Summary: Agencies heading into 2026 are facing quieter problems than before; process delays that feel normal, SOPs that exist but aren’t followed, and workflows shaped by habit rather than design. Workflow mapping brings those issues into the open. When paired with business process management consulting, agencies gain clarity, reduce friction across operations, and create processes that actually support growth instead of slowing it down.

- What does process mapping actually reveal inside an agency?

- Why does BPM consulting change outcomes, not just processes?

- Why do many agencies still struggle after mapping their processes?

- How does outsourcing strengthen workflow mapping and optimization?

- Conclusion: When clear workflows become a competitive advantage

Learn how structured workflow mapping and insurance consulting help agencies uncover operational gaps, improve execution speed, and build scalable processes for long-term stability.

Why does an agency that looks productive on the surface still struggle with delays, rework, and rising frustration? The answer rarely sits with people or effort. It sits inside the way work actually flows.

By 2026, agencies will operate under tighter margins, stricter compliance, and faster client expectations. What worked five years ago, informal approvals, undocumented handoffs, and tribal knowledge, no longer holds. Even high-performing teams begin to slow when workflows are unclear or outdated.

Most agencies already sense something is off. Tasks move, but not smoothly. Questions repeat. Simple requests take longer than expected. These are signs of broken or invisible workflows. Workflow mapping brings those blind spots into the open and shows where work stalls, loops back, or gets misrouted.

Outsourcing and insurance consulting play a growing role here. Internal teams are often too close to daily operations to step back and question them. External specialists review business workflow and operations without assumptions. In this blog, the focus stays on why workflow process mapping has become essential in 2026, how consulting exposes hidden inefficiencies, and why insurance businesses using consulting services are quietly pulling ahead.

What does process mapping actually reveal inside an agency?

What is business process mapping beyond a diagram on a slide? It is a practical method of documenting how work truly moves, from request to completion, across people, systems, and decisions.

Business process mapping captures steps that teams rarely question. Who reviews first. Where approvals wait. Which tasks rely on memory instead of structure. In insurance environments, this often exposes multiple versions of the same process running in parallel.

Workflow mapping also shows where effort is wasted. A policy endorsement might pass through three unnecessary checks. A claims file might be reopened because instructions were unclear. These inefficiencies feel small until they repeat hundreds of times.

Workflow process mapping turns assumptions into facts. It replaces “this usually works” with clarity. Once mapped, agencies can finally improve the workflow instead of guessing where delays originate. Business workflow and operations stop feeling abstract and start becoming manageable.

Why does BPM consulting change outcomes, not just processes?

Agencies rarely fail because they ignore problems. They fail because problems become normal. Business process management consulting challenges that normalization.

Consultants approach workflow mapping without emotional attachment to existing methods. They review end-to-end flows instead of isolated departments. For insurance consulting engagements, this perspective often reveals risks and inefficiencies teams learned to work around rather than fix.

Business process management consulting does not focus on theory. It connects mapping with execution, showing how changes impact turnaround time, accuracy, compliance, and team workload.

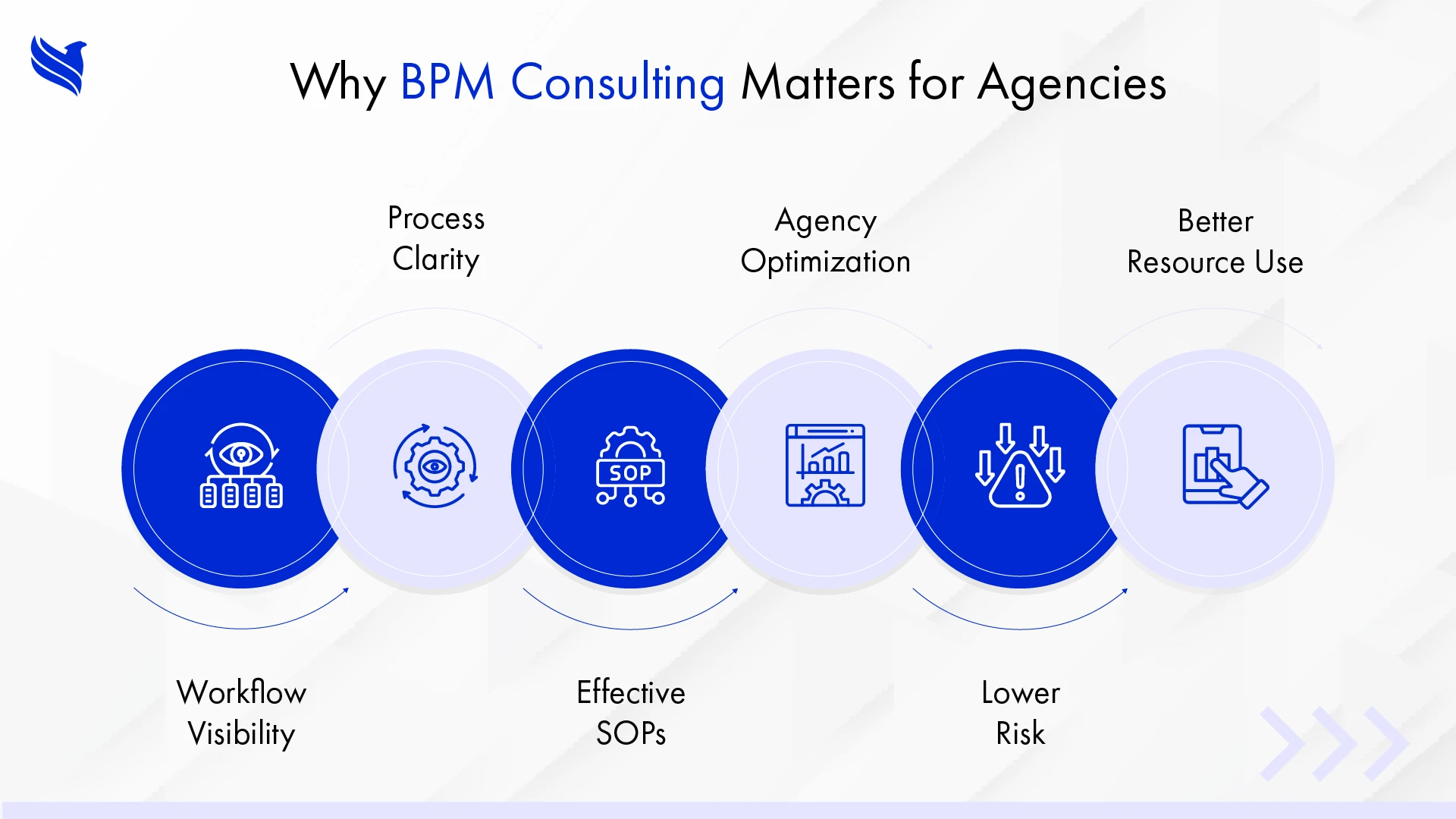

Key Advantages of Business Process Management Consulting:

1. Clear visibility across business workflow and operations

Consulting aligns every step into a single view. No more fragmented processes depending on individuals. Workflow mapping becomes consistent, shared, and measurable.

2. Actionable understanding of what is business process mapping

Instead of abstract models, agencies receive practical maps tied to real outcomes. Decisions, dependencies, and delays are documented clearly.

3. Stronger SOPs with real adoption

Many agencies attempt to optimize your SOPs for faster workflows but struggle with usage. Consulting aligns SOPs directly to mapped workflows. The benefits of SOPs appear quickly; fewer errors, smoother onboarding, and predictable execution.

4. True agency optimization, not surface-level fixes

Agency optimization becomes measurable. Turnaround times improve. Rework drops. Teams spend less time correcting mistakes and more time serving clients.

5. Lower operational risk

Insurance consulting embeds compliance into workflows. Risk stops relying on memory and starts living inside the process itself.

6. Better use of people and skills

Consulting highlights where skilled staff are stuck in low-value tasks. Workflow redesign frees capacity without increasing headcount.

Over time, these advantages compound. Insurance businesses using consulting services stop reacting and start planning. That shift alone changes how growth feels.

Why do many agencies still struggle after mapping their processes?

Research across service-driven industries shows a common pattern. Agencies map workflows once, file the documents, and return to old habits. The issue is not intent. It is sustainability.

Internal mapping efforts often stall because ownership is unclear. Processes evolve, but documentation does not. New hires learn shortcuts instead of SOPs. Technology changes, but workflows stay frozen.

Another challenge lies in bias. Teams map how work should happen, not how it does happen. Business process mapping loses value when honesty is replaced by ideal scenarios.

This is where insurance consulting and outsourcing create separation between execution and evaluation. External reviewers observe actual behavior. They ask uncomfortable but necessary questions. They test workflows against real volumes, not assumptions.

Without this discipline, workflow process mapping becomes outdated within months. With it, mapping stays alive, relevant, and useful.

How does outsourcing strengthen workflow mapping and optimization?

Outsourcing removes a major barrier: time. Internal teams are focused on delivery. Outsourced specialists focus exclusively on improving the workflow.

Insurance agency optimization services combine workflow mapping with implementation support. They do not stop at recommendations. They help redesign processes, update SOPs, train teams, and track performance.

Outsourcing also adds continuity. When internal roles change, external partners maintain process knowledge. Business workflow and operations stay consistent even during transitions.

For agencies scaling rapidly, outsourcing supports flexibility. Volume increases do not force rushed process changes. Workflow process mapping evolves alongside growth instead of lagging behind it.

Insurance businesses using consulting services often discover that outsourcing is not about losing control. It is about gaining structure, clarity, and momentum that internal teams cannot sustain alone.

Conclusion: When clear workflows become a competitive advantage

By 2026, agencies cannot afford invisible inefficiency. Workflow mapping, business process mapping, and consulting are no longer optional improvements. They are foundations for stability.

This blog explored why agencies struggle without clear workflows, how business process management consulting delivers measurable advantages, why internal mapping efforts fail, and how outsourcing sustains progress.

When agencies improve the workflow deliberately, results follow. SOPs become usable. Teams gain clarity. Clients experience consistency. Agency optimization stops feeling reactive.

For organizations ready to move forward, FBSPL supports agencies through structured workflow mapping, insurance consulting, and insurance agency optimization services. The path to stronger operations begins by making work visible, and fixing what has quietly held performance back.