Summary: FBSPL’s AOS team helps insurance agencies handle daily tasks with care and accuracy. Through trained assistants and automation, agencies reduce mistakes, maintain compliance, and free staff to focus on clients and business decisions; more than generic assistants or simple automation can offer.

- What is insurance automation?

- How does technology and automation improve insurance operations?

- What are the benefits of business process automation?

- What are the benefits of AI in insurance?

- Why do generic virtual assistants fall short?

- How FBSPL’s AOS Team works differently

- FBSPL AOS vs Generic virtual assistants & automation tools

- How AOS supports insurance agency optimization daily

- The outsourcing advantage with AOS

- Supporting the future of insurance agency operations

Take a look at how FBSPL’s AOS team supports insurance agencies with reliable workflows, better accuracy, and practical automation beyond typical virtual assistants.

Insurance agencies today carry a quiet burden. Volumes increase, regulations tighten, clients expect faster responses, and teams already feel stretched. Many businesses turn to an insurance virtual assistant or off-the-shelf insurance automation solutions hoping for relief. Some improvement happens. Yet the deeper problems remain; fragmented insurance processes, compliance risks, inconsistent service quality, and tools that never fully fit.

Outsourcing has become a practical step for agencies that want stability without adding permanent overhead. The challenge lies in choosing the right kind of support. In this blog, the focus stays on why businesses increasingly choose FBSPL’s AOS (Agency Optimization Services) over generic virtual assistants and basic automation tools and how this choice directly supports insurance agency optimization, long-term scalability, and the future of insurance agency operations.

What is insurance automation?

Insurance automation is the structured use of technology, people, and workflows to reduce manual work across insurance processes.

It goes beyond software scripts or task bots. True insurance automation connects policy servicing, accounting, compliance, claims support, CRM updates, and reporting into a single operational rhythm. Automation in Insurance works best when paired with trained specialists who understand how agencies actually function.

Generic tools automate steps. FBSPL’s Insurance Agency Automation Services optimize the system behind those steps.

How does technology and automation improve insurance operations?

Technology improves insurance operations by reducing delays, lowering error rates, and creating predictable workflows

Automation handles repeatable work like policy issuance updates, endorsements, renewals, certificates, data reconciliation, and reporting. This creates space for licensed staff to focus on client conversations and risk advice.

However, technology alone cannot fix broken workflows. Agencies using only tools often face:

- Poor integration with AMS or carrier portals

- Manual workarounds that cancel automation benefits

- Limited visibility into compliance and audit trails

FBSPL’s AOS model blends insurance workflow automation with domain-trained teams. Systems are configured around real agency activity, not idealized process maps.

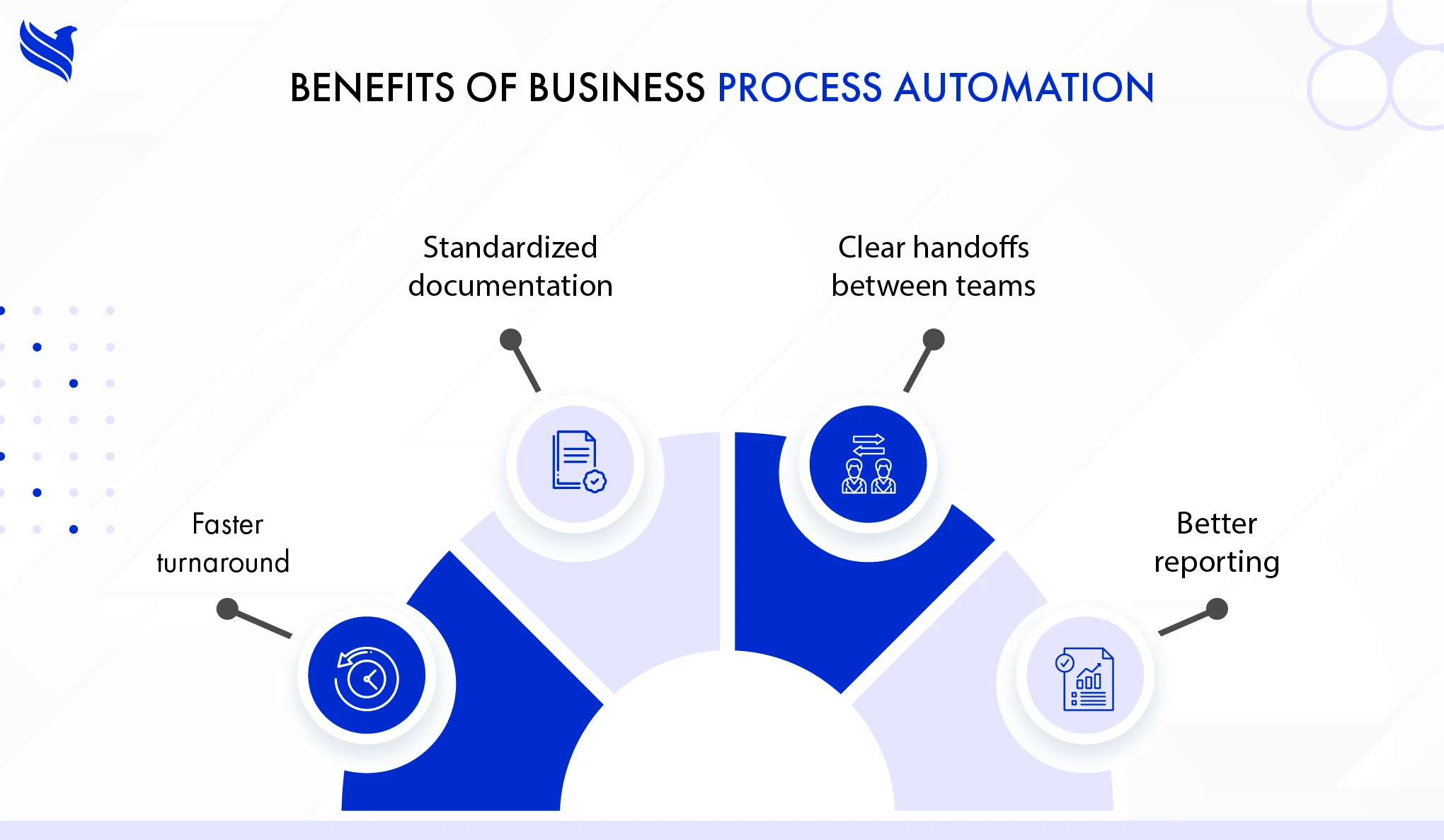

What are the benefits of business process automation?

Business process automation creates consistency, accountability, and scale. For insurance agencies, the benefits show up quickly:

- Faster turnaround without burnout

- Standardized documentation across teams

- Clear handoffs between sales, service, and accounting

- Better reporting for leadership decisions

Unlike generic automation, FBSPL’s approach focuses on insurance agency back office support that adapts as regulations, carriers, and volumes change. Automation stays flexible, not locked into rigid scripts.

What are the benefits of AI in insurance?

AI improves insurance operations by supporting accuracy, speed, and decision support; not by replacing people. AI helps with:

- Document classification and indexing

- Data validation across multiple systems

- Exception flagging for compliance and accounting

- Predictive workload planning

The AOS team uses AI as a support layer. Human review remains central. This balance protects agencies from silent errors, regulatory exposure, and poor client outcomes often seen with fully automated setups.

Why do generic virtual assistants fall short?

Generic virtual assistants are built for task completion, not insurance agency optimization. They often lack:

- Deep understanding of insurance workflows

- Knowledge of regional compliance standards

- Experience with AMS, carrier systems, and accounting tools

- Process ownership beyond assigned tasks

An insurance agency virtual assistant should act as an extension of the agency, not a temporary patch. That difference defines the FBSPL Team approach.

How FBSPL’s AOS Team works differently

FBSPL’s AOS team operates as a managed operational function, not individual task support. Key elements include:

- Dedicated insurance-trained professionals

- Documented SOPs aligned with agency workflows

- Continuous optimization, not static delivery

- Integrated use of insurance automation tools

This structure directly supports insurance agency optimization rather than isolated productivity gains.

FBSPL AOS vs Generic virtual assistants & automation tools

| Area | Generic virtual assistants / tools | FBSPL AOS team |

| Core focus | Task execution | End-to-end Agency Optimization Services |

| Insurance knowledge | Limited or generic | Trained across insurance processes |

| Automation approach | Tool-driven | Process + people + insurance automation |

| Compliance & security | Often unclear | Industry-grade data security and audit readiness |

| Integration | Minimal AMS or carrier alignment | Deep integration with AMS, CRMs, accounting systems |

| Scalability | Requires constant retraining | Built-in capacity planning and growth support |

| Quality control | Inconsistent | Multi-level QA and reporting |

| Strategic support | Not available | Agency consulting services improve strategic planning |

| Workflow ownership | Fragmented | Centralized, accountable delivery model |

| Future readiness | Short-term fixes | Built for the future of insurance agency operations |

How AOS supports insurance agency optimization daily

Optimization happens in small, repeated improvements; not big system changes. FBSPL’s AOS functions cover:

- Policy lifecycle management

- Renewals, endorsements, and certificates

- Accounting and reconciliation

- Carrier downloads and data cleanup

- Compliance documentation and audits

- CRM and AMS data accuracy

Each function runs on standardized workflows supported by insurance workflow automation, monitored by specialists who understand why the work matters.

Where automation alone usually breaks

Automation fails when exceptions increase. Insurance is full of exceptions.

Carrier changes, state regulations, underwriting nuances, and client-specific terms disrupt pure automation. Generic systems pause. Work queues pile up. Staff steps back in manually.

The AOS model anticipates exceptions. Human oversight keeps workflows moving while automation handles the heavy lifting in the background.

The outsourcing advantage with AOS

Outsourcing works best when control is not lost. With FBSPL:

- Agencies retain visibility and process ownership

- Service levels remain measurable

- Teams scale without hiring pressure

- Knowledge stays documented and transferable

This makes outsourcing a strategic move, not a short-term cost decision.

Supporting the future of insurance agency operations

The future favors agencies that combine automation with operational clarity.

Clients expect speed. Regulators expect accuracy. Teams expect manageable workloads. FBSPL’s Insurance Agency Optimization Services align all three by connecting people, platforms, and processes.

AOS does not replace agency culture. It strengthens it by removing operational friction that drains time and focus.