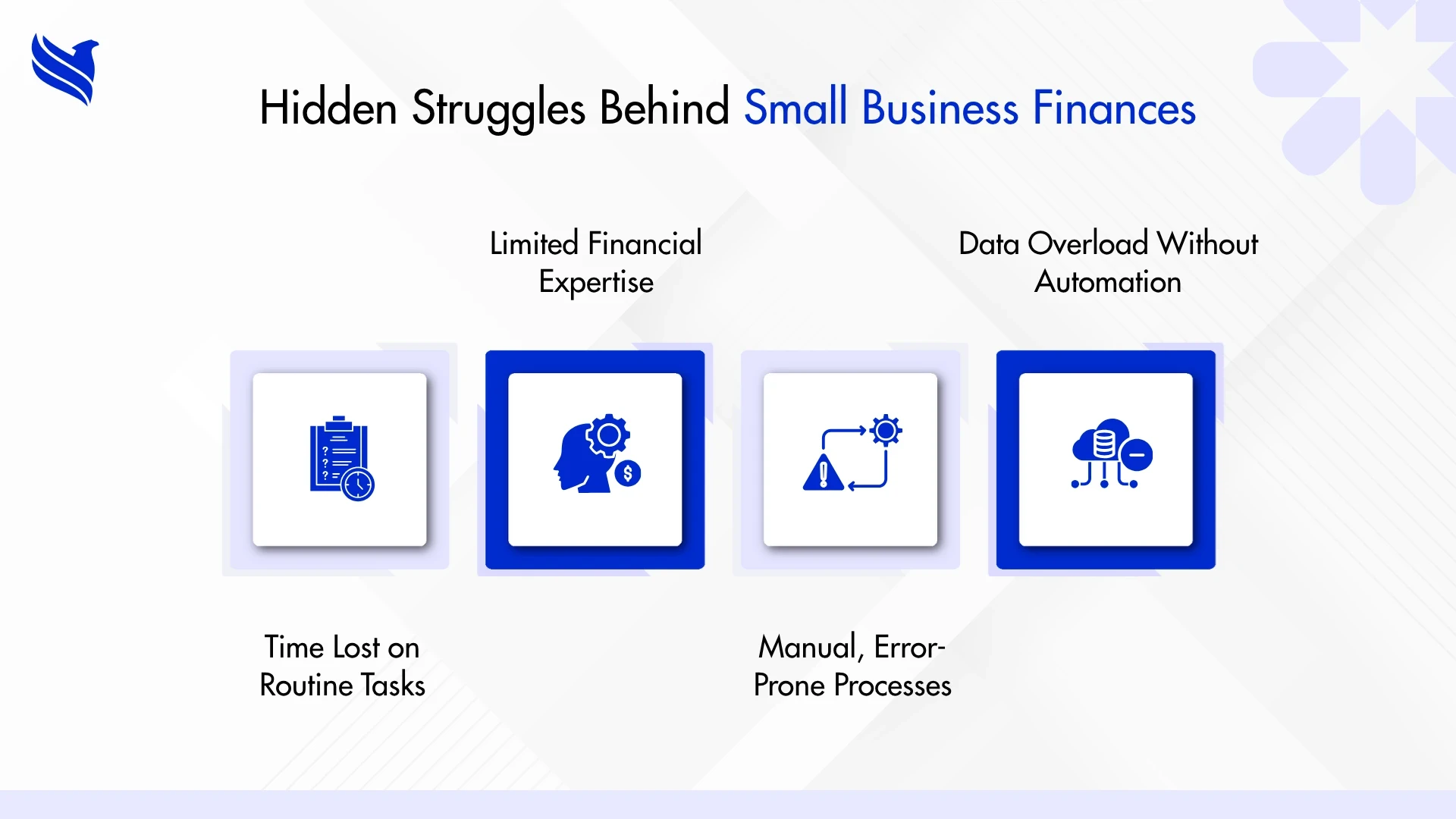

Challenges small businesses face

Keeping financial tasks inside the company often sounds ideal. But for many small businesses, it turns into a silent struggle. One error in a ledger or a missed tax deadline can trigger a domino effect of confusion.

- Too much time spent on the wrong work. Owners spend evenings sorting invoices or fixing entries instead of chasing growth opportunities.

- Skill limitations. Smaller teams may not have someone who understands tax codes, payroll systems, or digital accounting tools.

- Outdated manual work. Reliance on paper trails or spreadsheets means slower reporting and more mistakes.

- Data overload. As every payment and bill becomes digital, managing it all without automation is exhausting.

The financial side of small business ownership has turned into a full-time job on its own. Without expert help or automation, these tasks keep pulling focus away from what owners do best, i.e. running the business.

Best practices for outsourcing finance and accounting

Outsourcing doesn’t mean letting go; it means teaming up. When done right, outsourced accounting & bookkeeping becomes a support system that keeps things organized and reliable.

Here’s what makes the difference:

- Set clear outcomes. Know why you’re outsourcing. Maybe you want better accuracy, faster reports, or stress-free tax filing. Clear goals help the provider serve you better.

- Pick the right partner. Choose someone who understands small business accounting practices, not just big corporate setups. Experience with small teams makes communication smoother.

- Keep transparency open. Regular updates and shared dashboards help owners see every number whenever they want.

- Use the tech they recommend. Modern finance and accounting outsourcing services rely on smart tools and automation that remove human error and speed up tasks.

- Review regularly. Monthly or quarterly check-ins prevent small problems from snowballing.

The best outsourcing partnerships feel less like hiring a vendor and more like adding another member to your team, one who happens to be really good with numbers.

Tangible benefits of financial outsourcing

Many business owners start outsourcing to save time. But they stay because of how much smoother everything runs afterward.

- Accuracy improves. Automated checks and professional oversight mean fewer mistakes and more dependable numbers.

- Reports arrive faster. Real-time systems and structured workflows let you see financial performance whenever you need it.

- Costs go down. There’s no need to pay full-time staff or buy expensive software licenses.

- Flexibility grows. As your business scales, your outsourced team adjusts to match the workload.

- Insights get sharper. With AI in financial operations, data turns into useful predictions, like when cash flow might tighten or which products are most profitable.

The true benefits of financial reporting come from visibility. When reports are accurate and timely, business owners stop guessing and start deciding.

Tools powering modern outsourced finance

In 2026, finance isn’t about filing cabinets or ledgers; it’s mostly digital. Outsourced firms now use a mix of automation, analytics, and AI tools that make accounting simpler and faster.

- Cloud Accounting Platforms like QuickBooks Online, Zoho Books, or Xero keep records synced and accessible anywhere.

- AI-Based Reconciliation Tools automatically match transactions, catching mismatches instantly.

- OCR Technology helps scan and store receipts without manual entry.

- Predictive Dashboards show cash flow trends and financial health at a glance.

- Cybersecurity Systems protect all financial data with strong encryption and constant monitoring.

AI in financial operations isn’t just about speed, it’s about clarity. These tools remove repetitive work and help business owners see the story behind their numbers.

Common bookkeeping mistakes to avoid

Even with outsourcing, financial carelessness can creep in. Many small firms fall into similar traps, which can easily be avoided with a bit of attention.

- Mixing personal and business money. This makes bookkeeping confusing and complicates taxes.

- Waiting too long for reconciliation. The longer it’s delayed, the harder it gets to fix.

- Skipping data backups. Losing financial data can mean weeks of recovery work.

- Mislabeling expenses. A wrong category might distort profit reports or cause tax issues.

- Not communicating changes. If you switch banks or add a new service, your outsourcing partner needs to know immediately.

Avoiding such bookkeeping mistakes keeps your records clean and prevents small accounting issues from turning into larger operational setbacks.

Why more businesses are outsourcing accounting

So, why are so many small companies making the move? The short answer, control and clarity.

Why more businesses are outsourcing accounting comes down to three things:

- Access to skilled experts. Instead of hiring full-time accountants, small businesses can tap into a pool of professionals who understand taxation, compliance, and analytics.

- Smarter automation. Advanced outsourced accounting & bookkeeping systems detect errors early and handle routine work faster than any manual method.

- Data that drives decisions. With automation and analysis, finance and accounting outsourcing helps owners see their business in real numbers, not guesswork.

When asked, “What makes your outsourced accounting services ideal for small businesses?”, the best firms say it’s adaptability. They fit into the client’s systems, not the other way around. In 2026, outsourcing isn’t about cutting costs; it’s about gaining a financial partner who helps you plan with confidence.

Conclusion: The future of small business finance

For small business owners, outsourcing finance is no longer just an option; it’s a smarter way to operate. The workload that once slowed teams down is now handled by experts who bring technology, precision, and insight to every transaction.

As companies move forward, success will depend on blending small business accounting practices with modern automation tools. Those who stay ahead will avoid common bookkeeping mistakes, enjoy the benefits of financial reporting, and use data as a guide for growth.

The real win is time, more time to innovate, connect with customers, and make decisions that matter.

If your business is ready to outsource finance & accounting and gain reliable financial clarity, connect with FBSPL, where expertise and smart technology come together to make your numbers work for you.