From market shocks to liquidity crunches, here’s how CFOs lean on scenario-based cash flow models to keep businesses steady.

- Elements of cash flow modeling

- A market where certainty rarely exists

- The cash flow forecasting process

- Why CFOs treat forecasting like armor

- What is the 3 way cash flow model?

- What are cash flow models used for?

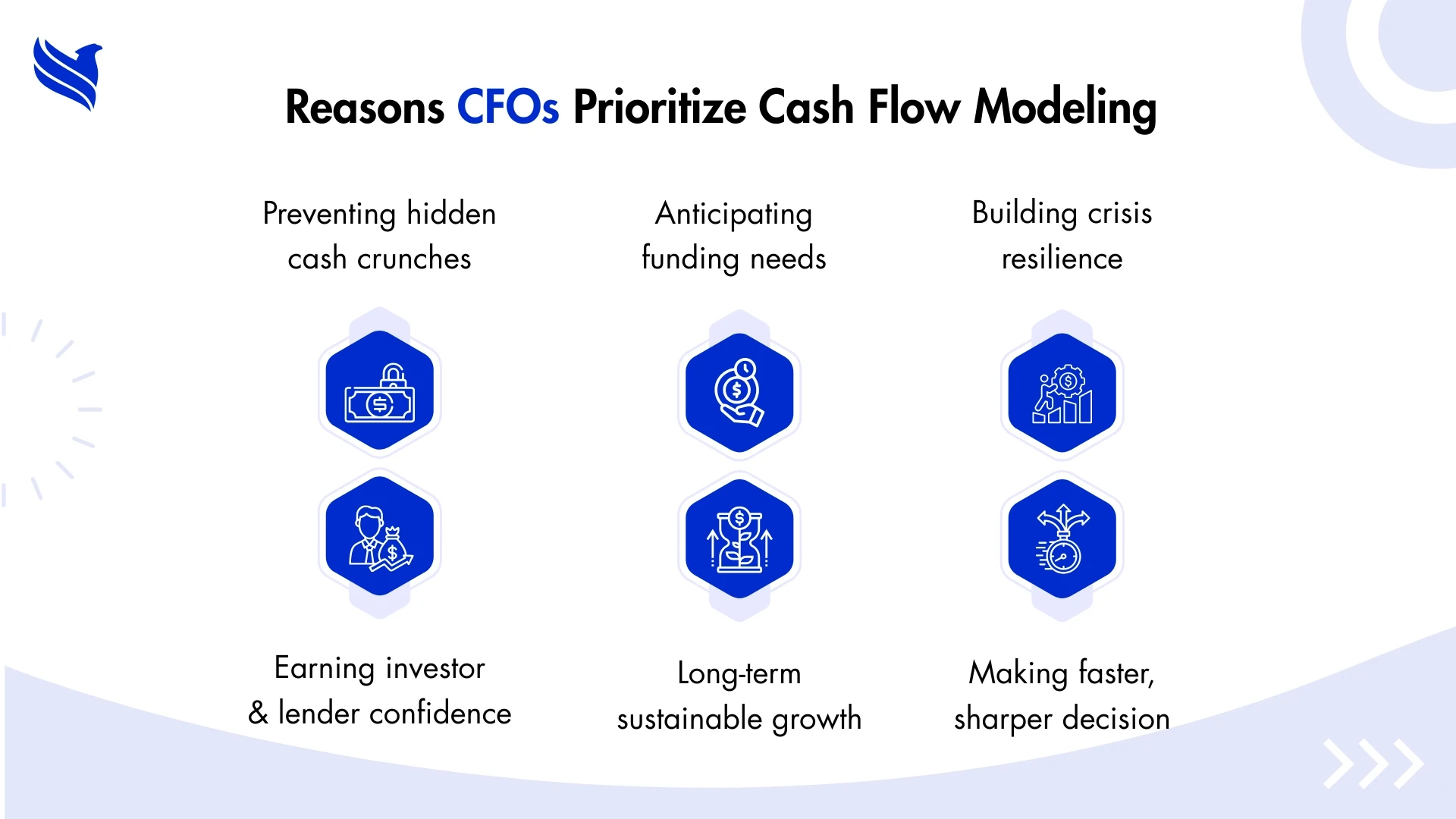

- Reasons CFOs prioritize cash flow modeling

- Outsourcing as the hidden advantage

- Conclusion: Preparing for the unseen

Markets used to feel like they had a rhythm. Today, they behave more like a playlist on shuffle. Interest rates climb without warning. Credit tightens overnight. A supplier halfway across the globe misses a shipment, and suddenly your cash position looks nothing like the forecast from last week. CFOs are the ones staring at these swings, knowing a misstep doesn’t just dent the bottom line, it can wipe out opportunities for years.

In uncertain climates, survival isn’t luck. It’s math. It’s the ability to run scenarios, to stress-test assumptions, to see ahead when the ground underfoot keeps moving. This is why cash flow modeling isn’t just “finance housekeeping” anymore, it’s one of the most critical disciplines in the modern CFO toolkit. A well-built cashflow forecast lets leadership ask, ‘what if?’ before reality answers with a gut punch.

The reality, though, is many firms can’t do this alone. They either lack the tech or the time. That’s why an increasing number lean on outsource accounting & bookkeeping partners who can handle the mechanics while internal leaders focus on decisions.

In this blog, the spotlight is on how CFOs actually use scenario-based models to protect companies, the role of forecasting, and where outsourcing slips in as a quiet but powerful advantage.

Elements of cash flow modeling

There’s a temptation to view cash flow like a simple ledger: money in, money out. But the elements of cash flow modeling are more layered.

- Operating cash flows cover the rhythm of sales receipts, rent, payroll, supplier bills.

- Investing cash flows are bets on growth, equipment, new ventures, acquisitions.

- Financing cash flows deal with the leverage game: loans drawn, repayments, equity raises, dividends.

Here’s where CFOs make it interesting. They don’t just record these numbers. They build interdependencies. Maybe that shiny new acquisition ties up liquidity for months, forcing tighter operating budgets. Or debt repayments suddenly clash with seasonal dips in revenue. A cash flow forecasting model captures this chain reaction.

And importantly, it isn’t static. A model built in January can look irrelevant by March if assumptions aren’t tweaked. Which is why, for CFOs, the model is never ‘done.’ It evolves with the market.

A market where certainty rarely exists

Talk to finance leaders, and they’ll admit the hardest part isn’t just volatility, it’s how fast it hits. A mid-tier retailer once had to scrap its yearly plan because currency swings alone shaved 12% off margins within two quarters.

The kicker? Their forecasts weren’t wrong, they were outdated. They hadn’t built scenarios for rapid shifts, only for gradual ones. Many smaller firms run into similar problems, often tripping over recurring cash flow mistakes like overestimating receivables or ignoring seasonal costs. These blind spots hurt most during shocks, when wiggle room is already thin.

This is why scenario thinking is rising. It forces leaders to ask the awkward questions: “What if we can’t refinance next year? What if that big client pays late? What if our cost of capital doubles?”

The cash flow forecasting process

Forecasting sounds complex, but at its core it’s a simple discipline. The problem? Most models age badly the moment the market throws a curveball.

Step one, gather every relevant piece of data, sales pipeline reports, expense schedules, supplier contracts. Step two, lay out assumptions about growth, costs, and payment terms. Step three, project numbers forward in weekly, monthly, or quarterly increments. That’s the skeleton.

Where the value comes in is the iteration. CFOs refine forecasts constantly, layering in real numbers and testing edge cases. The point isn’t to predict the future with perfect accuracy, it’s to prepare for the futures most likely to sting.

Technology has changed the game here. Today, platforms help automate much of this, even building scenarios at speed. Teams using advanced cash flow management tools often find they catch risks weeks earlier than manual spreadsheet setups. Exploring modern accounting tools is becoming less of a nice-to-have and more of a baseline expectation.

Why CFOs treat forecasting like armor

At the end of the day, this isn’t about pretty reports. It’s about breathing room, the kind that lets a company pay its people on time, handle a late client payment without panic, and keep doors open when the market stumbles. Forecasts aren’t trophies for the boardroom; they’re cushions that buy time, clarity, and options when it matters most.

Forecasting gives:

- Clarity: Decisions backed by data, not just gut feeling.

- Investor confidence: Boards and lenders want to see projections that hold water.

- Lead time: Spot a cash crunch early, fix it before it snowballs.

- Freedom to act: The ability to invest in growth while competitors' freeze.

Think of it as a survival kit. It doesn’t guarantee the storm won’t hit, but it ensures the business has flashlights, food, and a plan when it does.

What is the 3 way cash flow model?

The three-way model is one of the few tools that shows the whole financial picture. On their own, the Profit & Loss statement, Balance Sheet, and Cash Flow Statement tell useful but incomplete stories. Linked together, they reveal how profits translate into liquidity, how assets are funded, and where pressure points may form. It’s the difference between staring at snapshots and seeing the entire film.

It’s a method that links three critical statements into one cohesive engine:

- Profit & Loss statement (how profitable operations are).

- Balance Sheet (snapshot of assets, liabilities, equity).

- Cash Flow Statement (actual liquidity movements).

Why does it matter? Because financial blind spots often appear when these are viewed in isolation. A company might look profitable on paper (P&L), but if receivables drag too long, the cash flow for business is under strain. The 3-way model ties it all together, making sure CFOs aren’t looking at rosy profit numbers while quietly running out of cash.

What are cash flow models used for?

Cash flow models aren’t just spreadsheets, they're decision tools. CFOs rely on them for liquidity planning, risk checks, investment timing, and even weighing acquisitions. But they also play a quieter role: communication. Boards, lenders, and investors don’t just want numbers; they want a clear story of how money moves and where pressure points lie.

Plenty. They help with liquidity planning, risk assessments, investment timing, even M&A analysis. They also serve a softer purpose, communication. Boards, lenders, investors… they want visibility. Models provide a story told in numbers.

And, they guide priorities. For instance, if the model shows a crunch six months out, leadership might delay a capital project or renegotiate supplier terms. It’s not about predicting every twist. It’s about making sure surprises don’t become catastrophes.

Reasons CFOs prioritize cash flow modeling

It’s fair to ask: with so many competing tasks, why do CFOs put this front and center? The reasons CFOs prioritize cash flow modeling come down to the following:

- Volatility isn’t rare anymore—it’s the baseline.

- Debt is costlier—interest rate hikes punish sloppy liquidity planning.

- Supply chains wobble—and businesses need liquidity buffers.

- Digital investments aren’t optional—cash planning shows what’s affordable.

- Compliance eats resources—especially in industries where regulations change fast.

In truth, it’s less about choice and more about survival. A CFO without strong cash models is like a pilot without instruments: the flight might be smooth for a while, but the risk of crashing multiplies.

Outsourcing as the hidden advantage

Not every business has the budget or staff to build models that stand up to today’s pressures. That’s where outsourcing steps in quietly but decisively.

By leaning on outsource accounting & bookkeeping, companies get access to experts who’ve seen hundreds of variations of the same problem. They gain forecasting accuracy without sinking money into new headcount or systems. They also free up leadership time to focus on strategy, not spreadsheets.

For smaller and mid-sized firms, outsourcing is sometimes the only way to match the financial muscle of larger competitors. Plus, external specialists often catch blind spots faster, whether that’s misreading a report or not knowing how to properly interpret a cash flow statement.

Conclusion: Preparing for the unseen

The next shock isn’t a question of ‘if.’ It’s ‘when.’ Some companies will get blindsided. Others will adapt, pivot, and maybe even find opportunities hiding inside the disruption. The difference often comes down to cash visibility.

Scenario-based cash flow forecasting models aren’t perfect. But they turn unknowns into manageable risks. They transform CFOs from firefighters into architects of resilience. And when paired with the right tools or outsourcing partners, they help businesses not just survive, but step forward with confidence.

FBSPL has worked with hundreds of firms globally to strengthen their financial resilience, offering precision in forecasting, streamlined processes, and support tailored to the reality of running a business in unstable times.

The question is simple: when the next shock hits, will your company be scrambling, or ready? Partner with FBSPL and make sure it’s the latter.