For growing businesses, the balance sheet can reflect profits, accomplished sales targets, and steady operating margins. Yet, cash flow remains a persistent challenge. Due to this vendor payments are delayed, receivables are piled up, and operational liquidity is tightened, despite positive revenue trends.

And that's not an isolated issue. It is one of the most common cash flow challenges CFOs faces. For them, cash flow management has become more than a financial task. It influences every business decision, from workforce planning to vendor relationships and risk management. Cash flow for businesses is frequently the best indicator of their financial resiliency in uncertain economic conditions.

In addition, the CFO's expectations have changed. Now, they want future-ready liquidity models, build cross-functional cash flow discipline, and forecast with precision across multiple scenarios. But here comes the major question, i.e., 'How to manage cash flow?' In this blog, we have mentioned everything, including -

- Major reasons why profitable businesses face cash flow challenges

- How to improve business cash management

- The role of automation in cash flow management

- Tools and processes to build a cash-first culture

Major reasons why profitable businesses face cash flow challenges

No matter how profitable the organization is, they might feel cash flow pressure. At the end, CFOs often struggle with cash flow challenges. The reason is unawareness of the root causes of cash flow. Not only this, but there are also other reasons.

Here are the 5 reasons why businesses and CFOs struggle with cash flow management.

1. Inefficient inventory and procurement management

Whenever there is slow or excess inventory, cash gets locked up. So, businesses with poor inventory and procurement management often lead to capital being tied up where it doesn’t generate returns.

2. Delayed receivables and poor collection practices

If you have robust sales, but your clients are taking more than 90 days to pay invoices, it will impact your working capital. Also, without a strong AR strategy, your business will end up with poor liquidity.

3. Backloaded revenue models

Businesses that rely on subscriptions or project-based models may record revenue on a monthly basis or at the end of a project, but they will still incur operating expenses. Daily activities may be strained as a result of this delay in realization.

4. Unmonitored costing assets

When a business scales, the overhead cost increases. It includes salaries, technology subscriptions, outsourced services, and more. All this puts financial strain on businesses and eats up a lot of cash without being immediately noticeable.

5. Lack of cash flow visibility

A lot of businesses rely on financial data. Hence, without real-time dashboards or real-time planning, CFOs struggle to anticipate dips in liquidity before they become problematic.

To build better financial visibility, it is advisable to revisit the basics, starting with how to read a cash flow statement. It is helpful for businesses to learn how to turn reports into real-time decisions.

How to improve business cash management?

A lot of businesses think that improving cash flow management is all about ensuring smooth payment receivables or cutting costs. But it isn’t! If you're wondering how to improve business cash management, the key lies in cash predictability and financial discipline.

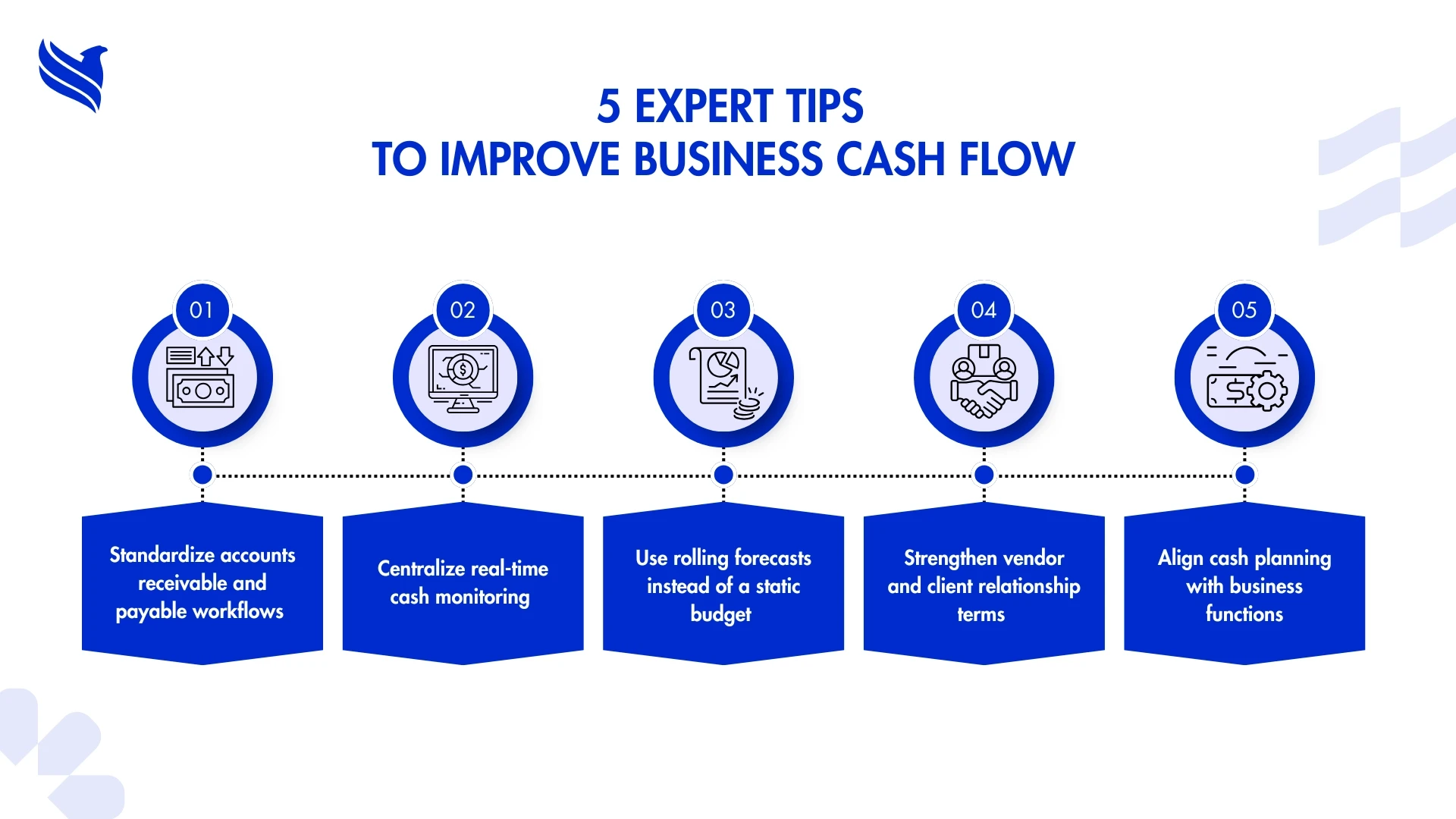

Here's how businesses can maintain better cash flow management.

1. Standardize accounts receivable and payable workflows

Businesses can significantly reduce the risk of payment delays by establishing clear SOPs for payables and receivables. Businesses should automate invoice reminders, establish payments terms to ensure efficient business cash management. By doing this, working capital health will improve and cash flow uncertainty will be decreased.

2. Centralize real-time cash monitoring

Real-time cash flow monitoring is the key to improving your business's cash management. Hence, implementing a customized dashboard helps businesses keep an eye on all payment cycles. To help CFOs make informed decisions, you can also integrate advanced BI tools.

3. Use rolling forecasts instead of a static budget

Static annual budgets always fail to reflect real-time business dynamics. Hence, switching to rolling cash flow forecasts would be beneficial for businesses and CFOs. With this practice, they get cash flow updates monthly or quarterly. Also, businesses can easily anticipate liquidity gaps and plan with greater agility.

4. Strengthen vendor and client relationship terms

Besides focusing on internal cash flows, revisit your contract terms with potential clients and vendors and improve the payment cycles if required. Even making small adjustments like automating invoicing for clients and exploring extended payment terms will bring meaningful improvements.

5. Align cash planning with business functions

Cash flow isn’t just a finance thing but is influenced by every other department. Therefore, CFOs must ensure that every business function is aligned with the company’s cash flow. For that, businesses should conduct monthly cross-functional reviews. It helps to synchronize cash planning with broader operational strategies.

The role of automation in cash flow management for growing businesses

Maintaining spreadsheets or tracking cash flow manually were traditional cash management methods. But these old techniques are insufficient to meet modern business cash flow demands. That's why automation plays a crucial role in cash flow management.

Let's discover how automation redefines how CFOs manage cash flow.

1. Centralized cash flow monitoring

Automated business dashboards gather data from multiple sources and offer real-time visibility into cash positions across receivables and payables.

2. Intelligent payment reminders

Businesses incorporate automated reminders for clients to ensure that everyone follows the payment cycle and reduce DSO without any manual effort.

3. Faster invoicing

With automation, businesses can ensure timely invoice generation with zero human errors. It further improves cash flow predictability and quicker collections.

4. Real-time alerts and reporting

Implementing automation in cash flow management allows businesses to set alerts for low cash balances or missed payments and act before a serious cash flow issue develops.

5. Scheduled vendor payments

Automated accounts payable workflows help businesses prioritize payments. They might be based on discounts, due dates, and cash position. Overall, businesses can schedule payments while preserving liquidity.

Conclusion!

For CFOs and modern-age businesses, managing cash flow is about building a forward-looking and data-driven financial foundation. Whether they want to deal with delayed receivables or plan for market uncertainty, cash flow management remains the most critical driver of operational flexibility. We hope everything mentioned in this blog will help all CFOs answer a common question: 'How do you manage cash flow for businesses?'

For more advanced techniques, you can also explore our blog on cash flow strategies for lasting business success.

Accurate financial data is a must for growing businesses looking forward to scaling efficiently. This is where outsourcing accounting and bookkeeping can be a game-changer. At FBSPL, we have a team of dedicated accounting and bookkeeping experts who are well-versed in integrating AI and automation into accounting solutions. We have helped numerous businesses automate their accounting processes while freeing up their internal resources for a higher-value strategy.

So, if you, too, have been looking for a reliable accounting and bookkeeping outsourcing company to help you with this, we'd like to have a quick conversation.