Summary: This blog explores whether small agencies will still matter in the P&C insurance industry by 2035. It examines operational challenges, changing customer expectations, emerging P&C insurance trends, and how digital transformation, licensed expertise, and outsourcing help agencies remain relevant.

- The real challenges small agencies face today

- Why small agencies still deliver unique value

- Strategies that help small agencies stay relevant through 2035

- Key trends shaping the P&C insurance industry

- How outsourcing strengthens local agencies

- The future belongs to agencies that balance trust and efficiency

An in-depth look at how small agencies can stay relevant by balancing local relationships, evolving operations, technology, and outsourcing support.

Will small agencies and local presence still matter in the P&C insurance industry by 2035, or will scale, automation, and centralized models quietly replace them?

This question sits at the center of many conversations today. The P&C insurance industry is moving fast. Claims are rising. Margins are tight. Regulations change without warning. At the same time, AI & automation in P&C insurance and digital platforms promise speed, consistency, and lower costs. For small insurance agencies, this creates pressure from every side.

The challenge is not whether technology will shape the future of P&C insurance, it already has. The real challenge is how agencies adapt without losing what made them relevant in the first place: trust, familiarity, and local understanding. Many agencies are discovering that the answer does not lie in choosing between people and technology, but in rethinking how work is distributed, including the growing role of P&C Insurance Outsourcing services.

In this blog, the focus is on whether small agencies can remain relevant by 2035, the obstacles they face, the benefits they still bring, the strategies that matter, key trends in P&C insurance, and how outsourcing is quietly redefining P&C insurance operations.

The real challenges small agencies face today

Small agencies rarely struggle with commitment. They struggle with capacity. Behind the phone calls and client meetings sits an expanding layer of operational work. Policy changes pile up. Endorsements move slowly through systems that were never designed for volume. P&C insurance claims management, constant follow-ups, documentation, and carrier coordination. None of this work disappears simply because an agency is small.

Hiring offers little relief. Experienced, licensed professionals are harder to find and harder to keep. Training new staff takes time that few teams can spare. Meanwhile, digital transformation in P&C insurance is often presented as a cure-all, yet implementation requires clarity, discipline, and ongoing maintenance.

These pressures create a quiet risk. When administrative work dominates the day, advisory quality slips. Response times lengthen. Relationships weaken, not because agencies stopped caring, but because the operating model could no longer keep up.

The solution emerging across the industry is structural rather than technological. Agencies that separate client-facing judgment from volume-driven processing regain balance. Technology supports this shift, but process design and outsourcing make it sustainable.

Why small agencies still deliver unique value

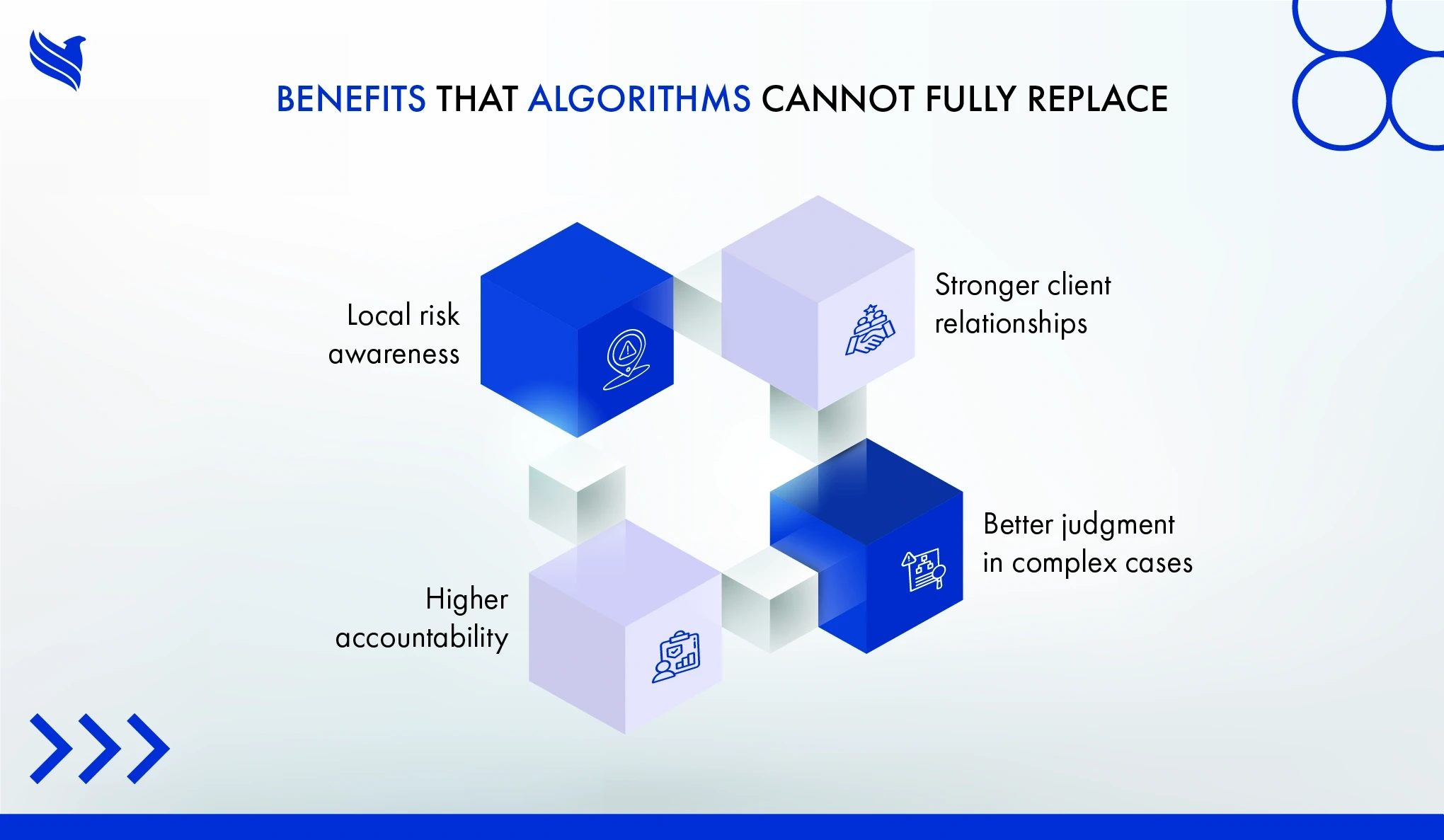

Despite consolidation and automation, small insurance agencies continue to offer advantages that remain difficult to scale digitally. These benefits include:

- Local risk awareness

Regional weather patterns, construction practices, and claim behaviors are often better understood locally than through centralized models. - Stronger client relationships

Familiarity encourages openness. Clients share details earlier, reducing misunderstandings and coverage gaps. - Higher accountability

Clients know who is responsible when issues arise, which builds trust even during disputes or claim delays. - Better judgment in complex cases

Automated systems handle standard scenarios well. Human judgment remains critical in nuanced underwriting and claims discussions.

These strengths suggest that small agencies are not becoming obsolete. Instead, their value shifts toward advisory and relationship-led roles, supported by more efficient P&C insurance operations.

Strategies that help small agencies stay relevant through 2035

Agencies that adapt early tend to follow similar strategic patterns. Key strategies include:

- Redefining internal roles

Licensed professionals focus on coverage advice, renewals, and complex claims, while administrative work is handled elsewhere. - Adopting selective automation

Tools are chosen to solve specific problems; document handling, workflow tracking, or claims updates; rather than broad, disruptive system changes. - Standardizing processes

Clear workflows reduce rework, errors, and dependency on individual employees. - Leveraging outsourced support

P&C Insurance Outsourcing services help absorb volume without increasing fixed costs. - Strengthening claims communication

Faster updates and clearer explanations improve client experience during stressful events.

These strategies allow agencies to remain local in presence while modern in execution.

Key trends shaping the P&C insurance industry

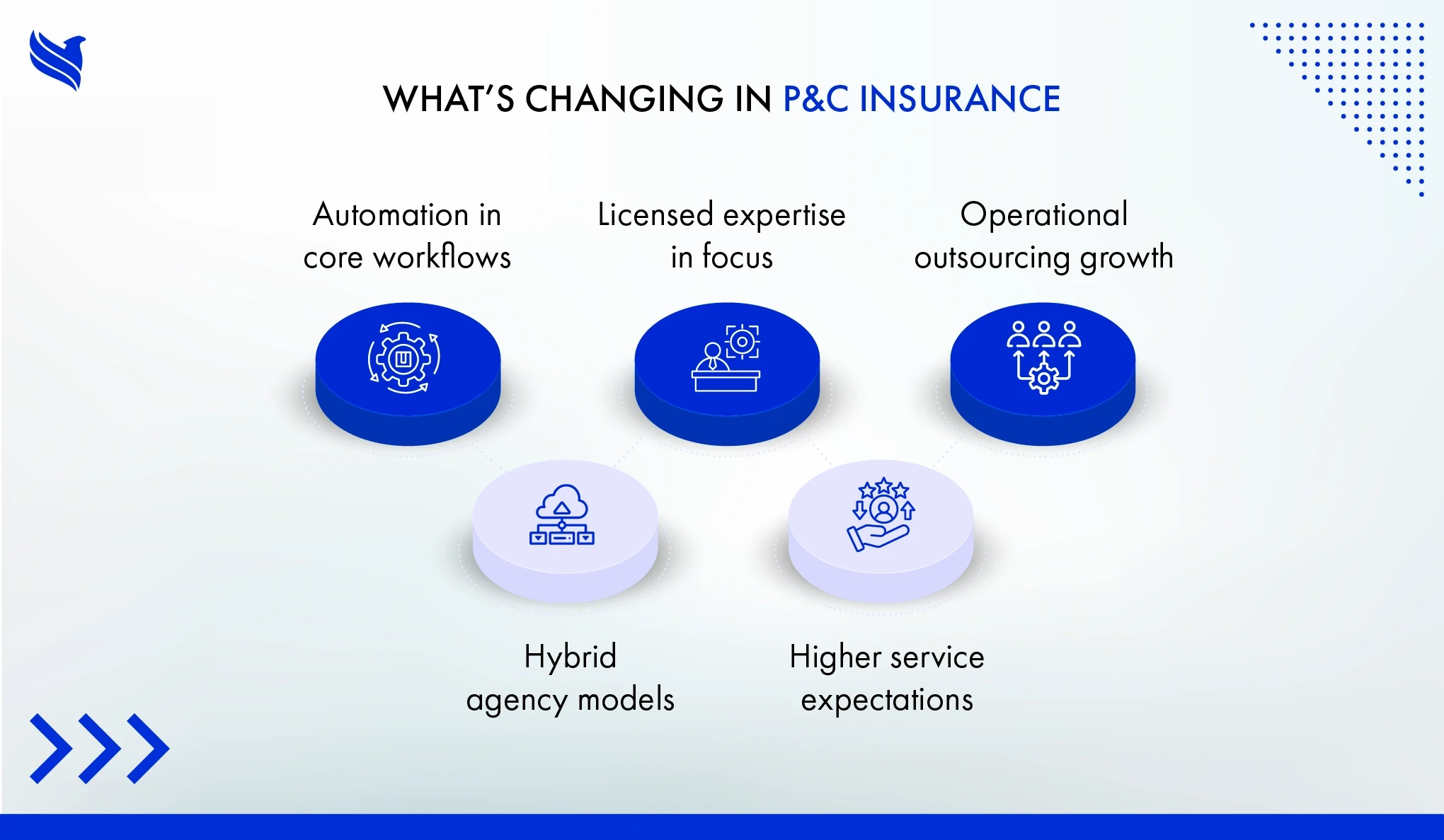

Several P&C insurance trends point toward a blended future rather than a fully centralized one. Among the most influential trends are:

- AI & automation in P&C insurance

Used for claims triage, document classification, fraud detection, and risk analysis. - Hybrid operating models

Core client-facing roles stay local, while processing and analytics are distributed. - Rising importance of licensed expertise

How licensed account managers help becomes more visible as advisory complexity increases. - Customer expectations for speed and clarity

Digital access is expected, but human support remains critical during claims and disputes. - Operational outsourcing becoming standard

Outsourcing shifts from cost control to capacity management and consistency.

These trends suggest that the future of P&C insurance favors flexibility over scale alone.

How outsourcing strengthens local agencies

Outsourcing rarely changes how an agency feels to its clients. Phones still ring locally. Familiar names still appear on emails. What changes is the stability behind those interactions.

When P&C insurance operations are supported externally, backlogs shrink. Turnaround times stabilize. Documentation becomes more consistent. During catastrophe seasons or growth periods, work no longer overwhelms internal teams.

In P&C insurance claims management, outsourcing often absorbs the most time-consuming tasks; status updates, document collection, carrier coordination; allowing licensed professionals to focus on communication and resolution. This improves the client experience without adding pressure to local staff.

Outsourcing also introduces discipline. Processes are documented. Metrics are tracked. Errors surface sooner. For small agencies, this structure provides resilience that would otherwise require significant internal investment.

Rather than weakening local presence, outsourcing quietly protects it.

The future belongs to agencies that balance trust and efficiency

By 2035, small agencies and local presence will still matter in the P&C insurance industry. Their role, however, will look different. Success will depend less on handling every task internally and more on managing relationships, judgment, and trust; supported by modern operations.

Agencies that embrace digital transformation in P&C insurance thoughtfully, adopt AI where it adds clarity, and rely on outsourcing to stabilize workloads are better positioned for long-term relevance. Those that resist operational change may struggle, not because local presence lost importance, but because the workload became unsustainable.

For agencies seeking to modernize without losing identity, FBSPL provides P&C Insurance Outsourcing services that strengthen operations, support licensed teams, and help agencies stay competitive in a changing industry.