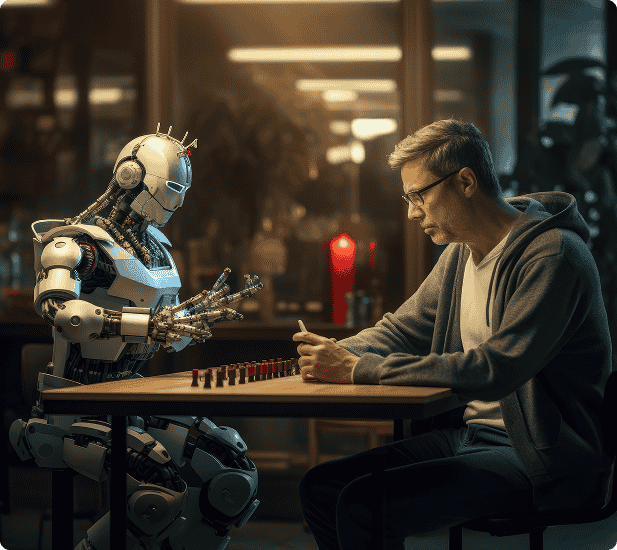

Transform your workflow with AI-led insurance services

FBSPL’s AI‑led Insurance Outsourcing services reduce operational costs by up to 50%, accelerate claims resolution by 55%, and boost policyholder satisfaction by 90%+.

FBSPL’s AI‑led Insurance Outsourcing services reduce operational costs by up to 50%, accelerate claims resolution by 55%, and boost policyholder satisfaction by 90%+.

Since 2006, we’ve been powering businesses with smart, scalable outsourcing solutions. As a leader in Business Process Management and Consulting, we specialize in Insurance Outsourcing, Accounting & Bookkeeping, Data Annotation, Digital Marketing, and Business Intelligence. Our goal is to improve operations, enhance control, and support sustainable growth.

+

Years of experience

+

Employees

Countries Served

The insurance industry is drowning in paperwork, siloed systems,

and reactive processes.

Here’s what’s getting in the way:

Delays in claims processing due to manual steps.

Inconsistent underwriting and fraud detection.

Customer support overloaded with basic queries.

Low adaptability to risk shifts without predictive analytics.

Fragmented documentation that’s hard to retrieve and analyze.

FBSPL combines deep domain outsourcing with AI-powered technologies to eliminate bottlenecks and redefine how insurance operations work.

What We Do : From policy issuance to claims support, we help P&C carriers handle rising workloads, compliance tasks, and client demands, without adding internal stress.

Results : Cut processing time in half and reduce admin load by 40%

What We Do : End-to-end support across benefits administration, from enrollments to renewals, designed to reduce errors, eliminate rework, and elevate employee experience.

Results : 98% Data work accuracy in benefits processing and 3x faster onboarding

What We Do : For agencies juggling too much, we automate the operational back end so you can focus on growth, client retention, and strategic work that matters.

Results : Clients report up to 50% gain in operational efficiency.

Automatically populates and processes quotes across carrier portals and rating engines in minutes

How It Helps: Get accurate quotes 3x faster, reduce human input by 60%

Uses intelligent extraction to pull critical data from policy documents into your systems.

How It Helps: Cuts manual effort by 50%, improves decision speed

Compares document versions to flag inconsistencies before quoting or binding.

How It Helps: Prevents downstream errors, improves quoting accuracy by 40%

Not just software, these tools are the backbone of smarter, faster insurance operations. Designed for real-world workflows, they bridge the gap between manual chaos and AI-powered clarity.

Policy-to-Policy Comparison

Highlights differences between Home and Auto insurance policies for faster, smarter decisions.

Policy-to-Quote Comparison

Align quotes with policies to ensure precision before issuance.

Data Extraction from PDFs

Pulls structured data from scanned or PDF files using AI and OCR.

Excel Creation from PDFs

Converts complex PDFs into editable, structured Excel reports.

Document Renaming Tool

Applies naming conventions automatically across batches

Digital Document Signing

Secure, compliant electronic signing with full audit trails.

Custom Automation Solutions

Tailored workflows to automate your most time-consuming insurance tasks

Intelligent Bot Deployment

Bots to manage tasks, queries, and power CX touchpoints.

Other providers offer automation. We offer outcomes.

|

|

Option 1 |

|

|

|

Option 2 |

|

|

|

Option 3 |

|

|

|

Option 4 |

|

|

|

Option 5 |

|

If you’re ready to reduce costs, improve accuracy, and scale your insurance business without hiring more, you're ready for FBSPL.

I must say that our partnership with Fusion Business Solutions (FBSPL) has been truly exceptional. What sets FBSPL apart is their remarkable ability to not only grasp our ever-evolving business needs but also their genuine curiosity to understand our culture. Their flexibility and agility have been invaluable as our startup continues to grow rapidly. FBSPL proactive approach, coupled with their rigorous processes and scalability, has significantly enhanced our customer experiences and AI operations.

Chin Ma

Founder and President

We reached out to Fusion in the Fall of 2022 as we were having issues recruiting a skilled and motivated workforce locally to fill back-office roles in our organization. What started as a simple documentation validation exercise quickly grew into the team supporting more strategic review and reconciliation activities. The team has shown repeatedly that they are willing to take on more and more complicated tasks, and the leadership team is quick to rally and support their employees when things fall off track.

James Oickle

President & CEO