Summary: Insurance companies are leaning on Insurance BPO services to keep up with daily processing work, avoid delays, and reduce small errors that slow everything down. With AI helping behind the scenes, teams get more breathing room to focus on clients and business growth.

See how insurance companies reduce workload, improve accuracy, and scale operations smoothly using Insurance BPO services combined with practical AI support.

What happens when insurance operations grow faster than the teams managing them?

Across the industry, insurers are writing more business, handling more renewals, and responding to more client requests than ever before. But behind that growth sits a quieter challenge; the day-to-day operational load is getting heavier. Policy reviews take longer, proposal preparation piles up, and intake errors slow everything down before the real work even begins.

This is why discussions around Insurance BPO services and Insurance outsourcing services are no longer just about saving money. They’re about keeping operations stable while business expands. Many insurance leaders are realizing that if their internal experts continue spending most of their time on repetitive processing tasks, service speed, accuracy, and growth will eventually suffer.

The shift toward Insurance business process outsourcing is happening because insurers want smoother workflows, faster turnaround, and more room for their teams to focus on advising clients and building relationships; not chasing paperwork.

What insurance BPO really means today

Insurance BPO is no longer just about delegating clerical tasks. Today, Insurance operations outsourcing is about building an operational engine that supports growth without increasing internal complexity.

At its core, Insurance back-office outsourcing covers essential yet time-intensive tasks such as:

- Policy administration support

- Endorsement processing

- Proposal comparison and formatting

- Data entry and system updates

- Documentation checks and compliance reviews

- Client onboarding and information collection

These are crucial functions; but they don’t necessarily require in-house strategic expertise. By partnering with a specialized Insurance BPO service provider, companies gain access to trained professionals, standardized workflows, and scalable capacity without expanding internal teams.

The biggest shift? Outsourcing is no longer just manual support. Modern outsourcing services for insurance companies now combine domain expertise with technology and automation. That blend is what makes the model powerful.

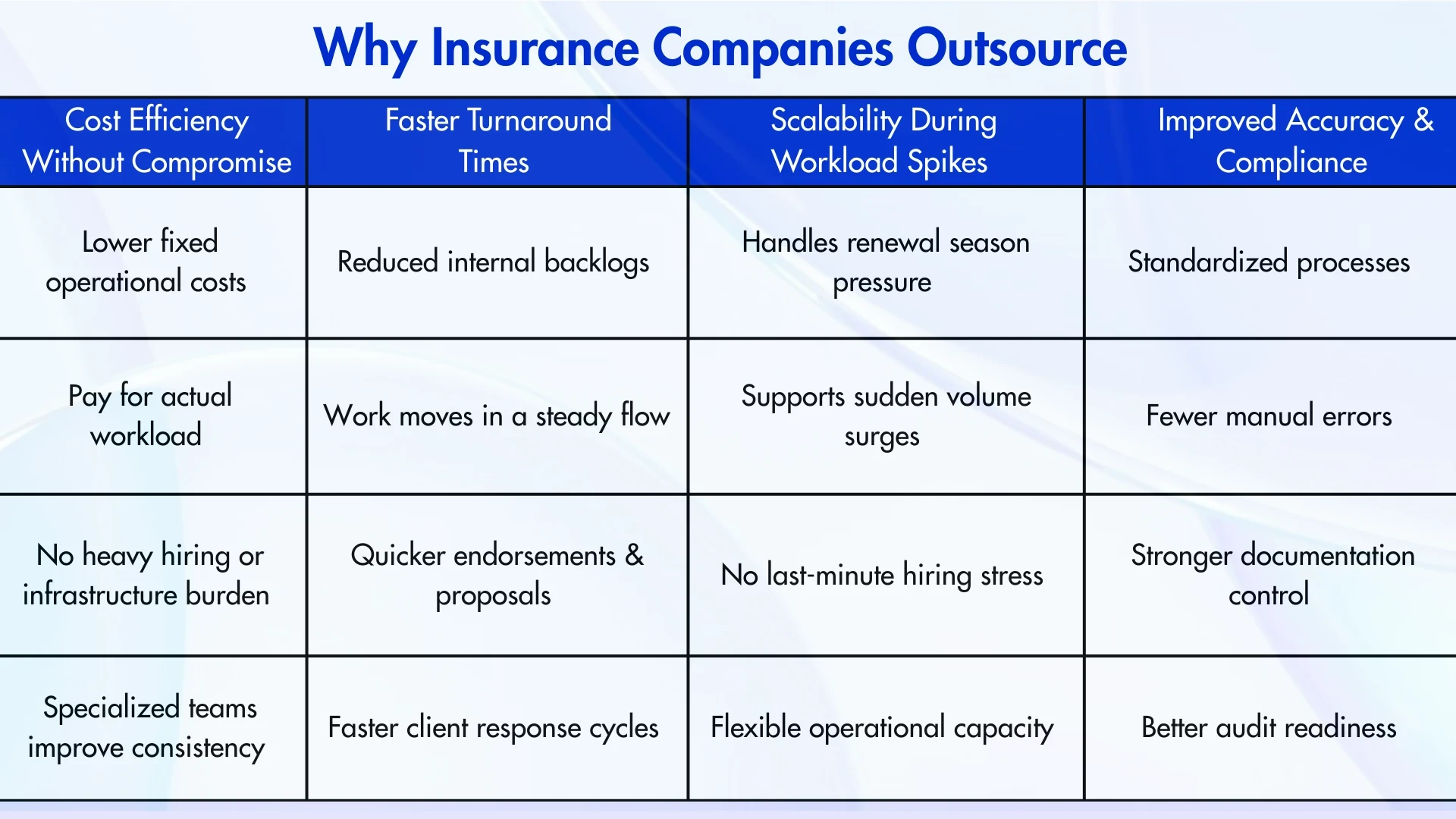

Why insurance companies outsource: The real business drivers

When discussing ‘Why insurance companies outsource’, the answer goes beyond “cost savings.” Yes, financial efficiency is important, but the deeper value lies in performance improvement.

1. Cost efficiency without capability loss

Building and running a big in-house operations team costs more than it first appears. There are salaries, training hours, software licenses, and the day-to-day overhead that never really goes away. Outsourcing changes that setup. Instead of carrying fixed costs all year, spending becomes tied to the amount of work that actually needs to be handled.

Quality doesn’t drop just because work moves outside. In many cases, it improves. Teams who work only on insurance tasks every day get used to the details, the documents, and the pace. That focus shows in the output.

2. Faster turnaround times

When tasks sit in internal queues, they often wait behind other priorities. That’s when endorsements slow down, proposals get delayed, and simple updates take longer than they should.

With a dedicated processing setup, work keeps moving. Files are picked up, handled, and passed along without the usual stop-start rhythm. That steady flow helps reduce bottlenecks and keeps timelines predictable. When turnaround improves, clients feel it too; they get answers faster and decisions don’t drag on.

3. Scalability during workload spikes

Insurance work comes in waves. Renewal seasons hit hard. Large submissions land all at once. Unexpected events can double the workload overnight. Internal teams can only stretch so far before quality or speed starts to slip.

Having outside support makes those busy stretches easier to manage. Extra hands can step in when volumes climb and scale back when things return to normal. There’s no scramble to hire short-term staff or push teams into constant overtime.

4. Improved accuracy and compliance

Repetitive work done under pressure is where mistakes tend to happen. A missed detail here or a wrong entry there can cause bigger issues later, especially in a regulated industry.

Consistent processes and routine checks help catch those slips early. When the work follows the same structure each time, it’s easier to see when something looks off. That makes records cleaner and compliance reviews far less stressful when they come around.

These are the core benefits of insurance BPO services; efficiency, scalability, accuracy, and focus.

How AI is transforming insurance BPO

While outsourcing alone improves operations, the real transformation is happening where AI meets insurance BPO. Repetitive, document-heavy insurance workflows are ideal candidates for intelligent automation.

Forward-thinking insurers are now combining insurance back-office outsourcing with AI-driven tools that reduce manual work even further. This means fewer delays, more consistency, and dramatically improved productivity.

FBSPL has taken this a step further by introducing AI-powered solutions designed specifically for insurance workflows; tools that enhance both in-house teams and outsourced operations.

Here’s a look at how these innovations are changing the game:

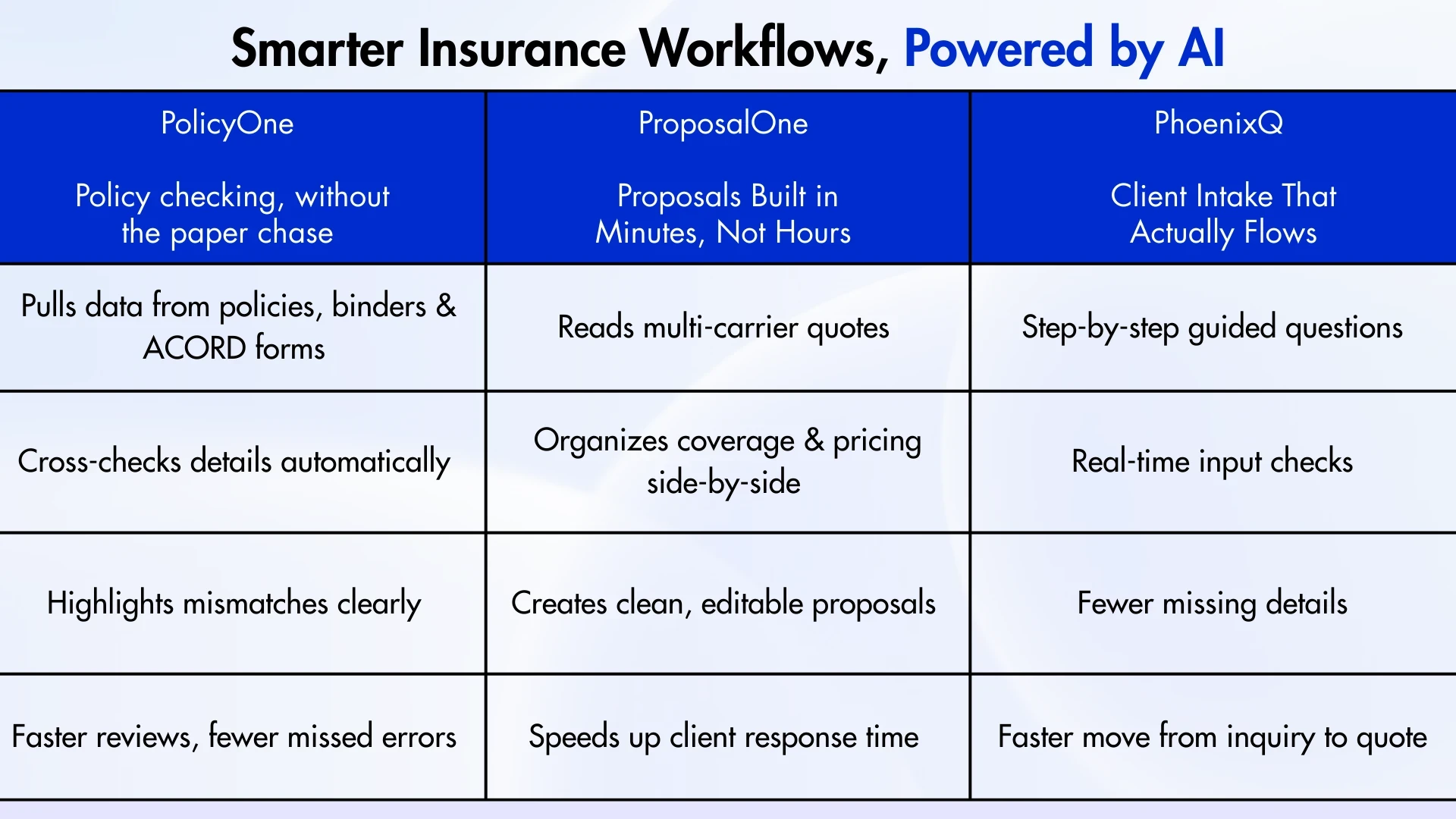

1. PolicyOne – Policy checking & documentation support

Anyone who’s reviewed policies manually knows how easy it is to get buried in details. You flip between documents, double-check numbers, scan endorsements, and still worry you might’ve missed something. It takes time, and it takes focus.

PolicyOne eases that pressure. It pulls important details from binders, ACORD forms, quotes, and prior policies, then checks them against each other and against what’s already in the system. Instead of hunting through pages, teams get a straightforward report that shows what lines up and what needs attention.

What that changes in daily work:

- Reviews move faster without feeling rushed

- Checks stay consistent, no matter who handles the file

- Small mismatches get caught before they turn into bigger issues

Less time spent searching. More time spent solving.

2. ProposalOne – Proposal creation made easier

Building proposals from multiple carrier quotes can feel repetitive. Copy this coverage here, paste that premium there, adjust formatting, check again. It’s necessary work, but it eats into the time agents could be spending with clients.

ProposalOne helps streamline that routine. It reads quote documents, gathers the main details, and puts together a clean, organized proposal draft. Teams can still adjust wording or add notes, but they don’t have to start from a blank page each time.

Day to day, that means:

- Fewer manual comparison steps

- More consistent proposal layouts

- Quicker turnaround when clients are waiting

The energy goes back into conversations and recommendations, not document assembly.

3. PhoenixQ – A smoother way to collect client information

Traditional forms can be a stumbling block. Clients skip questions, misunderstand what’s needed, or stop halfway through because it feels like too much at once. Then the team has to circle back to fill the gaps.

PhoenixQ takes a different approach. It guides people through questions one step at a time, offers help when something isn’t clear, and checks details as they’re entered. Once finished, the information is already where it needs to be.

The difference shows up quickly:

- More complete submissions from the start

- Less follow-up to correct or clarify details

- Faster movement from inquiry to quoting

It makes the first step easier for clients and lighter for the team.

Organizations exploring these tools may also find opportunities to experience their impact through a limited one-month pilot access designed to demonstrate how AI can enhance day-to-day insurance operations.

Together, these tools represent the next evolution of insurance operations outsourcing; where AI handles repetition, BPO teams manage processes, and internal staff focus on strategy.

The competitive advantage of modern insurance outsourcing

The combination of Insurance outsourcing services and AI-powered automation creates a powerful operational model:

- Faster policy issuance improves customer experience

- Cleaner intake data reduces rework and delays

- Standardized proposals improve sales consistency

- Scalable support allows growth without operational chaos

Insurance companies that adopt this hybrid model are not just cutting costs; they are building operations that are faster, smarter, and more resilient.

This is why insurance BPO services are no longer viewed as temporary support but as a long-term operational strategy. The right insurance BPO service provider brings process expertise, technology integration, and workflow optimization together under one umbrella.

The future of insurance operations is smarter, not larger

Insurance operations are not getting simpler. Documentation requirements are increasing; clients expect quicker service, and competition demands efficiency at every step. Trying to manage all of this with traditional, fully in-house processing is becoming harder to sustain.

This is where modern insurance BPO services are making a difference. By combining process expertise with intelligent automation, insurers can reduce operational strain, improve accuracy, and respond faster without constantly expanding internal teams.

FBSPL is helping insurance organizations move in this direction by bringing together deep insurance process knowledge and purpose-built AI tools that streamline policy checking, proposal creation, and client intake. The goal isn’t just to process work faster; it’s to create breathing room for insurance professionals to focus on service, strategy, and growth.

Smarter operations don’t come from doing more work; they come from doing the right work in the right way.