Summary - Insurance operations face growing pressure from rising volumes, tighter timelines, and higher client expectations. Intelligent automation and AI tools now help agencies reduce manual effort, improve accuracy, and accelerate workflows; allowing teams to focus on advisory roles, customer relationships, and long-term business growth.

Manual insurance processes can’t keep up with 2026 demands; AI and intelligent automation now drive faster, smarter, and more reliable operations.

Have you ever wondered why some agencies still spend hours; sometimes days; poring over stacks of policy documents, manually checking endorsements and coverage details, or painstakingly assembling proposals from multiple carriers? In 2026, that painstaking manual grind feels less like “industry standard” and more like “industry liability.”

The truth is stark: insurance automation isn’t optional anymore; it’s a business imperative. Insurers who stick with legacy manual workflows are increasingly stretched thin by rising customer expectations, skyrocketing volumes of policies and claims, and intense competitive pressure to perform smarter, faster, cheaper. And thanks to intelligent automation in insurance and AI-based tools, there’s now a way forward that doesn’t just cut costs; it unlocks real operational transformation.

What is intelligent automation in insurance?

At its core, intelligent automation in insurance is a rule-based automation with AI-driven capabilities such as natural language processing (NLP), machine learning, and predictive analytics to execute and streamline tedious, information-heavy tasks that once required manual human effort.

This isn’t just about robotic task execution. It’s about AI-augmented decisioning, real-time data extraction and validation, intelligent document processing, and automated workflows that:

- Interpret and extract data from unstructured sources (PDFs, email attachments, forms).

- Validate and compare data across multiple systems with accuracy and speed.

- Generate professional outputs (reports, proposals) automatically.

- Trigger follow-up processes without human intervention.

In essence, automation in the insurance industry transforms the traditional back office into a high-velocity, data-driven operational engine.

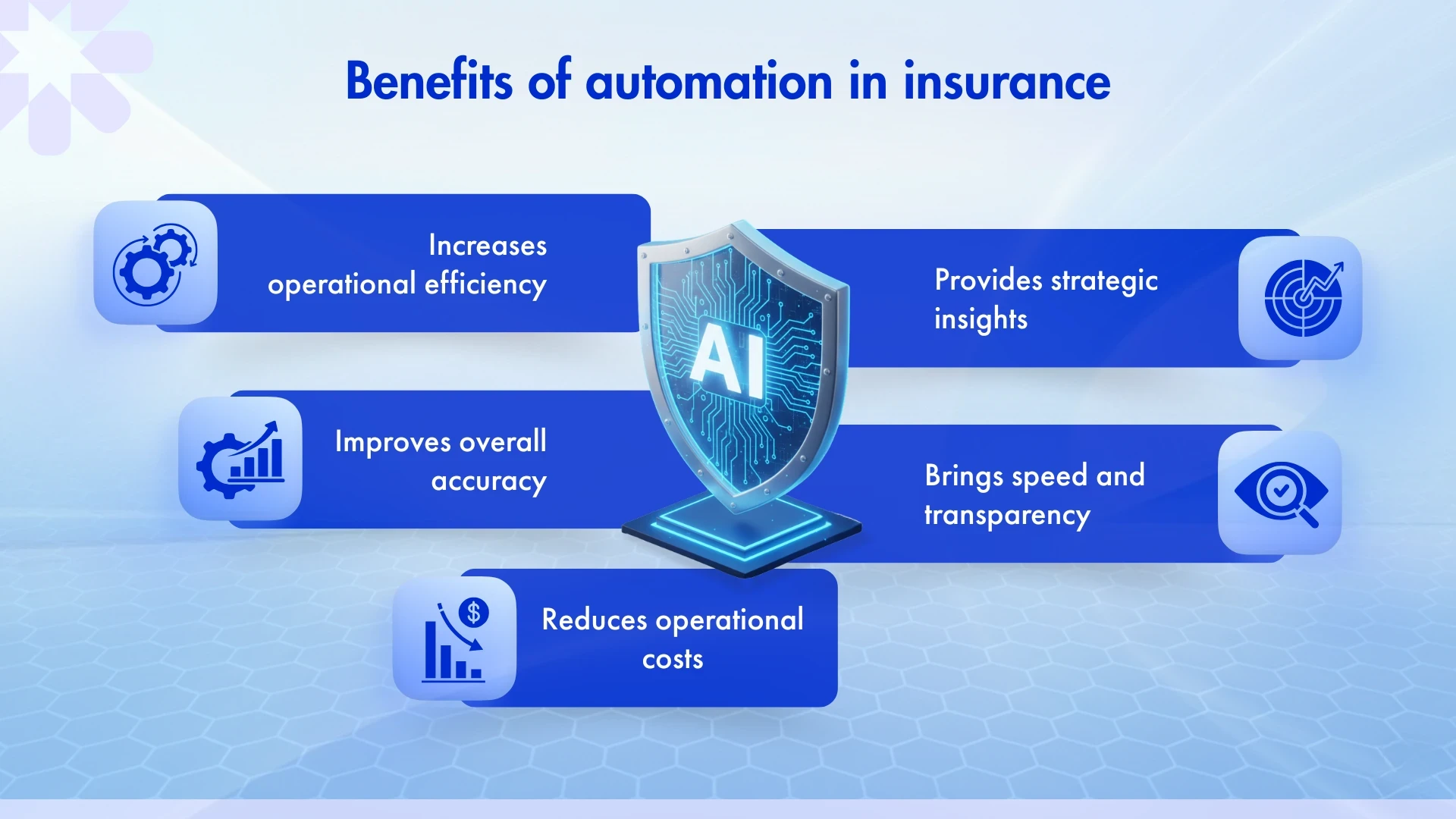

The tangible benefits of automation in insurance

By now, the industry has real evidence showing that insurance process automation delivers measurable performance gains:

- Operational Efficiency

AI deployment in underwriting can improve efficiency by about 25%, and claims processing speeds by 15% or more; even dramatically reducing routine claims turnaround from days to a couple of days or less. - Accuracy and Risk Management

Automation dramatically cuts human error by standardizing review processes and ensuring consistency across workflows. That means fewer oversights, lower E&O exposure, and better compliance; especially in regulated environments. - Cost Savings and Scalability

Research shows automation and digital tools can reduce operational costs by as much as 40%; with carriers reallocating human effort from paperwork to revenue-generating tasks. - Customer Experience & Retention

Modern policyholders expect digital speed and transparency; automation delivers faster quoting, real-time status updates, and frictionless interactions that enhance satisfaction and loyalty. - Strategic Insight

Automated systems generate rich, structured data, enabling analytics that help inform pricing, risk selection, product design, and customer segmentation.

These benefits underscore why automation isn’t a “nice-to-have” anymore; it’s a competitive edge.

The challenges that still slow adoption

Even with powerful tools on the table, intelligent automation in insurance isn’t plug-and-play. Insurers face real hurdles, including:

- Legacy systems and data silos, which make integration difficult.

- Organizational resistance and skill gaps, where teams lack training to effectively adopt new tools.

- Regulatory and compliance concerns, especially with sensitive data.

- Trust and transparency issues surrounding AI decisioning and customer privacy.

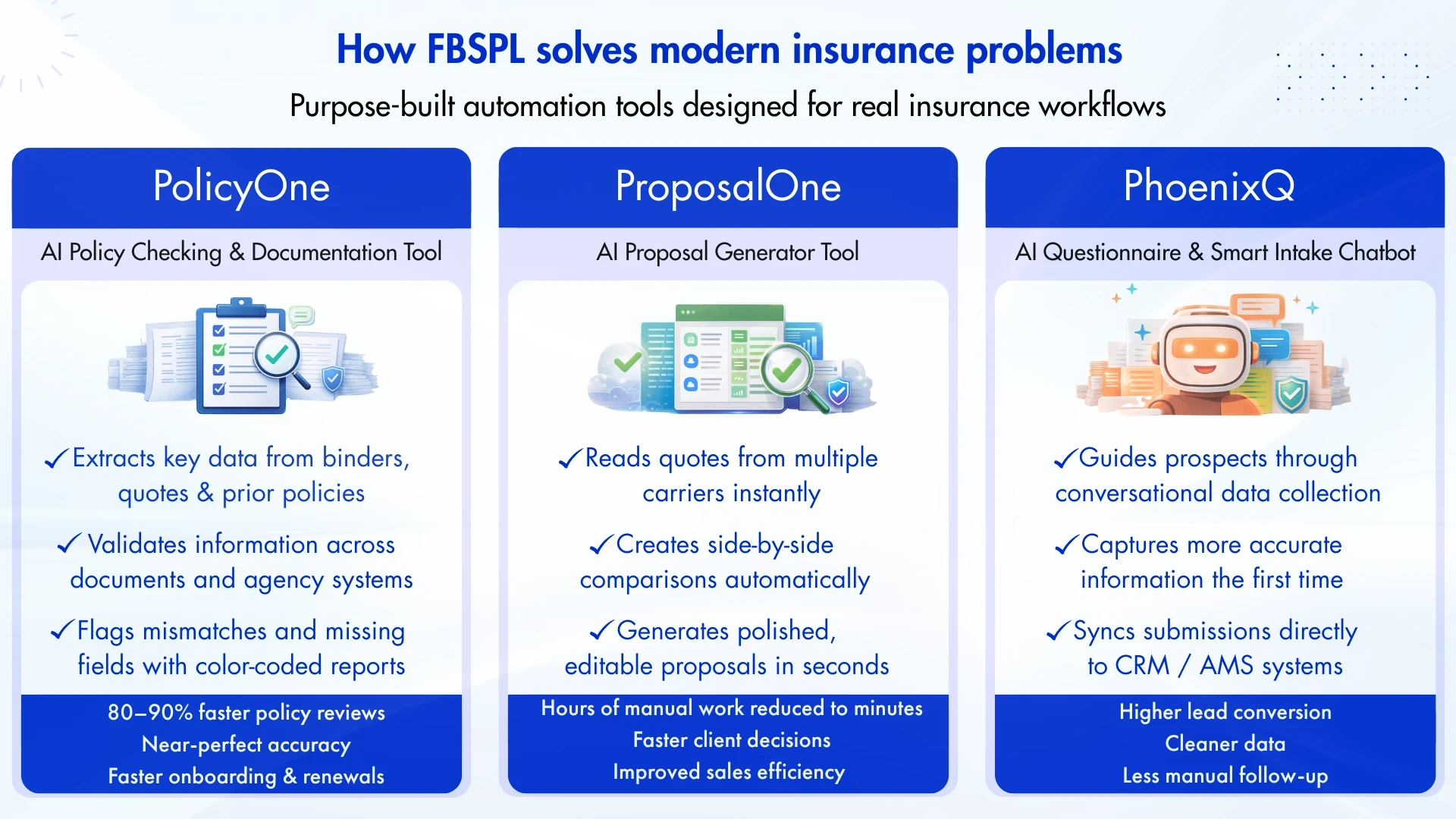

How FBSPL is tackling these operational challenges

So, what does this mean for agencies that want to move beyond today’s constraints and thrive in 2026? At FBSPL, we believe the answer lies in purpose-built automation tools; designed to handle real insurance workflows, deliver repeatable results, and free human talent for high-value work. Let’s take a look:

1. PolicyOne (AI Policy Checking & Documentation Tool)

This tool radically simplifies the traditionally manual process of policy review. It uses AI to:

- Extract key information from binders, ACORD forms, prior policies, and quotes.

- Validate data against existing agency records and across documents.

- Highlight mismatches and missing fields with clear, colour-coded discrepancy reports.

It cuts policy review times by up to 80-90%, boosts accuracy to near-perfect levels, and helps agencies accelerate onboarding and renewals.

2. ProposalOne (AI Proposal Generator Tool)

No more manual formatting, comparing spreadsheets, or juggling multiple quote documents. ProposalOne:

- Ingests quotes from multiple carriers.

- Generates side-by-side comparisons automatically.

- Produces professional, editable proposals ready for client delivery in seconds.

This is insurance automation that turns hours of work into clicks, improving sales efficiency and client experience.

3. PhoenixQ (AI Questionnaire & Chatbot)

PhoenixQ reimagines client intake with conversational AI. Instead of static forms:

- Prospects interact with a guided chat that collects accurate data.

- Submissions sync instantly to CRM or AMS systems.

The result? Higher lead conversion, more accurate data, and less manual follow-up.

Organizations exploring smarter ways to modernize their operations can also experience these capabilities firsthand through a one-month pilot access. This allows teams to see how intelligent automation performs in real-world insurance workflows, evaluate efficiency gains, and understand the practical impact before making longer-term decisions.

The future is clear: Focus on what matters most

Insurance operations are becoming faster, more data-driven, and more customer-focused than ever before. Manual processes that once worked are now slowing teams down, increasing risk, and limiting growth. Intelligent automation in insurance is no longer a future concept; it is the foundation of efficient, scalable, and modern operations.

Organizations that act now will not only reduce operational pressure but also create room for teams to focus on advisory work, client relationships, and strategic expansion. The shift toward insurance automation is already underway across the industry, and those who adapt early will lead the way.

At FBSPL, we’re helping insurance businesses make this transition with practical, purpose-built automation tools designed for real operational challenges. If you're exploring how to streamline workflows, improve accuracy, and unlock team productivity, our experts are ready to guide you through the possibilities.