Policy checking is one of the most time-consuming and resource-intensive processes of insurance operations. For decades, insurance policy checking has been handled manually, resulting in inconsistent formatting, human errors, and more, especially when businesses have high policy volumes.

But with AI in insurance, the process has accelerated and been entirely reshaped. AI-backed insurance systems can easily extract policy details, compare them with other policies, and validate the data in real time. Another added advantage of AI in policy checking is that it drastically reduces turnaround time while keeping compliance and accuracy on track.

As a result, businesses can boost their operational efficiency and maintain better client relations with timely risk mitigation. It is just a glimpse of how AI speeds up insurance policy checking processes. Read this blog to explore in detail how forward-thinking insurance businesses are integrating AI capabilities into their processes and workflows.

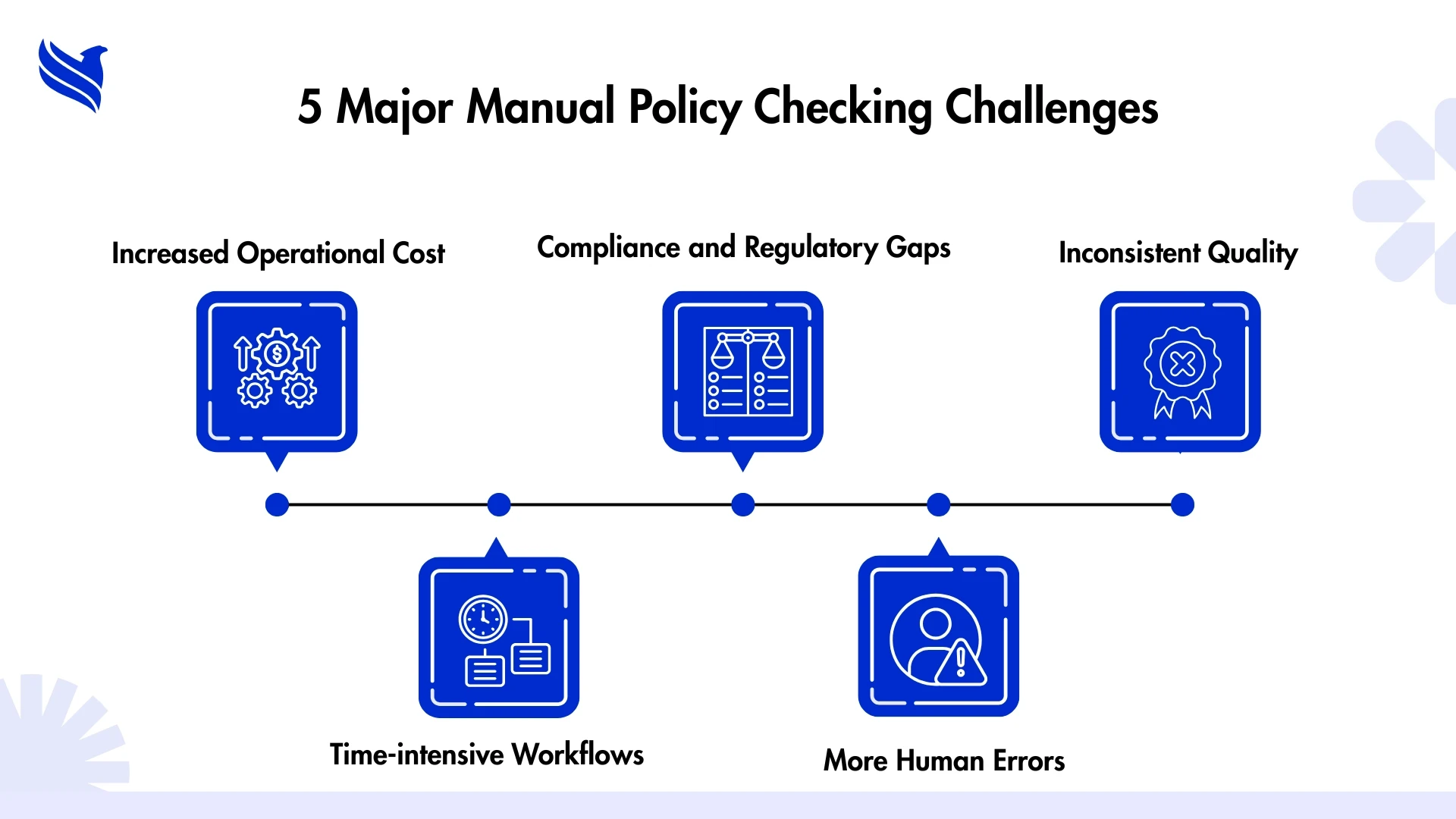

Manual policy checking challenges that impact business growth

Policy checking plays a crucial role in maintaining compliance and accuracy. However, when performed manually, it becomes a challenge for businesses, affecting their growth and operations.

Below are some major manual policy checking challenges impacting business growth.

1. Increased operational cost

Having an in-house team for repetitive policy checking tasks increases policy checking costs. It further reduces profit margins and limits reinvestment into growth-focused initiatives.

2. Time-intensive workflows

When businesses manually check the policies, they need to compare the data line-by-line, whether endorsements or prior-year policies. As policy volumes increase, businesses need more time to review policies. So, overall, manual policy checking is quite a time-intensive process.

3. Compliance and regulatory gaps

There is no denying that insurance rules and regulations evolve over time, and hence, manual policy checking might increase the risk. Sometimes, insurance fails to identify missing endorsements, outdated forms, or mandatory disclosures.

4. More human errors

No matter how experienced your insurance team is, they might overlook crucial details like missing coverage or limits. These human errors can cause reputational damage to businesses and lead to E&O exposures.

5. Inconsistent quality

Without automation, policy reviews will vary by process or checker. This inconsistency makes it difficult for businesses to maintain quality, especially for fast-growing agencies.

So, these are some of the manual insurance policy checking challenges that businesses usually face. For a deeper understanding of what makes an effective review process, explore our Insurance Policy Review Guide.

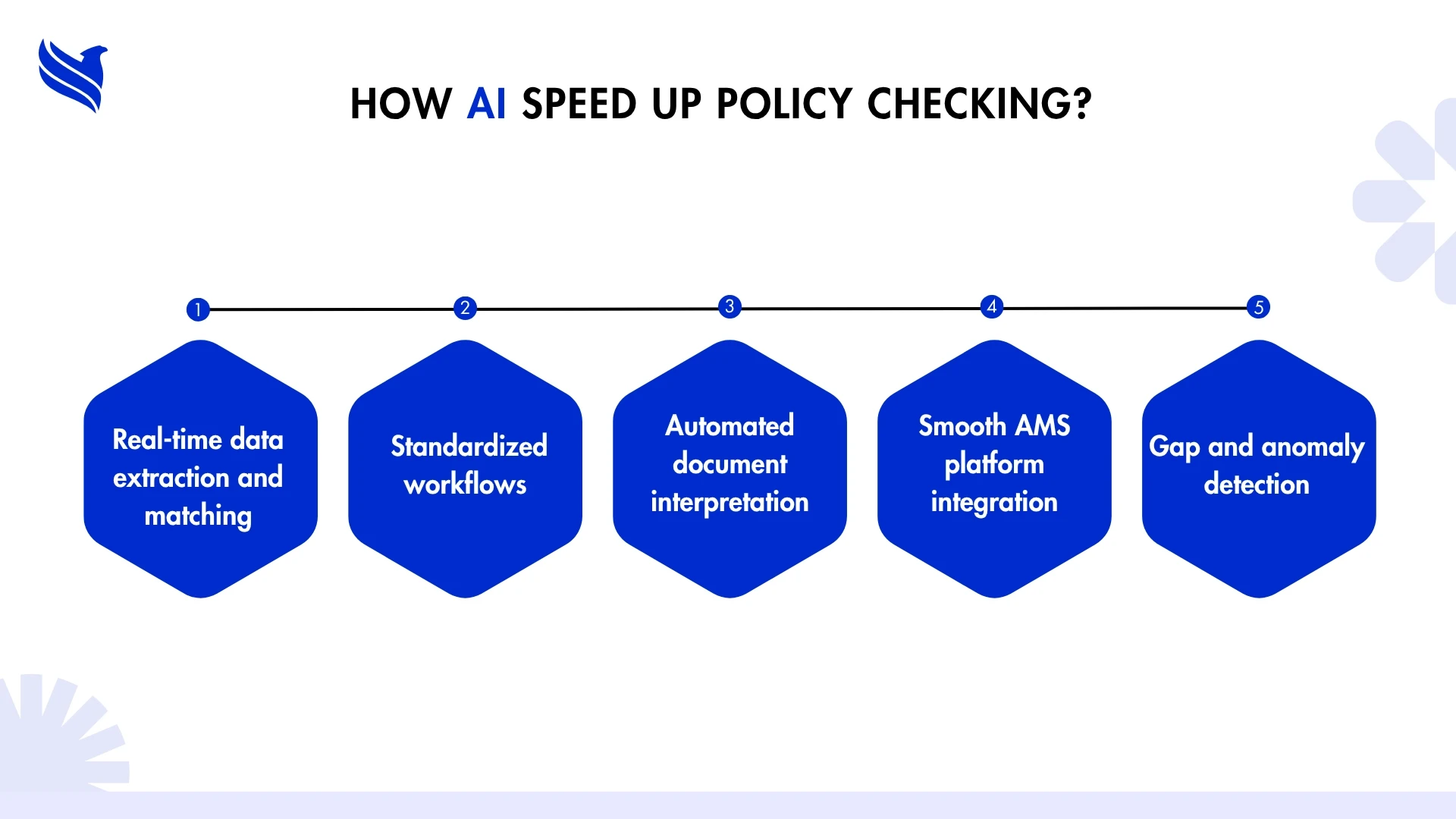

How AI accelerates insurance policy checking process

AI works as a strategic tool for businesses and helps them redefine their policy checking processes. Let’s see how AI is accelerating insurance policy checking for all-scale businesses and helping them speed up processes.

1. Real-time data extraction and matching

Whenever a new policy document is added to the system, AI automatically compares it with previous term versions or quote binders. It helps to detect changes in limits or endorsements and helps businesses make sure that no crucial data is missed during mid-term adjustments or renewals.

2. Standardized workflows

Unlike manual policy checking processes, AI introduces a layer of consistency. This means that each policy undergoes an in-depth review process ensuring uniform quality as the agency scales.

3. Automated document interpretation

AI-powered systems automatically read and interpret various policy formats. They use OCR and NLP to interpret the data. No matter whether your policy details are in PDF format or carrier-generated files, AI extract structured data to identify all the details.

If you're evaluating automation opportunities within your agency workflows, read this detailed breakdown on ‘Why automation is essential for policy management?’

4. Smooth AMS platform integration

With insurance, you need not worry about AMS integration. Now modern AI tools can easily integrate with agency management systems (AMS), making policy data instantly accessible. It further reduces data duplication and ensures continuity across in-house teams.

5. Gap and anomaly detection

AI/ML models can flag unusual policy entries or missing components. It further makes it easier for businesses to identify anomalies and gaps. Such AI-integrated systems evolve over time by learning from historical data and human corrections. All this further results in improved operational efficiency and accuracy.

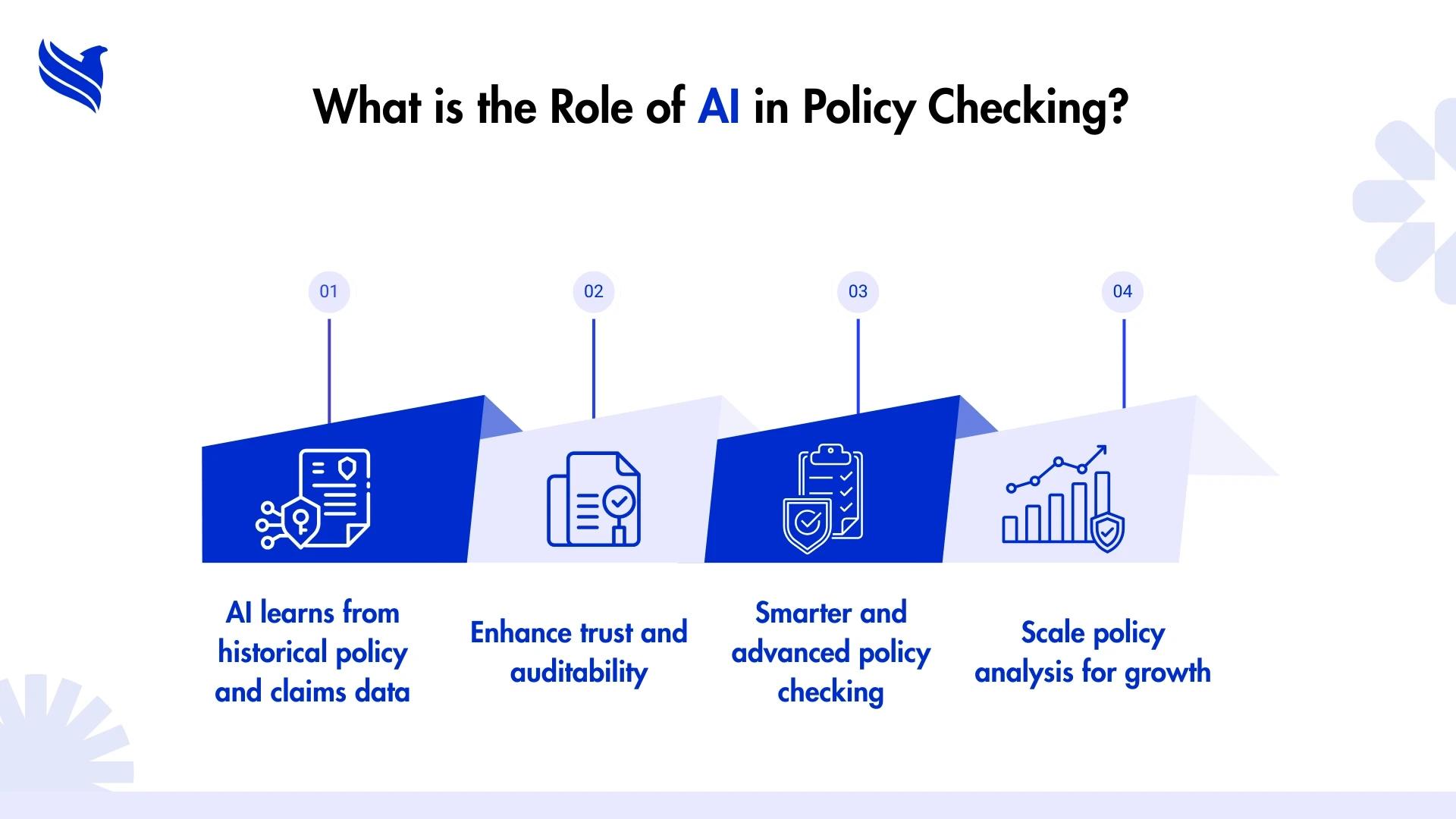

Role of AI in insurance policy analysis

While AI is already redefining how insurance businesses check policies today, its role is set to expand far beyond automation. So, for businesses who want to stay ahead, it’s not just about reducing workload, it’s about using AI as a strategic asset in policy checking and analysis.

1. AI learns from historical policy and claims data

Advanced AI and ML models evolve over time. AI systems can refine their policy validation process by analyzing past policy checks and claims history. This continuous learning loop enables smarter decision support, ensuring that each new policy is checked thoroughly from existing data.

2. Enhance trust and auditability

AI-driven technologies create organized audit trails. It enables insurers to maintain compliance with increasing regulatory requirements. These capabilities will support stronger governance and reporting procedures.

3. Smarter and advanced policy checking

AI in insurance is no longer just about rule-based automation but intelligent analysis. Accordingly, AI models will do more than simply extract and compare policy data in the future; they will also proactively indicate anomalous coverage patterns, suggest missing endorsements based on risk profiles, and assist in locating gaps that might result in claim denials or compliance problems.

4. Scale policy analysis for growth

As businesses expand and grow, AI will become essential to normalize policy data across carriers and legacy systems. Integrating AI in policy checking enables smoother integrations, policy standardization, and faster book roll analysis. An added advantage is that it will speed up your day-to-day business operations.

Take your next step towards smarter policy checking

Manual policy checking might have been the go-to technique for insurance businesses, but it is no longer sustainable in this modern landscape. The concept of AI in insurance policy is no longer theoretical but is already reshaping how forward-thinking businesses operate. Throughout this blog, we have explored how AI transforms insurance and helps businesses grow.

Now, the next step for businesses is to integrate AI in insurance, as it will open doors to scalable growth and strategic efficiency.

FBSPL, a leading insurance outsourcing service provider, helps businesses integrate smart AI solutions in insurance and other processes to speed up growth. We have helped 500+ businesses reach the heights of success. So, if you are looking to integrate AI in policy checking, we can help you. Feel free to send us your business requirements.