Summary: Insurance agencies handle information that can’t be taken lightly. As more work moves online, stronger protection and clearer compliance rules become essential. This blog provides a brief overview that explains the practices, checks, and support options that help agencies keep data safe and operations steady.

- Why do data security matters in the insurance industry?

- Security vs. Compliance: Two areas often confused but never interchangeable

- What is security compliance management?

- Core data security practices for insurance companies

- How outsourcing supports better security and compliance

- Conclusion: Keeping insurance operations safe as they evolve

A brief look at the security habits and compliance steps insurance teams rely on as their everyday work shifts deeper into digital systems.

What truly happens when insurance work, once handled across desks and filing cabinets, starts relying almost entirely on screens and online systems? The shift sounds simple from the outside, but the people inside the industry know the strain it creates. Systems that were never built to talk to each other now must cooperate. Older processes are pushed into new formats. Teams are expected to move faster without losing accuracy.

The biggest pressure comes from the responsibility attached to the information insurance agencies hold. It is sensitive, personal, and deeply tied to people’s financial lives. Any mistake or leak carries weight. The move toward digital operations may promise convenience, but it also brings uncertainty around who handles data, how it is stored, and whether everything being done meets regulatory expectations.

This is why many agencies bring in outsourcing partners, especially in insurance BPO work. These teams support the heavy operational load and help organizations keep order when files, tasks, and compliance checks grow beyond what internal staff can manage alone.

In this blog, the focus stays on the practices that keep insurance operations safe, compliant, and trustworthy as they continue to modernize.

Why do data security matters in the insurance industry?

Insurance firms carry a unique burden. A single application form can reveal more about a person than what is shared with most service providers. Medical details, financial statements, assets, identification, long-term claim histories, everything flows through the agency.

Because of this, the consequences of mishandled information are not small or abstract. Customers place their trust in insurers at vulnerable moments, and they expect that trust to be respected. When files fall into the wrong hands, the result is more than a technical problem. It becomes a personal concern for the people affected.

Threats do not come only from the outside. Internal oversights create just as much trouble, unrestricted access, incomplete deletion of documents, unmonitored downloads, or outdated systems that leave openings. Each weak point can distort records and undermine data integrity in insurance risk management, which influences underwriting accuracy and claim decisions.

This is why security in insurance is not a checklist. It is a commitment to protect the information that defines people’s financial safety. Agencies that go digital must approach it with that understanding.

Security vs. Compliance: Two areas often confused but never interchangeable

Security and compliance serve different purposes, and mixing the two leads to gaps no agency can afford.

Security deals with protection. It focuses on the methods and tools used to guard systems; controls that limit access, encryption, monitoring, authentication, and all the measures that keep unauthorized hands away from sensitive records.

Compliance, on the other hand, is about obligations. It relates to regulations, audit expectations, documentation, reporting, and the standards that agencies must meet to prove they operate responsibly.

One cannot replace the other. A firm may follow strict legal requirements but still lack the day-to-day safeguards needed to prevent an incident. Or a firm may have strong internal protections but fail to maintain evidence and documentation required during regulatory review.

When agencies understand the difference between security and compliance, the operational picture becomes clearer. Teams know what protects the business and what satisfies governing bodies. Both matter equally.

What is security compliance management?

Security compliance management is the discipline that ties rules, procedures, and daily actions together. It ensures that protection efforts match regulatory requirements and that nothing is left to assumption or chance.

In practice, it includes:

- Documenting internal policies

- Reviewing access lists

- Running checks at set intervals

- Keeping evidence for auditors

- Training staff on new regulations

- Monitoring how data moves through different systems

- Updating procedures when platforms or vendors change

This ongoing oversight brings structure to environments where many teams touch the same information. Without consistency, gaps appear. And without documented proof, organizations struggle during inspections or renewal cycles.

For insurance agencies, reliable compliance management is not a formality. It protects them from penalties, operational interruptions, and reputational damage.

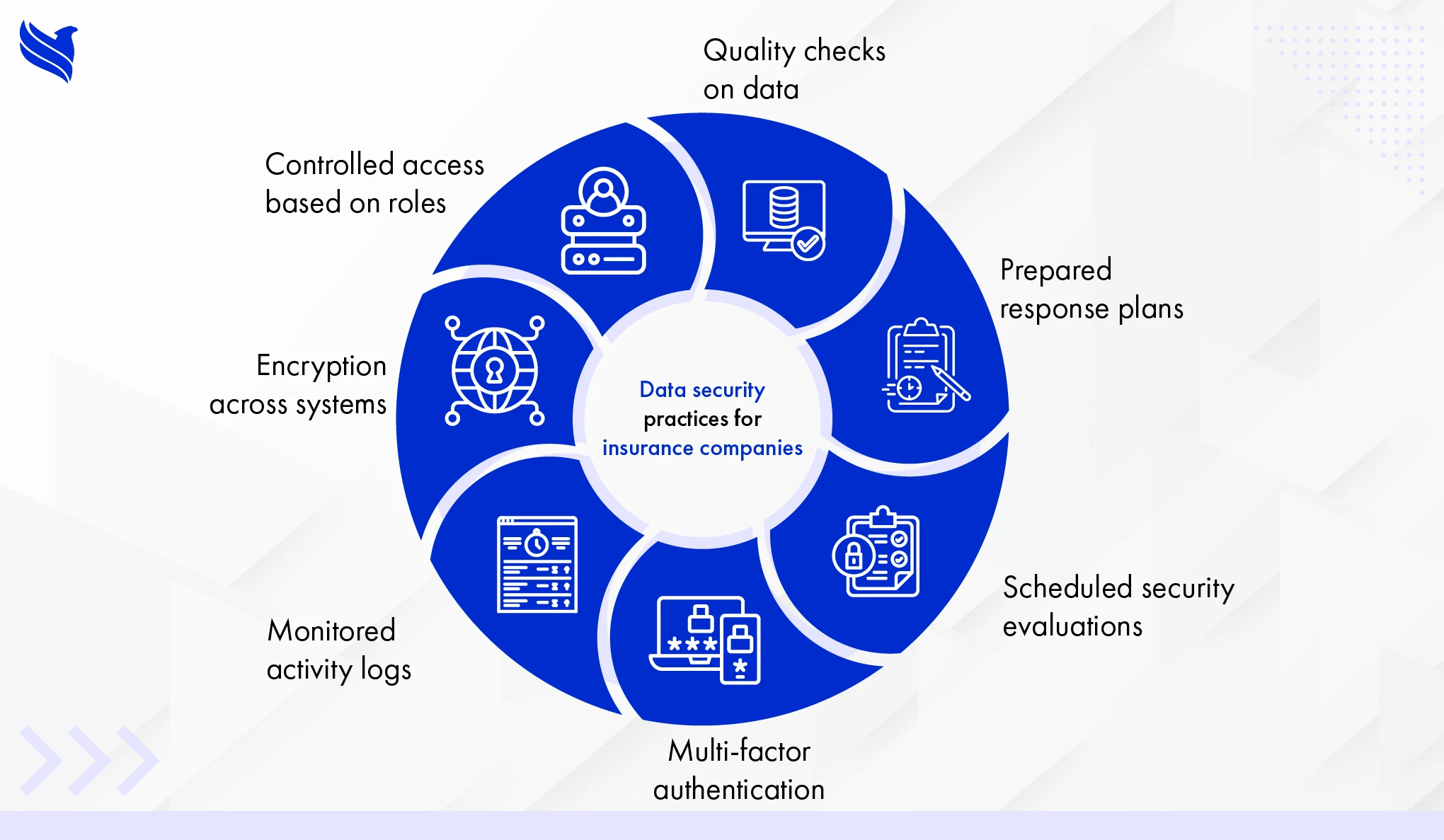

Core data security practices for insurance companies

Insurance work involves layers of sensitive data moving across multiple applications. To keep this information protected, a few practices must be non-negotiable:

- Controlled access based on roles

Not every employee needs access to every file. Restricting information reduces both accidental exposure and internal misuse. - Encryption across systems

Both stored data and transferred data must remain unreadable to anyone without authorization. - Monitored activity logs

Keeping track of who viewed, downloaded, or changed a file creates accountability and helps detect irregular behavior early. - Multi-factor authentication

A simple but essential safeguard that adds a second layer of protection. - Scheduled security evaluations

Old software and outdated settings create silent openings. Regular assessments prevent these from building up. - Prepared response plans

Clear instructions allow teams to handle incidents quickly, limiting damage and ensuring events are documented properly. - Quality checks on data

Accurate records support safe decision-making and uphold the integrity required for claims and underwriting.

These practices give insurance agencies a stable foundation as they increase reliance on digital systems.

How outsourcing supports better security and compliance

As workloads grow, so do the responsibilities tied to security and regulatory compliance. Many insurance agencies rely on insurance business outsourcing partners to help manage this pressure.

BPO teams bring structured processes, consistent documentation, and a controlled environment. In Data Security and Compliance in BPO, tasks are handled through pre-defined procedures, monitored access, and strict data handling rules. This reduces room for error and strengthens daily governance.

Additional advantages include:

- Clear recordkeeping

- Lower chance of overlooked tasks

- Built-in compliance automation for repetitive checks

- Proper audit trails

- Controlled data movement

- Easier scaling when volume changes

Instead of replacing internal departments, outsourcing supports them. It allows agencies to maintain high standards, protect customer information, and uphold ethical standards without stretching teams beyond their capacity.

Conclusion: Keeping insurance operations safe as they evolve

Digital growth brings opportunity, but it also demands caution. Insurance agencies cannot rely on outdated habits when so much personal information is stored and processed online. Strong protection, clear obligations, consistent routines, and reliable partners help create an environment where data stays safe and customers feel confident.

This blog outlined why security matters in insurance, how security differs from compliance, what security compliance management looks like, the practices every agency must adopt, and the ways outsourcing reinforces these efforts.

Agencies that prioritize these areas build trust, reduce risk, and stay prepared for the regulations ahead.

For support in establishing reliable, secure, and compliant operations, FBSPL offers the experience and structure needed to keep digital insurance work steady.