Quick summary: Insurance agencies are turning to outsourcing to handle growing workloads without losing their human touch. This blog highlights affordable models, key benefits, and what to look for in a trusted BPO partner. The right approach can save time, lower costs, and keep clients genuinely satisfied.

- Inside the operation: How insurance customer service outsourcing works

- The pressure points: Where agencies feel the strain

- Affordable outsourcing in 2025: Smart models, smarter spending

- What agencies gain: The benefits of insurance customer service outsourcing

- The human edge: Where efficiency meets empathy

- Finding the right fit: Choosing a BPO partner that matches your vision

- Building the future: Where outsourcing meets authentic service

See how smart outsourcing helps agencies cut costs, boost service quality, and keep every client interaction personal.

What really defines a great insurance agency in 2025; speed, empathy, or innovation? The truth is, it’s all three. Today’s policyholders want more than reliable coverage; they crave connection. They expect to be heard, not handled like a ticket number. Behind every call or claim lies a person hoping for reassurance, not a rehearsed response.

For many insurance agencies, though, keeping this balance between efficiency and empathy is tough. Teams juggle renewals, compliance checks, policy changes, and follow-ups, all at once. That’s where insurance agency customer service outsourcing quietly steps in to keep operations running smoothly. It’s not about cutting corners but about giving agencies the breathing room to focus on what matters most, relationships.

In this blog, we’ll unpack how Insurance Customer Service Outsourcing actually works, what pressures agencies face, affordable models in 2025, the Benefits of Insurance Customer Service Outsourcing, and how choosing the right BPO partner can turn day-to-day chaos into long-term growth.

Inside the operation: How insurance customer service outsourcing works

Behind every smooth insurance interaction is an invisible yet powerful system. Most of it runs through customer service BPOs, specialized partners that act as an extension of your team. They handle everything from claims follow-ups and billing questions to policy renewals and escalations.

But the old model of script-driven call centers is long gone. The new era of insurance customer service blends technology with human intuition. AI tools now sort inquiries based on urgency, analyze the tone of customer conversations, and route them intelligently. Meanwhile, well-trained support teams handle high-value or emotionally charged interactions, moments where empathy can’t be automated.

For agencies that serve global markets, outsourcing offers multilingual customer support that feels localized and personal. What ties it all together is integration. BPO teams plug right into your CRM or policy management systems, letting them see client histories in real time. When someone calls about a claim delay, agents already have the details; no awkward pauses, no hunting for files.

This is where insurance optimization takes shape; faster resolutions, consistent service, and clients who feel genuinely valued. Outsourcing, done right, doesn’t just save time; it strengthens trust.

The pressure points: Where agencies feel the strain

Insurance has always been a trust-driven industry. But between shifting regulations, mounting workloads, and rising customer expectations, keeping that trust intact is harder than ever.

When service lags, tensions rise. Policyholders waiting on claims or clarifications don’t just grow frustrated; they start looking for alternatives. Add intense compliance checks, billing follow-ups, and data entry work, and burnout becomes inevitable. Smaller agencies often take the biggest hit because scaling in-house service teams is expensive, time-consuming, and hard to sustain.

That’s when many turn to Outsource Insurance Agency Management Services. Instead of replacing internal staff, outsourcing adds strength where it’s needed most. It gives agencies the ability to scale support during busy seasons and avoid service bottlenecks without adding permanent overhead.

In short: outsourcing becomes a lifeline, not a loophole.

Affordable outsourcing in 2025: Smart models, smarter spending

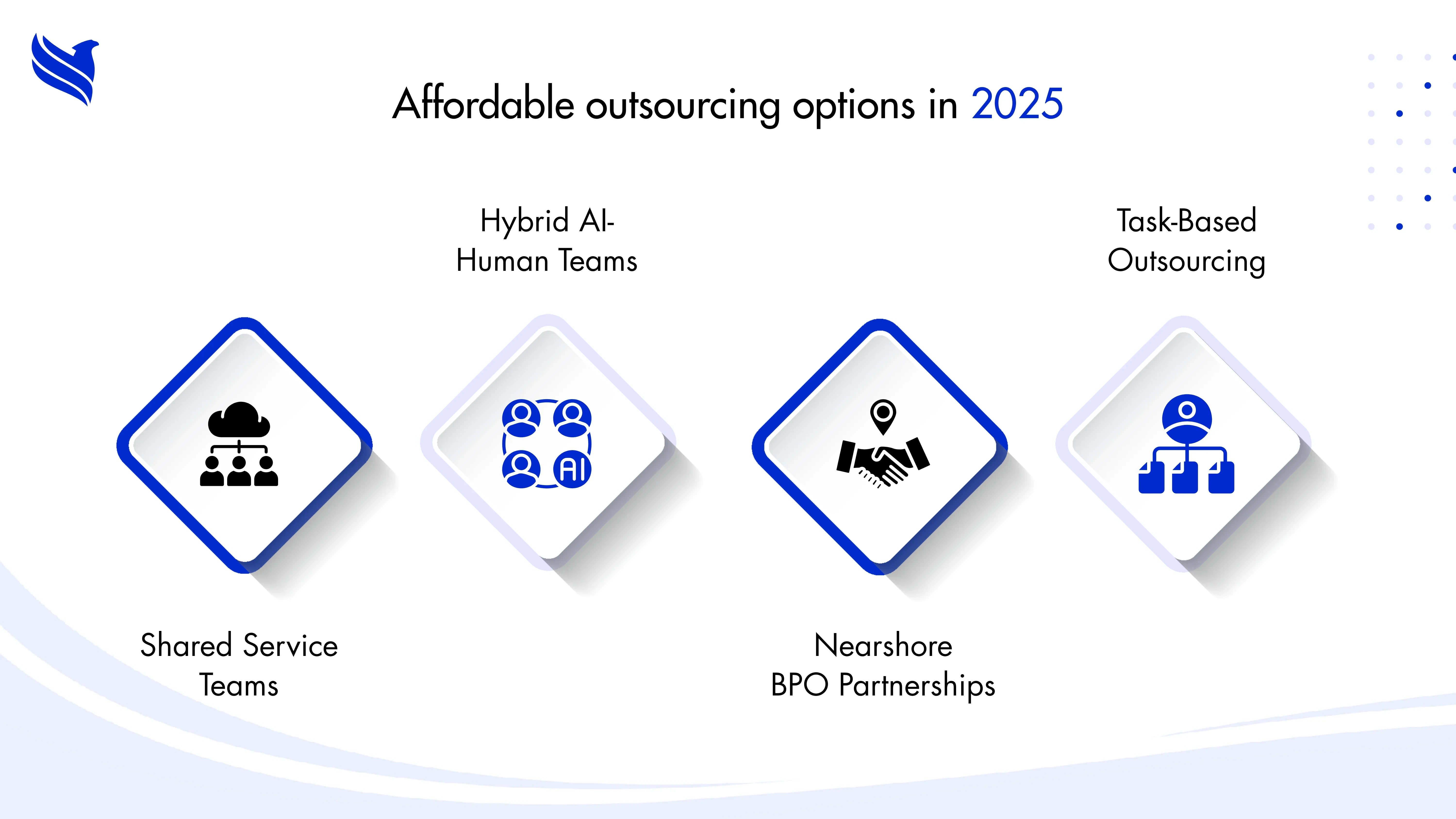

Today’s outsourcing landscape isn’t about chasing the cheapest deal; it’s about finding sustainable value. The best models are flexible and built to grow with your agency’s needs. A few of the most practical options include:

- Shared service teams: Perfect for smaller agencies; this model lets multiple firms share trained support teams that handle customer interactions around the clock. Smart scheduling and automation ensure each client still receives personal attention.

- Hybrid AI-human teams: This is where AI improves customer experience in insurance most effectively. Chatbots handle FAQs or policy inquiries, while human agents focus on emotional or complex cases. It’s efficiency, without compromising on warmth.

- Nearshore BPO partnerships: Many agencies now prefer nearshore outsourcing for better time zone alignment and cultural compatibility. It helps maintain communication flow while still reducing costs.

- Task-based outsourcing: Some agencies only outsource specific tasks, think claims processing, lead qualification, or policy data entry. It’s a flexible, measurable approach that makes tracking ROI easier.

Thanks to growing competition in the BPO space, even boutique firms now offer affordable and high-quality support services. Outsourcing is no longer about cutting costs; it’s about optimizing growth intelligently.

What agencies gain: The benefits of insurance customer service outsourcing

The Benefits of Insurance Customer Service Outsourcing go far beyond budget relief. In 2025, outsourcing has become a cornerstone of operational excellence. Here’s how it delivers tangible value:

- Round-the-clock customer support – Clients receive consistent, responsive help, whether it’s 9 a.m. or midnight.

- Specialized expertise – Trained representatives understand insurance flows, claim cycles, and regulatory nuances.

- Faster claim resolution – Speed matters. Streamlined processes strengthen claims optimization & customer retention, helping build loyalty over time.

- Consistent quality – Outsourced teams follow documented SOPs that mirror your agency’s tone and service standards.

- Scalable support – Resources adapt instantly to peak seasons or sudden workload surges.

- Insight-driven improvement – Advanced BPOs use dashboards to monitor satisfaction scores, resolution times, and emerging issues, revealing insights for better decision-making.

When implemented well, outsourcing is invisible to clients, but the results are impossible to miss.

The human edge: Where efficiency meets empathy

At its core, good outsourcing gives agencies something priceless: focus. Once customer service operations run seamlessly, internal teams can redirect their energy toward client relationships and strategic decisions.

Modern agency optimization services bring both empathy and intelligence into play. AI doesn’t replace people; it empowers them. It can detect customer frustration in real-time or guide an agent through compliance-heavy protocols. The result? Interactions that are faster, smoother, and genuinely human.

Consider a case shared by an agency in Chicago. After transitioning to a hybrid AI-human BPO model, they achieved a 40% reduction in claim handling time. Another agency in Sydney reported a 70% jump in satisfaction scores within six months of partnering with a dedicated service provider.

These aren’t exceptions; they represent what’s possible when people and technology work in sync. Because in the insurance world, efficiency earns you points, but empathy keeps your clients.

Finding the right fit: Choosing a BPO partner that matches your vision

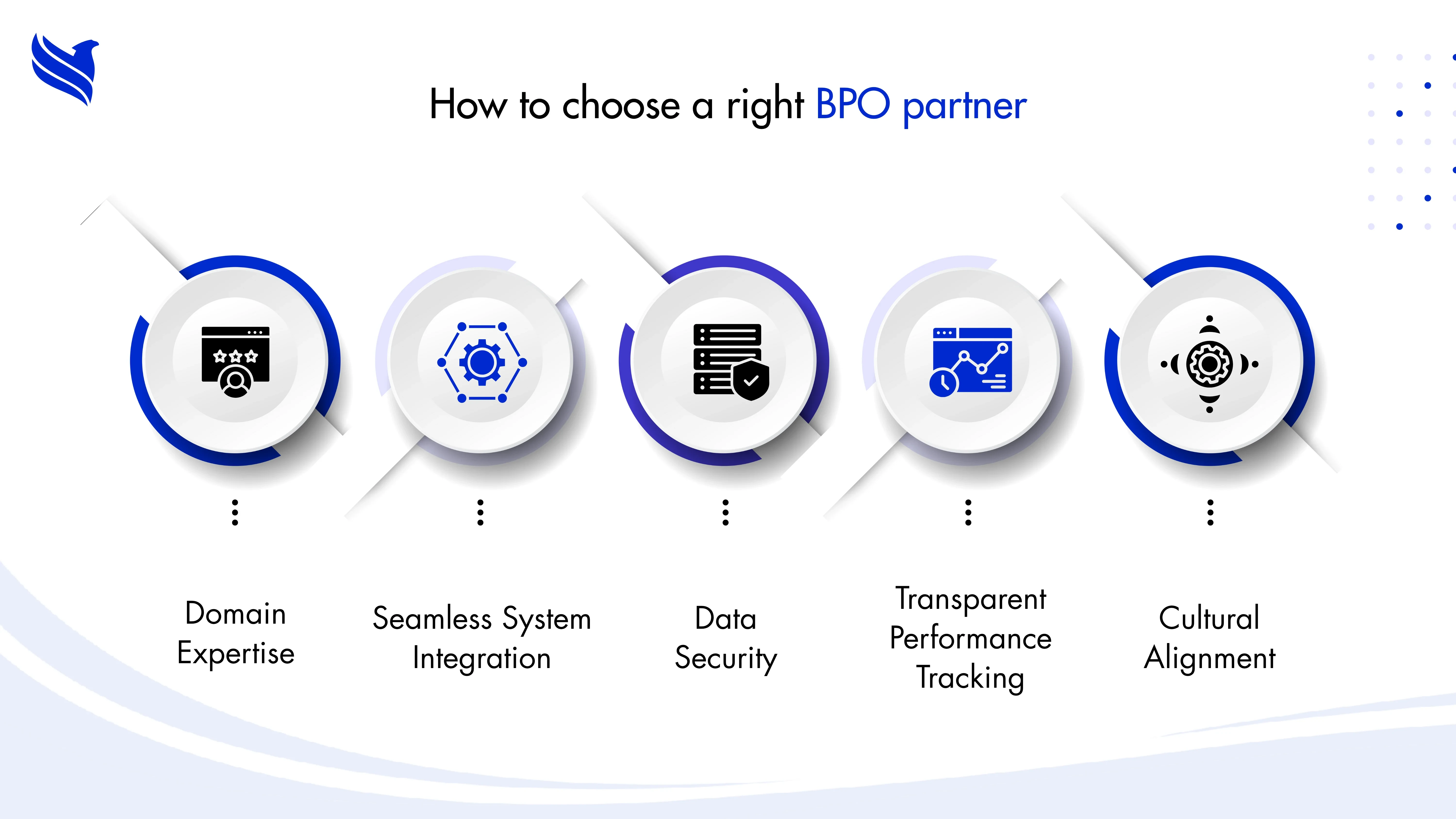

Selecting a BPO partner isn’t a quick procurement box to tick; it’s a relationship choice. The partner you choose becomes a natural extension of your brand voice.

Here’s what to weigh before signing on:

- Domain expertise: Look for partners already experienced in insurance operations.

- Seamless system integration: They should easily connect to your CRM and claims tools.

- Data security: Verify compliance standards and encryption methods to ensure safe handling of client information.

- Transparent performance tracking: Review metrics like customer satisfaction, response times, and first-call resolution rates.

- Cultural alignment: Shared communication styles and service ethics make collaboration effortless.

When these align, the partnership doesn’t just work; it flows.

Building the future: Where outsourcing meets authentic service

The insurance industry is transforming, not just in technology, but in tone. Agencies today aren’t judged solely on the products they sell but on how they make their clients feel through every interaction.

Insurance agency customer service outsourcing has evolved from a temporary cost strategy into a lasting growth enabler. Partnering with expert providers like FBSPL allows agencies to scale operations intelligently while keeping their human touch firmly intact.

FBSPL integrates automation, analytics, and skilled professionals to strengthen every layer of agency management, from compliance and claims to end-to-end client engagement. It’s a partnership model that helps agencies increase efficiency without losing authenticity.

For those ready to invest in customer-first operations, outsourcing isn’t a fallback. It’s the foundation for smarter, stronger, and more human service experiences.

So, the question isn’t if outsourcing fits into your agency’s future, it’s how soon you’re ready to make it part of your story.