The Property and Casualty (P&C) insurance business has never been simple, and with rapid expansion and influx of digital transformation the future seems highly challenging as well. Every corner of P&C Insurance is being pulled into a new world. Digital-first platforms. AI-driven underwriting. Policy shopping that happens over coffee on a phone screen. Customers aren’t waiting around anymore. They want answers instantly, and if they don’t get them, they’re gone.

That leaves a big question hanging in the air: where does the small P&C insurance agency fit into this future? Do they fade out? Or do they fight back and carve a new space for themselves?

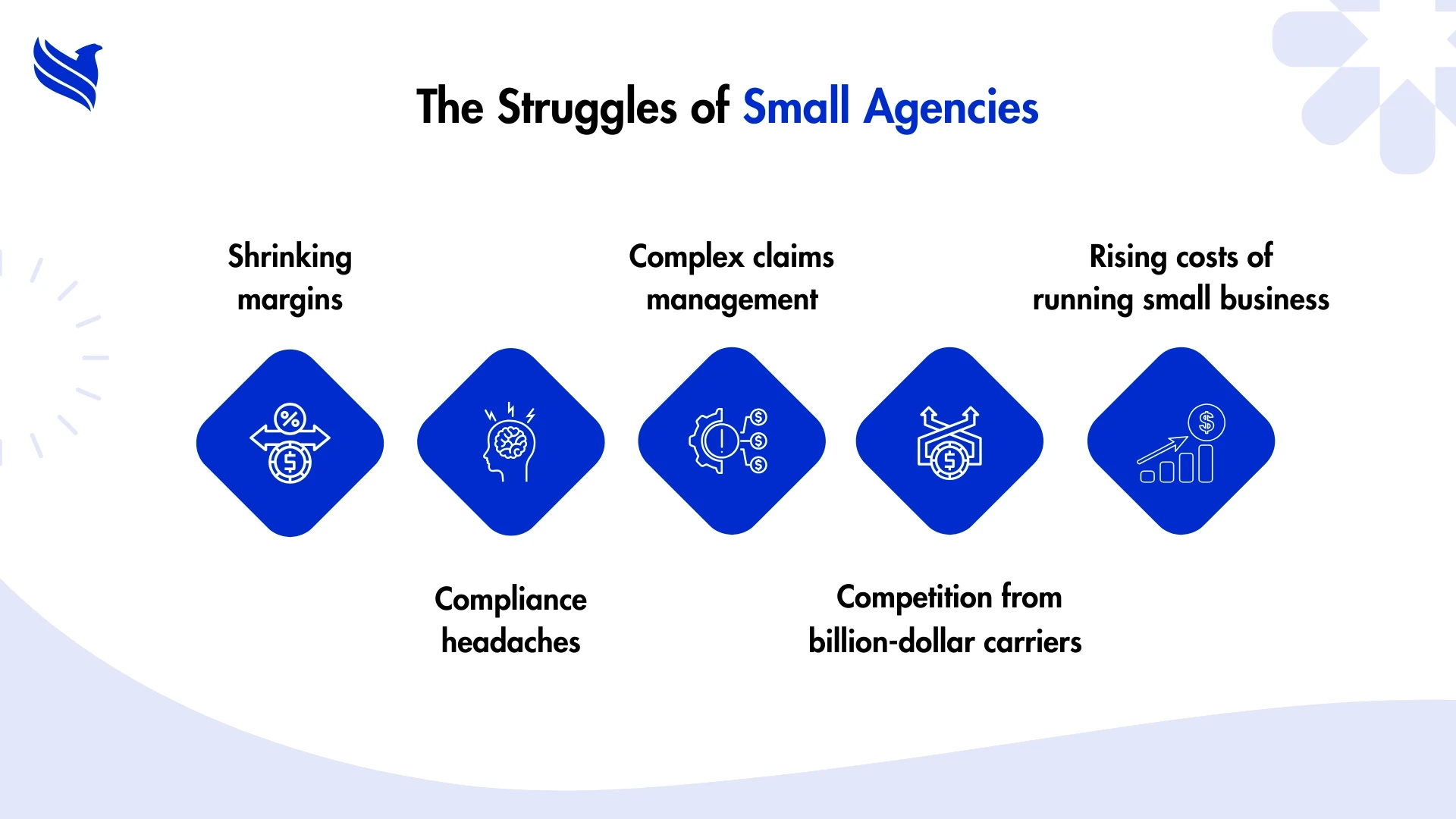

It’s not just about survival. It’s about relevance. Because right now, small agencies face serious P&C Insurance challenges like shrinking margins, regulatory headaches, competition from giants who’ve invested billions in tech. Add the ever-rising costs of running even a lean office, and the picture gets more complicated.

And yet, not every solution has to be homegrown. Many agencies are leaning into P&C insurance outsourcing services to balance the scales, whether that’s claims support, compliance work, or client engagement.

In this blog, the goal is to strip away the fluff and talk directly: what’s real, what’s not, and whether small agencies still matter in a digital-first market by 2035.

The big problems small agencies face today

Here’s the truth: technology didn’t just change the insurance game. It rewrote the rules. The way clients shop, compare, and renew policies has shifted entirely into digital channels. That’s the first punch small agencies took. Customers no longer drive across town to ask about coverage, they’re scrolling through five different quotes online before lunch.

Then there’s compliance. It’s messy, it’s unforgiving, and it only gets harder each year. Keeping up with changing laws, new state requirements, or federal reporting standards eats into bandwidth. Add P&C insurance claims management into the mix, already complicated, often emotional, and time-consuming, and smaller shops feel squeezed from every side.

But the biggest mistake some agencies make is pretending digital is optional. It’s not. Digital transformation in P&C insurance is not about fancy dashboards, it’s about survival. Agencies that digitize onboarding, automate renewals, and track customer data in real time find breathing room. They cut wasted time. They stop losing clients to frustration.

And the fix isn’t impossible. Start small. Automate one workflow. Outsource another. Even lean agencies can punch above their weight by being nimble. That’s the one advantage giants don’t have: agility.

Why local agencies still matter

Some people say geography doesn’t matter anymore, that being ‘local’ has lost its shine in a digital-first world. That’s only half true. Sure, most of the client’s first touchpoints are online. But insurance isn’t like ordering a pizza. A contract that protects your family’s house, or a multimillion-dollar liability policy for a small business? That’s personal.

This is where the local presence still cuts through the noise. A national carrier can give you speed. But can it give you a face that knows your town’s flood risks because he grew up down the street? Can it connect with a small manufacturer who wants someone to walk the plant floor before finalizing a commercial P&C insurance policy?

The local touch won’t disappear; it’ll evolve. Agencies will meet clients online but seal trust offline. The mix of digital efficiency and human reassurance is where small players stay relevant.

Smart moves for survival

So, what’s the strategy? Small agencies can’t afford to chase every trend, but they also can’t bury their heads in paper files and hope the storm passes. The ones who last will probably mix three things:

- Hybrid service: Digital for speed, human for trust. Let the client file a claim at 11 p.m. on a Sunday through a mobile app, but have an agent follow up the next day to walk them through details.

- AI and Insurtech innovations: Prediction matters. Imagine being able to warn a client about rising flood risk before they even think about coverage gaps. That’s where data tools, predictive analytics, and real-time risk monitoring come in.

- Smart outsourcing: Administrative work kills focus. Policy endorsements, claim follow-ups, compliance audits, those things don’t have to eat up local staff time. Outsourcing those processes gives agencies oxygen to grow.

The combination might sound obvious, but execution is what separates agencies that grow from those that fade.

What agencies get if they adapt

There’s good news in all this chaos. Done right, the payoff is massive.

- Clients stick longer when their problems are solved quickly, and nothing solves quicker than digital self-service backed by local support.

- P&C insurance solutions built for agencies are getting cheaper and more accessible, not less. What only carriers could afford ten years ago is on the table for small shops today.

- Costs drop when routine work is automated or outsourced. That opens up space for real client conversations instead of endless admin tasks.

- Better claims handling, because mastering P&C insurance claims management doesn’t just improve client satisfaction, it prevents churn.

So, while the list of P&C insurance challenges is long, the benefits of leaning into digital and partnerships are longer.

What 2035 would really looks like

Fast-forward a decade. Picture it.

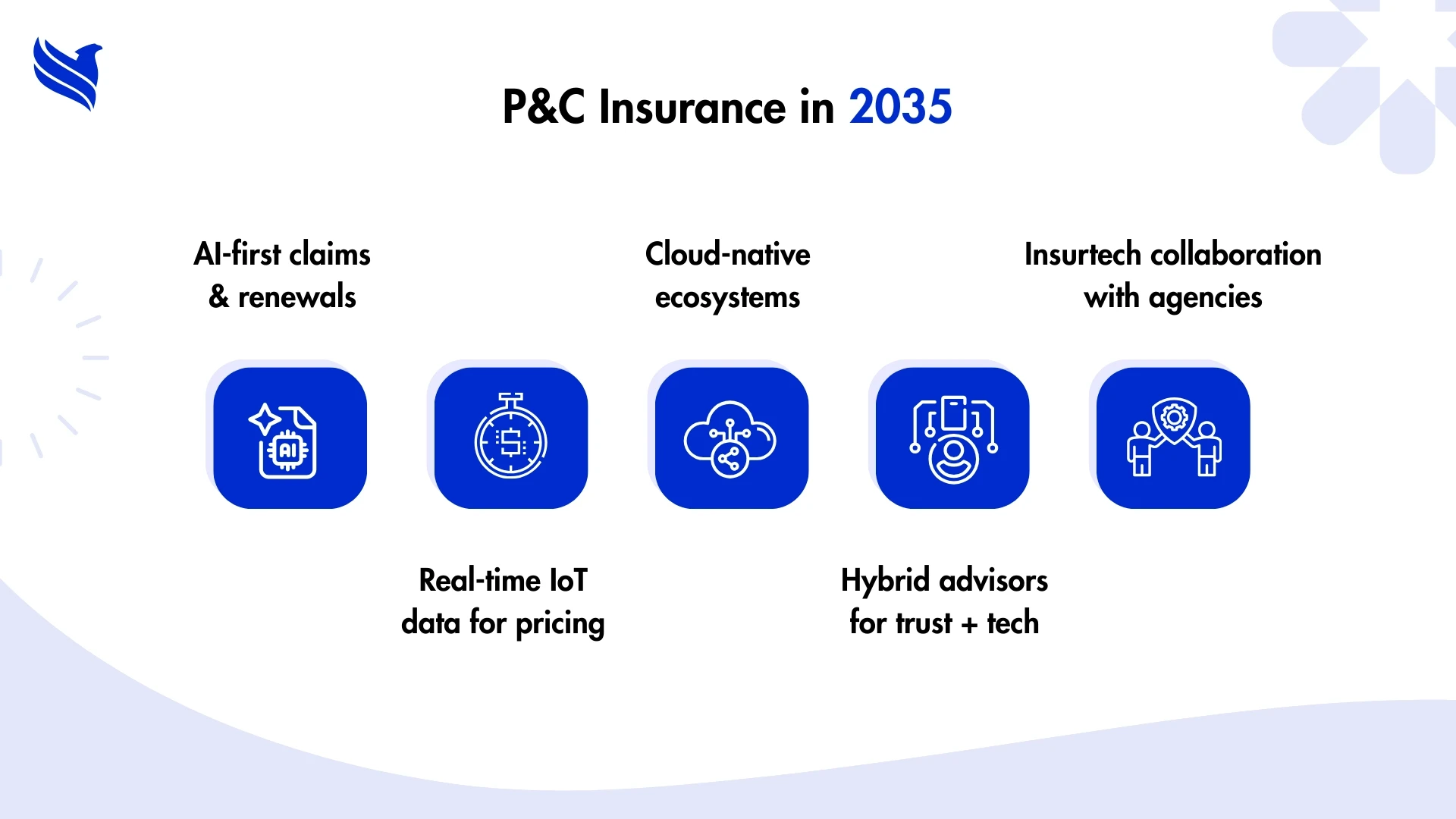

- AI-first everything. Policy renewals, pricing, even fraud detection will be handled by algorithms.

- Personalized pricing. IoT devices in cars, factories, and even wearables will feed real-time data into underwriting models. Rates will update on the fly.

- Insurtech collaboration. Instead of competing, agencies will white-label tech solutions or partner with platforms.

- Cloud-native ecosystems. Everything, from compliance tracking to customer chat, will run through cloud-based tools.

But here’s the part that’s often missed: in moments of crisis, people don’t want to argue with software. They want someone who knows their name, their business, their town. That’s why even in 2035, small agencies won’t disappear, they’ll evolve into hybrid advisors.

Why outsourcing will be essential

Running lean will be non-negotiable in 2035. Margins are already thin for small agencies, and adding tech investments only increases the squeeze. That’s where P&C insurance outsourcing services will change the game.

Imagine this: claims are filed at 2 a.m., processed through automation, validated by an outsourced team overseas while the local office sleeps, and by morning the client gets a status update. That level of service used to be unthinkable for small shops. Now it’s possible, and affordable.

Agencies already using outsourcing for claims, compliance, and back-office see accuracy rates near 99.9% and SLA adherence that rivals big carriers. And as outlined in modern claims management strategies, this isn’t just operational efficiency, it’s client experience.

By 2035, agencies that refuse to outsource will be carrying a backpack full of rocks while their competitors sprint ahead.

It’s not about size, it’s about adaptability

The question of whether small agencies will survive in 2035 isn’t the right one. The real question is which agencies will adapt and which won’t. Those that embrace P&C insurance digital transformation, tap into outsourcing, and double down on the human relationships that digital platforms can’t replace, they’ll still have a seat at the table.

FBSPL has been helping agencies do exactly that: modernizing workflows, streamlining policy administration, scaling claims, and boosting accuracy, all without ballooning costs.

The future isn’t about size; it’s about adaptability. If your agency is ready to evolve and claim its place in 2035’s digital-first market, FBSPL can help you make that leap.

Reach out to FBSPL today and start reshaping the way your agency works.