Summary: Insurance teams spend too much time on repetitive work. This blog explains what operations look like before and after automation, how common bottlenecks are reduced, and why better workflows help teams spend less time fixing issues and more time handling real business priorities.

- Before automation: When manual insurance processes control the day

- After automation: What changes when repetition disappears

- Intelligent policy review: From hours of reading to minutes of insight

- Smarter intake: Fixing errors before they enter the system

- From manual proposals to instant, client-ready presentations

- The bigger picture: Where FBSPL is taking insurance automation next

- What happens next: When insurance work starts working for you

A practical look at what really changes in insurance operations when manual work is reduced and processes become easier to manage.

What if the biggest drain on insurance growth isn’t competition or pricing pressure; but the hours your best people lose to manual work every single day?

Across the insurance industry, teams are still buried under spreadsheets, PDFs, emails, and rekeying data between systems. Policy reviews stretch for hours. Client intake forms come back incomplete. Proposal creation feels more like document assembly than selling. According to multiple industry studies, 30–40% of an insurance professional’s time is still spent on repetitive, low-value tasks, while analysts estimate that over 60% of insurance operations are already automatable with today’s technology.

This gap between effort and impact is where transformation begins. The shift from manual insurance processes to intelligent workflows isn’t just about speed; it’s about changing what work looks like when humans stop doing what machines do better.

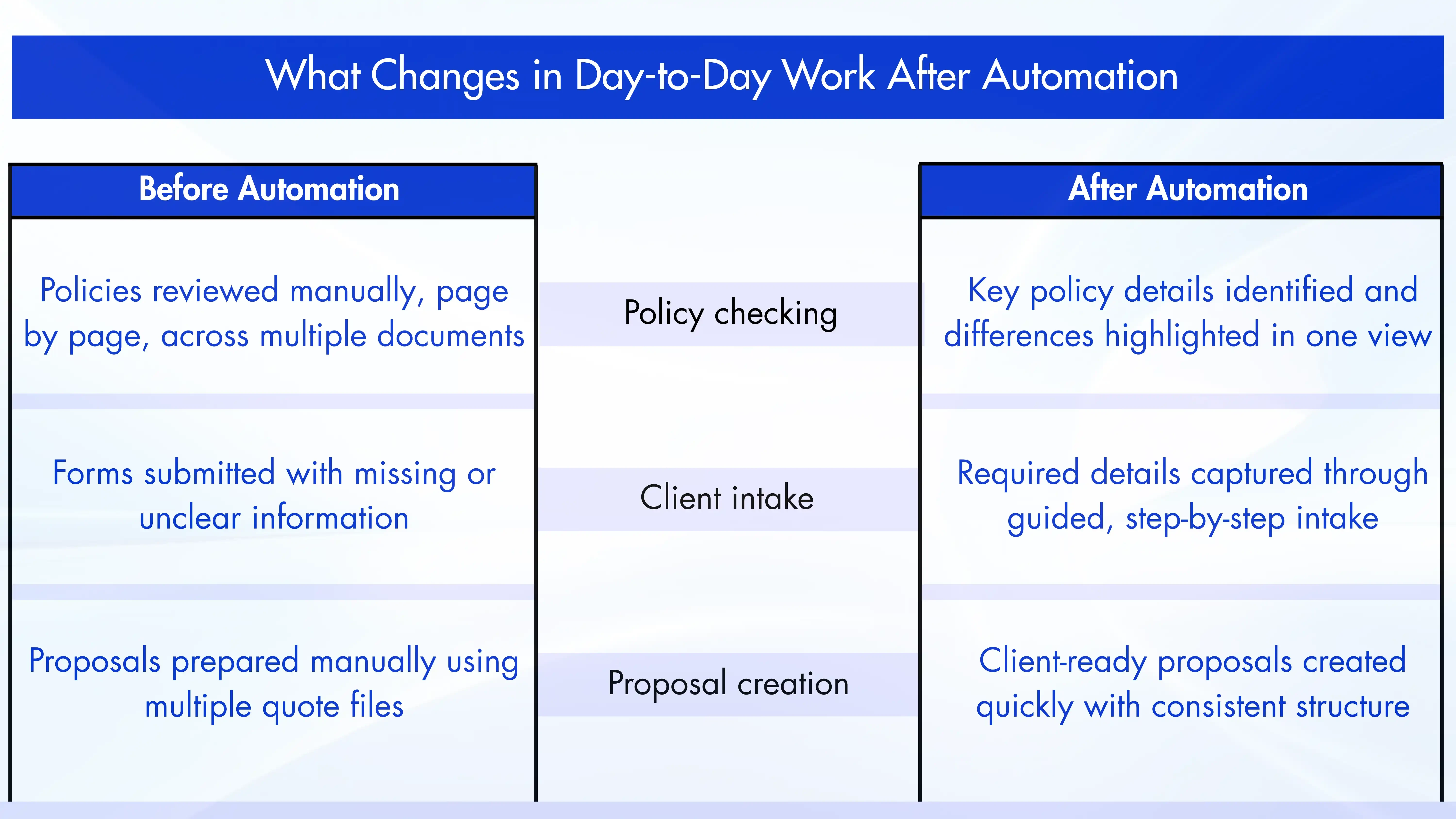

Below is a clear before-and-after look at what happens when insurance automation replaces manual effort; and how AI-driven workflows are quietly redefining insurance operations.

Before automation: When manual insurance processes control the day

In many agencies and insurance businesses, the workday starts reactively. A policy document arrives. Someone downloads it. Someone else scans it. Another person reviews it line by line, hoping nothing is missed. By the time discrepancies are identified, the client is already waiting; or worse, an error has moved downstream.

This is the reality of manual insurance processes:

- Policy checking depends on human attention and availability

- Intake data is often incomplete or inconsistent

- Proposal preparation requires copying, formatting, and double-checking

- Errors aren’t caught early; they surface late, when fixing them costs more

The numbers are sobering. Industry benchmarks show that policy reviews alone can consume 45–60 minutes per file, and manual intake errors account for up to 25–30% of downstream rework. Proposal creation, especially for multi-carrier comparisons, can stretch into hours; time taken away from client conversations and growth initiatives.

Manual work doesn’t fail because people aren’t capable. It fails because the system demands too much human effort for tasks that are rule-based, repetitive, and pattern-driven. That’s why simply “working harder” never fixes operational bottlenecks.

After automation: What changes when repetition disappears

When insurance process automation enters the workflow, the nature of work shifts dramatically. Instead of starting with documents, teams start with insights. Instead of reviewing line by line, they review exceptions. Instead of chasing missing data, they receive structured, validated information upfront.

This is where AI in insurance operations creates its first real impact:

- Tasks that once took hours are completed in minutes

- Accuracy improves because machines don’t get fatigued

- Workflows become predictable and scalable

- Teams gain back time to focus on advisory, relationships, and strategy

Automation doesn’t remove people from the process—it removes friction from their day. And the biggest gains appear in areas that were historically the most painful.

Intelligent policy review: From hours of reading to minutes of insight

Policy checking has long been one of the most labor-intensive parts of insurance operations. Comparing endorsements, limits, premiums, and exclusions across policies requires deep focus; and even then, errors slip through.

Modern AI-driven workflows change this entirely.

Instead of reading every page, intelligent systems can extract and structure policy data in seconds, regardless of format. Renewals can be compared instantly against existing coverage. Missing endorsements and mismatches are automatically flagged, not discovered accidentally.

The impact is immediate:

- Up to 70% reduction in policy review time

- Higher consistency across reviewers

- Client-ready outputs that improve trust and clarity

This capability alone helps eliminate manual processes in insurance that were never designed for scale. Humans move from “checking everything” to “confirming what matters,” which is a far better use of expertise.

Smarter intake: Fixing errors before they enter the system

Client intake is where many operational problems quietly begin. Incomplete forms, incorrect fields, and vague responses often pass through unchecked; only to resurface later as rework, delays, or frustrated follow-ups.

Automation flips this dynamic by introducing intelligence at the very first touchpoint.

Instead of static forms, AI-powered intake workflows guide users step by step. Inputs are validated in real time. Contextual prompts clarify what’s needed before submission. Errors are flagged instantly, not days later.

The results are hard to ignore:

- Up to 60% fewer submission errors

- Faster quote readiness

- Cleaner data flowing into downstream systems

This is insurance automation doing what it does best: preventing problems instead of managing them. Teams spend less time correcting mistakes and more time responding quickly; something today’s clients expect as standard.

From manual proposals to instant, client-ready presentations

Proposal creation is often the final bottleneck before revenue. Gathering quotes from multiple carriers, aligning formats, comparing terms, and building a presentable document takes time; especially when done manually.

AI-driven workflows remove this friction by automating the heavy lifting.

Instead of copying and pasting, intelligent systems can read multiple quote documents, extract key details, compare them side by side, and generate a polished proposal in seconds. The output is consistent, branded, and editable; ready for client review almost instantly.

Insurance teams using automated proposal workflows have reported:

- Up to 40% faster proposal generation

- Improved sales responsiveness

- Better client understanding through clear comparisons

This shift doesn’t just save time; it changes momentum. Faster proposals mean faster decisions, shorter sales cycles, and a stronger competitive edge.

The bigger picture: Where FBSPL is taking insurance automation next

The capabilities discussed above are not isolated fixes. They are part of a broader vision: intelligent, connected workflows that quietly handle complexity in the background while people focus on what truly matters; clients, growth, and decision-making.

FBSPL is actively investing in a new generation of AI-led solutions designed to:

- Reduce operational effort without sacrificing control

- Improve accuracy without adding oversight layers

- Standardize workflows while remaining flexible to business needs

These upcoming innovations are built to work with existing systems, not disrupt them; and to support humans, not replace them. They represent the next step in insurance process automation, where efficiency and insight move together.

What happens next: When insurance work starts working for you

The real promise of insurance automation isn’t speed alone;it’s clarity. When repetitive tasks fade into the background, teams gain space to think, advise, and act with confidence. Policy reviews become insight-led. Intake turns proactive instead of corrective. Proposals shift from document assembly to meaningful conversations.

For organizations looking to explore these capabilities more closely, a limited one-month pilot access will be available to experience how intelligent workflows can integrate into day-to-day insurance operations. This pilot is designed to offer a practical view of how automation can support accuracy, efficiency, and focus; without disrupting existing processes.

At FBSPL, this evolution is intentional. The capabilities shaping today’s workflows are just the foundation of a broader roadmap focused on intelligent, connected operations; where accuracy improves quietly, turnaround times shrink naturally, and teams spend more time on decisions that actually move the business forward. The future of insurance operations won’t feel automated; it will feel effortless.